To open a Roth IRA account, you will need a valid government-issued photo ID such as a driver's license or passport, your Social Security number, and proof of income like recent pay stubs or tax returns. Financial institutions may also require personal information including your date of birth, address, and employment details to comply with regulatory requirements. Having these documents ready streamlines the application process and ensures your account setup meets all legal standards.

What Documents are Needed to Open a Roth IRA Account?

| Number | Name | Description |

|---|---|---|

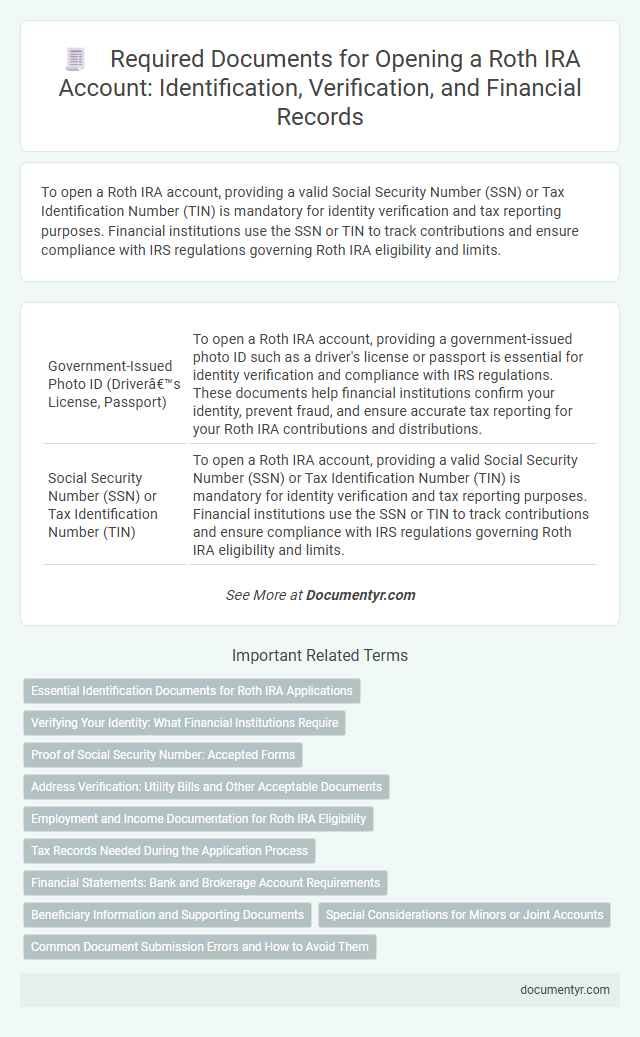

| 1 | Government-Issued Photo ID (Driver’s License, Passport) | To open a Roth IRA account, providing a government-issued photo ID such as a driver's license or passport is essential for identity verification and compliance with IRS regulations. These documents help financial institutions confirm your identity, prevent fraud, and ensure accurate tax reporting for your Roth IRA contributions and distributions. |

| 2 | Social Security Number (SSN) or Tax Identification Number (TIN) | To open a Roth IRA account, providing a valid Social Security Number (SSN) or Tax Identification Number (TIN) is mandatory for identity verification and tax reporting purposes. Financial institutions use the SSN or TIN to track contributions and ensure compliance with IRS regulations governing Roth IRA eligibility and limits. |

| 3 | Proof of Address (Utility Bill, Lease Agreement) | To open a Roth IRA account, proof of address is required, commonly verified through documents such as utility bills or lease agreements dated within the last three months. These documents help financial institutions confirm your residency and comply with regulatory requirements. |

| 4 | Employment and Income Information (Pay Stub, W-2, 1099 Form) | To open a Roth IRA account, you must provide employment and income information such as a recent pay stub, W-2 form, or 1099 form to verify your earnings and eligibility. These documents are essential for confirming that your income falls within IRS limits for Roth IRA contributions. |

| 5 | Bank Account Information (Routing and Account Numbers, Voided Check) | To open a Roth IRA account, you need to provide your bank account information, including the routing and account numbers, to facilitate contributions and transfers. A voided check is often required to verify these bank details, ensuring accurate and secure electronic fund transfers. |

| 6 | Beneficiary Designation Form | A Beneficiary Designation Form is essential when opening a Roth IRA account to specify who will inherit the funds upon the account holder's death, ensuring smooth transfer and avoiding probate. This form typically requires the beneficiary's full name, Social Security number, date of birth, and relationship to the account holder. |

| 7 | Roth IRA Application Form | To open a Roth IRA account, the Roth IRA application form is essential, requiring personal identification details such as your Social Security number, date of birth, and contact information. This form also mandates information about your employment status and beneficiaries to comply with IRS regulations and facilitate proper account setup. |

