To open a Roth IRA account, you need a valid government-issued photo ID such as a driver's license or passport, your Social Security number, and proof of income or employment. Most financial institutions also require your bank account information for funding the account. Additionally, completing the account application form with personal details and beneficiary information is necessary for account setup.

What Documents Are Needed for Opening a Roth IRA Account?

| Number | Name | Description |

|---|---|---|

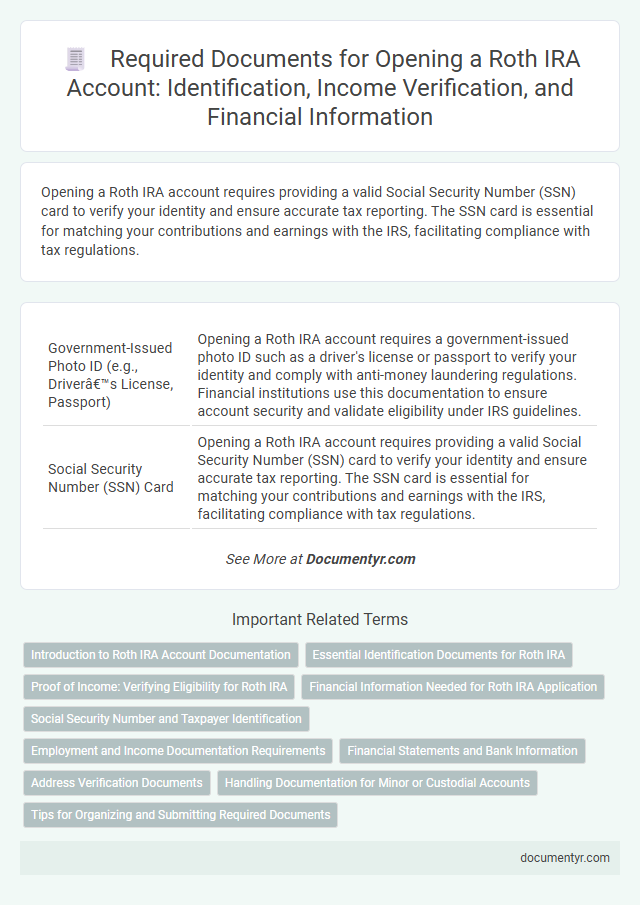

| 1 | Government-Issued Photo ID (e.g., Driver’s License, Passport) | Opening a Roth IRA account requires a government-issued photo ID such as a driver's license or passport to verify your identity and comply with anti-money laundering regulations. Financial institutions use this documentation to ensure account security and validate eligibility under IRS guidelines. |

| 2 | Social Security Number (SSN) Card | Opening a Roth IRA account requires providing a valid Social Security Number (SSN) card to verify your identity and ensure accurate tax reporting. The SSN card is essential for matching your contributions and earnings with the IRS, facilitating compliance with tax regulations. |

| 3 | Proof of Address (e.g., Utility Bill, Lease Agreement) | Proof of address documents, such as a recent utility bill or lease agreement, are essential when opening a Roth IRA account to verify the applicant's residential address. Financial institutions require these documents to comply with regulatory standards and ensure accurate account holder information. |

| 4 | Employment Information/Pay Stub | To open a Roth IRA account, providing recent employment information, such as a current pay stub, verifies your earned income eligibility for contributions. Documentation typically includes employer name, job title, income details, and pay period dates to ensure compliance with IRS income requirements. |

| 5 | Bank Account Information (e.g., Voided Check) | To open a Roth IRA account, you must provide bank account information, such as a voided check or a bank statement, to facilitate contributions and electronic transfers. This documentation ensures accurate linkage between your financial institution and the IRA provider for seamless fund movement. |

| 6 | Beneficiary Designation Form | When opening a Roth IRA account, a Beneficiary Designation Form is essential to specify who will inherit the account assets in the event of the account holder's death, ensuring efficient and direct transfer of funds. This form typically requires detailed information about each beneficiary, including their full name, Social Security number, date of birth, and relationship to the account holder. |

| 7 | Previous Year’s Tax Return (if applicable) | When opening a Roth IRA account, providing the previous year's tax return is crucial for verifying your adjusted gross income (AGI) to ensure eligibility based on IRS income limits. This document helps the financial institution confirm you meet Roth IRA contribution requirements and accurately report your tax situation. |

| 8 | Existing Retirement Account Statements (for rollovers) | Existing retirement account statements are essential for opening a Roth IRA if you plan to perform a rollover, as they provide detailed information on the current account balance, investment types, and distribution history. These statements ensure accurate transfer of funds and help avoid tax penalties during the rollover process. |

| 9 | Roth IRA Application Form | The Roth IRA application form requires essential personal information such as Social Security number, date of birth, and contact details to verify identity and eligibility. Providing accurate financial details, including employment status and income, ensures compliance with IRS contribution limits and tax regulations. |

| 10 | Proof of Income (if required by provider) | Proof of income for opening a Roth IRA account typically includes recent pay stubs, W-2 forms, or tax returns to verify eligibility based on earned income. Some providers may also accept alternative documentation such as 1099 forms for self-employed individuals or pension statements if applicable. |

Introduction to Roth IRA Account Documentation

Opening a Roth IRA account requires specific documentation to verify your identity and financial information. Proper documentation ensures compliance with IRS regulations and smooth account setup.

