To prepare for a small business tax audit, gather essential documents such as income statements, expense receipts, bank statements, and payroll records. Maintain organized financial records, including tax returns from previous years, invoices, and proof of deductions, to substantiate reported figures. Accurate documentation ensures a smoother audit process and helps resolve issues efficiently.

What Documents Are Necessary for a Small Business Tax Audit?

| Number | Name | Description |

|---|---|---|

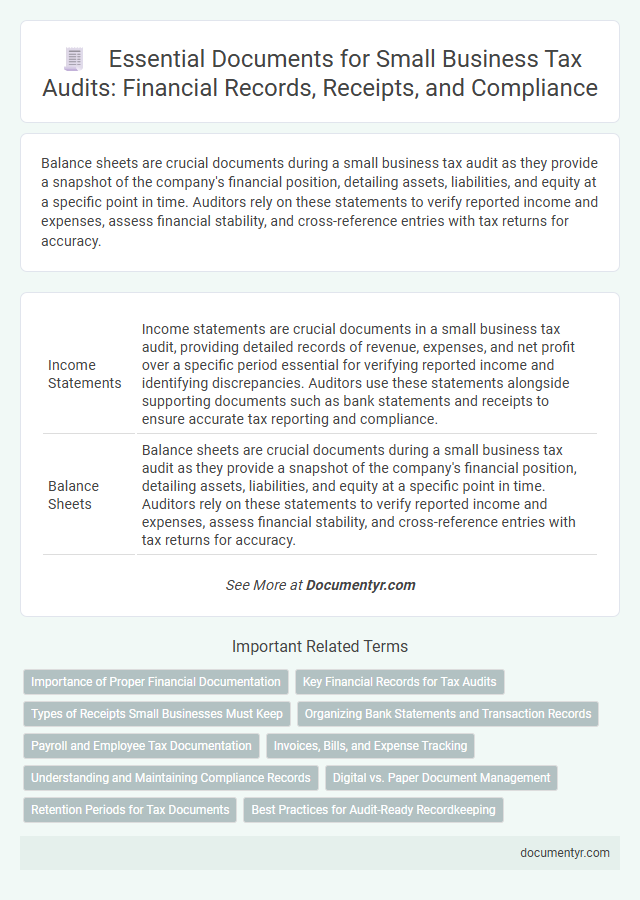

| 1 | Income Statements | Income statements are crucial documents in a small business tax audit, providing detailed records of revenue, expenses, and net profit over a specific period essential for verifying reported income and identifying discrepancies. Auditors use these statements alongside supporting documents such as bank statements and receipts to ensure accurate tax reporting and compliance. |

| 2 | Balance Sheets | Balance sheets are crucial documents during a small business tax audit as they provide a snapshot of the company's financial position, detailing assets, liabilities, and equity at a specific point in time. Auditors rely on these statements to verify reported income and expenses, assess financial stability, and cross-reference entries with tax returns for accuracy. |

| 3 | General Ledger | A comprehensive general ledger is essential for a small business tax audit as it provides detailed records of all financial transactions, ensuring transparency and accuracy in reported income and expenses. Maintaining organized general ledger accounts helps auditors verify tax filings, support deductions, and identify discrepancies efficiently. |

| 4 | Bank Statements | Bank statements are essential documents for a small business tax audit, providing detailed records of all financial transactions and verifying reported income and expenses. Accurate bank statements help auditors identify discrepancies, support expense deductions, and ensure compliance with tax regulations. |

| 5 | Cash Receipts | Cash receipts are critical documents for a small business tax audit as they provide proof of income and validate reported revenues. Maintaining organized records of all cash transactions, including receipts, deposit slips, and related bank statements, ensures accurate verification of financial records by tax authorities. |

| 6 | Sales Invoices | Sales invoices are essential documents in a small business tax audit as they provide detailed records of all sales transactions, including date, amount, customer information, and tax collected. Accurate and organized sales invoices support revenue verification, help identify discrepancies, and substantiate reported income to tax authorities. |

| 7 | Purchase Invoices | Purchase invoices are crucial documents in a small business tax audit, as they provide detailed records of business expenses and validate deductible costs claimed on tax returns. Maintaining organized, accurate purchase invoices ensures compliance with tax regulations and supports the credibility of reported financial data during the audit process. |

| 8 | Expense Receipts | Expense receipts are essential documents for a small business tax audit, providing proof of deductible business costs such as supplies, travel, and meals. Maintaining organized and detailed receipts supports accurate expense reporting and helps substantiate claims during the audit process. |

| 9 | Payroll Records | Payroll records, including employee wage statements, tax withholding forms (W-4), payroll tax filings (941, 940), and payment proofs for Social Security, Medicare, and unemployment taxes, are essential documents for a small business tax audit. Maintaining accurate timecards, pay stubs, and records of employee benefits ensures compliance and supports claims during IRS examinations. |

