Small business grant applications typically require a comprehensive business plan, financial statements such as profit and loss statements, and tax returns. Applicants must also provide proof of business ownership, legal structure documentation, and identification. Supporting documents like resumes, licenses, and letters of recommendation can strengthen the application by demonstrating credibility and preparedness.

What Documents are Necessary for Small Business Grant Applications?

| Number | Name | Description |

|---|---|---|

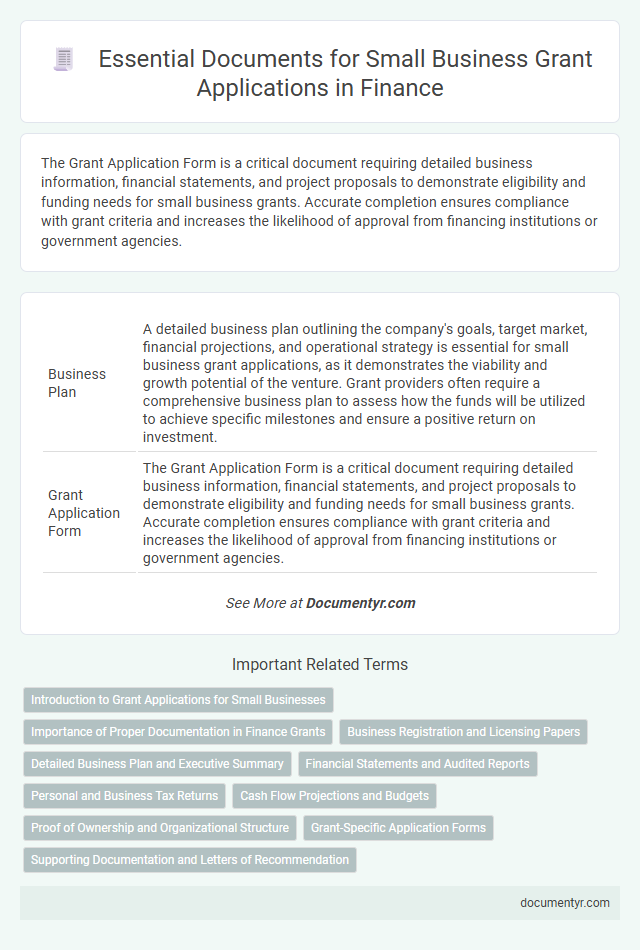

| 1 | Business Plan | A detailed business plan outlining the company's goals, target market, financial projections, and operational strategy is essential for small business grant applications, as it demonstrates the viability and growth potential of the venture. Grant providers often require a comprehensive business plan to assess how the funds will be utilized to achieve specific milestones and ensure a positive return on investment. |

| 2 | Grant Application Form | The Grant Application Form is a critical document requiring detailed business information, financial statements, and project proposals to demonstrate eligibility and funding needs for small business grants. Accurate completion ensures compliance with grant criteria and increases the likelihood of approval from financing institutions or government agencies. |

| 3 | Executive Summary | An effective Executive Summary for small business grant applications must clearly outline the business plan, objectives, and funding requirements while highlighting the company's unique value proposition. Including summarized financial statements, market analysis, and the intended use of grant funds ensures a comprehensive overview that appeals to grant reviewers. |

| 4 | Financial Statements | Small business grant applications typically require detailed financial statements, including balance sheets, income statements, and cash flow statements to demonstrate the business's financial health and viability. Accurate, audited financial statements provide grantors with essential insights into revenue streams, expenses, liabilities, and overall fiscal responsibility. |

| 5 | Profit and Loss Statement | A Profit and Loss Statement is essential for small business grant applications as it provides a detailed summary of revenues, costs, and expenses incurred over a specific period, demonstrating the financial health and profitability of the business. This document helps grant reviewers assess the viability and sustainability of the business, influencing funding decisions. |

| 6 | Balance Sheet | A detailed balance sheet is essential for small business grant applications, providing a snapshot of assets, liabilities, and equity to demonstrate financial health and stability. Lenders and grantors use this document to assess the company's ability to manage funds and meet obligations, making accuracy and up-to-date figures critical for approval. |

| 7 | Cash Flow Statement | A detailed cash flow statement is crucial for small business grant applications as it demonstrates the company's ability to manage incoming and outgoing funds effectively, ensuring financial stability. This document provides grant reviewers with transparent insights into operational liquidity and helps validate the business's capacity to utilize the grant funds responsibly. |

| 8 | Tax Returns | Small business grant applications typically require recent federal and state tax returns, including Form 1040 Schedule C or corporate tax filings such as Form 1120, to verify income and financial stability. Accurate tax documentation helps grant providers assess eligibility and ensures transparency in the financial status of the business applicant. |