- Proof of Identity - Government-issued ID such as a driver's license or passport is required to confirm your identity.

- Social Security Number - Your SSN is necessary for tax reporting and eligibility verification.

- Bank Account Information - A voided check or bank statement is needed for funding the Roth IRA account.

Having these documents ready facilitates a quick and efficient Roth IRA account opening process.

Essential Identification Documents for Roth IRA

| Document Type | Description | Purpose |

|---|---|---|

| Valid Government-Issued Photo ID | Examples include a driver's license, state ID card, or passport. | Confirms identity and legal eligibility to open a Roth IRA account. |

| Social Security Number (SSN) or Taxpayer Identification Number (TIN) | Official SSN card or tax documents displaying the number. | Required for tax reporting and verifying U.S. residency status. |

| Proof of Address | Utility bill, lease agreement, or bank statement dated within the last 3 months. | Verifies current residential address for account records. |

| Employment Information | Recent pay stub or employer letter. | Used by some financial institutions to assess contribution eligibility. |

| Beneficiary Information | Names, Social Security Numbers, and contact details of designated beneficiaries. | Ensures proper account ownership transfer in the event of your death. |

Proof of Income: Verifying Eligibility for Roth IRA

Opening a Roth IRA account requires certain documents to verify your eligibility, with proof of income being essential. Financial institutions need to confirm that your earnings qualify for Roth IRA contributions under IRS guidelines.

Proof of income can include recent pay stubs, W-2 forms, or tax returns, which demonstrate your earned income for the year. Self-employed individuals may need to provide 1099 forms or profit and loss statements for verification. These documents ensure you meet the income limits set for Roth IRA contributions, allowing you to secure your retirement savings appropriately.

Financial Information Needed for Roth IRA Application

To open a Roth IRA account, you must provide key financial information including your Social Security number and annual income details. Proof of identity such as a government-issued ID is essential to verify your eligibility. Additionally, you may need to disclose your employment status and financial institution details for account setup.

Social Security Number and Taxpayer Identification

Opening a Roth IRA account requires specific identification documents to verify the account holder's eligibility and tax status. The Social Security Number (SSN) or Taxpayer Identification Number (TIN) plays a crucial role in this verification process.

- Social Security Number (SSN) - This unique nine-digit number is required to confirm your identity and report contributions accurately to the IRS.

- Taxpayer Identification Number (TIN) - For individuals without an SSN, a TIN serves as an alternative identification for tax reporting purposes.

- Verification of Tax Status - Providing your SSN or TIN ensures proper tax treatment of contributions and withdrawals within the Roth IRA framework.

Employment and Income Documentation Requirements

What employment documents are required to open a Roth IRA account? Proof of employment is essential to verify your eligibility for a Roth IRA. Typical documents include recent pay stubs, a W-2 form, or an employment verification letter from your employer.

Which income documents must be submitted to open a Roth IRA? Accurate income reporting is necessary for contribution limits and eligibility assessment. You should provide recent tax returns, pay stubs, or other income statements such as 1099 forms for self-employment income.

Financial Statements and Bank Information

To open a Roth IRA account, financial institutions typically require recent financial statements to verify your income and financial status. These documents may include pay stubs, tax returns, or investment account summaries to provide a clear picture of your financial health.

Bank information is also essential, including your checking or savings account details, to facilitate contributions and withdrawals. Providing accurate bank information ensures seamless transfers and helps maintain the integrity of your Roth IRA account.

Address Verification Documents

When opening a Roth IRA account, address verification documents are essential to confirm your residential information. Commonly accepted documents include a utility bill, bank statement, or a government-issued ID that clearly shows your current address. These documents must be recent, typically dated within the last 90 days, to meet the financial institution's verification requirements.

Handling Documentation for Minor or Custodial Accounts

Opening a Roth IRA account involves specific documentation requirements, especially when managing accounts for minors or custodial accounts. Proper handling of these documents ensures compliance with financial regulations and secures the account holder's benefits.

- Proof of Identity - Valid government-issued identification for both the custodian and the minor is required to verify identities.

- Custodial Agreement - Legal documents establishing the custodian's authority to manage the Roth IRA on behalf of the minor must be completed.

- Minor's Social Security Number - The minor's Social Security Number is essential for tax reporting and account setup purposes.

What Documents Are Needed for Opening a Roth IRA Account? Infographic