| 8 | Spousal Information (if applicable) | When opening a Roth IRA account, providing spousal information is necessary if you plan to make contributions based on joint income or qualify for spousal IRA benefits; this typically includes your spouse's Social Security number, date of birth, and proof of marriage. Accurate spousal data ensures compliance with IRS regulations and enables proper tax treatment of your combined retirement savings. |

| 9 | Previous IRA Statements (for rollovers or transfers) | Previous IRA statements are essential for opening a Roth IRA account when initiating rollovers or transfers, as they provide detailed information on existing account balances and transaction histories required for accurate account setup. These documents ensure compliance with IRS regulations and facilitate a smooth, error-free transfer process by verifying the source and tax status of funds. |

| 10 | Citizenship/Residency Verification Document | To open a Roth IRA account, financial institutions typically require a government-issued identification document such as a valid U.S. passport or a state-issued driver's license to verify citizenship or residency status. Proof of Social Security Number, like a Social Security card or W-2 form, is also essential to meet IRS regulations for Roth IRA eligibility. |

Essential Identification Documents for Roth IRA Applications

| Document Type | Description |

|---|---|

| Government-Issued Photo ID | Valid passport, state driver's license, or state ID card to verify identity. |

| Social Security Number (SSN) | Required to verify tax identification and eligibility for Roth IRA contributions. |

| Proof of U.S. Citizenship or Residency | U.S. birth certificate or permanent resident card (Green Card) to confirm eligibility. |

| Address Verification Document | Recent utility bill, bank statement, or lease agreement showing current residential address. |

| Employment Information | Employer's name and contact information for income verification and contribution limits. |

Verifying Your Identity: What Financial Institutions Require

Financial institutions require specific documents to verify your identity when opening a Roth IRA account. Typically, a valid government-issued photo ID such as a driver's license or passport is necessary. Proof of Social Security number, like a Social Security card or tax documents, is also essential for identity verification.

Proof of Social Security Number: Accepted Forms

Opening a Roth IRA account requires specific documents, with proof of your Social Security number being essential. Financial institutions accept various forms as valid proof to verify your identity and ensure compliance.

Accepted forms of proof of Social Security number include your Social Security card, a W-2 form showing your SSN, or a 1099-R tax form. Some institutions may also accept a pay stub or a tax return that displays your Social Security number clearly. Providing one of these documents helps facilitate the account opening process efficiently.

Address Verification: Utility Bills and Other Acceptable Documents

Opening a Roth IRA account requires verifying your address to comply with financial regulations. Utility bills and other specific documents serve as proof of your residence during this process.

- Utility Bills - Recent utility bills such as electricity, water, or gas, dated within the last 90 days, are commonly accepted for address verification.

- Bank Statements - Official bank or credit card statements reflecting your current address can be used as valid documentation.

- Government-Issued Documents - Documents like a driver's license, voter registration card, or property tax bill showing your residence address are acceptable.

Employment and Income Documentation for Roth IRA Eligibility

Opening a Roth IRA requires verifying your employment status and income to ensure eligibility. Proper documentation helps confirm that contributions comply with IRS income limits.

- Recent Pay Stubs - These provide current proof of employment and income earned from wages or salary.

- W-2 Forms - Annual wage statements showing total income and tax withholdings from employers.

- Tax Returns - IRS Form 1040 confirms adjusted gross income, a key factor for Roth IRA eligibility.

Tax Records Needed During the Application Process

What tax records are needed during the Roth IRA account application process? Applicants must provide recent tax returns, including Form 1040, to verify income eligibility. Supporting documents like W-2s or 1099s help confirm earned income for Roth IRA contributions.

Financial Statements: Bank and Brokerage Account Requirements

To open a Roth IRA account, financial institutions typically require recent financial statements, including bank and brokerage account documents. These statements verify your financial status and help meet regulatory requirements. Ensure your financial records are accurate and up-to-date to facilitate a smooth account opening process.

Beneficiary Information and Supporting Documents

Opening a Roth IRA requires submitting key documents to verify identity and designate beneficiaries. Accurate beneficiary information ensures your assets pass smoothly according to your wishes.

- Beneficiary Designation Form - This form captures the names and contact details of individuals who will inherit the account.

- Proof of Identity - Valid government-issued ID such as a driver's license or passport confirms your identity.

- Supporting Documentation - Additional items like a Social Security number and proof of address help validate your eligibility and reduce fraud risk.

Ensure all beneficiary details are complete and supported by proper documentation when opening your Roth IRA.

Special Considerations for Minors or Joint Accounts

Opening a Roth IRA account requires key documents such as a valid government-issued ID, Social Security number, and proof of address. Financial institutions may also request employment information and bank details for funding the account.

For minors, a custodial Roth IRA requires a parent or guardian's identification and Social Security number to act as custodian. Joint accounts are generally not permitted for Roth IRAs, but custodial accounts can be structured to benefit a minor with an adult custodian overseeing the account.

What Documents are Needed to Open a Roth IRA Account? Infographic