Freelancers must gather key documents such as Form 1099-MISC or 1099-NEC from clients, expense receipts, and bank statements to accurately report income and deductible costs. Maintaining organized records of invoices, contracts, and business-related payments ensures comprehensive and compliant tax filings. Proper documentation facilitates accurate calculation of taxable income and maximizes potential deductions.

What Documents Does a Freelancer Need for Tax Filing?

| Number | Name | Description |

|---|---|---|

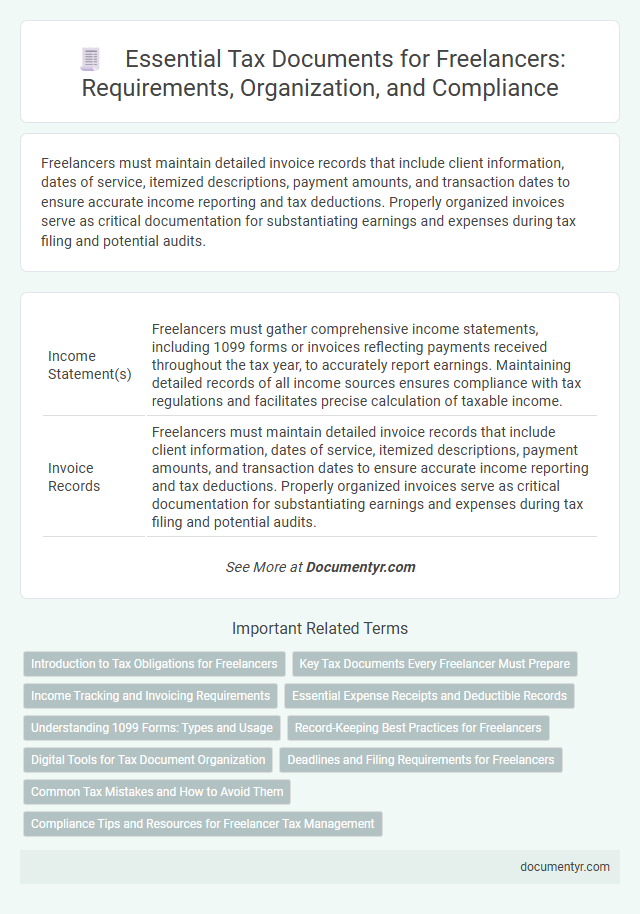

| 1 | Income Statement(s) | Freelancers must gather comprehensive income statements, including 1099 forms or invoices reflecting payments received throughout the tax year, to accurately report earnings. Maintaining detailed records of all income sources ensures compliance with tax regulations and facilitates precise calculation of taxable income. |

| 2 | Invoice Records | Freelancers must maintain detailed invoice records that include client information, dates of service, itemized descriptions, payment amounts, and transaction dates to ensure accurate income reporting and tax deductions. Properly organized invoices serve as critical documentation for substantiating earnings and expenses during tax filing and potential audits. |

| 3 | Bank Statements | Freelancers must keep detailed bank statements to accurately track income and expenses for tax filing purposes, ensuring all transactions align with reported earnings. These statements provide essential documentation for proving income sources, validating deductions, and reconciling annual financial records with tax returns. |

| 4 | Form 1099-NEC | Freelancers need to collect Form 1099-NEC from each client who paid them $600 or more during the tax year, as this form reports nonemployee compensation essential for accurate income reporting. Properly organizing 1099-NEC forms alongside expense receipts and bank statements ensures precise tax filing and maximizes potential deductions. |

| 5 | Form 1099-K | Freelancers must collect Form 1099-K issued by payment processors when transactions exceed $600 to accurately report income to the IRS. This form details gross payment card and third-party network transactions, crucial for reconciling annual revenue and ensuring compliance with tax regulations. |

| 6 | Expense Receipts | Freelancers must retain expense receipts such as invoices for business purchases, travel costs, software subscriptions, and office supplies to accurately report deductions and reduce taxable income. Proper documentation ensures compliance with IRS regulations, supports claims during audits, and maximizes legitimate expense reporting. |

| 7 | Mileage Log | Freelancers must maintain a detailed mileage log to accurately track business-related travel expenses, which is essential for maximizing tax deductions. This log should include dates, destinations, purposes, and miles driven to comply with IRS requirements and support claims during tax filing. |

| 8 | Home Office Expense Records | Freelancers must maintain detailed home office expense records including utility bills, rent or mortgage statements, and receipts for office supplies to claim accurate deductions during tax filing. Proper documentation of these expenses ensures compliance with tax regulations and maximizes potential tax benefits related to the home office. |

