Essential documents for retirement account rollovers include a valid government-issued ID, recent account statements from both the current and receiving institutions, and a completed rollover request form. Tax identification numbers and beneficiary designation forms are often required to ensure proper processing and compliance with IRS regulations. Maintaining accurate documentation throughout the rollover helps prevent delays and potential tax penalties.

What Documents Are Necessary for Retirement Account Rollovers?

| Number | Name | Description |

|---|---|---|

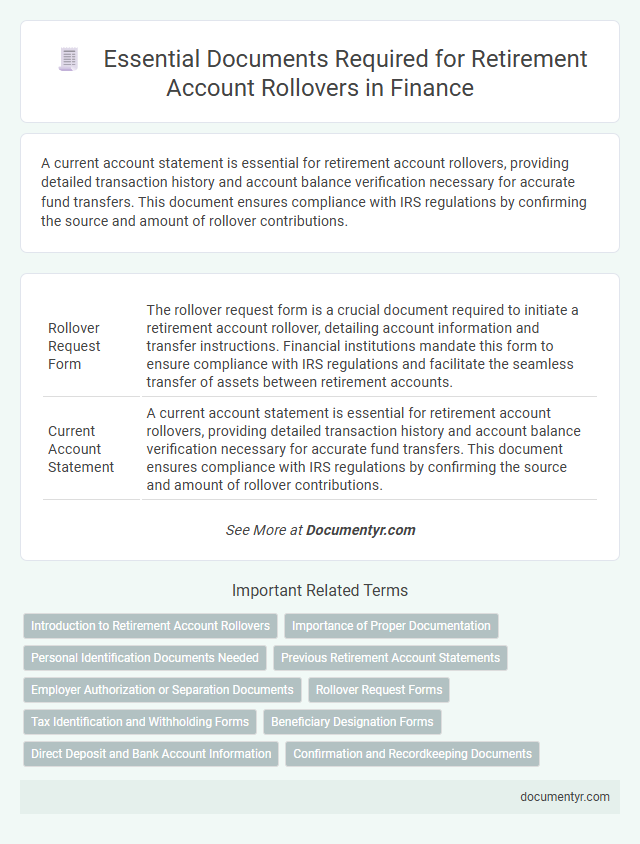

| 1 | Rollover Request Form | The rollover request form is a crucial document required to initiate a retirement account rollover, detailing account information and transfer instructions. Financial institutions mandate this form to ensure compliance with IRS regulations and facilitate the seamless transfer of assets between retirement accounts. |

| 2 | Current Account Statement | A current account statement is essential for retirement account rollovers, providing detailed transaction history and account balance verification necessary for accurate fund transfers. This document ensures compliance with IRS regulations by confirming the source and amount of rollover contributions. |

| 3 | Rollover Contribution Form | The Rollover Contribution Form is a critical document required to transfer funds from one retirement account to another, ensuring compliance with IRS regulations and facilitating a smooth rollover process. This form typically includes information about the originating and receiving accounts, rollover amount, and participant details to properly execute the transfer. |

| 4 | Distribution Request Form | The Distribution Request Form is a crucial document required for processing retirement account rollovers, authorizing the transfer of funds from one account to another. This form typically includes personal identification details, account information, and the specific rollover instructions to ensure a seamless and compliant transaction. |

| 5 | Employer Separation Verification (if applicable) | Employer separation verification is essential for retirement account rollovers and typically requires documentation such as a termination or separation letter, final pay stub reflecting last employment date, or an official employer statement confirming employment end. These documents verify the account holder's eligibility to transfer funds from a workplace retirement plan to another qualified retirement account. |

| 6 | IRA Application (if opening a new IRA) | When opening a new IRA for a retirement account rollover, essential documents include a completed IRA application form, a government-issued photo ID, and proof of address to verify identity and residency. Additionally, you may need recent account statements from the existing retirement account to facilitate a smooth and accurate transfer of assets. |

| 7 | Direct Transfer Authorization | Direct Transfer Authorization is a critical document required for retirement account rollovers, enabling the seamless transfer of funds directly between financial institutions without incurring taxes or penalties. This authorization must include detailed account information, signatures, and trustee details to ensure compliance with IRS regulations and facilitate a smooth rollover process. |

| 8 | Proof of Identity (Driver’s License, Passport) | Proof of identity, such as a valid driver's license or passport, is essential for retirement account rollovers to verify the account holder's identity and prevent fraud. Financial institutions require these documents to ensure compliance with regulatory standards and to protect the security of the rollover transaction. |

| 9 | 1099-R Form | The 1099-R form is essential for retirement account rollovers, as it reports distributions from pensions, IRAs, and other retirement plans to the IRS. Investors must provide this form to verify the tax-free transfer of funds between accounts and ensure compliance with IRS rollover rules. |

| 10 | 5498 Form | The IRS Form 5498 is essential for retirement account rollovers as it reports contributions, including rollovers, to individual retirement arrangements (IRAs). This form helps verify the amount rolled over and is crucial for accurate tax reporting and compliance during the rollover process. |

| 11 | Plan Administrator Letter | The Plan Administrator Letter is a crucial document required for retirement account rollovers, detailing the terms, conditions, and contact information necessary for transferring funds between accounts. This letter ensures regulatory compliance and facilitates a smooth rollover process by clarifying the holder's entitlements and any applicable fees or restrictions. |

