Essential documents for filing federal income taxes include W-2 forms from employers, 1099 forms for various types of income, and proof of any deductible expenses such as mortgage interest or charitable contributions. Taxpayers should also have records of any estimated tax payments made throughout the year and Social Security numbers for themselves, their spouses, and dependents. Accurate and organized documentation ensures proper reporting and helps maximize eligible deductions and credits.

What Documents Are Necessary for Filing Federal Income Taxes?

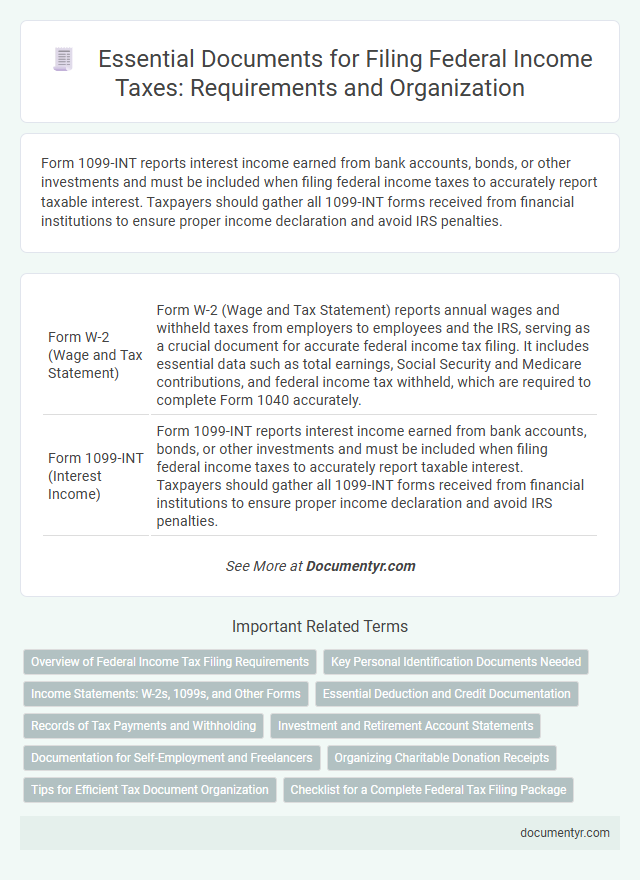

| Number | Name | Description |

|---|---|---|

| 1 | Form W-2 (Wage and Tax Statement) | Form W-2 (Wage and Tax Statement) reports annual wages and withheld taxes from employers to employees and the IRS, serving as a crucial document for accurate federal income tax filing. It includes essential data such as total earnings, Social Security and Medicare contributions, and federal income tax withheld, which are required to complete Form 1040 accurately. |

| 2 | Form 1099-INT (Interest Income) | Form 1099-INT reports interest income earned from bank accounts, bonds, or other investments and must be included when filing federal income taxes to accurately report taxable interest. Taxpayers should gather all 1099-INT forms received from financial institutions to ensure proper income declaration and avoid IRS penalties. |

| 3 | Form 1099-DIV (Dividends and Distributions) | Form 1099-DIV reports dividends and distributions received from investments, which are essential for accurately filing federal income taxes and must be included to calculate taxable income from dividends. Taxpayers should gather all 1099-DIV forms from brokerage accounts and investment firms to ensure proper reporting of qualified dividends, ordinary dividends, and capital gains distributions. |

| 4 | Form 1099-B (Proceeds from Broker and Barter Exchange Transactions) | Form 1099-B reports proceeds from broker and barter exchange transactions, including details on the sale of stocks, bonds, and other securities necessary for accurately calculating capital gains or losses on federal income tax returns. Taxpayers must include Form 1099-B alongside Schedule D and Form 8949 to properly report investment income and ensure compliance with IRS regulations. |

| 5 | Form 1099-MISC (Miscellaneous Income) | Form 1099-MISC is essential for reporting miscellaneous income such as rents, royalties, and non-employee compensation, which must be included when filing federal income taxes. Taxpayers should gather all 1099-MISC forms received from clients or payers to accurately report taxable income and avoid penalties. |

| 6 | Form 1099-NEC (Nonemployee Compensation) | Form 1099-NEC is essential for reporting nonemployee compensation paid to independent contractors and freelancers, showing amounts of $600 or more earned during the tax year. Accurate filing of this form ensures taxpayers correctly report income received outside of traditional employment, preventing underreported earnings and potential IRS penalties. |

| 7 | Form 1099-G (Unemployment Compensation, State Tax Refunds) | Form 1099-G reports government payments such as unemployment compensation and state tax refunds essential for accurately filing federal income taxes. Taxpayers must include this form to ensure proper reporting of income, as it directly affects taxable income and potential refund calculations. |

| 8 | Form 1099-R (Retirement Plan Distributions) | Form 1099-R is essential for reporting distributions from retirement plans, including pensions, IRAs, and annuities, and must be included when filing federal income taxes to accurately report taxable income and calculate potential penalties. Taxpayers should ensure they have this form from each payer to avoid errors or delays in processing their tax returns. |

