Lenders typically require proof of identity, income verification such as pay stubs or tax returns, and credit history details for personal loan approval. Bank statements and employment verification may also be requested to assess financial stability. Providing accurate and complete documentation helps streamline the approval process and improve chances of securing the loan.

What Documents are Needed for a Personal Loan Approval?

| Number | Name | Description |

|---|---|---|

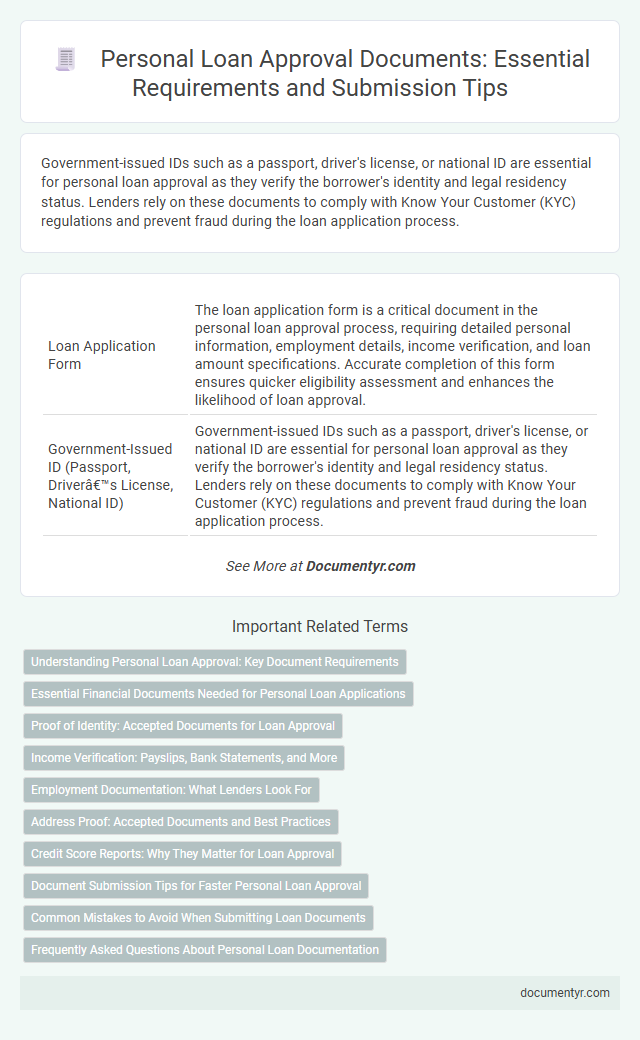

| 1 | Loan Application Form | The loan application form is a critical document in the personal loan approval process, requiring detailed personal information, employment details, income verification, and loan amount specifications. Accurate completion of this form ensures quicker eligibility assessment and enhances the likelihood of loan approval. |

| 2 | Government-Issued ID (Passport, Driver’s License, National ID) | Government-issued IDs such as a passport, driver's license, or national ID are essential for personal loan approval as they verify the borrower's identity and legal residency status. Lenders rely on these documents to comply with Know Your Customer (KYC) regulations and prevent fraud during the loan application process. |

| 3 | Recent Passport-Sized Photographs | Recent passport-sized photographs are essential for personal loan approval as they verify the applicant's identity and complement other documents like proof of income and residence. Lenders typically require two to three clear photographs taken within the last six months to ensure up-to-date identification standards. |

| 4 | Proof of Address (Utility Bill, Rent Agreement, Bank Statement) | Proof of address is a critical document for personal loan approval, commonly verified through utility bills, rent agreements, or recent bank statements that clearly display the applicant's name and residential address. Lenders use these documents to confirm the borrower's current residence, ensuring accurate identity verification and reducing the risk of fraud. |

| 5 | Proof of Income (Salary Slips, Bank Statements, Income Certificate) | Proof of income is essential for personal loan approval, typically requiring salary slips, recent bank statements, and a formal income certificate to verify the applicant's financial stability. These documents help lenders assess repayment capacity by providing detailed evidence of consistent earnings and cash flow. |

| 6 | Employment Verification/Offer Letter | Employment verification or an offer letter is essential for personal loan approval, as it confirms the applicant's income stability and job status. Lenders typically require recent pay stubs, employer contact information, and a formal offer letter detailing salary and employment terms to assess creditworthiness accurately. |

| 7 | Form 16/Income Tax Returns | Form 16 and Income Tax Returns (ITR) are crucial documents for personal loan approval as they provide verified proof of income and tax compliance, helping lenders assess the borrower's repayment capacity. Consistent Form 16 submissions and detailed ITR filings enhance the credibility of an application by reflecting stable earnings and financial discipline. |

| 8 | Bank Statements (Last 3–6 Months) | Bank statements for the last 3-6 months are essential for personal loan approval as they provide a detailed record of your income, expenses, and financial stability, helping lenders assess your repayment capacity. These statements validate your salary credits, recurring payments, and overall cash flow trends critical for risk evaluation in the loan underwriting process. |

| 9 | Credit Report | A credit report is a crucial document for personal loan approval, providing lenders with a detailed history of your credit behavior, including credit accounts, loan repayments, and outstanding debts. Accurate credit reports help lenders assess creditworthiness and determine loan eligibility and interest rates. |

| 10 | PAN Card (For India) or Social Security Number (For US) | For personal loan approval, lenders in India require a valid PAN Card to verify identity and financial transactions, while in the US, the Social Security Number (SSN) is essential for credit checks and income verification. These identification documents enable accurate credit assessments and compliance with regulatory requirements, streamlining the loan authorization process. |

