Essential documents for tax deduction proof in 2024 include official receipts, invoices, and certificates related to deductible expenses such as medical bills, educational fees, charitable donations, and mortgage interest statements. Maintaining accurate payroll records, bank statements, and investment documents also supports claims for deductions and credits. Digital copies backed by secure cloud storage ensure easy access and verification during tax filing or audit processes.

What Documents are Necessary for Tax Deduction Proof in 2024?

| Number | Name | Description |

|---|---|---|

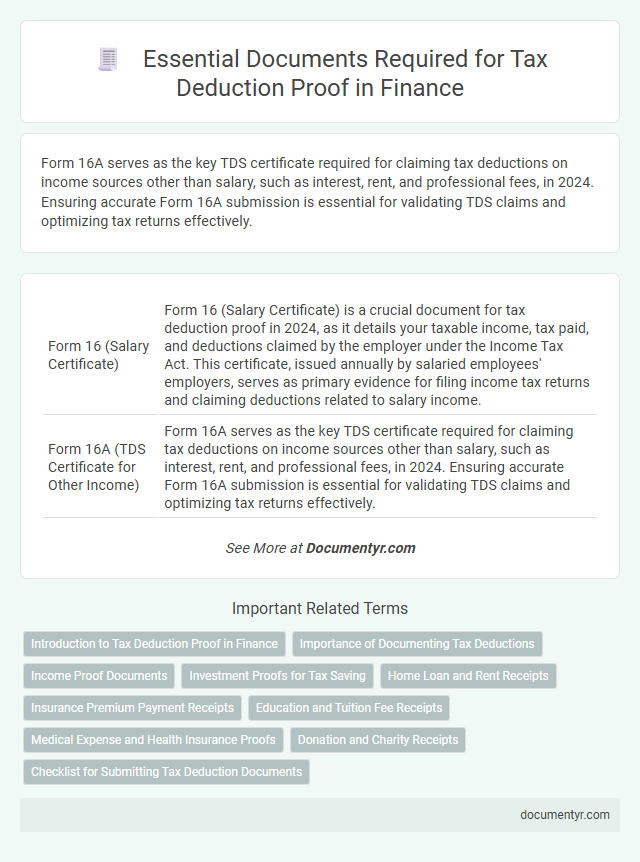

| 1 | Form 16 (Salary Certificate) | Form 16 (Salary Certificate) is a crucial document for tax deduction proof in 2024, as it details your taxable income, tax paid, and deductions claimed by the employer under the Income Tax Act. This certificate, issued annually by salaried employees' employers, serves as primary evidence for filing income tax returns and claiming deductions related to salary income. |

| 2 | Form 16A (TDS Certificate for Other Income) | Form 16A serves as the key TDS certificate required for claiming tax deductions on income sources other than salary, such as interest, rent, and professional fees, in 2024. Ensuring accurate Form 16A submission is essential for validating TDS claims and optimizing tax returns effectively. |

| 3 | Form 26AS (Tax Credit Statement) | Form 26AS (Tax Credit Statement) is essential for tax deduction proof in 2024, consolidating details of tax deducted at source (TDS), advance tax payments, and self-assessment tax. It serves as a comprehensive document issued by the Income Tax Department, enabling taxpayers to verify the exact amount of tax credited against their PAN and ensuring accurate filing of income tax returns. |

| 4 | Salary Slips | Salary slips for the financial year 2024 serve as essential documents to validate income and tax deductions claimed in tax returns, detailing monthly earnings, tax withholdings, and provident fund contributions. Employers must provide accurate and timely salary slips to ensure correct documentation for verifying tax deduction proofs during audits or assessments. |

| 5 | Rent Receipts | Rent receipts must include the landlord's name, tenant's name, property address, rental period, amount paid, and the landlord's signature to qualify as valid tax deduction proof in 2024. These documents are essential in claiming deductions under Section 80GG of the Income Tax Act or for rent paid when House Rent Allowance (HRA) is exempt. |

| 6 | Home Loan Interest Certificate | The Home Loan Interest Certificate issued by the lender is a crucial document for claiming tax deductions under Section 24(b) of the Income Tax Act in 2024, detailing the exact amount of interest paid on the home loan during the financial year. This certificate must be submitted alongside the income tax return to substantiate the deduction claim and ensure compliance with tax regulations. |

| 7 | Principal Repayment Certificate (Home Loan) | For tax deduction proof in 2024, the Principal Repayment Certificate issued by the lender is essential to claim deductions under Section 80C for home loan principal repayment. This certificate must clearly display the principal amount paid during the financial year to validate the deduction claim. |

| 8 | Life Insurance Premium Receipts | Life insurance premium receipts are essential documents for claiming tax deductions under Section 80C of the Income Tax Act in 2024, serving as proof of payments made towards life insurance policies. These receipts must clearly state the policyholder's name, premium amount, policy number, and payment date to validate deductions during income tax filing. |

