Key documents required for an investment property loan application include proof of income such as pay stubs, tax returns, and bank statements to verify financial stability. Lenders also demand detailed information about the property, including purchase agreements, rental income projections, and property appraisals. Credit reports and identification documents are essential for assessing borrowing risk and confirming borrower identity.

What Documents Are Needed for an Investment Property Loan Application?

| Number | Name | Description |

|---|---|---|

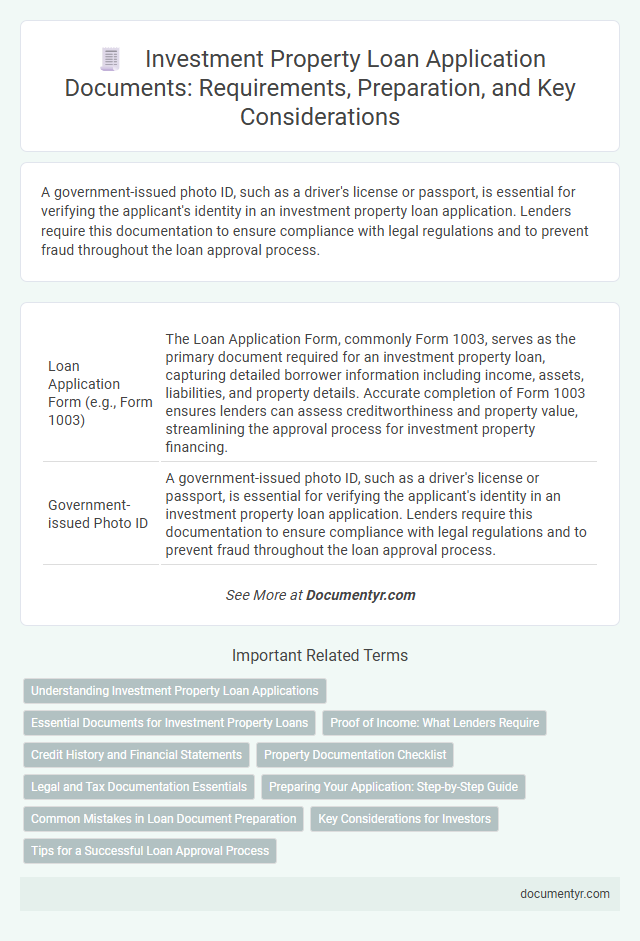

| 1 | Loan Application Form (e.g., Form 1003) | The Loan Application Form, commonly Form 1003, serves as the primary document required for an investment property loan, capturing detailed borrower information including income, assets, liabilities, and property details. Accurate completion of Form 1003 ensures lenders can assess creditworthiness and property value, streamlining the approval process for investment property financing. |

| 2 | Government-issued Photo ID | A government-issued photo ID, such as a driver's license or passport, is essential for verifying the applicant's identity in an investment property loan application. Lenders require this documentation to ensure compliance with legal regulations and to prevent fraud throughout the loan approval process. |

| 3 | Social Security Card | A Social Security Card is a critical document for an investment property loan application as it verifies the borrower's identity and Social Security Number (SSN), which lenders use to assess credit history and financial background. Lenders require this document alongside income statements, tax returns, and property details to ensure compliance with federal regulations and accurately evaluate loan eligibility. |

| 4 | Purchase Agreement | A comprehensive investment property loan application requires a fully executed purchase agreement detailing the property's purchase price, terms, and contingencies. This document verifies the buyer's commitment and provides lenders with critical information to assess risk and approve financing. |

| 5 | Proof of Down Payment Funds | Proof of down payment funds for an investment property loan application requires bank statements, gift letters, or evidence of liquid assets demonstrating sufficient funds. Lenders also verify the source of these funds to ensure compliance with anti-money laundering regulations. |

| 6 | Bank Statements (Personal & Business) | Bank statements for both personal and business accounts are crucial in an investment property loan application to verify income stability, cash flow, and financial health over the past 2-3 months. Lenders analyze these documents to assess the borrower's ability to manage debt and make consistent mortgage payments. |

| 7 | Asset Statements (Retirement, Brokerage Accounts) | Asset statements from retirement and brokerage accounts are essential documents for an investment property loan application, providing proof of financial stability and liquidity to lenders. These statements demonstrate the borrower's capacity to cover down payments, closing costs, and reserve requirements, enhancing the loan approval likelihood. |

| 8 | Recent Pay Stubs | Recent pay stubs provide lenders with proof of consistent income and employment stability, essential for evaluating an applicant's ability to repay an investment property loan. Typically, borrowers must submit at least two to three of the most recent pay stubs covering 30 days or more to meet standard documentation requirements. |

| 9 | Two Years’ W-2 Forms | Two years' W-2 forms are essential for verifying stable income and employment history when applying for an investment property loan. Lenders rely on these documents to assess the borrower's ability to repay the loan and to evaluate financial consistency over time. |