| 10 | Tax Returns (Previous Years) | Maintaining comprehensive tax returns from previous years is crucial for a small business tax audit, as these documents provide a detailed record of reported income, deductions, and credits that auditors use to verify compliance and identify discrepancies. Accurate and organized past tax returns enable efficient cross-referencing with financial statements and supporting documents, ensuring a thorough and transparent audit process. |

| 11 | 1099 Forms | Small business tax audits require thorough documentation, with 1099 forms essential for verifying payments made to independent contractors and vendors. Accurate 1099 reporting helps the IRS confirm income declarations and ensures compliance with federal tax regulations, minimizing audit risks. |

| 12 | W-2 Forms | W-2 forms are essential documents during a small business tax audit as they verify employee wage information and tax withholdings reported to the IRS. Accurate and complete W-2 records help auditors assess payroll compliance and identify discrepancies in reported income and taxes. |

| 13 | Loan Agreements | Loan agreements are crucial documents in a small business tax audit, providing evidence of borrowed funds, repayment terms, and interest expenses claimed as deductions. Auditors scrutinize these agreements to verify the legitimacy of loans, confirm compliance with tax codes, and ensure accurate reporting of liabilities and interest income. |

| 14 | Lease Agreements | Lease agreements are critical documents in a small business tax audit, providing proof of rental expenses and terms that affect deductible business costs. Auditors scrutinize these agreements to verify lease periods, payment amounts, and compliance with tax regulations related to property use. |

| 15 | Depreciation Schedules | Depreciation schedules are essential documents in a small business tax audit as they detail the allocation of asset costs over their useful life, directly impacting taxable income calculations. Accurate and thorough depreciation records, including purchase dates, asset descriptions, and calculated depreciation methods, help substantiate deductions claimed on tax returns and reduce the risk of audit adjustments. |

| 16 | Asset Purchase Records | Asset purchase records, including invoices, purchase agreements, and proof of payment, are essential documents in a small business tax audit to verify the accuracy of reported expenses and asset values. Detailed depreciation schedules and documentation of financing methods must be maintained to support asset cost bases and compliance with tax regulations. |

| 17 | Credit Card Statements | Credit card statements are essential documents for small business tax audits as they provide detailed records of expenses and transactions that support deductible business costs. Maintaining organized and comprehensive credit card statements helps verify financial accuracy and substantiates claims made on tax returns during the audit process. |

| 18 | Inventory Reports | Inventory reports are essential documents for a small business tax audit, providing detailed records of stock levels, purchases, and sales throughout the fiscal year. Accurate inventory valuation methods, such as FIFO or LIFO, along with supporting invoices and inventory count sheets, help verify reported income and cost of goods sold to ensure compliance with tax regulations. |

| 19 | Petty Cash Logs | Petty cash logs are essential documents during a small business tax audit as they provide a detailed record of minor expenditures and cash disbursements. Accurate and well-maintained petty cash logs help verify expense claims and support compliance with tax regulations. |

| 20 | Employee Benefit Records | Employee benefit records essential for a small business tax audit include documentation of health insurance plans, retirement contributions, employee stock options, and any fringe benefits provided. Properly maintaining payroll records, benefit plan summaries, and compliance reports ensures verification of tax deductions and adherence to IRS regulations during the audit. |

| 21 | State and Local Tax Filings | State and local tax filings required for a small business tax audit include sales tax returns, income tax filings, property tax statements, and payroll tax documents. Maintaining accurate records of exemptions, tax credits, and payment receipts ensures compliance and facilitates efficient audit reviews. |

| 22 | Cancelled Checks | Cancelled checks provide crucial proof of payment and financial transactions, serving as vital evidence during a small business tax audit to verify expenses and taxable deductions. Maintaining organized records of cancelled checks helps substantiate cash disbursements, supplier payments, and loan repayments, ensuring compliance with IRS regulations. |

| 23 | Supporting Documentation for Deductions | Supporting documentation for deductions during a small business tax audit includes receipts, invoices, bank statements, and credit card records that validate business expenses. Maintaining organized payroll records, mileage logs, and detailed financial statements ensures compliance and substantiates claims for deductions such as travel, supplies, and employee wages. |

| 24 | Travel and Entertainment Records | Accurate travel and entertainment records, including detailed receipts, mileage logs, and expense reports, are crucial for substantiating deductible expenditures during a small business tax audit. Maintaining organized documentation of dates, purposes, and participants helps ensure compliance with IRS regulations and minimizes the risk of audit adjustments. |

| 25 | Chart of Accounts | The Chart of Accounts is essential for a small business tax audit as it organizes all financial transactions into categories facilitating accurate income and expense tracking. Auditors rely on this detailed account structure to verify reported figures and ensure compliance with tax regulations. |

Importance of Proper Financial Documentation

Proper financial documentation is crucial during a small business tax audit to verify income, expenses, and tax deductions accurately. Maintaining organized records reduces the risk of penalties and ensures compliance with tax regulations.