| 9 | Health Insurance Premium Receipts (Section 80D) | Health insurance premium receipts are essential documents for claiming tax deductions under Section 80D in 2024, requiring proof of payment for policies covering self, family, and senior citizens. These receipts must clearly state the insurer's name, policy number, premium amount, and payment date to validate eligibility for deductions up to Rs25,000 or Rs50,000 for senior citizens. |

| 10 | Medical Bills (Section 80DDB/80DD/80U) | To claim tax deductions under Sections 80DDB, 80DD, and 80U in 2024, taxpayers must submit original medical bills, prescription proofs from a certified specialist, and disability certificates issued by recognized medical authorities. These documents serve as essential evidence proving eligibility and the validity of claimed expenses or disabilities for income tax benefits. |

| 11 | Investment Proofs (ELSS, PPF, NSC, SSY, FD, NPS, etc.) | Investment proofs essential for tax deduction in 2024 include ELSS statements, PPF passbooks, NSC certificates, Sukanya Samriddhi Yojana (SSY) passbooks, fixed deposit receipts, and NPS contribution statements, each serving as verifiable evidence for claiming deductions under Section 80C and related provisions. Maintaining authentic, updated documents from authorized financial institutions ensures seamless submission during tax assessments or audits. |

| 12 | Education Loan Interest Certificate | The Education Loan Interest Certificate is essential for claiming tax deductions under Section 80E of the Income Tax Act, providing proof of interest paid on education loans during the financial year 2024. This document must be furnished to substantiate claims and ensure compliance with tax regulations while maximizing eligible deductions. |

| 13 | Donation Receipts (Section 80G) | Donation receipts under Section 80G are essential documents for tax deduction proof in 2024, requiring authorized organizations' certification and donor details such as name, donation amount, and date. These receipts must comply with the Income Tax Department's specifications to claim deductions effectively, ensuring the donor's eligibility for a tax benefit of up to 50% or 100% of the donated amount depending on the category of the charity. |

| 14 | Receipts for Tuition Fees | Receipts for tuition fees must clearly state the student's name, institution details, payment date, and amount paid to qualify as valid tax deduction proof in 2024. These receipts should be official, itemized, and retained for submission during tax filing to ensure compliance with current revenue authority guidelines. |

| 15 | Mutual Fund Investment Statements | Mutual fund investment statements required for tax deduction proof in 2024 include detailed transaction summaries, capital gains reports, dividend reinvestment details, and unit holding statements issued by the fund house or registrar. These documents must clearly reflect investment amounts, dates, and applicable deduction sections under relevant tax laws to ensure compliance and validation during income tax filing. |

| 16 | Provident Fund Contribution Statements | Provident Fund Contribution Statements are essential documents for verifying tax deductions related to retirement savings under Section 80C in 2024. These statements must clearly display the employee's and employer's contributions, along with the relevant financial year, to ensure compliance and successful claim processing. |

| 17 | Proof of Payment for National Pension System (NPS) | Proof of payment for the National Pension System (NPS) in 2024 requires submission of stamped contribution receipts or transaction confirmation statements issued by the NPS Trust or authorized entities. These documents must clearly show the subscriber's details, contribution amount, and date of payment to qualify for tax deduction claims under Section 80CCD(1B) of the Income Tax Act. |

| 18 | Dividend and Interest Statements | Dividend and interest statements, such as Form 1099-DIV and Form 1099-INT, are essential documents for tax deduction proof in 2024, detailing the income earned from investments. These statements must be retained and submitted to the IRS to validate claims of deductions on dividend payouts and interest income during tax filing. |

| 19 | Receipts for Electricity/Water Bills (for Capital Gains exemptions) | For tax deduction proof in 2024 related to capital gains exemptions, submitting original receipts of electricity and water bills is essential to validate the claim. These documents must clearly show the payment details, property address, and billing period to comply with Income Tax Department requirements. |

| 20 | Capital Gains Statements | Capital gains statements are essential documents for tax deduction proof in 2024, detailing the sale or transfer of assets and reflecting the capital gains or losses incurred during the fiscal year. These statements, often provided by brokerage firms or financial institutions, must include transaction dates, purchase and sale prices, and any associated costs to substantiate claims for accurate tax reporting and deductions. |

| 21 | Statement of HRA (House Rent Allowance) | For tax deduction proof in 2024, the Statement of HRA (House Rent Allowance) must include the employer's certification, rent receipts, and the landlord's details such as name and address to validate the claim. This document is essential to substantiate HRA exemption under Section 10(13A) of the Income Tax Act, ensuring accurate calculation of taxable income. |

| 22 | Property Tax Receipts | Property tax receipts from 2024 must include the payer's name, property address, amount paid, and payment date to qualify as proof for tax deduction claims. Maintaining official, stamped, or digitally authenticated receipts ensures compliance with the Income Tax Department's documentation requirements for property tax deductions. |

| 23 | Receipts for Purchase of Specified Assets under Section 54/54EC | Receipts for the purchase of specified assets under Section 54/54EC in 2024 must clearly detail the asset description, purchase date, cost, and seller information to serve as valid proof for tax deduction claims. These documents play a crucial role in verifying eligibility for capital gains exemptions and must be retained alongside the asset registration and payment proofs. |

| 24 | Other Section-specific Exemption/ Deduction Certificates | For tax deduction proof in 2024, essential Other Section-specific Exemption/Deduction Certificates include Form 16B for property tax deductions, Form 15G/15H for non-deduction of TDS on interest income, and donation receipts qualifying under Section 80G. These documents must be accurately submitted to claim exemptions related to housing loan interest, senior citizen savings, and charitable contributions effectively. |

