FHA loan approval requires several key documents, including proof of income such as pay stubs, tax returns, and W-2 forms to verify financial stability. Borrowers must also provide credit reports, bank statements, and a valid government-issued ID to assess creditworthiness and identity. Additionally, documentation of any debts, assets, and employment history is essential to satisfy FHA underwriting guidelines.

What Documents are Needed for FHA Loan Approval?

| Number | Name | Description |

|---|---|---|

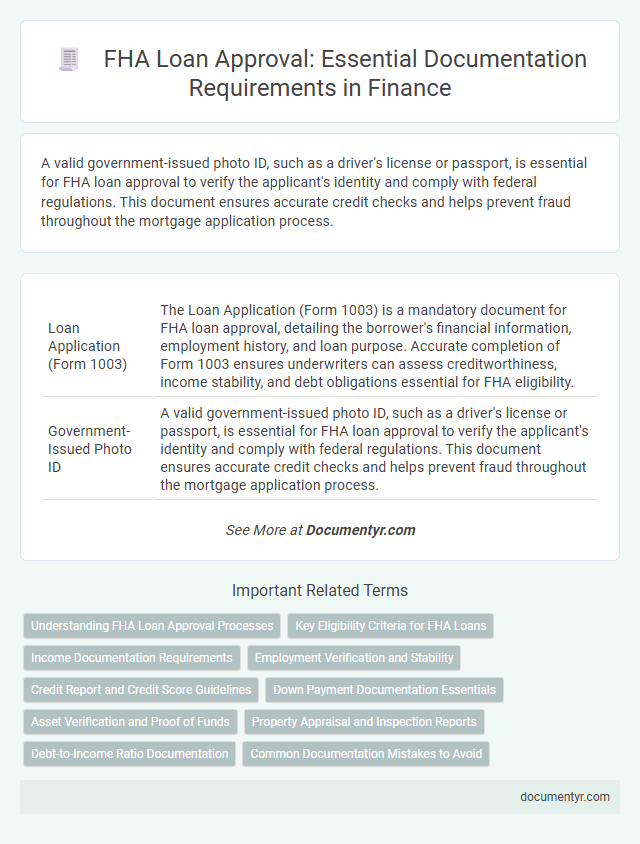

| 1 | Loan Application (Form 1003) | The Loan Application (Form 1003) is a mandatory document for FHA loan approval, detailing the borrower's financial information, employment history, and loan purpose. Accurate completion of Form 1003 ensures underwriters can assess creditworthiness, income stability, and debt obligations essential for FHA eligibility. |

| 2 | Government-Issued Photo ID | A valid government-issued photo ID, such as a driver's license or passport, is essential for FHA loan approval to verify the applicant's identity and comply with federal regulations. This document ensures accurate credit checks and helps prevent fraud throughout the mortgage application process. |

| 3 | Social Security Card | A Social Security Card is essential for FHA loan approval as it verifies the borrower's legal identity and eligibility to work in the United States. Lenders require the card alongside other documents to confirm the applicant's Social Security Number for credit and background checks. |

| 4 | Proof of Legal Residency | Proof of legal residency is essential for FHA loan approval, typically requiring documents such as a valid Permanent Resident Card (Green Card), Employment Authorization Document (EAD), or a valid visa along with an I-94 form. Lenders may also request additional evidence like a valid passport or citizenship certificate to verify the applicant's authorized presence in the United States. |

| 5 | Pay Stubs (last 30 days) | Lenders require pay stubs from the last 30 days to verify consistent income and employment stability for FHA loan approval, ensuring borrowers meet debt-to-income ratio standards. These documents provide critical evidence of recent earnings, helping underwriters assess the applicant's ability to make monthly mortgage payments. |

| 6 | W-2 Forms (last 2 years) | Lenders require W-2 forms from the past two years to verify consistent income and employment history for FHA loan approval. These documents help establish a borrower's financial stability and ensure qualification under FHA guidelines. |

| 7 | Federal Tax Returns (last 2 years) | Federal tax returns from the last two years are essential for FHA loan approval as they provide a verified record of income and financial stability. Lenders analyze these documents to assess consistent earnings and ensure the borrower meets debt-to-income ratio requirements. |

