To open a Roth IRA, you need a valid government-issued photo ID such as a driver's license or passport, proof of Social Security number, and basic personal information including your date of birth and address. Financial details like your employment status, annual income, and bank account information for funding the account are also required. Some institutions may request beneficiary designations and a completed application form to finalize the account setup.

What Documents Are Necessary for Opening a Roth IRA?

| Number | Name | Description |

|---|---|---|

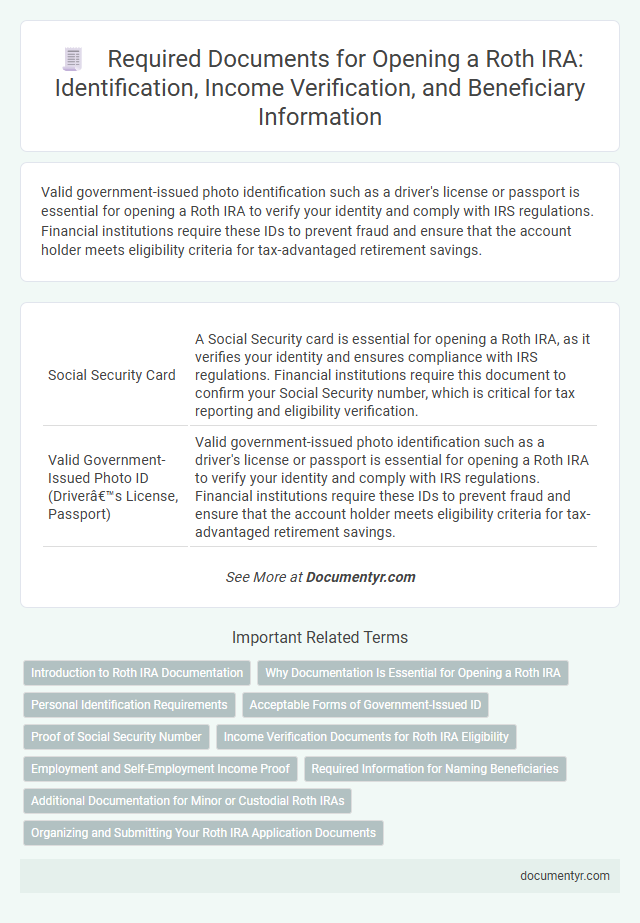

| 1 | Social Security Card | A Social Security card is essential for opening a Roth IRA, as it verifies your identity and ensures compliance with IRS regulations. Financial institutions require this document to confirm your Social Security number, which is critical for tax reporting and eligibility verification. |

| 2 | Valid Government-Issued Photo ID (Driver’s License, Passport) | Valid government-issued photo identification such as a driver's license or passport is essential for opening a Roth IRA to verify your identity and comply with IRS regulations. Financial institutions require these IDs to prevent fraud and ensure that the account holder meets eligibility criteria for tax-advantaged retirement savings. |

| 3 | Proof of Address (Utility Bill, Lease Agreement) | To open a Roth IRA, providing proof of address is essential and can be verified through documents such as a recent utility bill or a valid lease agreement. These documents must display the account holder's name and current residential address to meet financial institution requirements. |

| 4 | Employment Information (Employer Name, Address) | Opening a Roth IRA requires accurate employment information, including your employer's name and address, to verify income eligibility and facilitate contribution tracking. Providing these details ensures that your account setup complies with IRS regulations and helps maintain accurate financial records for tax purposes. |

| 5 | Bank Account Information (Routing and Account Number) | Opening a Roth IRA requires providing bank account information, including the routing number and account number, to facilitate contributions and transfers. These details ensure accurate electronic fund transfers between your bank and the IRA custodian, streamlining the account funding process. |

| 6 | Beneficiary Designation Form | When opening a Roth IRA, submitting a completed Beneficiary Designation Form is essential to specify who will inherit the account assets upon the accountholder's death, ensuring the funds are distributed according to their wishes. This form usually requires personal information of the beneficiaries, such as full names, Social Security numbers, and relationship to the accountholder, which helps avoid probate and facilitates smooth account transfer. |

| 7 | New Account Application Form | The New Account Application Form is essential for opening a Roth IRA, requiring personal identification details such as Social Security Number, date of birth, and contact information. This form also gathers financial information and beneficiary designations to comply with IRS regulations and facilitate accurate account setup. |

