Small business loan applications typically require key documents such as financial statements, including balance sheets and income statements, to demonstrate business stability and profitability. Lenders also request tax returns from the past two to three years to assess consistent revenue streams. A detailed business plan and proof of identity or ownership documentation are essential to verify the legitimacy and goals of the enterprise.

What Documents Are Required for Small Business Loan Applications?

| Number | Name | Description |

|---|---|---|

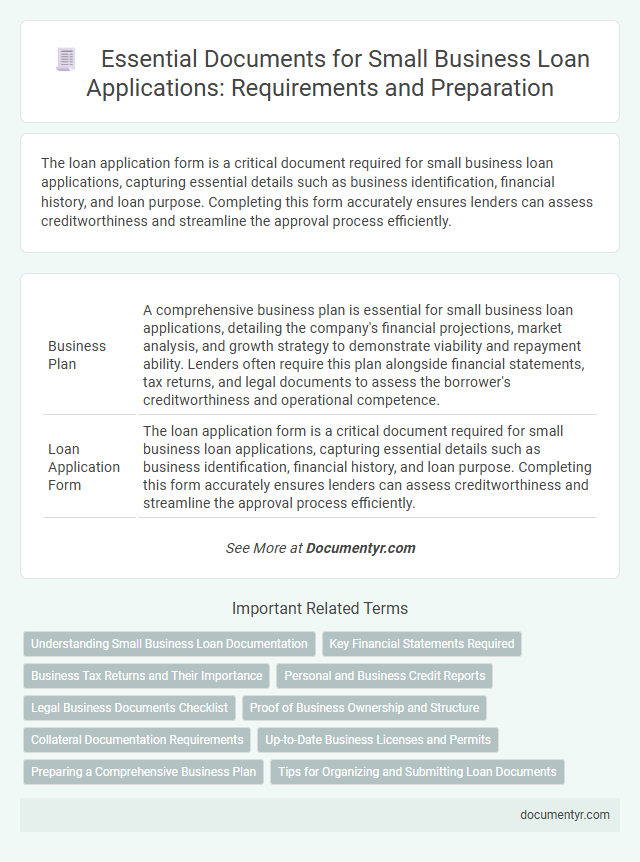

| 1 | Business Plan | A comprehensive business plan is essential for small business loan applications, detailing the company's financial projections, market analysis, and growth strategy to demonstrate viability and repayment ability. Lenders often require this plan alongside financial statements, tax returns, and legal documents to assess the borrower's creditworthiness and operational competence. |

| 2 | Loan Application Form | The loan application form is a critical document required for small business loan applications, capturing essential details such as business identification, financial history, and loan purpose. Completing this form accurately ensures lenders can assess creditworthiness and streamline the approval process efficiently. |

| 3 | Business License | A valid business license is essential for small business loan applications as it verifies the legal operation and legitimacy of the business. Lenders rely on this document to assess compliance with local regulations and confirm the business's authorization to operate within its jurisdiction. |

| 4 | Articles of Incorporation | Articles of Incorporation are essential documents required for small business loan applications as they verify the legal existence and structure of the business entity. Lenders use these documents to confirm ownership details and ensure compliance with state regulations before approving financing. |

| 5 | Employer Identification Number (EIN) | An Employer Identification Number (EIN) is a critical document required for small business loan applications, serving as a unique identifier for your business when filing taxes and opening bank accounts. Lenders use the EIN to verify your business's legal structure and creditworthiness, making it essential to include along with financial statements, tax returns, and business licenses. |

| 6 | Personal Identification (Driver’s License or Passport) | Small business loan applications require personal identification documents such as a valid driver's license or passport to verify the borrower's identity and prevent fraud. These government-issued IDs are essential for establishing personal credibility alongside financial records during the loan approval process. |

| 7 | Personal Tax Returns | Lenders typically require personal tax returns from small business loan applicants to verify individual income and assess financial stability, often requesting the last two to three years of returns. These documents provide critical insights into the borrower's ability to repay the loan and are essential for both sole proprietors and small business owners with guarantees. |

| 8 | Business Tax Returns | Business tax returns are essential documents for small business loan applications as they provide lenders with a detailed record of the company's financial health and profitability. These returns typically include IRS Form 1120, 1120S, or 1065, along with supporting schedules, which help verify income, expenses, and tax liability. |

| 9 | Personal Financial Statement | A personal financial statement is a critical document for small business loan applications, detailing the entrepreneur's assets, liabilities, income, and expenses to assess creditworthiness. Lenders use this statement to evaluate the borrower's financial stability and ability to repay the loan. |