| 9 | Bank Statements | Bank statements are essential documents in small business grant applications as they provide a detailed record of the company's financial transactions, demonstrating cash flow stability and operational viability. Lenders and grant committees often require bank statements from the past three to six months to verify income, expenses, and overall financial health. |

| 10 | Articles of Incorporation | Articles of Incorporation serve as a fundamental legal document required for small business grant applications, proving the business's official formation and registration with state authorities. These documents establish the company's structure and legitimacy, often necessary to qualify for funding and demonstrate compliance with grant requirements. |

| 11 | Business License | A valid business license is a critical document for small business grant applications, as it verifies the legal operation of the business within the jurisdiction. Grant providers require this license to ensure the business complies with local regulations and is eligible to receive funding. |

| 12 | Employer Identification Number (EIN) | An Employer Identification Number (EIN) is a critical document required for small business grant applications as it uniquely identifies the business for tax purposes and confirms legal entity status. Including a valid EIN in grant submissions facilitates verification processes, ensuring eligibility and expediting funding decisions. |

| 13 | Proof of Ownership | Proof of ownership documents necessary for small business grant applications typically include business licenses, incorporation papers, partnership agreements, or a sole proprietorship's certificate. These documents verify the legal ownership structure and eligibility, ensuring grant providers can confirm the applicant's authority to operate the business. |

| 14 | Organizational Chart | An organizational chart is essential for small business grant applications as it visually represents the company's structure, outlining key roles and reporting relationships to demonstrate operational clarity. Including this document helps grant reviewers assess management capabilities and the business's ability to efficiently execute the proposed project. |

| 15 | Resumes of Key Personnel | Resumes of key personnel must highlight relevant experience, qualifications, and leadership roles to demonstrate the management team's capability to successfully execute the proposed project. Detailed resumes provide grant evaluators with insight into the small business's expertise, boosting credibility and increasing the likelihood of funding approval. |

| 16 | Market Analysis | A thorough market analysis report demonstrating target audience insights, competitive landscape, and growth potential is crucial for small business grant applications. Supporting documents such as industry research data, customer demographics, and market trend projections strengthen the credibility of the business plan. |

| 17 | Budget Proposal | A detailed budget proposal is essential for small business grant applications, outlining projected expenses, revenue, and resource allocation to demonstrate financial planning and viability. Including itemized costs for equipment, personnel, marketing, and operational expenses ensures transparency and strengthens the grant request. |

| 18 | Project Timeline | A detailed project timeline outlining key milestones, start and end dates, and resource allocation is essential for small business grant applications to demonstrate feasibility and planning. Clear scheduling evidence supports the grantor's confidence in the applicant's ability to execute the project within the specified funding period. |

| 19 | Letters of Support or Recommendation | Letters of Support or Recommendation for small business grant applications typically need to come from credible sources such as industry professionals, community leaders, or past clients who can vouch for the business's impact and reliability. These documents should highlight the business's strengths, past achievements, and potential for growth to enhance the application's credibility and persuasiveness. |

| 20 | Vendor Quotes or Estimates | Vendor quotes or estimates are crucial for small business grant applications as they provide detailed cost breakdowns supporting the requested funding amount. Accurate and itemized vendor estimates validate the budget and demonstrate the feasibility of project expenses to grant reviewers. |

| 21 | Evidence of Matching Funds | Evidence of matching funds in small business grant applications typically requires bank statements, financial statements, or letters from financial institutions confirming available funds or committed resources. Documentation must clearly demonstrate that the applicant has secured the required amount of capital to complement the grant, ensuring financial viability and compliance with grant conditions. |

| 22 | Partnership Agreements | Partnership agreements are essential documents for small business grant applications, detailing the ownership structure, roles, and responsibilities of each partner, which demonstrates the clarity and legitimacy of the business operation to grant providers. These agreements help establish legal and financial accountability, ensuring that the grant funds will be managed and utilized according to the terms agreed upon by all partners. |

| 23 | Minority/Women-Owned Business Certification (if applicable) | Minority and women-owned business certifications, such as SBA 8(a), Woman-Owned Small Business (WOSB), or Minority Business Enterprise (MBE) certificates, are essential documents when applying for small business grants targeting underrepresented entrepreneurs. Applicants must also provide proof of business ownership, valid tax identification numbers, financial statements, and detailed business plans tailored to grant requirements. |

| 24 | Nonprofit Status Documentation (if applicable) | Small business grant applications for nonprofits require documentation proving tax-exempt status, such as the IRS Form 1023 approval letter or the IRS determination letter indicating 501(c)(3) status. These documents verify eligibility and demonstrate compliance with federal regulations necessary for grant approval. |

| 25 | Legal Contracts | Small business grant applications typically require legal contracts such as business registration documents, partnership agreements, and lease agreements to verify the entity's legitimacy and operational foundation. These contracts demonstrate ownership structure, business location, and legal compliance, which are critical for grant eligibility and approval. |

