First-time homebuyer mortgage applications typically require proof of income, such as recent pay stubs, tax returns, and W-2 forms. Lenders also request credit history reports and documentation of assets, including bank statements and investment accounts. Additional documents include identification, employment verification, and details about any existing debts to assess financial stability.

What Documents are Necessary for First-Time Homebuyer Mortgage Applications?

| Number | Name | Description |

|---|---|---|

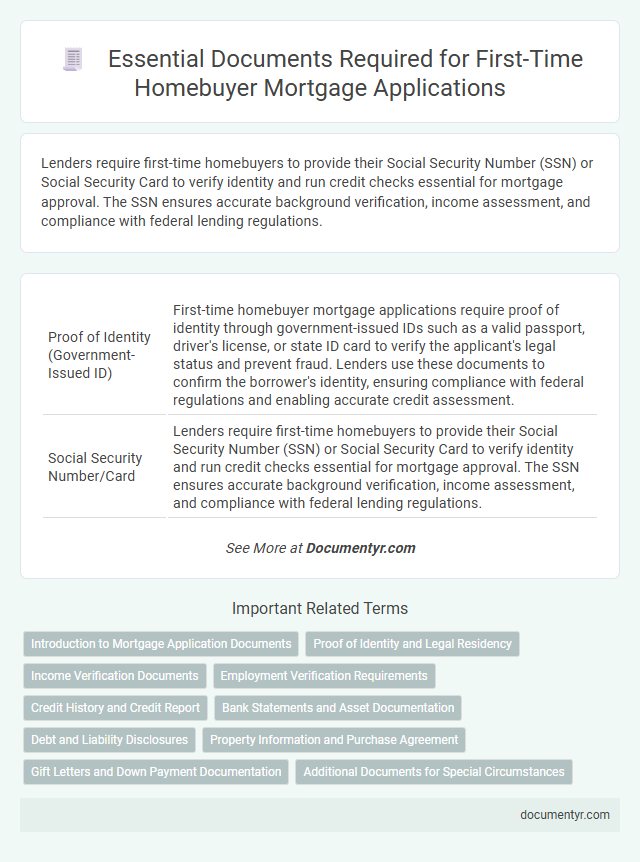

| 1 | Proof of Identity (Government-Issued ID) | First-time homebuyer mortgage applications require proof of identity through government-issued IDs such as a valid passport, driver's license, or state ID card to verify the applicant's legal status and prevent fraud. Lenders use these documents to confirm the borrower's identity, ensuring compliance with federal regulations and enabling accurate credit assessment. |

| 2 | Social Security Number/Card | Lenders require first-time homebuyers to provide their Social Security Number (SSN) or Social Security Card to verify identity and run credit checks essential for mortgage approval. The SSN ensures accurate background verification, income assessment, and compliance with federal lending regulations. |

| 3 | Proof of Income (Recent Pay Stubs) | Recent pay stubs serve as critical proof of income, demonstrating consistent earnings and employment stability for first-time homebuyer mortgage applications. Lenders typically require pay stubs from the past 30 days to verify the borrower's ability to meet monthly mortgage payments. |

| 4 | W-2 Forms (Last 2 Years) | First-time homebuyers must provide W-2 forms from the last two years to verify their income and employment stability when applying for a mortgage. Lenders use these documents to assess the borrower's ability to repay the loan and to ensure consistent earnings. |

| 5 | Tax Returns (Last 2 Years) | First-time homebuyer mortgage applications require tax returns from the last two years to verify income consistency and employment stability, providing lenders with a clear financial history. These documents help assess debt-to-income ratios and ensure borrowers meet underwriting criteria for loan approval. |

| 6 | Bank Statements (Last 2-3 Months) | Bank statements from the last 2-3 months are essential for first-time homebuyer mortgage applications, providing lenders with a clear record of income consistency, savings, and spending habits. These documents verify funds for down payments and closing costs while helping assess the applicant's financial stability and risk level. |

| 7 | Employment Verification Letter | An Employment Verification Letter is crucial for first-time homebuyer mortgage applications as it confirms the applicant's current employment status, job title, and income stability, providing lenders with proof of consistent and reliable earnings. This document typically includes contact information of the employer, length of employment, and salary details, helping to assess the borrower's ability to repay the loan. |

| 8 | Proof of Additional Income (Bonuses, Alimony, Child Support) | First-time homebuyers must provide documented proof of additional income sources such as bonuses, alimony, and child support to strengthen their mortgage application. Accepted documents include recent pay stubs reflecting bonuses, official divorce decrees outlining alimony or child support agreements, and bank statements or court orders verifying consistent receipt of these payments. |

| 9 | Credit Report/Authorization | Lenders require first-time homebuyers to provide a credit report authorization form to access their credit history, which is essential for assessing loan eligibility and interest rates. This document allows mortgage companies to verify credit scores, outstanding debts, and payment history, ensuring accurate risk evaluation during the application process. |

| 10 | Asset Statements (Retirement, Investment Accounts) | Asset statements such as retirement accounts (401(k), IRA) and investment accounts (stocks, bonds, mutual funds) are essential for first-time homebuyer mortgage applications to verify financial stability and reserves. Lenders require these documents to assess the borrower's ability to cover down payments, closing costs, and demonstrate long-term financial reliability. |

| 11 | Gift Letter (If Receiving Down Payment Gift) | A gift letter is an essential document for first-time homebuyers receiving financial assistance for their down payment, explicitly stating the amount gifted and confirming that no repayment is expected. Mortgage lenders require the letter to verify the source of funds and ensure compliance with loan qualification standards. |

