When applying for a small business loan, essential documents typically include a detailed business plan, financial statements such as profit and loss statements, balance sheets, and cash flow projections. Lenders also require personal and business tax returns, bank statements, and legal documents such as business licenses and registrations. Providing accurate and thorough documentation increases the likelihood of loan approval and favorable terms.

What Documents Are Necessary to Apply for a Small Business Loan?

| Number | Name | Description |

|---|---|---|

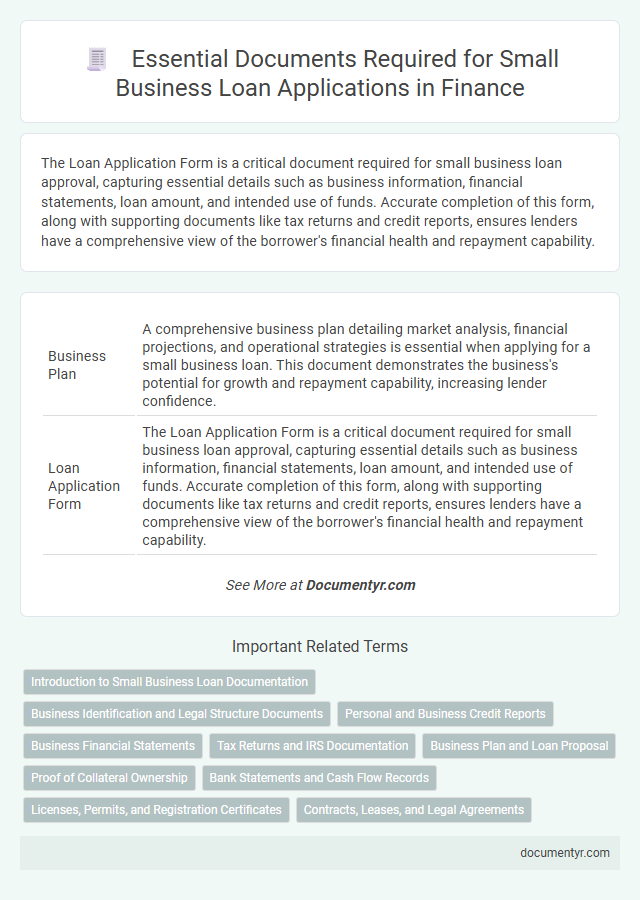

| 1 | Business Plan | A comprehensive business plan detailing market analysis, financial projections, and operational strategies is essential when applying for a small business loan. This document demonstrates the business's potential for growth and repayment capability, increasing lender confidence. |

| 2 | Loan Application Form | The Loan Application Form is a critical document required for small business loan approval, capturing essential details such as business information, financial statements, loan amount, and intended use of funds. Accurate completion of this form, along with supporting documents like tax returns and credit reports, ensures lenders have a comprehensive view of the borrower's financial health and repayment capability. |

| 3 | Personal Identification | Lenders require personal identification documents such as a government-issued ID, Social Security number, and proof of address to verify the applicant's identity when applying for a small business loan. These documents ensure compliance with anti-fraud regulations and help establish the borrower's creditworthiness. |

| 4 | Business Licenses and Permits | Required documents for a small business loan include valid business licenses and permits that demonstrate legal authorization to operate within specific industries and jurisdictions. Lenders often verify these credentials to assess regulatory compliance, reducing loan approval risks and ensuring the business meets local, state, and federal requirements. |

| 5 | Articles of Incorporation or Organization | Articles of Incorporation or Organization are essential documents that verify the legal formation and structure of a small business, confirming its registered status with the state. Lenders require these documents to assess the business's legitimacy and ensure compliance with regulatory requirements before approving a loan application. |

| 6 | Personal and Business Tax Returns | Submitting personal and business tax returns is crucial when applying for a small business loan, as lenders use these documents to assess financial stability and income consistency. These returns provide detailed insights into revenue, expenses, and profit margins, helping lenders evaluate creditworthiness and repayment potential. |