| 9 | Form 1098 (Mortgage Interest Statement) | Form 1098 (Mortgage Interest Statement) is essential for taxpayers who paid mortgage interest during the tax year, as it reports the amount of mortgage interest and points paid to lenders, enabling potential deductions. This document must be included when itemizing deductions on Schedule A to accurately reduce taxable income and maximize tax benefits related to homeownership. |

| 10 | Form 1098-T (Tuition Statement) | Form 1098-T (Tuition Statement) is essential for taxpayers claiming education-related tax credits, reporting qualified tuition and related expenses paid to eligible educational institutions. Accurate submission of this document ensures eligibility for the American Opportunity Credit or Lifetime Learning Credit, directly impacting federal income tax calculations. |

| 11 | Form 1098-E (Student Loan Interest Statement) | Form 1098-E is essential for taxpayers who paid student loan interest, as it reports the amount of interest paid that may be deductible on federal income taxes. Including this form when filing can reduce taxable income by up to $2,500, providing significant tax relief for qualified student loan borrowers. |

| 12 | Form 1095-A (Health Insurance Marketplace Statement) | Form 1095-A, issued by the Health Insurance Marketplace, provides essential information on health coverage, including months covered and premium details, crucial for accurately completing the Premium Tax Credit section of federal income tax returns. Taxpayers must include this form to reconcile advance premium tax credits or claim the credit if they purchased insurance through the Marketplace. |

| 13 | Form 5498 (IRA Contributions) | Form 5498 reports IRA contributions, including traditional, Roth, SEP, and SIMPLE IRAs, essential for accurately filing federal income taxes and verifying contribution limits. Taxpayers should retain this form for record-keeping as it provides information on rollover contributions and the fair market value of the IRA at year-end, which impacts tax reporting and retirement planning. |

| 14 | Schedule K-1 (Partnerships, S Corporations, Trusts) | Schedule K-1 is essential for taxpayers involved in partnerships, S corporations, or trusts, as it reports their share of income, deductions, and credits necessary for accurate federal income tax filing. Key documents to accompany Schedule K-1 include partnership agreements, corporate financial statements, and trust tax returns, ensuring precise reporting of each entity's financial activities. |

| 15 | Prior Year Federal and State Tax Returns | Prior year federal and state tax returns are essential documents for filing federal income taxes as they provide crucial information for accurate reporting and verification of income, deductions, and credits. These returns help ensure consistency and enable tax authorities to cross-check data for compliance and proper tax calculation. |

| 16 | Social Security Number (SSN) or Taxpayer Identification Number (TIN) | Accurate filing of federal income taxes requires providing a valid Social Security Number (SSN) or Taxpayer Identification Number (TIN) to identify taxpayers and ensure proper credit for tax payments. IRS mandates these identification numbers on all tax returns, including forms such as Form 1040, to process returns and maintain taxpayer records efficiently. |

| 17 | Bank Account and Routing Numbers (for Direct Deposit) | Bank account and routing numbers are essential for filing federal income taxes to enable direct deposit of tax refunds, ensuring faster and secure transfer of funds to the taxpayer's account. Accurate bank routing numbers must correspond to the taxpayer's financial institution, while the account numbers verify the specific checking or savings account for proper deposit. |

| 18 | Documentation of Other Income (Alimony, Gambling, Prizes) | Documentation of other income for federal income tax filing includes Form 1099-MISC or 1099-NEC for alimony received, records of gambling winnings such as W-2G forms, and statements detailing prize or award values. Accurate reporting of these documents ensures compliance with IRS regulations and proper calculation of taxable income. |

| 19 | Receipts for Deductible Expenses (Charitable Donations, Medical, Education) | Receipts for deductible expenses such as charitable donations, medical expenses, and education costs are essential documents for filing federal income taxes, as they provide credible evidence to substantiate claims for tax deductions and credits. Accurate record-keeping of these receipts ensures compliance with IRS regulations and maximizes potential tax benefits. |

| 20 | Real Estate Tax Receipts | Real estate tax receipts are essential documents for filing federal income taxes as they provide proof of property tax payments, which may be deductible if you itemize deductions on Schedule A. Retain these receipts carefully to substantiate claims for property tax deductions and ensure compliance with IRS requirements during tax audits. |

| 21 | Childcare Expenses and Provider Details | To accurately claim childcare expenses on federal income taxes, taxpayers must provide detailed receipts or statements from the childcare provider, including the provider's name, address, and taxpayer identification number (TIN). Documentation should also include the total amount paid for the year and the dates services were provided to ensure eligibility for the Child and Dependent Care Credit. |

| 22 | Records of Estimated Tax Payments Made | Records of estimated tax payments made, including payment vouchers and confirmation receipts from the IRS, are essential for accurately reporting and reconciling tax liabilities on federal income tax returns. Retaining detailed documentation of quarterly payments helps ensure correct crediting of taxes paid and prevents underpayment penalties. |

| 23 | Proof of Health Insurance Coverage | Proof of health insurance coverage documents, such as Form 1095-A, 1095-B, or 1095-C, are essential for accurately filing federal income taxes and verifying compliance with the Affordable Care Act requirements. These forms provide detailed information on coverage periods, policyholders, and dependents, which directly impact tax credits and potential penalties. |