| 10 | Business Financial Statements | Business financial statements required for small business loan applications typically include the balance sheet, income statement, and cash flow statement, providing lenders with a comprehensive view of the company's financial health, profitability, and liquidity. Accurate and up-to-date financial statements demonstrate the business's ability to repay the loan and support the loan amount requested. |

| 11 | Balance Sheet | A current balance sheet is essential for small business loan applications as it provides lenders with a snapshot of the company's assets, liabilities, and equity, reflecting its financial health and stability. This document helps assess the business's ability to repay the loan by showcasing liquidity, debt levels, and overall capital structure. |

| 12 | Profit and Loss Statement | A Profit and Loss Statement is essential for small business loan applications as it provides detailed insight into the company's revenues, expenses, and net income over a specific period, demonstrating the business's profitability and financial health. Lenders analyze this statement to assess cash flow stability and the business's ability to repay the loan, making it a critical document alongside tax returns and balance sheets. |

| 13 | Cash Flow Statement | A detailed cash flow statement is essential for small business loan applications as it demonstrates the ability to generate sufficient cash to cover loan repayments, reflecting the business's financial health and operational efficiency. Lenders require this document to assess liquidity by tracking the inflows and outflows of cash over a specified period, ensuring the business can sustain debt without jeopardizing daily operations. |

| 14 | Bank Statements | Bank statements are critical in small business loan applications as they provide lenders with a detailed record of the business's financial activity, demonstrating cash flow stability and the ability to repay the loan. Typically, lenders request the last three to six months of bank statements to assess income consistency, expenses, and overall financial health. |

| 15 | Accounts Receivable Aging Report | Lenders require an Accounts Receivable Aging Report to evaluate the quality and collectability of a small business's outstanding invoices, helping assess cash flow stability and repayment ability. This document categorizes receivables by the length of time they've been outstanding, providing critical insight into potential credit risks and overall financial health. |

| 16 | Accounts Payable Aging Report | Lenders require a detailed Accounts Payable Aging Report to assess a small business's outstanding obligations, categorizing debts by due dates to evaluate financial stability and payment patterns. This document helps demonstrate the company's liquidity and capacity to manage current liabilities, influencing loan approval decisions. |

| 17 | Business Debt Schedule | A detailed Business Debt Schedule is crucial for small business loan applications, listing all existing debts with creditor names, outstanding balances, interest rates, monthly payments, and maturity dates to demonstrate current liabilities. Lenders rely on this document to assess the business's debt load, repayment capacity, and overall financial health, influencing loan approval decisions. |

| 18 | Collateral Documentation | Collateral documentation for small business loan applications typically includes detailed asset valuations such as property deeds, vehicle titles, equipment appraisals, and inventory lists, which demonstrate the borrower's ability to secure the loan. Lenders often require proof of clear ownership, recent tax assessments, and insurance policies to validate the collateral's value and legal standing. |

| 19 | Ownership and Affiliates List | Small business loan applications require comprehensive documentation of ownership structure, including detailed lists of all owners, partners, and affiliates with corresponding ownership percentages. Lenders use this ownership and affiliates list to assess control, financial responsibility, and potential conflicts of interest in the business. |

| 20 | Commercial Lease Agreement (if applicable) | A Commercial Lease Agreement outlines the terms between a small business and the property owner, serving as proof of business premises and affecting loan eligibility and terms. Lenders require this document to verify operating expenses and confirm the business's physical location as part of the loan application process. |

| 21 | Franchise Agreement (if applicable) | Small business loan applications often require a franchise agreement to verify the terms and obligations between the franchisor and franchisee, ensuring the lender understands the business model and associated risks. This document details the franchise's operational rights, fees, and renewal conditions, providing critical insight into the loan applicant's legal and financial commitments. |

| 22 | Resumes of Key Owners/Managers | Resumes of key owners and managers are essential for small business loan applications as they demonstrate relevant industry experience, leadership skills, and the ability to manage financial responsibilities effectively. Detailed profiles showcasing educational background, professional achievements, and business acumen significantly enhance lenders' confidence in the management team's capability to drive business success and ensure loan repayment. |

| 23 | Purchase Agreements (for equipment or property purchases) | Purchase agreements are essential for small business loan applications as they provide lenders with detailed proof of the intended use of funds for equipment or property acquisitions. These legally binding documents outline the terms, price, and description of the assets, ensuring transparency and reducing lender risk during the loan evaluation process. |

Understanding Small Business Loan Documentation

Understanding small business loan documentation is essential for a smooth application process. Preparing the correct documents can significantly improve your chances of approval.