| 8 | Bank Statements (last 2-3 months) | FHA loan approval requires bank statements from the last 2-3 months to verify consistent income deposits and financial stability. These statements help lenders assess cash flow, savings, and ability to cover mortgage payments, ensuring borrower reliability. |

| 9 | Proof of Down Payment | Proof of down payment for FHA loan approval requires documents such as bank statements, gift letters, or evidence of sale of assets demonstrating the source and availability of funds. Lenders scrutinize these documents to verify that the borrower meets the minimum 3.5% down payment requirement and that the funds are not borrowed unless properly documented as gifts. |

| 10 | Asset Statements (retirement, stocks, savings) | FHA loan approval requires comprehensive asset statements, including detailed records of retirement accounts such as 401(k)s and IRAs, stock portfolios, and savings accounts, to verify the borrower's financial stability and ability to cover down payments and closing costs. These documents must clearly display account balances, recent transactions, and any restrictions on fund accessibility to meet FHA underwriting standards. |

| 11 | Employment Verification Letter | An Employment Verification Letter is a crucial document for FHA loan approval, confirming steady income and job stability to lenders. This letter typically includes the borrower's job title, length of employment, salary, and employer contact information to validate financial reliability. |

| 12 | Proof of Additional Income (bonus, overtime, alimony) | Lenders require documentation such as pay stubs, tax returns, and court orders to verify additional income sources like bonuses, overtime pay, and alimony for FHA loan approval. Consistent proof over a two-year period strengthens the application and demonstrates reliable repayment ability. |

| 13 | Purchase Agreement (if available) | The Purchase Agreement is a critical document for FHA loan approval, detailing the terms of the home sale and confirming the property's purchase price. It provides the lender with essential information needed to assess the loan application, verify buyer and seller commitments, and proceed with the underwriting process. |

| 14 | Gift Letter (if down payment is a gift) | For FHA loan approval, a Gift Letter is essential when the down payment is provided as a gift, confirming that the funds are a true gift with no repayment required. This letter must include the donor's name, relationship to the borrower, amount of the gift, and a statement that repayment is not expected, ensuring compliance with FHA guidelines and facilitating the loan approval process. |

| 15 | Rent Payment History (if applicable) | For FHA loan approval, providing a detailed rent payment history is crucial if the borrower has been renting, as it demonstrates consistent on-time payments and financial responsibility. Lenders typically require canceled rent checks, bank statements showing electronic payments, or a rent ledger from the landlord covering at least 12 months. |

| 16 | Credit Report Authorization | Lenders require credit report authorization as a crucial document for FHA loan approval to assess the borrower's creditworthiness and repayment history. This authorization allows access to detailed credit reports, which are essential for evaluating risk and determining loan eligibility. |

| 17 | Debt Statements (credit cards, loans) | Debt statements, including recent credit card statements and loan payoff statements, are essential documents for FHA loan approval as they provide detailed information about the borrower's outstanding debts and monthly payment obligations. These documents help lenders assess the debt-to-income ratio to ensure the borrower qualifies for the FHA loan program. |

| 18 | Divorce Decree (if applicable) | Lenders require a Divorce Decree for FHA loan approval to verify spousal obligations and clarify alimony or child support payments affecting debt-to-income ratios. This document ensures accurate assessment of financial liabilities, impacting loan eligibility and terms. |

| 19 | Bankruptcy Discharge Papers (if applicable) | Bankruptcy discharge papers are critical for FHA loan approval as they verify the borrower's discharge date and confirm the resolution of previous credit issues. Lenders require these documents to assess financial recovery and ensure compliance with FHA's mandated waiting periods after bankruptcy. |

| 20 | Child Support/Alimony Documentation (if applicable) | For FHA loan approval, borrowers must provide copies of divorce decrees, separation agreements, or court orders detailing child support or alimony payments, along with proof of receipt for at least six months. Lenders require these documents to verify the consistency and continuing nature of income from child support or alimony, ensuring it can be counted toward qualifying income. |

Understanding FHA Loan Approval Processes

Understanding the documents required for FHA loan approval helps streamline the application process and avoid delays. FHA loans focus on verifying income, assets, and creditworthiness through specific paperwork.