| 10 | Two Years’ Tax Returns (Personal & Business) | Two years' tax returns, both personal and business, are crucial documents for an investment property loan application as they provide lenders with verified income history and financial stability. These returns help assess debt-to-income ratios, cash flow, and the applicant's ability to manage mortgage payments, increasing the likelihood of loan approval. |

| 11 | Property Rental Income Statements (if applicable) | Property rental income statements provide crucial verification of consistent cash flow for investment property loan applications, demonstrating the borrower's ability to cover mortgage payments. Lenders typically require detailed rental income documents, including leases and bank statements, to assess the property's income stability and risk profile. |

| 12 | Current Lease Agreements (if applicable) | Current lease agreements are essential documents for an investment property loan application, providing lenders with proof of rental income and tenant occupancy. These agreements demonstrate the property's cash flow potential and help underwriters assess the borrower's ability to cover mortgage payments. |

| 13 | Existing Mortgage Statements (if applicable) | Existing mortgage statements are crucial documents for an investment property loan application as they provide lenders with detailed information on current loan balances, payment history, and outstanding debt obligations. These statements help underwriters assess the borrower's financial stability and ability to manage additional property financing effectively. |

| 14 | Insurance Documents (Homeowner’s, Flood, Rental) | Insurance documents crucial for an investment property loan application include the homeowner's insurance policy, flood insurance if the property is in a flood-prone area, and rental insurance when the property generates rental income. Lenders require these documents to ensure the property is adequately protected against potential risks, safeguarding their investment. |

| 15 | Credit Report Authorization | A credit report authorization form is essential for an investment property loan application, allowing lenders to access your detailed credit history and assess financial reliability. This document verifies your creditworthiness, influencing loan approval decisions and interest rates offered. |

| 16 | Schedule of Real Estate Owned | The Schedule of Real Estate Owned (SREO) is a critical document listing all owned properties, including addresses, market values, and outstanding mortgage balances, essential for assessing the borrower's real estate portfolio during an investment property loan application. Lenders use the SREO to evaluate financial stability, cash flow potential, and debt-to-equity ratios, ensuring informed lending decisions. |

| 17 | Appraisal Report (or Authorization) | The appraisal report is a crucial document in an investment property loan application, providing an unbiased market value assessment to ensure the property's worth aligns with the loan amount requested. Lenders require either the official appraisal report or an authorization form allowing them to order one, ensuring accurate evaluation of the property's potential as collateral. |

| 18 | Property Title/Deed | Lenders require the property title or deed to verify ownership and confirm there are no liens or encumbrances that could affect the loan. A clear and marketable title ensures the investment property can be used as collateral for the loan application. |

| 19 | HOA Documents (if applicable) | HOA documents required for an investment property loan application typically include the homeowner association's bylaws, financial statements, meeting minutes, and any pending litigation disclosures to verify the community's financial health and regulatory compliance. Lenders review these documents to assess potential risks related to fees, restrictions, and the overall stability of the HOA before approving financing. |

| 20 | Proof of Additional Income (e.g., alimony, child support) | Proof of additional income, such as alimony or child support, requires official court orders, recent bank statements showing consistent deposits, and payment history documentation to verify reliability. Lenders may also request tax returns and affidavits to confirm the income's stability and duration for the investment property loan application. |

| 21 | Gift Letter (if down payment is a gift) | A gift letter is a critical document in an investment property loan application when the down payment is provided by someone other than the borrower. This letter must clearly state the donor's intent that the funds are a gift and do not require repayment, helping lenders verify the borrower's financial eligibility and source of the down payment. |

| 22 | Business License (if self-employed) | A business license is essential for self-employed applicants seeking an investment property loan, as it verifies the legitimacy of their business operations and income. Lenders require this document to assess financial stability and ensure compliance with local regulations before approving the loan. |

| 23 | Profit & Loss Statements (if self-employed) | Profit and Loss Statements are essential for self-employed individuals applying for an investment property loan, as they demonstrate consistent income and business profitability over time. Lenders typically require at least two years of detailed P&L statements to assess financial stability and repayment capacity accurately. |

| 24 | LLC/Corporation Documents (if purchasing under entity) | For an investment property loan application under an LLC or corporation, essential documents include the Articles of Organization or Incorporation, Operating Agreement or Bylaws, and Employer Identification Number (EIN) confirmation. Lenders also require recent tax returns, financial statements, and authorized signatory resolutions to verify the entity's financial standing and legal authority to transact. |

| 25 | Landlord Reference Letters (if applicable) | Landlord reference letters are crucial when applying for an investment property loan, as they validate your rental history, payment reliability, and property management skills. These letters typically include details such as lease terms, payment consistency, and tenant behavior, reinforcing your credibility to lenders. |

