To complete 401(k) rollover paperwork, essential documents include the account statement from your current 401(k) plan, a completed rollover form provided by the receiving financial institution, and a letter of acceptance from the new plan or IRA. Verification of identity, such as a government-issued ID, and recent pay stubs or tax forms may also be required to ensure accurate processing. Properly submitting these documents helps facilitate a seamless transfer of retirement assets without tax penalties.

What Documents are Necessary for 401(k) Rollover Paperwork?

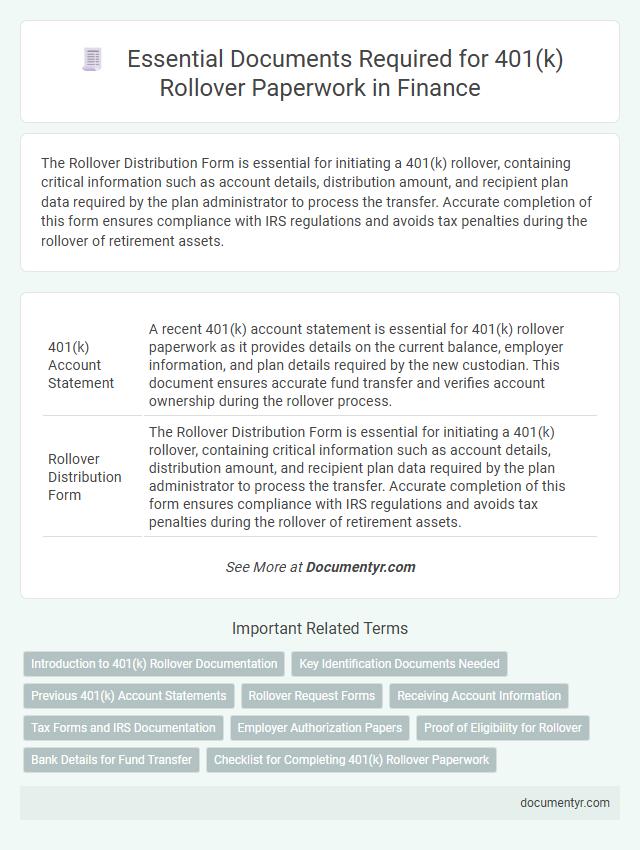

| Number | Name | Description |

|---|---|---|

| 1 | 401(k) Account Statement | A recent 401(k) account statement is essential for 401(k) rollover paperwork as it provides details on the current balance, employer information, and plan details required by the new custodian. This document ensures accurate fund transfer and verifies account ownership during the rollover process. |

| 2 | Rollover Distribution Form | The Rollover Distribution Form is essential for initiating a 401(k) rollover, containing critical information such as account details, distribution amount, and recipient plan data required by the plan administrator to process the transfer. Accurate completion of this form ensures compliance with IRS regulations and avoids tax penalties during the rollover of retirement assets. |

| 3 | Rollover Contribution Form | The Rollover Contribution Form is essential for initiating a 401(k) rollover, detailing the account holder's information, the current 401(k) plan specifics, and the destination retirement account details. Accurate completion of this document ensures compliance with IRS regulations and facilitates direct trustee-to-trustee transfers, minimizing tax liabilities and penalties. |

| 4 | IRA or New Plan Account Application | Essential documents for a 401(k) rollover include the IRA or new plan account application form, which gathers personal information and investment preferences. Also required are the recent 401(k) plan statements and a rollover request form to authorize the transfer of funds to the new retirement account. |

| 5 | Employer Authorization Letter | The Employer Authorization Letter is essential for 401(k) rollover paperwork as it confirms the plan sponsor's approval and authorizes the transfer of funds between retirement accounts. This document must include detailed information such as the participant's name, account number, plan details, and the receiving financial institution to ensure a smooth and compliant rollover process. |

| 6 | Notice of Rollover Eligibility | The Notice of Rollover Eligibility is a crucial document required for 401(k) rollover paperwork, as it details the amount available for rollover and the deadlines for completing the transfer. This notice ensures compliance with IRS regulations and helps investors avoid tax penalties by providing clear instructions on the rollover process. |

| 7 | IRS Form 1099-R | IRS Form 1099-R is essential for 401(k) rollover paperwork, reporting distributions from pensions, annuities, retirement plans, and IRAs to both the IRS and the account holder. This form details the gross distribution amount and the taxable portion, enabling accurate tax reporting and facilitating the rollover process to avoid potential penalties. |

| 8 | IRS Form 5498 | IRS Form 5498 is essential for 401(k) rollover paperwork as it reports contributions, including rollovers, to individual retirement accounts and ensures proper IRS tracking. This form helps verify the amount rolled over and confirms the transaction's tax-deferred status, facilitating accurate tax reporting and compliance. |

| 9 | Proof of Identification (e.g., Driver’s License, Passport) | Proof of identification, such as a valid driver's license or passport, is a crucial document for 401(k) rollover paperwork to verify the account holder's identity and prevent fraudulent activity. Financial institutions require these government-issued IDs to comply with federal regulations and ensure a smooth and secure transfer of retirement funds. |

| 10 | Beneficiary Designation Form | The Beneficiary Designation Form is crucial for 401(k) rollover paperwork as it specifies who will inherit the account assets in the event of the account holder's death. Accurate completion of this form ensures that beneficiary information is up-to-date, preventing delays or disputes during the rollover process. |

| 11 | Direct Rollover Authorization Letter | A Direct Rollover Authorization Letter is essential for 401(k) rollover paperwork, as it grants explicit permission to transfer funds directly from the current plan to the new retirement account, bypassing tax penalties and withholding. This document must include account details, the recipient plan information, and the participant's signature to ensure compliance with IRS regulations and facilitate a smooth rollover process. |