- Financial Statements - Lenders require income statements, balance sheets, and cash flow statements to assess your business's financial health.

- Tax Returns - Business and personal tax returns from the past two to three years provide proof of consistent income and financial stability.

- Business Plan - A comprehensive business plan outlines your company's goals, market strategy, and repayment plan, helping lenders evaluate risk and potential.

Key Financial Statements Required

When applying for a small business loan, key financial statements play a crucial role in demonstrating your business's financial health. Lenders require these documents to assess your ability to repay the loan.

- Income Statement - Shows your business's revenue, expenses, and profit over a specific period.

- Balance Sheet - Provides a snapshot of your business's assets, liabilities, and equity at a given point in time.

- Cash Flow Statement - Details the cash inflows and outflows, highlighting liquidity and operational efficiency.

Providing accurate financial statements increases the chances of securing your small business loan.

Business Tax Returns and Their Importance

Business tax returns are a critical component of small business loan applications. Lenders analyze these documents to assess the financial health and income consistency of the business.

Providing accurate and complete tax returns helps demonstrate the business's ability to repay the loan. These documents offer a detailed record of revenue, expenses, and profit margins over time.

Personal and Business Credit Reports

Small business loan applications require thorough documentation, including personal and business credit reports. These reports provide lenders with critical insights into creditworthiness and financial history.

Your personal credit report reveals repayment reliability and financial responsibility, influencing loan approval decisions. The business credit report reflects your company's financial health, payment history, and use of credit lines. Providing accurate and up-to-date credit reports can improve your chances of securing funding.

Legal Business Documents Checklist

| Document | Description | Purpose in Loan Application |

|---|---|---|

| Business License | Proof of legal authorization to operate your business. | Confirms business legality and compliance with local regulations. |

| Employer Identification Number (EIN) | Federal tax ID assigned by the IRS for your business entity. | Validates business identity and tax obligations. |

| Articles of Incorporation or Organization | Document filed with the state that establishes the business entity. | Demonstrates business structure and registration status. |

| Operating Agreement or Bylaws | Internal document outlining management and ownership of the business. | Provides clarity on roles and responsibilities within the business. |

| Partnership Agreement | Legal contract detailing terms of the partnership if applicable. | Specifies ownership shares and partnership terms. |

| Certificate of Good Standing | State-issued certificate confirming that the business complies with state laws. | Assures lenders of business legitimacy and compliance. |

| Fictitious Business Name Statement | Documentation of any DBA ("Doing Business As") names used by the business. | Verifies alternate business names registered with the state or county. |

| Franchise Agreements | Legal contract if the business operates as a franchise. | Shows authorization to operate under an established brand. |

Proof of Business Ownership and Structure

Proof of Business Ownership and Structure is a crucial document for small business loan applications. Lenders typically require legal documents such as articles of incorporation, partnership agreements, or a sole proprietorship registration to verify your business's legitimacy. Providing clear evidence of your business structure helps streamline the approval process and establishes trust with financial institutions.

Collateral Documentation Requirements

Collateral documentation is a crucial part of small business loan applications, serving as proof of assets that secure the loan. Common documents include property deeds, vehicle titles, equipment appraisals, and inventory lists. Lenders require these to assess the value and ensure the collateral sufficiently covers the loan amount.

Up-to-Date Business Licenses and Permits

Up-to-date business licenses and permits are critical documents for small business loan applications, demonstrating legal operation compliance. Lenders require these to verify that the business meets all regulatory requirements before approving financing.

- Proof of Valid Business License - This document confirms the business is authorized to operate within its industry and locality.

- Current Permits Relevant to Business Activities - These permits show compliance with specific industry regulations, such as health, safety, or environmental standards.

- Renewal Documentation - Providing evidence of timely renewals indicates the business maintains ongoing legal compliance and operational legitimacy.

Preparing a Comprehensive Business Plan

What documents are essential for small business loan applications? A comprehensive business plan is a critical document that outlines your business goals, strategies, and financial projections. It demonstrates to lenders your ability to manage and grow the business successfully.

How does preparing a detailed business plan benefit your loan application? A well-structured business plan provides clarity on market analysis, competitive advantage, and revenue models. It reassures lenders of your preparedness and reduces the perceived risk associated with lending.

What key components should your business plan include? Essential sections are the executive summary, detailed marketing strategy, operational plan, and financial statements such as cash flow projections and profit and loss forecasts. These elements collectively offer a full picture of your business viability.

What Documents Are Required for Small Business Loan Applications? Infographic