| 12 | Beneficiary Designation Form | The Beneficiary Designation Form is essential for retirement account rollovers to ensure that account assets are transferred according to the account holder's wishes upon death. This form must be completed and submitted along with rollover paperwork to authenticate beneficiary rights and avoid probate delays. |

| 13 | Transfer of Assets Form | The Transfer of Assets Form is a critical document required to initiate a retirement account rollover, enabling the direct transfer of funds from one account to another without triggering taxable events. This form typically includes details such as account information, trustee contact, and signature authorization to ensure a smooth and compliant rollover process. |

| 14 | Recent Tax Returns (if requested) | Recent tax returns may be required for retirement account rollovers to verify income sources and ensure compliance with IRS regulations. Providing accurate tax documentation helps streamline the rollover process and prevents potential tax penalties. |

| 15 | Spousal Consent Form (if required) | A Spousal Consent Form is necessary for retirement account rollovers when the account owner is married and the plan requires the spouse's approval to transfer assets, ensuring legal protection for both parties. This document typically includes the spouse's signature, acknowledging their consent to the rollover transaction and waiving certain rights to the account. |

| 16 | Settlement Statement | A Settlement Statement is a crucial document required for retirement account rollovers as it provides a detailed record of the transaction, including the amounts transferred and fees incurred. Financial institutions rely on this statement to verify the proper transfer of funds and ensure compliance with IRS rollover regulations. |

Introduction to Retirement Account Rollovers

Retirement account rollovers allow you to transfer funds from one retirement plan to another without incurring taxes or penalties. Understanding the necessary documents ensures a smooth rollover process and protects your retirement savings. Key documents typically include account statements, identification proof, and rollover forms provided by both the current and receiving financial institutions.

Importance of Proper Documentation

Proper documentation is essential for a smooth retirement account rollover process. It ensures compliance with IRS regulations and prevents unexpected tax liabilities.

Key documents include the distribution form from the current account provider and acceptance paperwork from the new retirement plan. These documents verify the transfer and maintain the tax-advantaged status of the rollover.

Personal Identification Documents Needed

| Document Type | Description | Purpose in Retirement Account Rollovers |

|---|---|---|

| Government-Issued Photo ID | Valid driver's license, state ID card, or passport | Confirms the account holder's identity to prevent fraud and verify eligibility for rollover transactions |

| Social Security Number (SSN) | Social Security card or IRS-issued document containing SSN | Used for tax reporting and to link the rollover to the correct individual in the IRS system |

| Proof of Residency | Utility bill, lease agreement, or bank statement showing current address | Verifies the account holder's address, which may be required by financial institutions processing the rollover |

| Account Statements | Recent statements from the existing retirement account | Confirms account ownership and details needed to execute a smooth rollover |

Previous Retirement Account Statements

Previous retirement account statements are essential when initiating a rollover to verify account details and ensure accuracy. You should gather these documents to facilitate a smooth transfer of your retirement funds.

- Recent Account Statement - Shows current balance and investment holdings necessary for accurate rollover processing.

- Transaction History - Provides a record of recent contributions and distributions, helping to identify any pending transactions.

- Account Identification Details - Includes account numbers and provider information, essential for correctly linking your old account to the new one.

Employer Authorization or Separation Documents

Employer authorization or separation documents are essential for processing retirement account rollovers. These documents confirm the termination of employment and the employee's eligibility to transfer retirement funds.

Common examples include a separation notice, termination letter, or an employer-signed authorization form. Providing these ensures compliance with plan rules and facilitates a smooth rollover process.

Rollover Request Forms

Rollover request forms are essential documents needed when transferring funds from one retirement account to another. These forms initiate the process and ensure compliance with IRS regulations to maintain tax advantages.

The form requires detailed information about the current retirement account, the receiving account, and the amount to be rolled over. Accurate completion of the rollover request form helps prevent potential delays or tax penalties. Financial institutions often provide specific versions of these forms tailored to the type of retirement account involved.

Tax Identification and Withholding Forms

When completing a retirement account rollover, providing your Tax Identification Number (TIN), usually your Social Security Number, is essential for accurate tax reporting. The IRS requires Form W-9 to verify your TIN and prevent backup withholding during the rollover process. Additionally, submitting withholding election forms, such as Form W-4P, allows you to specify any federal income tax withholding preferences on distributions or rollovers.

Beneficiary Designation Forms

What documents are necessary for retirement account rollovers? One crucial document is the Beneficiary Designation Form, which specifies who will inherit your account after your passing. Ensuring this form is up to date helps protect your assets and streamlines the rollover process.

Direct Deposit and Bank Account Information

Completing a retirement account rollover requires specific documents to ensure a smooth transfer of funds. Direct deposit setup and accurate bank account information are critical components of this process.

- Direct Deposit Authorization - This form confirms your consent to deposit rollover funds directly into your designated bank account.

- Bank Account Information - Providing accurate account numbers and routing details facilitates seamless fund transfers and prevents delays.

- Account Statement - Recent statements from your current retirement account verify fund availability and assist in the rollover verification.

Having these documents prepared ahead of time expedites your retirement account rollover and secures proper fund allocation.

What Documents Are Necessary for Retirement Account Rollovers? Infographic