| 7 | Personal and Business Bank Statements | Personal and business bank statements provide lenders with critical insights into cash flow, spending habits, and financial stability when applying for a small business loan. These documents verify income sources, demonstrate consistent revenue, and highlight the ability to manage expenses, which are essential criteria for loan approval. |

| 8 | Balance Sheet | A current balance sheet is essential to apply for a small business loan, providing lenders with a detailed snapshot of the company's assets, liabilities, and equity at a specific point in time. This document helps evaluate the business's financial health and ability to repay the loan, making it a critical component of the loan application package. |

| 9 | Profit and Loss Statement (Income Statement) | A Profit and Loss Statement (Income Statement) is essential for small business loan applications as it details the company's revenue, expenses, and net profit over a specific period, demonstrating financial performance and cash flow management. Lenders rely on this document to assess the business's profitability, operational efficiency, and ability to repay the loan. |

| 10 | Cash Flow Statement | A cash flow statement is essential for a small business loan application as it provides lenders with a clear overview of the company's inflows and outflows of cash, demonstrating the business's ability to generate enough liquidity to meet loan obligations. This financial document highlights operational efficiency and helps assess repayment capacity, making it a critical component alongside tax returns and balance sheets. |

| 11 | Debt Schedule | A comprehensive debt schedule listing all outstanding loans, credit lines, and repayment terms is essential when applying for a small business loan, as it demonstrates your current financial obligations. This document helps lenders assess your debt-to-income ratio and overall credit risk, improving the chances of loan approval. |

| 12 | Business Credit Report | A comprehensive business credit report is essential when applying for a small business loan, as it provides lenders with detailed insights into the company's credit history, including payment behavior, outstanding debts, and credit score. This report often influences loan approval decisions and interest rates by demonstrating the business's financial reliability and risk level. |

| 13 | Personal Credit Report | A personal credit report is essential when applying for a small business loan, as lenders evaluate credit history to assess the applicant's financial responsibility and risk level. It typically includes credit scores, outstanding debts, payment history, and public records, which directly impact loan approval and interest rates. |

| 14 | Ownership and Affiliations Documentation | Ownership and affiliations documentation required for a small business loan application typically includes business registration certificates, partnership agreements, and shareholder information to verify the legal structure and ownership percentages. Lenders may also request documents detailing any affiliations with other businesses to assess potential impacts on loan risk and repayment capacity. |

| 15 | Accounts Receivable Aging Report | Lenders require an Accounts Receivable Aging Report to evaluate the timeliness and reliability of a business's incoming cash flow, which directly impacts loan eligibility and terms. This report categorizes outstanding invoices by age, helping financial institutions assess credit risk and the company's ability to meet debt obligations. |

| 16 | Accounts Payable Aging Report | Lenders require an Accounts Payable Aging Report to assess a small business's outstanding liabilities and payment patterns, which helps determine creditworthiness and cash flow management. This document categorizes unpaid bills by invoice due dates, providing critical insight into the company's short-term financial obligations and vendor relationships. |

| 17 | Collateral Documentation | Collateral documentation for a small business loan typically includes detailed records proving ownership and value of assets such as real estate deeds, vehicle titles, equipment appraisals, and inventory lists. Lenders require these documents to assess the borrower's ability to secure the loan and minimize their risk by verifying the tangible assets offered as collateral. |

| 18 | Commercial Lease Agreement | A commercial lease agreement is a crucial document when applying for a small business loan, as it verifies the business's physical location and outlines the rental terms, impacting the lender's assessment of financial stability. Lenders often require this agreement to evaluate fixed costs and ensure the business has a secure operational space, which directly influences loan approval decisions. |

| 19 | Franchise Agreement (if applicable) | A Franchise Agreement is a critical document when applying for a small business loan for a franchise, as it outlines the legal relationship between the franchisor and franchisee, including operational guidelines and fees. Lenders require this agreement to assess the business model's stability, revenue potential, and any ongoing financial obligations that could impact loan repayment. |

| 20 | Evidence of Equity Investment | Evidence of equity investment typically includes financial statements, bank statements, canceled checks, or investment agreements demonstrating the owner's personal funds or assets contributed to the business. Lenders require this documentation to assess the borrower's financial commitment and reduce loan risk. |

Introduction to Small Business Loan Documentation

Applying for a small business loan requires thorough preparation and documentation. Lenders assess various documents to evaluate the financial health and creditworthiness of the business.

