To apply for a personal loan online, essential documents typically include a valid government-issued ID, proof of income such as pay stubs or bank statements, and recent utility bills to verify your address. Lenders may also require your Social Security number for credit checks and employment verification. Having these documents ready streamlines the application process and increases the likelihood of approval.

What Documents Are Needed to Apply for a Personal Loan Online?

| Number | Name | Description |

|---|---|---|

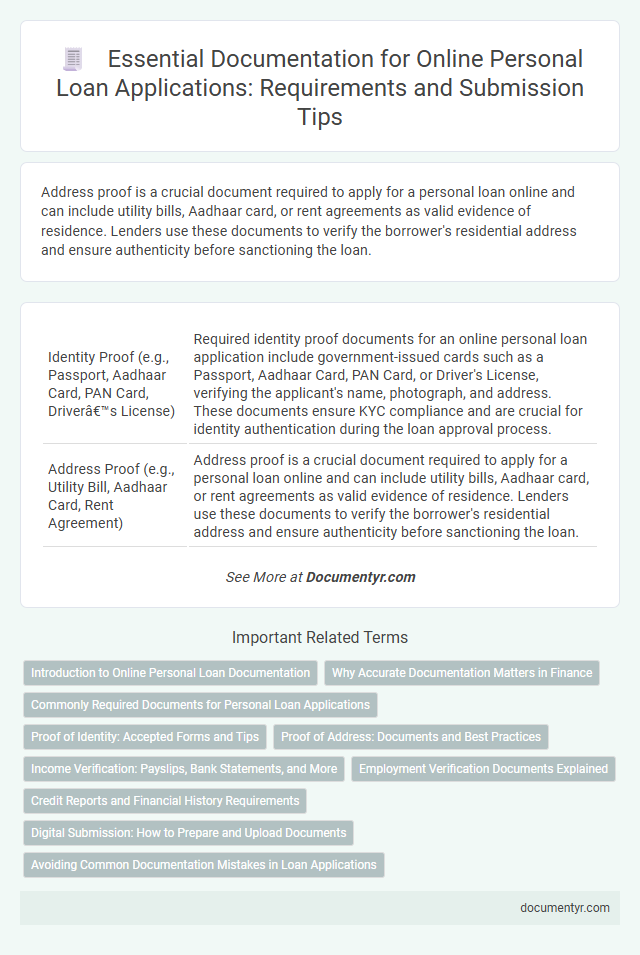

| 1 | Identity Proof (e.g., Passport, Aadhaar Card, PAN Card, Driver’s License) | Required identity proof documents for an online personal loan application include government-issued cards such as a Passport, Aadhaar Card, PAN Card, or Driver's License, verifying the applicant's name, photograph, and address. These documents ensure KYC compliance and are crucial for identity authentication during the loan approval process. |

| 2 | Address Proof (e.g., Utility Bill, Aadhaar Card, Rent Agreement) | Address proof is a crucial document required to apply for a personal loan online and can include utility bills, Aadhaar card, or rent agreements as valid evidence of residence. Lenders use these documents to verify the borrower's residential address and ensure authenticity before sanctioning the loan. |

| 3 | PAN Card | A PAN Card is a mandatory document for applying for a personal loan online as it serves as a primary identification and tax verification tool, ensuring the lender can authenticate the borrower's identity and financial history. Lenders use the PAN Card to track credit history and prevent fraud, making it essential for loan approval and verification processes. |

| 4 | Income Proof (e.g., Salary Slips, Income Tax Returns, Form 16) | Income proof documents such as recent salary slips, income tax returns (ITR), and Form 16 are essential for validating financial stability when applying for a personal loan online. These documents help lenders assess repayment capacity and verify the applicant's consistent income stream. |

| 5 | Bank Statements | Bank statements are essential documents for applying for a personal loan online as they provide lenders with a detailed overview of your income, spending habits, and financial stability, typically requiring at least three to six months of statements. These documents help verify your ability to repay the loan and ensure transparency in your financial history. |

| 6 | Employment Proof (e.g., Employment Certificate, Offer Letter) | Employment proof is a critical document when applying for a personal loan online, typically including an Employment Certificate or Offer Letter that verifies your job status and income stability. These documents help lenders assess your repayment capacity by confirming your current employment details and salary information. |

