Financial aid verification requires submitting key documents such as the FAFSA application, tax returns, W-2 forms, and proof of income. Students may also need to provide identity verification and household size information to confirm eligibility. Accurate and complete documentation ensures timely processing and disbursement of financial aid awards.

What Documents Are Necessary for Financial Aid Verification?

| Number | Name | Description |

|---|---|---|

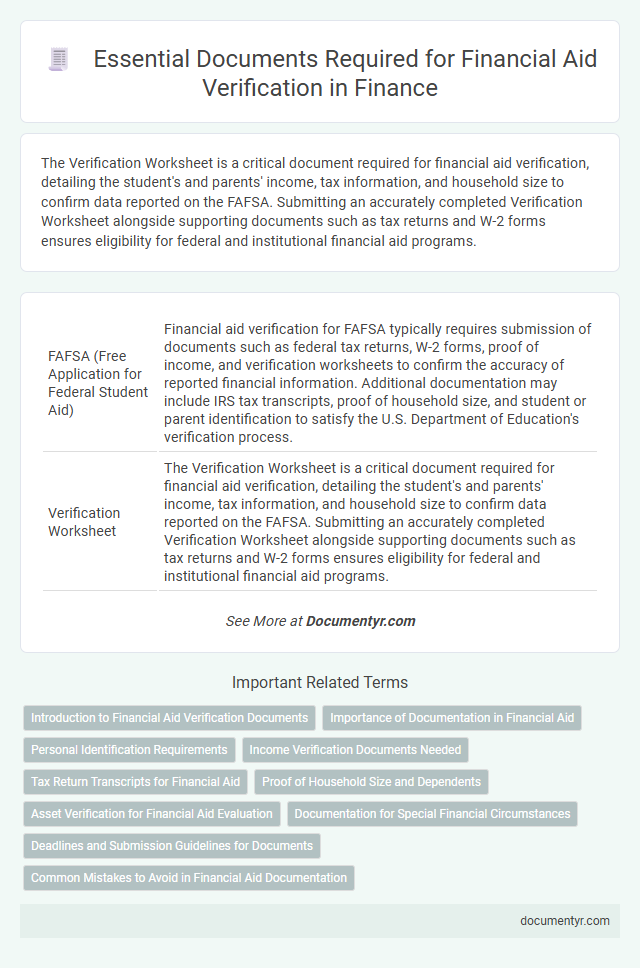

| 1 | FAFSA (Free Application for Federal Student Aid) | Financial aid verification for FAFSA typically requires submission of documents such as federal tax returns, W-2 forms, proof of income, and verification worksheets to confirm the accuracy of reported financial information. Additional documentation may include IRS tax transcripts, proof of household size, and student or parent identification to satisfy the U.S. Department of Education's verification process. |

| 2 | Verification Worksheet | The Verification Worksheet is a critical document required for financial aid verification, detailing the student's and parents' income, tax information, and household size to confirm data reported on the FAFSA. Submitting an accurately completed Verification Worksheet alongside supporting documents such as tax returns and W-2 forms ensures eligibility for federal and institutional financial aid programs. |

| 3 | Federal Income Tax Returns (IRS Form 1040) | Federal Income Tax Returns (IRS Form 1040) are essential for financial aid verification, providing accurate income and tax information to confirm eligibility for aid programs. Submitting signed copies of the IRS Form 1040, including all schedules and attachments, ensures the correct assessment of a student's or family's financial status by the financial aid office. |

| 4 | W-2 Forms | W-2 forms are essential documents for financial aid verification as they provide detailed information about an applicant's annual income and taxes withheld, helping financial aid offices assess financial need accurately. Submitting accurate W-2 forms ensures proper evaluation of eligibility for grants, scholarships, and federal student loans. |

| 5 | IRS Tax Return Transcript | The IRS Tax Return Transcript is essential for financial aid verification, providing an official summary of income, tax payments, and filing status directly from the IRS. This document ensures accurate assessment of a student's and family's financial situation when applying for federal aid such as FAFSA. |

| 6 | Non-filing Statement | A Non-filing Statement is required for students or parents who did not file a federal tax return, serving as official proof of non-filing from the IRS. This document verifies the absence of income tax records, ensuring accurate assessment during the financial aid verification process. |