| 9 | Health Insurance Statements (Form 1095-A/C/B) | Freelancers must gather Health Insurance Statements, specifically Form 1095-A, 1095-B, or 1095-C, which detail their healthcare coverage and are essential for accurate tax filing and potential premium tax credit reconciliation. These forms document monthly insurance coverage, marketplace enrollment, and employer-provided benefits, directly impacting tax deductions and penalty exemptions. |

| 10 | Retirement Contribution Statements (Form 5498) | Freelancers must retain Form 5498, which reports IRA contributions including traditional, Roth, SEP, and SIMPLE IRAs, as crucial documents for tax filing to verify retirement savings and potential deductions. This form, provided by financial institutions, helps accurately report retirement contributions and ensure compliance with IRS regulations for tax benefits. |

| 11 | Asset Purchase Receipts | Freelancers must retain asset purchase receipts to accurately document deductible expenses and calculate depreciation for tax filing purposes. These receipts provide essential proof of business-related acquisitions, ensuring compliance with tax regulations and maximizing eligible deductions. |

| 12 | Previous Year Tax Return | Freelancers should have their previous year tax return ready as it provides a detailed record of income, deductions, and tax payments essential for accurate filing. This document helps in ensuring consistency, claiming carry forward losses, and calculating advance tax liabilities. |

| 13 | Estimated Tax Payment Receipts (Form 1040-ES) | Freelancers must keep Estimated Tax Payment Receipts, specifically Form 1040-ES, to accurately report quarterly tax prepayments to the IRS. These receipts serve as proof of payments made toward income tax and self-employment tax, ensuring compliance and preventing penalties during annual tax filing. |

| 14 | Business License(s) | Freelancers should include valid business licenses when preparing tax filings as these documents validate their legal operation and may impact deductions or tax obligations. Maintaining updated business licenses ensures compliance with local regulations and can streamline the filing process with tax authorities. |

| 15 | Contract Agreements | Freelancers must maintain detailed contract agreements outlining the scope of work, payment terms, and client information to ensure accurate tax filing and income reporting. These contracts serve as crucial documentation for verifying deductible expenses and supporting income claims during tax audits. |

| 16 | Proof of Internet/Phone Expenses | Freelancers must provide detailed invoices and monthly bills as proof of internet and phone expenses to claim deductions during tax filing. Accurate records including payment receipts and service agreements help substantiate these business-related costs to tax authorities. |

| 17 | Software Subscription Receipts | Freelancers must retain software subscription receipts as proof of deductible business expenses when filing taxes, ensuring accurate reporting of costs related to essential tools and applications. These documents help validate claims for software expenses, minimizing audit risks and maximizing potential deductions. |

| 18 | Education or Training Expense Receipts | Freelancers must keep detailed receipts and invoices related to education or training expenses to maximize tax deductions and validate claims during filing. Proper documentation includes course fees, seminar registrations, and related educational materials directly associated with skill enhancement for their freelance work. |

| 19 | Marketing/Advertising Receipts | Freelancers must retain detailed marketing and advertising receipts to accurately report deductible business expenses on their tax returns, including invoices, payment proofs, and contract agreements with marketing service providers. These documents substantiate claims for expense deductions under IRS guidelines, reducing taxable income and ensuring compliance during audits. |

| 20 | Charitable Contribution Receipts (if applicable) | Freelancers must retain charitable contribution receipts as proof of donations that can be deducted on their tax returns, reducing taxable income. These documents should include the organization's name, donation amount, and date, and must be from qualified nonprofits to ensure IRS compliance. |

Introduction to Tax Obligations for Freelancers

Freelancers must understand their tax obligations to comply with government regulations and avoid penalties. Proper documentation is essential for accurate income reporting and deductible expense claims. Knowing which documents to gather simplifies the tax filing process and ensures financial transparency.

Key Tax Documents Every Freelancer Must Prepare

Freelancers must prepare key tax documents such as Form 1099-NEC to report non-employee compensation from clients. Maintaining accurate records of invoices, receipts, and expenses is essential to claim deductions and calculate taxable income. Additionally, freelancers should keep a detailed mileage log and bank statements to support business-related expenses during tax filing.

Income Tracking and Invoicing Requirements

Freelancers must maintain accurate income tracking and invoicing documents for tax filing purposes. Proper documentation ensures compliance with tax authorities and simplifies expense reporting.

