Non-US residents applying for a credit card typically need to provide a valid passport, proof of address such as a utility bill or lease agreement, and a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Financial institutions often require proof of income, such as recent pay stubs or bank statements, to assess creditworthiness. Additional documents may include a visa, employment authorization, or a credit history report from the applicant's home country.

What Documents Are Needed for Applying for a Credit Card as a Non-US Resident?

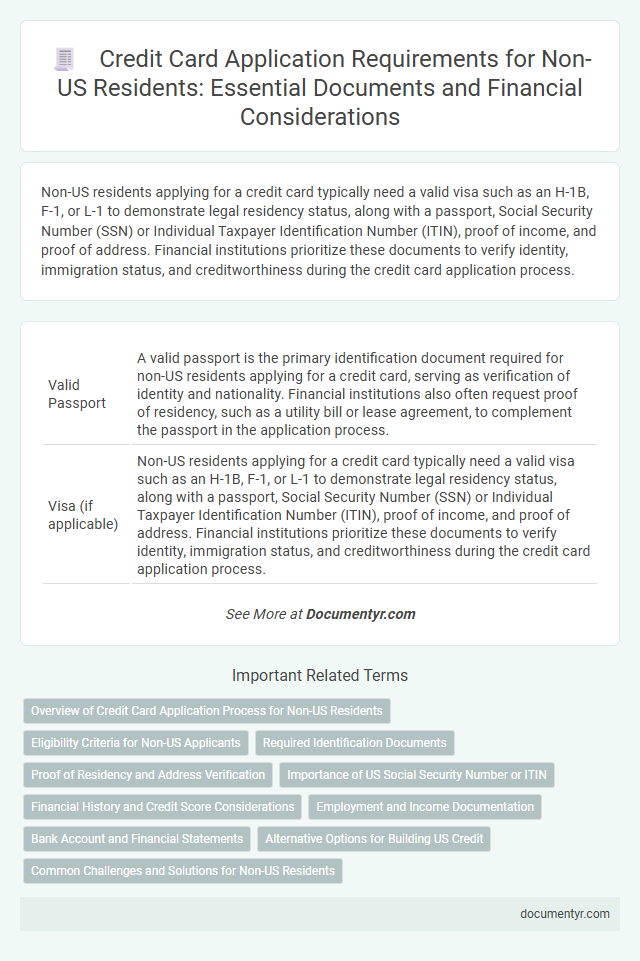

| Number | Name | Description |

|---|---|---|

| 1 | Valid Passport | A valid passport is the primary identification document required for non-US residents applying for a credit card, serving as verification of identity and nationality. Financial institutions also often request proof of residency, such as a utility bill or lease agreement, to complement the passport in the application process. |

| 2 | Visa (if applicable) | Non-US residents applying for a credit card typically need a valid visa such as an H-1B, F-1, or L-1 to demonstrate legal residency status, along with a passport, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), proof of income, and proof of address. Financial institutions prioritize these documents to verify identity, immigration status, and creditworthiness during the credit card application process. |

| 3 | Proof of Legal Residency (Green Card, Employment Authorization Document, etc.) | Non-US residents must provide proof of legal residency, such as a Green Card, Employment Authorization Document (EAD), or valid visa, to apply for a credit card in the United States. These documents verify the applicant's lawful presence and eligibility to engage in financial transactions within the country. |

| 4 | Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN) | Non-US residents applying for a credit card typically need to provide an Individual Taxpayer Identification Number (ITIN) or a Social Security Number (SSN) to verify their identity and enable credit reporting. Lenders use these numbers to assess creditworthiness and comply with regulatory requirements, making either an ITIN or SSN essential for approval. |

| 5 | Proof of Address (utility bill, lease agreement, bank statement) | Non-US residents applying for a credit card must provide valid proof of address, which commonly includes documents such as a recent utility bill, a lease agreement, or a bank statement, all typically dated within the last three months to ensure current residency verification. These documents help card issuers confirm the applicant's residential status and establish a secure financial profile for credit evaluation. |

| 6 | Proof of Income (pay stubs, employment letter, tax returns) | Non-US residents applying for a credit card must provide proof of income, including recent pay stubs, an employment verification letter, and tax returns to demonstrate financial stability. These documents help credit card issuers assess the applicant's ability to repay credit obligations despite the absence of a US credit history. |