- Proof of Income - Recent pay stubs, W-2 forms, and tax returns verify your earnings consistency and stability.

- Credit Report - A credit report assesses credit score and history to determine risk factors for loan approval.

- Asset Documentation - Bank statements and documents for other assets confirm your financial reserves and ability to cover down payments and closing costs.

Submitting accurate and complete documentation increases the likelihood of FHA loan approval and speeds up the underwriting process.

Key Eligibility Criteria for FHA Loans

FHA loan approval requires specific documents to verify eligibility, including proof of steady employment and income through recent pay stubs, W-2 forms, and tax returns. Applicants must provide a valid Social Security number and evidence of legal residency in the U.S. Additionally, documentation of debt obligations and credit history is essential to assess the borrower's ability to repay the loan.

Income Documentation Requirements

| Income Documentation Requirements for FHA Loan Approval | |

|---|---|

| Pay Stubs | Recent pay stubs covering at least 30 days to verify current income and employment status. |

| W-2 Forms | W-2 forms from the past two years to provide a consistent record of annual earnings. |

| Tax Returns | Complete federal tax returns for the past two years, including all schedules, especially for self-employed applicants or those with additional income sources. |

| Employment Verification | Written verification from your employer confirming job position, length of employment, and salary details. |

| Profit and Loss Statements | Year-to-date profit and loss statements for business owners to assess financial stability. |

| Social Security or Disability Income | Documentation of benefits or awards letters confirming the amount and duration of income. |

| Alimony or Child Support | Legal documents verifying ongoing payments, if used to qualify for the loan. |

Employment Verification and Stability

Employment verification is a critical component of FHA loan approval, requiring detailed documentation of your current job status. Lenders typically request pay stubs, W-2 forms, and contact information for your employer to confirm your employment history.

Stability in employment is closely assessed, as consistent income reduces lending risk. Providing two years of continuous work records helps demonstrate reliable earnings and financial stability to support your loan application.

Credit Report and Credit Score Guidelines

For FHA loan approval, your credit report is a critical document that lenders evaluate to assess your creditworthiness. The minimum credit score typically required is 580, but some lenders may accept scores as low as 500 with a larger down payment. Reviewing your credit report helps identify any discrepancies or negative marks that could impact your loan eligibility.

Down Payment Documentation Essentials

Securing an FHA loan requires thorough documentation, especially for down payment verification. Accurate proof of funds is critical to demonstrate your ability to meet FHA lending requirements.

- Bank Statements - Provide recent bank statements to confirm available cash reserves for the down payment.

- Gift Letters - Submit official gift letters if the down payment includes financial gifts from family or friends.

- Proof of Savings - Show records of consistent savings over time to validate the source of the down payment funds.

Asset Verification and Proof of Funds

What documents are needed for FHA loan approval focusing on asset verification and proof of funds? Lenders require recent bank statements, typically covering the last two to three months, to verify your liquid assets. Documentation must clearly demonstrate sufficient funds for down payment, closing costs, and reserves.

Property Appraisal and Inspection Reports

Property appraisal and inspection reports are essential documents for FHA loan approval. You must provide these reports to ensure the property's value and condition meet FHA requirements.

- Property Appraisal Report - This document verifies the home's market value, confirming it meets FHA loan limits and protects lender investment.

- Home Inspection Report - Offers detailed insights into the property's structural integrity, systems, and potential repairs needed before approval.

- Compliance with FHA Standards - Both reports must demonstrate the property satisfies FHA safety, security, and livability guidelines.

Debt-to-Income Ratio Documentation

When applying for an FHA loan, providing accurate documentation of your debt-to-income (DTI) ratio is crucial for approval. Lenders assess your ability to manage monthly debts alongside your income to determine eligibility.

Key documents include recent pay stubs covering at least 30 days, W-2 forms from the past two years, and tax returns that verify your income stability. You also need to supply statements for all recurring debts, such as credit card bills, auto loans, and student loans, to accurately calculate your monthly obligations. This detailed financial information helps ensure the DTI ratio meets FHA guidelines, typically not exceeding 43%.

What Documents are Needed for FHA Loan Approval? Infographic