| 11 | Debt Obligation Documents (if applicable) | Debt obligation documents required for personal loan approval typically include statements of existing loans, credit card bills, and any formal agreements indicating outstanding financial commitments. These documents help lenders assess current liabilities and the borrower's repayment capacity. |

| 12 | Guarantor/Co-Applicant Documents (if applicable) | Guarantor or co-applicant documents required for personal loan approval typically include valid identity proof, address proof, income statements such as salary slips or tax returns, and credit history reports. Financial institutions may also request bank statements, employment verification, and a signed consent form to confirm the guarantor's or co-applicant's commitment to loan repayment responsibilities. |

| 13 | Age Proof | Valid age proof documents such as a government-issued passport, birth certificate, or driver's license are essential for personal loan approval to verify the applicant's eligibility based on minimum age criteria. Lenders require these documents to ensure compliance with age-related lending policies and prevent fraudulent applications. |

| 14 | Proof of Residence Ownership (if applicable) | Proof of residence ownership, such as a property deed or recent utility bills in the applicant's name, is often required for personal loan approval to verify the borrower's stable living situation and financial reliability. Lenders use these documents to assess risk and confirm the applicant's commitment to maintaining consistent financial obligations. |

Understanding Personal Loan Approval: Key Document Requirements

Understanding the personal loan approval process involves knowing the essential documents lenders require to evaluate your application accurately. These documents help verify your identity, income, and creditworthiness, ensuring a smooth approval experience.

Commonly needed documents include a valid government-issued ID, proof of address, recent salary slips or income statements, and bank statements. Lenders may also request credit reports and employment verification to assess financial stability thoroughly.

Essential Financial Documents Needed for Personal Loan Applications

Submitting the right financial documents is critical for personal loan approval. Lenders assess your financial stability and creditworthiness through detailed documentation.

- Proof of Identity - Government-issued ID such as a passport or driver's license verifies your identity.

- Proof of Income - Recent pay stubs, tax returns, or bank statements confirm your ability to repay the loan.

- Credit Report - A credit report shows your credit history and score, impacting loan eligibility and terms.

Proof of Identity: Accepted Documents for Loan Approval

| Document Type | Description | Examples | Purpose in Loan Approval |

|---|---|---|---|

| Government-issued Photo ID | Official identification containing a photo to verify the borrower's identity | Passport, Driver's License, National ID Card | Confirms legal identity and prevents fraud |

| Social Security Card / Number | Unique identification number for tracking financial and social contributions | Social Security Card, Tax Identification Number (TIN) | Used for credit history checks and identity verification |

| Utility Bills | Recent bills indicating the borrower's residential address | Electricity Bill, Water Bill, Gas Bill (issued within last 3 months) | Proof of residence linked to identity validation |

| Resident Permit / Visa | Valid document proving legal residence status | Residence Permit Card, Work Visa | Confirms authorized residency for loan eligibility |

| Birth Certificate | Official document recording birth details and identity | Certified Birth Certificate | Used in some cases to verify full legal name and DOB |

Income Verification: Payslips, Bank Statements, and More

Income verification is a crucial part of personal loan approval, requiring documents such as payslips and bank statements. Payslips provide proof of consistent earnings, while bank statements demonstrate account activity and financial stability. Lenders may also request tax returns or employment verification letters to confirm your income sources and repayment ability.

Employment Documentation: What Lenders Look For

Employment documentation is a critical component in personal loan approval as it verifies the borrower's income stability. Lenders typically require recent pay stubs, employment verification letters, and sometimes tax returns to assess job consistency and earning capacity. These documents help lenders evaluate the risk and ensure the borrower can reliably repay the loan.

Address Proof: Accepted Documents and Best Practices

Address proof is a critical requirement for personal loan approval, serving as verification of the applicant's residential address. Commonly accepted documents include utility bills, bank statements, and government-issued ID cards that display the current address.

Submitting clear, updated, and authentic address proof can expedite the loan processing time and reduce the risk of application rejection. Best practices involve providing documents issued within the last three months and ensuring the address matches other submitted identification papers.

Credit Score Reports: Why They Matter for Loan Approval

Credit score reports play a crucial role in the approval process of a personal loan. Lending institutions rely on these reports to assess the risk profile of borrowers and make informed decisions.

- Credit Score Indicates Borrower Reliability - A strong credit score reflects a history of timely repayments and responsible credit management.

- Credit Reports Detail Financial Behavior - Reports include payment history, outstanding debts, and credit inquiries, providing lenders with a comprehensive financial overview.

- Loan Terms Depend on Credit Scores - Higher credit scores often qualify for lower interest rates and better loan conditions.

Document Submission Tips for Faster Personal Loan Approval

Submitting the correct documents is essential for a smooth personal loan approval process. Proper organization and timely submission can significantly speed up verification and approval.

- Valid Identity Proof - Provide government-issued IDs like a passport or driver's license to confirm your identity.

- Income Proof - Submit recent salary slips, bank statements, or tax returns to demonstrate your repayment capacity.

- Address Verification - Include utility bills, rental agreements, or other official documents to verify your residency.

Keeping these documents current and clearly legible helps reduce delays during personal loan approval.

Common Mistakes to Avoid When Submitting Loan Documents

Submitting the correct documents is crucial for personal loan approval. Common documents include proof of identity, income verification, and address proof.

One common mistake is providing outdated or incomplete documents, which can delay processing. Applicants often submit blurry photocopies instead of clear, legible copies. Missing signatures or inconsistent information across documents can also lead to rejection.

What Documents are Needed for a Personal Loan Approval? Infographic