- Income Records - Track all payments received, including date, amount, and client details for accurate revenue reporting.

- Invoices - Issue detailed invoices for each project or service, containing your business name, tax ID, and payment terms.

- Expense Receipts - Save receipts related to business expenses to claim deductions and reduce taxable income.

Your organized record-keeping facilitates smoother tax filing and minimizes the risk of audits or penalties.

Essential Expense Receipts and Deductible Records

Freelancers must carefully organize expense receipts and deductible records to ensure accurate tax filing. Essential documentation supports claims and helps maximize tax deductions.

- Receipts for Business Expenses - Keep physical or digital copies of all purchases related to your freelance work, such as office supplies and software subscriptions.

- Records of Home Office Expenses - Document mortgage interest, rent, utilities, and repairs if you claim a home office deduction.

- Vehicle Use Documentation - Maintain mileage logs and receipts for fuel, maintenance, and insurance when using your vehicle for business purposes.

Understanding 1099 Forms: Types and Usage

Freelancers must gather specific documents for accurate tax filing, and understanding 1099 forms is essential. These forms report income received outside traditional employment, crucial for self-employed tax reporting.

The most common 1099 forms freelancers encounter include 1099-NEC and 1099-MISC. The 1099-NEC reports nonemployee compensation, while the 1099-MISC covers miscellaneous income such as royalties or rent.

Record-Keeping Best Practices for Freelancers

| Document Type | Description | Record-Keeping Best Practice |

|---|---|---|

| Income Records | Invoices, payment confirmations, and bank statements showing received payments | Store digital copies in organized folders labeled by client and date; back up data regularly |

| Expense Receipts | Receipts for business-related purchases such as software, equipment, office supplies, and travel | Scan and categorize receipts by expense type; use expense tracking apps to simplify documentation |

| 1099 Forms (or equivalent) | Forms received from clients reporting freelance income paid during the tax year | Collect all client-issued 1099 forms before filing; maintain copies for at least seven years |

| Bank and Credit Card Statements | Statements showing business-related transactions | Reconcile statements monthly to ensure all income and expenses are accounted for; keep digital records |

| Business Licenses and Permits | Official documents validating the freelancer's ability to operate legally | Keep electronic and physical copies accessible; update renewal reminders to avoid lapses |

| Contracts and Agreements | Written agreements outlining job scope, payment terms, and deadlines | Maintain clear, signed copies organized by project; reference contracts when reporting income |

| Tax Deduction Records | Documentation supporting deductible expenses such as home office, health insurance, and education | Keep detailed records and receipts; maintain mileage logs if claiming transport deductions |

| Previous Tax Returns | Copies of filed tax returns for prior years | Store securely to assist in tax preparation and audits; keep for at least seven years |

Digital Tools for Tax Document Organization

Freelancers must organize key financial documents for accurate and efficient tax filing. Digital tools streamline the collection, storage, and management of these essential tax documents.

- Income Statements - Digital invoicing platforms archive earnings and generate summaries for tax reporting.

- Expense Receipts - Mobile scanning apps digitize and categorize business expenses for easy retrieval during tax preparation.

- Tax Forms - Cloud-based tax software integrates W-9s, 1099s, and other forms to simplify document submission and compliance.

Deadlines and Filing Requirements for Freelancers

Freelancers must gather essential documents such as 1099-NEC forms, expense receipts, and profit and loss statements for accurate tax filing. Meeting IRS deadlines is crucial to avoid penalties and ensure compliance with tax regulations.

The primary deadline for freelancers to file taxes is April 15 unless an extension is requested, extending the deadline to October 15. Quarterly estimated tax payments are required on April 15, June 15, September 15, and January 15 of the following year. Keeping organized records throughout the year simplifies the filing process and supports accurate reporting of income and deductions.

Common Tax Mistakes and How to Avoid Them

What documents does a freelancer need for tax filing? Key documents include 1099 forms, expense receipts, bank statements, and proof of income. Maintaining organized records reduces the risk of errors and ensures accurate reporting.

What are common tax mistakes freelancers make? Overlooking deductible expenses, misreporting income, and missing estimated tax payments are frequent errors. Staying informed about tax rules and using accounting software helps prevent these issues.

How can freelancers avoid tax filing errors? Regularly tracking income and expenses, consulting tax professionals, and filing on time are essential steps. Efficient documentation supports compliance and minimizes the chance of audits.

What Documents Does a Freelancer Need for Tax Filing? Infographic