| 8 | W-2 Form (if applicable) | To open a Roth IRA, providing a W-2 form is essential if you have earned income from employment, as it verifies your taxable earnings and eligibility for contributions. This document ensures accurate calculation of your contribution limits based on reported wages. |

| 9 | Previous Year's Tax Return (if self-employed) | Self-employed individuals must provide their previous year's tax return, such as IRS Schedule C or Schedule SE, to verify income and confirm eligibility for a Roth IRA. This documentation ensures accurate assessment of earned income and compliance with contribution limits set by the IRS. |

| 10 | Rollover or Transfer Forms (if applicable) | Rollover or transfer forms are essential documents for opening a Roth IRA when moving funds from another retirement account, facilitating a tax-free transfer process. These forms typically require details about the current account provider, the amount being transferred, and must comply with IRS rollover regulations to maintain tax advantages. |

Introduction to Roth IRA Documentation

Opening a Roth IRA requires specific documentation to ensure compliance with financial regulations. These documents verify your identity, income, and eligibility for tax benefits. Understanding the necessary paperwork helps streamline the account setup process for your retirement savings.

Why Documentation Is Essential for Opening a Roth IRA

Opening a Roth IRA requires specific documentation to verify your identity, income, and eligibility. Necessary documents typically include a government-issued ID, Social Security number, and proof of earned income such as pay stubs or tax returns.

Documentation is essential for compliance with IRS regulations and to prevent fraud. Accurate records ensure your account is properly established and that you meet contribution limits and eligibility criteria for tax benefits.

Personal Identification Requirements

When opening a Roth IRA, personal identification is a crucial requirement to verify your identity and comply with financial regulations. Valid identification documents ensure the financial institution can securely process your account application.

You typically need a government-issued photo ID, such as a passport or driver's license. In some cases, a Social Security number or Individual Taxpayer Identification Number is also necessary to complete the verification.

Acceptable Forms of Government-Issued ID

Opening a Roth IRA requires verifying your identity with acceptable government-issued identification. You must provide valid documentation to comply with federal regulations and ensure account security.

- Driver's License - A current driver's license with your photo and full name is commonly accepted for identity verification.

- Passport - A valid U.S. or foreign passport serves as proof of identity and citizenship when opening a Roth IRA.

- State-Issued ID Card - Non-driver identification cards issued by your state government are valid forms of ID for opening an IRA.

Providing one of these government-issued IDs helps protect your financial information and confirms your eligibility to open a Roth IRA.

Proof of Social Security Number

| Document Type | Description | Examples |

|---|---|---|

| Proof of Social Security Number (SSN) | Verification of your Social Security Number is essential for opening a Roth IRA. The SSN confirms your identity and eligibility for tax benefits associated with the account. |

|

Income Verification Documents for Roth IRA Eligibility

To open a Roth IRA, submitting valid income verification documents is essential to confirm eligibility. These documents demonstrate that your earned income meets the IRS requirements for contributing to a Roth IRA.

Commonly accepted income verification documents include recent pay stubs, W-2 forms, and tax returns such as the IRS Form 1040. Self-employed individuals may provide 1099 forms or a Schedule C from their tax filings. These records help financial institutions verify your income and ensure compliance with Roth IRA contribution limits.

Employment and Self-Employment Income Proof

What documents are necessary to prove employment or self-employment income when opening a Roth IRA? Proof of income typically includes recent pay stubs, W-2 forms, or 1099 forms for contract work. For self-employed individuals, providing recent tax returns or profit and loss statements is essential to verify earnings.

Required Information for Naming Beneficiaries

When opening a Roth IRA, providing accurate beneficiary information is essential to ensure proper account distribution. Required documents for naming beneficiaries help avoid legal complications and facilitate smooth asset transfer.

- Full Legal Name - The beneficiary's complete legal name is needed to precisely identify the individual entitled to the account benefits.

- Social Security Number (SSN) - The SSN verifies the beneficiary's identity and assists in tax reporting and tracking by financial institutions.

- Relationship to Account Holder - Specifying the beneficiary's relationship clarifies intent for asset designation and may impact tax implications and inheritance rights.

Additional Documentation for Minor or Custodial Roth IRAs

Opening a Roth IRA requires standard identification documents such as a government-issued ID, Social Security number, and proof of address. For minor or custodial Roth IRAs, additional paperwork includes the custodian's identification and legal documentation establishing custodial responsibility. These documents ensure compliance with IRS regulations and protect the minor's financial interests.

What Documents Are Necessary for Opening a Roth IRA? Infographic