| 24 | Records of Business Income and Expenses (if Self-Employed) | Self-employed individuals must provide detailed records of all business income, including invoices, receipts, and bank statements, alongside documented business expenses such as receipts for supplies, mileage logs, and payroll records to accurately report earnings and claim deductions. Maintaining organized financial records ensures compliance with IRS requirements and supports the validity of income and expense claims during tax filing and audits. |

| 25 | State and Local Tax Documentation | State and local tax documentation required for filing federal income taxes includes W-2 forms showing state and local tax withholdings, 1099 forms reporting income subject to state taxes, and property tax statements for potential deductions. Taxpayers should also gather records of any state and local tax payments made throughout the year, such as estimated tax payments or local tax receipts, to ensure accurate reporting and maximize deductions. |

Overview of Federal Income Tax Filing Requirements

Filing federal income taxes requires specific documents to accurately report income and claim deductions. Understanding these essential documents ensures compliance with IRS regulations and maximizes potential refunds.

- Form W-2 - Reports wages, salaries, and tax withheld from employers.

- Form 1099 - Details various income types such as freelance earnings, interest, and dividends.

- Receipts and Statements - Supports deductions and credits claimed on the tax return.

Key Personal Identification Documents Needed

Filing federal income taxes requires specific personal identification documents to verify your identity. These documents ensure accurate processing and compliance with IRS regulations.

- Social Security Number (SSN) - A unique identifier required for you, your spouse, and any dependents to file your tax return.

- Valid Photo ID - A government-issued identification such as a driver's license or passport to confirm your identity.

- Taxpayer Identification Number (TIN) - Needed for individuals without an SSN, this IRS-issued number is essential for tax reporting.

Having these key identification documents ready simplifies the federal tax filing process and helps avoid delays.

Income Statements: W-2s, 1099s, and Other Forms

What income statements are necessary for filing federal income taxes? W-2 forms report wages and salaries from employers, essential for tax filing. Various 1099 forms capture non-wage income such as freelance earnings, dividends, and interest.

Essential Deduction and Credit Documentation

Filing federal income taxes requires specific documents to verify income, deductions, and credits accurately. Essential records include W-2 forms, 1099 statements, and receipts for deductible expenses.

For deduction claims, retain mortgage interest statements, property tax bills, and charitable donation receipts. Credit documentation often involves education expenses, child care costs, and energy-efficient home improvement invoices.

Records of Tax Payments and Withholding

| Document Type | Description | Purpose |

|---|---|---|

| W-2 Form | Issued by employers, this form reports annual wages and the amount of federal, state, and other taxes withheld. | Used to report income and tax withholding to the IRS, verifying payroll tax payments. |

| 1099 Forms | Includes various types such as 1099-INT (interest income), 1099-DIV (dividends), and 1099-MISC (miscellaneous income). | Reports non-employment income subject to tax and any withholding on such payments. |

| IRS Form 1095-A | Health Insurance Marketplace Statement, showing coverage and any premium tax credits received. | Required to reconcile premium tax credits and verify health coverage compliance. |

| Proof of Estimated Tax Payments | Records or vouchers for quarterly estimated tax payments made directly to the IRS. | Demonstrates prepayments of income tax to avoid underpayment penalties. |

| Receipts or Statements for Federal Tax Withholding | Documents reflecting withholding from pensions, annuities, or Social Security benefits. | Shows tax withheld on non-wage income sources, necessary for accurate tax calculations. |

| Payroll Tax Records | Employer records of payroll tax deposits and withholdings including Social Security and Medicare taxes. | Supports verification of withholdings related to employee earnings and tax credits. |

Investment and Retirement Account Statements

Investment and retirement account statements are essential documents for filing federal income taxes. These statements include 1099 forms that report dividends, interest, and capital gains from investments. Your accurate tax filing depends on providing these documents to report income and ensure compliance with IRS regulations.

Documentation for Self-Employment and Freelancers

Federal income tax filing requires specific documentation to accurately report income and expenses, especially for self-employed individuals and freelancers. Proper records ensure compliance and maximize deductions.

- Form 1099-NEC - Reports non-employee compensation received from clients or businesses for freelance work.

- Schedule C (Form 1040) - Used to report income or loss from a business operated as a sole proprietorship.

- Receipts and Expense Records - Detailed documentation of business-related expenses such as supplies, travel, and home office costs to support deductions.

Organizing Charitable Donation Receipts

Organizing charitable donation receipts is crucial when filing your federal income taxes. These receipts serve as proof of your contributions and help maximize your deductions.

Keep each receipt clearly labeled with the donor organization's name, donation date, and amount donated. Accurate records simplify the process and ensure compliance with IRS requirements.

Tips for Efficient Tax Document Organization

Organizing your tax documents efficiently starts with gathering all necessary paperwork, including W-2s, 1099 forms, and receipts for deductible expenses. Store these documents in clearly labeled folders sorted by category and date to ensure quick access during tax filing. Using digital tools to scan and categorize your records can streamline the process and reduce errors.

What Documents Are Necessary for Filing Federal Income Taxes? Infographic