Introduction to Tax Deduction Proof in Finance

Tax deduction proof is essential for accurate financial reporting and compliance with tax regulations in 2024. It involves providing valid documents that substantiate eligible expenses, ensuring taxpayers receive appropriate deductions. Proper documentation helps avoid disputes with tax authorities and supports transparent financial management.

Importance of Documenting Tax Deductions

Accurate documentation of tax deductions is essential to ensure compliance with the 2024 tax regulations and to optimize financial outcomes. Proper records protect taxpayers during audits and validate claims for deductible expenses.

- Receipts and Invoices - These serve as primary evidence of deductible expenses such as charitable donations, medical costs, and business expenses.

- Bank and Credit Card Statements - Statements provide a detailed transaction history that supports deduction claims and reconciles receipts.

- Form W-2 and 1099s - These official documents report income and withholding details necessary for accurate tax deduction filing.

Income Proof Documents

What income proof documents are necessary for tax deduction proof in 2024? Employers must provide Form W-2 showing annual wages and tax withholdings. Freelancers and self-employed individuals should submit Form 1099 or detailed income statements.

Investment Proofs for Tax Saving

Investment proofs are essential for claiming tax deductions in 2024. Maintaining accurate documentation ensures compliance and maximizes your tax savings.

- Equity-Linked Savings Scheme (ELSS) Statements - These documents verify your investments under ELSS, qualifying for tax deductions under Section 80C.

- Public Provident Fund (PPF) Passbook - The PPF passbook serves as proof of deposits made, which are eligible for tax benefits.

- Life Insurance Premium Receipts - Premium payment receipts provide confirmation to claim deductions under Section 80C for life insurance policies.

Home Loan and Rent Receipts

For tax deduction proof in 2024, essential documents include home loan statements and rent receipts. These documents help validate claims under sections 80C, 24(b), and 80GG of the Income Tax Act.

Home loan statements must detail principal and interest payments, issued by the bank or financial institution. Rent receipts should include the landlord's name, address, tenant's details, payment amount, and signature. Maintaining these documents ensures compliance and smooth processing of tax deductions.

Insurance Premium Payment Receipts

For tax deduction proof in 2024, insurance premium payment receipts are essential documents demonstrating eligible expenses. These receipts must include details such as the policyholder's name, payment amount, insurer's name, and payment date. Submitting original or digitally verified receipts ensures compliance with tax authority requirements and facilitates smooth processing of deductions.

Education and Tuition Fee Receipts

For tax deduction proof in 2024, education and tuition fee receipts are essential documents required by tax authorities. These receipts must clearly state the payer's name, educational institution, amount paid, and the academic period.

Parents or guardians claiming deductions need to retain original tuition fee receipts as proof of payment. Digital copies of these receipts are also acceptable if they meet the authenticity criteria set by tax regulations.

Medical Expense and Health Insurance Proofs

| Document Type | Purpose | Details Required | 2024 Specific Notes |

|---|---|---|---|

| Medical Expense Receipts | Proof of medical costs for tax deduction | Invoice with provider name, date, service description, and amount paid | Ensure receipts are itemized and dated within the 2024 tax year |

| Prescription Records | Verification of prescribed medication expenses | Pharmacy statements or prescriptions including drug name and cost | Approved prescriptions linked directly to your or your dependents' expenses |

| Health Insurance Premium Statements | Documentation of premiums paid for qualifying insurance plans | Annual or monthly premium statements from insurer with payment proof | Include both employer-sponsored and privately purchased insurance plans |

| Explanation of Benefits (EOB) | Summary of insurance coverage and out-of-pocket medical expenses | Date of service, amount billed, amount covered, and amount owed by you | Supports deduction of unreimbursed medical expenses in 2024 |

| Doctor's Certificates or Letters | Support for medical necessity claims | Official letter stating the nature of the medical condition and treatment | Required when claiming expenses for treatments without standard invoices |

Donation and Charity Receipts

Tax deductions for donations in 2024 require specific documentation to ensure compliance with legal standards. Proper charity receipts serve as critical proof for claiming these deductions accurately.

- Official Charity Receipt - Must include the charity's name, registration number, date, and donation amount.

- Donation Acknowledgment Letter - Signed by an authorized representative, confirming the donation and its details.

- Proof of Payment - Bank statements, credit card slips, or digital transaction records that verify the donation transfer.

Maintaining these documents is essential for successfully claiming tax deductions on charitable donations in 2024.

What Documents are Necessary for Tax Deduction Proof in 2024? Infographic