| 7 | Proof of Untaxed Income | Proof of untaxed income for financial aid verification typically requires documents such as Social Security benefit statements (SSA-1099), veterans non-education benefits statements, and records of child support received. Additional acceptable documents include untaxed portions of pensions, military or clergy allowances, and interest income statements from accounts that did not report taxes withheld. |

| 8 | Social Security Benefits Statement | For financial aid verification, a Social Security Benefits Statement (SSA-1099) is essential to confirm the amount of Social Security income received during the tax year. This document provides precise income data required by the financial aid office to accurately assess eligibility. |

| 9 | Child Support Documentation | Child support documentation required for financial aid verification includes court orders, payment receipts, or official statements detailing the amount and frequency of payments received or made. Accurate submission of these documents ensures proper assessment of the student's financial need and eligibility for aid programs. |

| 10 | SNAP (Food Stamps) Benefit Letter | The SNAP (Food Stamps) Benefit Letter is a crucial document for financial aid verification as it confirms eligibility and the amount of assistance received. This official letter must include the recipient's name, case number, benefit amount, and issue date to meet federal verification requirements. |

| 11 | TANF (Temporary Assistance for Needy Families) Documentation | TANF documentation required for financial aid verification includes official award letters, benefit statements, or verification forms issued by the state or local welfare agency confirming enrollment in the Temporary Assistance for Needy Families program. Providing these documents ensures accurate assessment of financial need and eligibility for aid programs. |

| 12 | Proof of Household Size | Proof of household size for financial aid verification typically requires documents such as a completed Verification of Household Size form, tax returns, or affidavits confirming the number of family members residing in the household. Official records like utility bills, lease agreements, or birth certificates may also be requested to substantiate the listed household members. |

| 13 | Proof of Citizenship or Eligible Noncitizen Status | To verify financial aid eligibility, required documents include a U.S. passport, birth certificate, or Certificate of Naturalization to prove U.S. citizenship, or an Alien Registration Card (Green Card), Employment Authorization Document (EAD), or I-94 form for eligible noncitizens. These documents must be valid and submitted promptly to ensure timely processing of financial aid applications. |

| 14 | Selective Service Registration Proof (if applicable) | Selective Service Registration proof, such as a registration acknowledgment letter or a status information letter from the Selective Service System, is required for males aged 18-25 as part of financial aid verification. This document confirms compliance with federal regulations, ensuring eligibility for federal student aid programs. |

| 15 | Asset Statements (Bank or Investment Records) | Asset statements such as recent bank statements or investment account records are essential for financial aid verification to accurately assess an applicant's financial resources. These documents provide detailed proof of available funds, ensuring that the financial aid office can verify reported assets and determine eligibility based on current financial standings. |

| 16 | Marriage Certificate (if marital status changed) | A marriage certificate is essential for financial aid verification to confirm a change in marital status, as this information directly impacts the assessment of household income and dependency status. Providing an official marriage certificate ensures accurate evaluation of financial resources and eligibility for aid programs. |

| 17 | Divorce Decree/Separation Agreement (if applicable) | The Divorce Decree or Separation Agreement is essential for financial aid verification to accurately determine the custodial parent responsible for the student's financial information. This document clarifies income, assets, and support obligations, ensuring precise assessment of eligibility for need-based aid programs. |

| 18 | Death Certificate (if parent or spouse deceased) | A Death Certificate is required during financial aid verification if a parent or spouse is deceased, confirming the individual's status and eligibility. This document ensures accurate assessment of household income and dependency status, which directly impacts aid determination. |

| 19 | Legal Guardianship Documentation | Legal guardianship documentation, such as court orders or notarized affidavits establishing guardianship, is essential for financial aid verification to confirm the guardian's legal authority to manage the student's financial affairs. These documents ensure accurate assessment of financial responsibility and eligibility for aid programs. |

| 20 | Dependent/Independent Status Documentation | Financial aid verification requires dependent students to provide parental tax returns, W-2 forms, and proof of household size, while independent students must submit their own tax documents, IRS verification of non-filing, and proof of legal independence such as court orders or military records. The verification process ensures accurate classification by confirming financial and familial status through these key documents. |

Introduction to Financial Aid Verification Documents

Financial aid verification is a critical process that ensures your submitted information is accurate for awarding financial assistance. Understanding the required documents helps streamline this verification and secure your aid promptly.