| 12 | Debt Statements (Credit Cards, Loans) | First-time homebuyers must provide detailed debt statements, including credit card balances and outstanding loan documents, to verify their financial obligations and calculate debt-to-income ratios accurately. Lenders require recent statements from all revolving accounts and installment loans to assess credit risk and ensure borrowers can manage mortgage payments alongside existing debts. |

| 13 | Rental History (Rental Agreements, Landlord Reference) | First-time homebuyers must provide detailed rental history documents, including rental agreements and landlord references, to verify payment consistency and reliability. These records help lenders assess creditworthiness by demonstrating timely rent payments and responsible tenancy over at least the past 12 months. |

| 14 | Purchase Agreement/Sales Contract | The Purchase Agreement or Sales Contract is a critical document in first-time homebuyer mortgage applications, serving as proof of the agreed-upon terms between buyer and seller, including price, property details, and contingencies. Lenders require this contract to assess the loan amount, verify the property's purchase price, and ensure the transaction meets underwriting criteria before approving mortgage financing. |

| 15 | Proof of Down Payment Funds | First-time homebuyers must provide proof of down payment funds through bank statements, gift letters, or documentation of liquid assets. Lenders require these documents to verify the source and availability of funds, ensuring compliance with mortgage qualification criteria. |

Introduction to Mortgage Application Documents

Applying for a mortgage as a first-time homebuyer requires submitting specific documents to verify your financial status and eligibility. Lenders use these documents to assess your creditworthiness and ability to repay the loan.

Essential mortgage application documents include proof of income, tax returns, and employment verification. These materials help streamline the approval process and provide a clear financial picture to the lender.

Proof of Identity and Legal Residency

What documents are necessary to prove identity and legal residency for first-time homebuyer mortgage applications? Lenders require government-issued photo identification such as a passport or driver's license to verify identity. Proof of legal residency may include a green card, visa, or permanent resident card to confirm the applicant's eligibility to apply.

Income Verification Documents

| Income Verification Documents for First-Time Homebuyer Mortgage Applications | |

|---|---|

| Recent Pay Stubs | Typically, lenders require pay stubs from the last 30 days to confirm your current employment status and income level. |

| W-2 Forms | W-2 forms from the previous two years provide a comprehensive view of your annual earnings and employment history. |

| Tax Returns | Complete federal tax returns, usually for the past two years, are necessary to verify all sources of income, especially for self-employed applicants. |

| Bank Statements | Recent bank statements, often for the last two to three months, demonstrate income deposits and financial stability. |

| Employment Verification Letter | An employment verification letter from your employer confirms your job status, salary, and length of employment. |

| Self-Employment Documentation | Profit and loss statements, business tax returns, and 1099 forms are required if you are self-employed. |

Employment Verification Requirements

Employment verification is a critical component of first-time homebuyer mortgage applications. Lenders require this to assess the borrower's income stability and ability to repay the loan.

Common documents for employment verification include recent pay stubs, W-2 forms from the past two years, and sometimes tax returns for self-employed applicants. Lenders may also request contact information for the employer to confirm job status. Consistent and verifiable employment history improves the chances of mortgage approval.

Credit History and Credit Report

First-time homebuyers must provide essential documents to support their mortgage applications, with a focus on credit history and credit reports. Lenders use these documents to assess the borrower's financial reliability and creditworthiness.

- Credit Report - A detailed credit report from major credit bureaus outlines the borrower's credit accounts, payment history, and outstanding debts.

- Credit Score - The numerical credit score summarizes credit risk and influences loan terms and interest rates.

- Credit History Documentation - Documents such as credit card statements, loan repayment records, and any public credit information validate the accuracy of the credit report.

Submitting accurate and complete credit-related documents is vital for securing mortgage approval and favorable lending conditions.

Bank Statements and Asset Documentation

Bank statements are crucial for first-time homebuyer mortgage applications, as they provide proof of income, savings, and financial stability. Lenders typically require statements from the past two to three months to verify consistent cash flow and account balances.

Asset documentation helps demonstrate your ability to cover down payments and closing costs. Common assets include retirement accounts, investment portfolios, and additional checking or savings accounts, all of which must be clearly documented with statements or official records.

Debt and Liability Disclosures

First-time homebuyers must provide detailed debt and liability disclosures as part of their mortgage applications. These documents include credit card statements, loan agreements, and any outstanding debt balances to verify financial obligations. Accurate disclosure of liabilities ensures lenders assess the borrower's repayment capacity effectively.

Property Information and Purchase Agreement

For first-time homebuyer mortgage applications, detailed property information is essential, including the property address, legal description, and appraisal report. Lenders require a purchase agreement that outlines the terms of sale, purchase price, and contingencies to verify the transaction's legitimacy. These documents help underwriters assess the property's value and the buyer's commitment before approving the loan.

Gift Letters and Down Payment Documentation

First-time homebuyers must provide specific documents to support their mortgage applications, with gift letters and down payment proof being critical. These documents verify the source and legitimacy of funds used for the purchase.

- Gift Letters - Detail the amount and donor information to confirm funds are a gift, not a loan.

- Down Payment Documentation - Includes bank statements or financial records demonstrating available funds.

- Verification of Donor's Financial Ability - Sometimes required to ensure the gift is within the donor's means.

What Documents are Necessary for First-Time Homebuyer Mortgage Applications? Infographic