| 7 | Recent Passport-size Photographs | Recent passport-size photographs are often required when applying for a personal loan online to verify the applicant's identity and ensure the accuracy of the loan application. These photos must meet specific size and quality standards set by the lender to avoid delays in the loan approval process. |

| 8 | Loan Application Form | The loan application form is a critical document in the online personal loan process, requiring detailed personal information, employment history, and financial status to assess creditworthiness. Submitting an accurately completed loan application form expedites approval by enabling lenders to verify identity, income, and repayment capacity efficiently. |

Introduction to Online Personal Loan Documentation

Applying for a personal loan online requires submitting specific documents to verify your identity and financial status. Lenders use these documents to assess your eligibility and process your application efficiently.

- Proof of Identity - A government-issued ID such as a passport or driver's license confirms your identity.

- Proof of Income - Recent pay slips, tax returns, or bank statements demonstrate your ability to repay the loan.

- Address Verification - Utility bills or rental agreements verify your current residential address.

Why Accurate Documentation Matters in Finance

Applying for a personal loan online requires essential documents such as proof of identity, income statements, and credit history reports. Accurate documentation ensures the lender can assess your financial reliability and repayment capacity effectively. Properly submitted documents reduce processing time and increase the likelihood of loan approval in the competitive finance market.

Commonly Required Documents for Personal Loan Applications

When applying for a personal loan online, lenders typically require several key documents to process your application efficiently. Commonly requested documents include a government-issued ID for identity verification, proof of income such as recent pay stubs or tax returns, and bank statements to assess financial stability. Providing these documents promptly ensures a smoother approval process and helps demonstrate your creditworthiness.

Proof of Identity: Accepted Forms and Tips

Proof of identity is a crucial document when applying for a personal loan online as it verifies your legal identity. Lenders require accepted forms to ensure authenticity and prevent fraud during the approval process.

- Government-Issued ID - Valid passports, driver's licenses, and national ID cards are commonly accepted for identity verification.

- Recent Utility Bills - These are sometimes requested to confirm your residential address alongside your identity proof.

- Clear and Legible Copies - Ensure your documents are scanned or photographed clearly to avoid delays in loan processing.

Proof of Address: Documents and Best Practices

What documents can serve as valid proof of address when applying for a personal loan online? Common documents include utility bills, bank statements, and rental agreements. Ensure these documents are recent and clearly show your name and address to meet lender requirements.

Income Verification: Payslips, Bank Statements, and More

Income verification is a critical step when applying for a personal loan online. Lenders require proof to assess your ability to repay the borrowed amount.

- Payslips - Recent payslips demonstrate regular income and job stability.

- Bank Statements - Bank statements verify salary deposits and track financial activity over months.

- Tax Returns - Tax returns provide comprehensive evidence of annual income for self-employed applicants.

Providing accurate income documents speeds up loan approval and increases the chances of securing favorable terms.

Employment Verification Documents Explained

Employment verification documents are crucial when applying for a personal loan online. These documents confirm your job status and income stability to the lender.

Common employment verification documents include recent pay stubs, employment letters, and tax returns. You may also need to provide bank statements showing salary deposits for additional proof.

Credit Reports and Financial History Requirements

When applying for a personal loan online, lenders require detailed credit reports to assess your creditworthiness. These reports include your credit score, payment history, and any existing debts.

Financial history requirements often involve providing proof of income, such as pay stubs or tax returns, to verify your ability to repay the loan. Lenders may also request bank statements to evaluate your spending habits and savings. A comprehensive review of your credit reports and financial documents helps lenders minimize risk and approve eligible applicants.

Digital Submission: How to Prepare and Upload Documents

Applying for a personal loan online requires submitting specific documents to verify identity, income, and creditworthiness. Common documents include a government-issued ID, proof of income, bank statements, and address proof.

Prepare digital copies of these documents by scanning or photographing them clearly with a smartphone or scanner. Ensure files are in accepted formats like PDF, JPEG, or PNG and keep file sizes within the lender's upload limits.

What Documents Are Needed to Apply for a Personal Loan Online? Infographic