- Federal Tax Returns - Official IRS tax transcripts or signed tax return copies validate reported income and tax information.

- Proof of Income - Pay stubs, W-2 forms, or alternative income statements confirm earnings when tax returns are unavailable.

- Household Information - Documentation of family size and number of dependents supports accurate calculation of financial need.

Importance of Documentation in Financial Aid

Verification of financial aid requires precise and thorough documentation to confirm the information provided on your application. Accurate records ensure eligibility and prevent delays in receiving necessary funds.

- Proof of Income - Documents such as tax returns or pay stubs verify reported earnings for accurate financial assessment.

- Household Size Confirmation - Birth certificates or other legal documents establish the number of dependents.

- Proof of Citizenship or Residency - Identification like passports or permanent resident cards confirm eligibility for aid programs.

Providing complete and verified documents is crucial for timely and accurate financial aid processing.

Personal Identification Requirements

Personal identification documents are essential for financial aid verification to confirm the student's identity. Commonly required items include a valid government-issued ID such as a passport or driver's license. These documents ensure the accuracy of the application and prevent fraud during the financial aid process.

Income Verification Documents Needed

Income verification documents are essential for financial aid verification to confirm your reported earnings. Commonly required documents include tax returns, W-2 forms, and recent pay stubs.

Additional sources such as Social Security benefits statements, self-employment income records, and untaxed income documentation may also be needed. These documents ensure accurate assessment of your financial situation for aid eligibility.

Tax Return Transcripts for Financial Aid

What documents are necessary for financial aid verification? Tax return transcripts are essential as they provide the IRS-verified income information required by financial aid offices. These transcripts help confirm the accuracy of the data submitted on the Free Application for Federal Student Aid (FAFSA).

Proof of Household Size and Dependents

Proof of household size is essential for financial aid verification as it confirms the number of individuals supported by the applicant's income. Documents such as a recent tax return, a signed statement from the applicant, or official letters verifying household members are commonly required. Verifying dependents involves submitting birth certificates, adoption papers, or legal guardianship documents to establish eligibility for aid adjustments.

Asset Verification for Financial Aid Evaluation

Asset verification is a crucial part of the financial aid evaluation process to ensure accurate assessment of a student's financial situation. Required documents typically include bank statements, investment account summaries, and records of other assets such as trust funds or real estate holdings.

These documents validate reported asset values, helping financial aid offices determine eligibility and appropriate aid amounts. Precise asset verification prevents discrepancies and supports fair distribution of financial aid resources.

Documentation for Special Financial Circumstances

| Document Type | Description | Purpose |

|---|---|---|

| Letter Explaining Special Circumstances | Personal statement detailing unusual financial situations such as job loss, death of a family member, or significant medical expenses. | Helps financial aid officers understand unique financial conditions not reflected in standard forms. |

| Separation or Divorce Decree | Legal documentation verifying changes in family structure affecting income or household size. | Confirms altered financial responsibilities impacting eligibility. |

| Proof of Unemployment | Recent unemployment benefit statements or termination letters. | Demonstrates loss of income requiring reassessment of aid. |

| Medical Expense Records | Receipts or bills for ongoing or unexpected medical costs burdening finances. | Validates financial hardship due to health-related expenses. |

| Documentation of One-Time Income | Tax returns or statements showing lump-sum payments such as inheritances or settlements. | Ensures income assessment excludes non-recurring funds. |

| Proof of Disability | Official notices or medical certification confirming disability status. | Provides context for additional financial needs or limitations. |

Deadlines and Submission Guidelines for Documents

Submitting the correct documents on time is essential for financial aid verification. Missing deadlines or improper submissions can delay or jeopardize your aid package.

- Tax Return Transcripts - Federal tax return transcripts must be submitted by the university's stated deadline, often within 30 days of the aid offer.

- Verification Worksheets - Completed verification worksheets should be submitted according to the financial aid office's instructions to avoid processing delays.

- Proof of Income Documentation - Supporting documents such as W-2 forms or proof of untaxed income must meet submission deadlines, typically outlined in the financial aid award letter.

What Documents Are Necessary for Financial Aid Verification? Infographic