| 26 | Insurance Certificates | Small business grant applications often require proof of insurance, such as general liability, workers' compensation, or property insurance certificates, to demonstrate financial responsibility and risk management. Submitting up-to-date insurance certificates ensures compliance with grant eligibility criteria and supports the evaluation of the business's operational stability. |

| 27 | DUNS Number | A DUNS Number is essential for small business grant applications as it provides a unique identifier used by government agencies and lenders to verify a company's financial and credit history. Including a DUNS Number helps streamline application verification processes and enhances eligibility for federal and private grant programs. |

| 28 | Business Insurance Proof | Business insurance proof is essential for small business grant applications as it demonstrates risk management and financial stability, often requiring documentation such as liability insurance policies, workers' compensation certificates, or property insurance documents. Grant providers prioritize businesses with verified insurance coverage to ensure project continuity and mitigate potential risks during fund utilization. |

Introduction to Grant Applications for Small Businesses

Small business grant applications require specific documentation to verify eligibility and support your funding request. Understanding these required documents is essential for a successful application process.

Common documents include a comprehensive business plan outlining your company's mission and growth strategy. Financial statements such as balance sheets, profit and loss statements, and cash flow projections demonstrate your business's financial health. Additional paperwork might include tax returns, proof of business registration, and a detailed budget for how the grant funds will be used.

Importance of Proper Documentation in Finance Grants

Proper documentation is crucial for small business grant applications to ensure accuracy and compliance with funding requirements. Essential documents typically include a detailed business plan, financial statements, and proof of business registration.

These documents demonstrate your business's viability and financial health, which increases the likelihood of grant approval. Organizing and submitting the correct paperwork reduces delays and strengthens your application in competitive grant processes.

Business Registration and Licensing Papers

| Document Type | Description | Purpose in Grant Application |

|---|---|---|

| Business Registration Certificate | Official proof of your business's legal existence issued by the government or relevant authority. | Confirms the legitimacy of the business applying for the grant and verifies its operational status. |

| Business License | Authorization granted to operate a specific type of business within a particular location or industry sector. | Ensures compliance with local regulations and demonstrates eligibility for funding based on industry standards. |

| Employer Identification Number (EIN) or Tax Identification Number (TIN) | Unique identifier assigned for tax purposes, often required for financial and legal correspondence. | Validates business identity for tax and administrative procedures linked to grant approval. |

Detailed Business Plan and Executive Summary

Preparing a detailed business plan and a clear executive summary is crucial for small business grant applications. These documents demonstrate the viability and strategic direction of your business to funding agencies.

- Detailed Business Plan - Outlines the business model, market analysis, financial projections, and operational strategy to prove business feasibility.

- Executive Summary - Provides a concise overview of the business plan, highlighting key points to capture the grant provider's attention quickly.

- Supporting Financial Documents - Includes budgets, income statements, and cash flow forecasts to validate the financial assumptions presented in the plan.

Financial Statements and Audited Reports

Small business grant applications typically require detailed financial statements to assess the viability and financial health of your business. These statements include income statements, balance sheets, and cash flow statements, providing a comprehensive view of business operations.

Audited reports, prepared by certified accountants, add credibility and transparency to your financial data. Including these verified documents strengthens your application by demonstrating accurate financial management and compliance with accounting standards.

Personal and Business Tax Returns

Small business grant applications often require both personal and business tax returns to verify financial stability and eligibility. Personal tax returns provide insights into the applicant's income and creditworthiness, while business tax returns reflect the company's revenue and operational performance. Submitting accurate and complete tax documents enhances the chances of securing grant funding by demonstrating financial transparency.

Cash Flow Projections and Budgets

```htmlWhat documents are necessary for small business grant applications? Cash flow projections and budgets are essential to demonstrate your financial planning and sustainability. These documents provide a clear picture of expected income, expenses, and cash availability to grant reviewers.

```Proof of Ownership and Organizational Structure

Submitting a small business grant application requires specific documents to verify your business credentials. Proof of ownership and organizational structure are critical components that validate your eligibility for funding.

- Proof of Ownership - Documents such as business licenses, partnership agreements, or shareholder certificates confirm who legally controls the business.

- Organizational Structure - Providing an organizational chart or legal formation documents shows the hierarchy and operational framework of your business.

- Supporting Identification - Personal identification or tax identification numbers link ownership and structure details to registered entities.

Ensuring these documents are accurate and up-to-date increases the chances of securing small business grant funding.

Grant-Specific Application Forms

Grant-specific application forms are essential documents required when applying for a small business grant. These forms often ask for detailed business information, financial statements, and project proposals tailored to the grant's criteria. Submitting accurate and complete application forms increases the chances of securing funding for your business needs.

What Documents are Necessary for Small Business Grant Applications? Infographic