| 12 | Plan Summary or SPD (Summary Plan Description) | The Summary Plan Description (SPD) is a crucial document detailing the rules, benefits, and rights associated with a 401(k) plan, guiding participants through the rollover process. Obtaining the SPD ensures clarity on plan-specific requirements, eligibility criteria, and necessary forms to successfully complete 401(k) rollover paperwork. |

| 13 | Tax Withholding Election Form | The Tax Withholding Election Form is a crucial document in 401(k) rollover paperwork, allowing account holders to specify their tax withholding preferences on the distribution. Proper completion of this form helps avoid unexpected tax liabilities and ensures compliance with IRS regulations during the rollover process. |

| 14 | Account Transfer Request Form | The Account Transfer Request Form is essential for initiating a 401(k) rollover, providing detailed information about the current retirement account and the receiving institution. This document ensures accurate fund transfers by specifying account numbers, plan administrator details, and authorization signatures, facilitating a smooth rollover process. |

| 15 | Trustee-to-Trustee Transfer Request | The Trustee-to-Trustee Transfer Request requires key documents such as the completed rollover request form, a recent 401(k) account statement, and identification proof to verify the account holder. Proper submission of these documents ensures seamless direct transfer of retirement funds between financial institutions without tax penalties. |

Introduction to 401(k) Rollover Documentation

401(k) rollover paperwork requires specific documents to ensure a smooth transfer of retirement funds from one account to another. Proper documentation helps avoid tax penalties and maintains the tax-deferred status of the retirement savings.

Key documents typically include the distribution request form from the current 401(k) plan and the acceptance form from the receiving IRA or new 401(k) plan. Proof of identification and account statements are also commonly required to verify account details and ownership.

Key Identification Documents Needed

Completing a 401(k) rollover requires specific identification documents to verify your identity and account details. These documents ensure a smooth transfer of your retirement funds without delays.

- Government-issued photo ID - Required to confirm your identity, such as a driver's license or passport.

- Social Security Number (SSN) - Needed to match your records and authenticate your retirement account.

- Recent 401(k) statement - Provides information about your current account balance and plan details for accurate processing.

Having these key identification documents prepared simplifies the 401(k) rollover paperwork process.

Previous 401(k) Account Statements

Previous 401(k) account statements are essential documents for 401(k) rollover paperwork as they provide a comprehensive record of your account balance and transaction history. These statements help verify the exact amount available for rollover and ensure accuracy during the transfer process. Keeping recent and accurate statements simplifies communication between your former and new plan administrators, expediting the rollover.

Rollover Request Forms

Rollover request forms are essential documents required to initiate a 401(k) rollover process. These forms capture crucial information such as account details and the destination of transferred funds.

Employers or plan administrators provide the rollover request forms, which must be completed accurately to avoid delays. The forms typically request personal identification, current 401(k) plan specifics, and the receiving retirement account information. Submitting these documents promptly ensures a smooth and timely transfer of retirement assets.

Receiving Account Information

When initiating a 401(k) rollover, obtaining accurate receiving account information is crucial to ensure seamless fund transfer. Proper documentation prevents delays and errors in the rollover process.

- Account Number - The specific number identifying your new retirement account is required for correct fund allocation.

- Account Type - Clarity on whether the receiving account is a traditional IRA, Roth IRA, or another 401(k) type influences rollover tax implications.

- Custodian's Contact Information - Details of the financial institution managing the receiving account help verify instructions and resolve issues efficiently.

Tax Forms and IRS Documentation

What tax forms are necessary for 401(k) rollover paperwork? The primary IRS document required is the Form 1099-R, which reports distributions from retirement accounts. You will also need to complete IRS Form 5498, used to report contributions to individual retirement accounts during the rollover process.

Employer Authorization Papers

| Document Name | Description | Purpose | Key Information Included |

|---|---|---|---|

| Employer Authorization Letter | Official letter from the current or former employer authorizing the 401(k) rollover. | Confirms employer consent to transfer 401(k) funds to a new plan or IRA. | Employer's name, employee's name, authorization statement, signature of authorized personnel, date. |

| Plan Termination Notice | Document indicating termination or changes in the employer's 401(k) plan. | Supports the rationale for rollover by confirming plan closure or changes requiring distribution. | Plan name, termination date, employer contact information. |

| Authorization Form from Employer | Standard form provided by employer to approve rollover requests. | Serves as formal approval for 401(k) distribution and rollover process. | Employee details, plan information, signature fields, rollover instructions. |

| Verification of Employment Status | Document confirming employment termination or status change. | Required to validate eligibility for 401(k) rollover. | Employee name, employment dates, employer signature or seal. |

Proof of Eligibility for Rollover

Proof of eligibility is a critical component of 401(k) rollover paperwork, verifying that the account holder meets the necessary criteria to transfer funds. Proper documentation ensures compliance with IRS regulations and smooth processing of the rollover request.

- Employment Termination Letter - Confirms the end of employment, qualifying the individual for a rollover from their former employer's 401(k) plan.

- Age Verification Documents - Includes government-issued ID or birth certificate to confirm the account holder meets age requirements for certain penalty-free rollovers.

- Plan Distribution Statement - Provides detailed information on the 401(k) plan distribution, supporting eligibility and facilitating accurate fund transfer.

Bank Details for Fund Transfer

When processing a 401(k) rollover, accurate bank details are essential for a successful fund transfer. Required documents typically include a voided check or a bank statement to verify the receiving account information. Providing the bank's routing number and account number ensures the rollover funds are correctly deposited into the new retirement account.

What Documents are Necessary for 401(k) Rollover Paperwork? Infographic