Essential documents include business financial statements, tax returns, and a detailed business plan. These materials provide insight into the company's revenue, expenses, and growth potential.

Business Identification and Legal Structure Documents

Applying for a small business loan requires submitting specific documents that verify your business identity and legal structure. These documents help lenders assess the legitimacy and framework of your business.

- Employer Identification Number (EIN) - Issued by the IRS, the EIN is a unique identifier for your business used for tax purposes.

- Business License or Permit - This document proves that your business is legally authorized to operate in your city or state.

- Articles of Incorporation or Organization - These papers define the legal structure of your business, such as LLC, corporation, or partnership.

Personal and Business Credit Reports

When applying for a small business loan, providing both personal and business credit reports is crucial. These reports offer lenders detailed insights into your creditworthiness and financial history.

Your personal credit report reflects your individual financial responsibility, while the business credit report showcases the financial health of your company. Accurate and up-to-date credit information increases the chances of loan approval.

Business Financial Statements

Business financial statements are essential documents when applying for a small business loan. They provide a clear picture of your company's financial health and performance.

- Balance Sheet - Shows your business's assets, liabilities, and equity at a specific point in time.

- Income Statement - Details your revenue, expenses, and profit over a set period.

- Cash Flow Statement - Tracks the inflows and outflows of cash, highlighting liquidity and operational efficiency.

Lenders use these statements to evaluate your creditworthiness and ability to repay the loan.

Tax Returns and IRS Documentation

Tax returns are critical documents required to apply for a small business loan. They provide lenders with a detailed record of your business income and financial history.

IRS documentation, including transcripts and notices, helps verify the authenticity of your tax returns. Lenders use these documents to assess your creditworthiness and repayment ability. Providing accurate and complete tax records can significantly improve your chances of loan approval.

Business Plan and Loan Proposal

| Document | Description | Purpose |

|---|---|---|

| Business Plan | A detailed document outlining your business goals, market analysis, organizational structure, product or service offerings, and financial projections. It includes sections on marketing strategy, operational plan, and competitive analysis. | Demonstrates the viability and growth potential of the business to lenders. Provides evidence of strategic planning, revenue streams, and ability to repay the loan. |

| Loan Proposal | A formal letter or document addressed to the lender that specifies the loan amount requested, loan purpose, repayment plan, and terms. Often includes clear justification for the funding and financial needs. | Clarifies how the loan will be used and reassures lenders of the borrower's commitment and repayment capability. Supports the business plan with focused financial requests and expectations. |

Proof of Collateral Ownership

Proof of collateral ownership is a critical document when applying for a small business loan. Lenders require clear evidence that the applicant owns the assets offered as collateral, such as real estate deeds, vehicle titles, or equipment appraisals. This documentation helps secure the loan and reduces lender risk by verifying that collateral can be claimed in case of default.

Bank Statements and Cash Flow Records

Applying for a small business loan requires thorough financial documentation to demonstrate creditworthiness and business stability. Bank statements and cash flow records are essential documents that lenders use to assess the financial health of your business.

- Bank Statements - Detailed monthly bank statements provide proof of income, expenses, and overall account activity over a specific period.

- Cash Flow Records - Accurate cash flow statements highlight the inflow and outflow of cash, reflecting the business's ability to meet financial obligations.

- Financial Consistency - Consistent and well-maintained bank and cash flow records increase the credibility of your loan application with lenders.

Licenses, Permits, and Registration Certificates

When applying for a small business loan, lenders require proof of your business's legal operation, which includes licenses, permits, and registration certificates. These documents verify that your business complies with local, state, and federal regulations, establishing credibility and reducing risk for the lender. Common examples include a business license, health permits, and state registration certificates, all crucial for securing loan approval.

What Documents Are Necessary to Apply for a Small Business Loan? Infographic