Understanding Investment Property Loan Applications

| Document Type | Description | Purpose in Loan Application |

|---|---|---|

| Proof of Income | Recent pay stubs, tax returns, or profit and loss statements for self-employed applicants | Verifies borrower's ability to repay the loan by confirming consistent income |

| Credit Report | Official credit report obtained from credit bureaus | Assesses creditworthiness and risk profile of the applicant |

| Property Information | MLS listing, purchase agreement, or appraisal report | Provides details on the investment property's value and condition |

| Bank Statements | Statements from the last 2-3 months | Shows financial reserves and cash flow to cover down payment and closing costs |

| Debt Information | Documentation of existing loans, credit card statements, and obligations | Calculates debt-to-income ratio important for loan approval criteria |

| Identification | Government-issued IDs such as driver's license or passport | Confirms borrower identity and prevents fraud |

| Rental Income Documentation | Current lease agreements or rental history reports | Supports projected income from the investment property |

| Down Payment Proof | Bank statements or gift letters confirming funds for the down payment | Validates availability of initial equity required for the loan |

| Business Documents (if applicable) | Operating agreements, business licenses, or incorporation papers | Required for self-employed borrowers or those purchasing through an entity |

Essential Documents for Investment Property Loans

When applying for an investment property loan, certain essential documents are required to assess your financial stability and the property's value. These documents help lenders determine your eligibility and the loan terms.

The primary documents include proof of income, such as recent pay stubs, tax returns, and bank statements. You will also need the property's purchase agreement, appraisal report, and details about any current debts or liabilities. Providing comprehensive documentation ensures a smoother loan approval process for investment properties.

Proof of Income: What Lenders Require

Proof of income is a critical component in an investment property loan application. Lenders require detailed documentation to verify the borrower's ability to repay the loan.

Common proof of income documents include recent pay stubs, W-2 forms, and federal tax returns. Self-employed borrowers must provide profit and loss statements, 1099 forms, and sometimes bank statements.

Credit History and Financial Statements

Applying for an investment property loan requires thorough documentation to verify financial stability and creditworthiness. Key documents focus on credit history and detailed financial statements to support the application.

- Credit Report - A comprehensive report from credit bureaus that outlines your credit score, outstanding debts, and payment history.

- Personal Financial Statements - Summaries of assets, liabilities, income, and expenses that provide a clear snapshot of your financial health.

- Business Financial Statements - If applicable, profit and loss statements and balance sheets for investment properties or related business entities demonstrating income and expenses.

Property Documentation Checklist

Securing an investment property loan requires thorough documentation to ensure a smooth application process. A comprehensive property documentation checklist is essential for verifying eligibility and property value.

Key documents include the purchase agreement, property deed, and recent property tax statements. Additionally, an appraisal report and proof of homeowner's insurance are often required to affirm the property's condition and coverage.

Legal and Tax Documentation Essentials

Applying for an investment property loan requires submitting specific legal and tax documents to verify financial stability and compliance. Lenders demand these documents to assess the borrower's eligibility and minimize risk.

- Title Deed - Confirms legal ownership of the property and any existing liens or encumbrances.

- Tax Returns - Provides proof of income and financial history for at least the past two years.

- Property Insurance Documents - Ensures the investment property is adequately protected against potential damages or losses.

Accurate and complete legal and tax documentation expedites the loan approval process for investment properties.

Preparing Your Application: Step-by-Step Guide

What documents are necessary for an investment property loan application? Lenders typically require proof of income, tax returns, and credit reports to evaluate your financial stability. These documents verify your ability to manage loan repayments and assess investment risk.

How can you prepare your investment property loan application effectively? Gather recent pay stubs, two years of tax returns, and bank statements before applying. Organizing these papers ensures a smoother review process by the lender.

Which additional documents might be needed for an investment property loan? Rental income statements, property details, and a list of current assets and liabilities are often requested. These materials provide a complete financial picture for underwriting purposes.

Why is a credit report essential in your loan application? Credit reports demonstrate your creditworthiness and payment history to lenders. A strong credit score increases the chances of loan approval and favorable interest rates.

Where should you obtain your financial documents for an investment property loan? Secure official records from your employer, bank, and tax authorities to include accurate data in your application. Authentic documents reduce processing delays and build lender trust.

Common Mistakes in Loan Document Preparation

Proper preparation of documents is essential for a successful investment property loan application. Common mistakes in loan document preparation can delay approval or cause rejection.

- Incomplete Financial Records - Providing partial or outdated financial statements often leads to processing delays and additional verification requests.

- Missing Personal Identification - Failure to include valid government-issued IDs or proof of residency can result in application setbacks.

- Inaccurate Property Information - Incorrect details about the investment property, such as address or appraisal value, may cause lender mistrust and qualification issues.

Key Considerations for Investors

Investors applying for an investment property loan must provide essential documents such as proof of income, bank statements, and credit history to demonstrate financial stability. Detailed property information, including purchase agreements and appraisals, helps lenders assess the loan risk accurately. Accurate tax returns and documentation of existing debts are critical for evaluating an investor's repayment capacity and loan eligibility.

What Documents Are Needed for an Investment Property Loan Application? Infographic