Essential documents include income statements, receipts, bank statements, and tax returns. Payroll records, invoices, and expense reports also play a vital role in substantiating business activities. You must keep these documents readily accessible to provide clear evidence of your financial transactions during the audit process.

Key Financial Records for Tax Audits

Key financial records are essential during a small business tax audit to verify accurate reporting and compliance. These documents include income statements, balance sheets, and cash flow statements prepared for the audit period.

Receipts, invoices, and bank statements serve as proof of transactions and support expense deductions claimed on tax returns. Payroll records, tax filings, and correspondence with the tax authority also form crucial parts of the audit documentation.

Types of Receipts Small Businesses Must Keep

Small businesses must keep detailed receipts to support all income and expense claims during a tax audit. Essential receipt types include sales receipts, purchase receipts, and expense receipts for items like office supplies, utilities, and travel. Proper documentation of these receipts ensures accurate record-keeping and compliance with tax regulations.

Organizing Bank Statements and Transaction Records

Organizing bank statements and transaction records is crucial for a small business tax audit to verify income and expenses accurately. Proper documentation helps streamline the audit process and ensures compliance with tax regulations.

- Bank Statements - Collect all monthly bank statements to confirm deposits, withdrawals, and account balances during the audit period.

- Transaction Records - Maintain detailed records of all transactions, including receipts, invoices, and payment confirmations to support income and expense claims.

- Reconciliations - Perform regular bank reconciliations to match bank statements with your accounting records, identifying discrepancies early for accurate reporting.

Payroll and Employee Tax Documentation

During a small business tax audit, payroll and employee tax documentation are critical for verifying compliance with tax laws. Accurate records help demonstrate that your business has correctly reported wages and withheld appropriate taxes.

- Payroll Registers - Detailed payroll registers provide a comprehensive record of employee wages, hours worked, and tax withholdings.

- Employee Tax Forms (W-2, W-4) - W-2 forms report annual wages and tax deductions, while W-4 forms show employee withholding allowances.

- Tax Deposit Records - Documentation of tax deposits confirms that payroll taxes were submitted timely to the IRS and other tax authorities.

Maintaining organized payroll and employee tax documents ensures a smoother audit process and compliance verification.

Invoices, Bills, and Expense Tracking

What documents are necessary for a small business tax audit? Accurate invoices and bills provide essential proof of income and expenses, helping verify financial transactions. Detailed expense tracking supports deductions and clarifies spending patterns during the audit process.

Understanding and Maintaining Compliance Records

| Document Type | Description | Importance in Tax Audit |

|---|---|---|

| Tax Returns | Copies of all federal, state, and local tax returns filed by the business. | Primary evidence of income reported and deductions claimed. Essential for verifying compliance. |

| Financial Statements | Balance sheets, income statements, and cash flow statements prepared during the tax year. | Support reported income and expenses; clarify financial position during audit. |

| Bank Statements | Monthly bank statements for all business accounts. | Verify sources of deposits and withdrawals; important for detecting discrepancies. |

| Receipts and Invoices | Documentation of business expenses and sales transactions. | Prove legitimacy of expense deductions and revenue reported. |

| Payroll Records | Employee pay stubs, timesheets, and payroll tax filings. | Confirm accurate wage reporting and proper payroll tax payments. |

| Inventory Records | Logs and valuation reports of inventory held during the tax period. | Validate cost of goods sold and inventory valuations influencing taxable income. |

| Expense Documentation | Contracts, leases, utility bills, and other expense-related documents. | Confirm business expense claims; prevent disallowance of deductions. |

| Loan and Debt Documents | Loan agreements, promissory notes, and repayment schedules. | Explain liabilities and interest deductions reported on tax returns. |

| Compliance Records | Licenses, permits, and business registration certificates. | Establish legitimacy and regulatory compliance of the business's operations. |

| Correspondence from Tax Authorities | Notices, letters, and audit reports received from IRS or tax agencies. | Track prior audit history and responses; support proactive compliance efforts. |

Digital vs. Paper Document Management

Small business tax audits require thorough documentation to verify financial accuracy and compliance. Essential documents include income statements, expense receipts, bank statements, and tax returns.

Digital document management streamlines organization, allowing easy access to scanned invoices, electronic receipts, and digital bank records. Paper documents require meticulous filing and increase the risk of loss or damage during audit preparation.

Retention Periods for Tax Documents

Small business tax audits require thorough documentation, including income records, expense receipts, and payroll information. Retention periods for tax documents generally range from three to seven years, depending on the type of record and tax authority guidelines. Keeping your financial documents organized and retained for the appropriate duration ensures compliance and smooth audit processes.

What Documents Are Necessary for a Small Business Tax Audit? Infographic