| 7 | Bank Account Statement | Non-US residents applying for a credit card typically need to provide recent bank account statements as proof of financial stability and income. These statements should clearly display account activity, balances, and the account holder's name to meet issuer requirements. |

| 8 | Proof of Enrollment (for students, e.g., I-20 form or acceptance letter) | Non-US resident students applying for a credit card must provide proof of enrollment, such as an I-20 form or an acceptance letter from an accredited educational institution, to verify their student status. These documents confirm eligibility and help issuers assess the applicant's credibility despite lacking a US credit history. |

| 9 | Reference Letter from Employer or Bank (if required) | Non-US residents applying for a credit card often need a reference letter from their employer or bank, confirming their financial stability and employment status to enhance the application's credibility. This document typically includes details such as job title, length of employment, salary, or banking history, helping issuers assess creditworthiness beyond standard identification and income proofs. |

Overview of Credit Card Application Process for Non-US Residents

Applying for a credit card as a non-US resident involves specific documentation and verification processes. Financial institutions require proof of identity, residency, and income to assess eligibility accurately.

- Valid Identification - A government-issued passport or national ID is necessary to confirm your identity.

- Proof of Residency - Documents such as a visa, utility bills, or bank statements showing your US address are required.

- Income Verification - Pay stubs, tax returns, or employment letters help lenders evaluate your financial stability.

Completing these steps ensures compliance with regulatory requirements and improves the chances of credit card approval.

Eligibility Criteria for Non-US Applicants

Non-US residents applying for a credit card must provide proof of identity, such as a valid passport or government-issued ID. Financial institutions typically require evidence of income or employment, including pay stubs, tax returns, or bank statements. Eligibility criteria often include a valid visa or residency permit and a US-based address to process the application successfully.

Required Identification Documents

Applying for a credit card as a non-US resident requires specific identification documents to verify your identity and residency status. These documents ensure compliance with financial regulations and help protect against fraud.

- Valid Passport - A government-issued passport serves as the primary form of identification for non-US residents.

- Visa or Immigration Documents - Proof of legal status in the US, such as a visa or permanent resident card, is necessary.

- Proof of Address - Utility bills, lease agreements, or bank statements showing your US residential address are often required.

Proof of Residency and Address Verification

What documents are required for proof of residency when applying for a credit card as a non-US resident? Proof of residency is essential to verify Your current address in the United States or your home country. Acceptable documents often include utility bills, lease agreements, or bank statements that display Your name and address clearly.

How does address verification impact the credit card application process for non-US residents? Address verification confirms Your physical location, helping credit card issuers assess identity and reduce fraud risk. Documents such as a recent utility bill, official government correspondence, or rental contracts serve this purpose effectively.

Importance of US Social Security Number or ITIN

Non-US residents applying for a credit card in the United States must provide several key documents to verify their identity and financial status. These typically include a valid passport, proof of address, and immigration documents such as a visa or green card.

A crucial requirement is the US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), which are essential for credit checks and tax reporting. Without an SSN or ITIN, approval chances drop significantly, as these numbers enable lenders to assess credit history and comply with IRS regulations.

Financial History and Credit Score Considerations

Non-US residents applying for a credit card must provide proof of identity, such as a passport, and documentation of their financial history, including bank statements or proof of income. Lenders may also require a credit report from the applicant's home country to assess creditworthiness and credit score. Understanding how credit history is evaluated without a US credit score is crucial for approval.

Employment and Income Documentation

| Document Type | Description | Purpose |

|---|---|---|

| Employment Verification Letter | Official letter from the employer confirming current employment status, job title, duration of employment, and salary details | Confirms stable income source and job security for creditworthiness assessment |

| Recent Pay Stubs | Copies of pay stubs from the last 2 to 3 months showing gross income, deductions, and net pay | Provides evidence of consistent monthly income and ability to repay credit card balances |

| Tax Returns or W-2 Forms | Annual tax filing documents or wage statements demonstrating total income earned during the previous year(s) | Verifies annual income and financial stability for credit evaluation |

| Bank Statements | Recent bank statements (typically last 3 to 6 months) showing salary deposits and account activity | Supports proof of income and cash flow consistency |

| Employment Contract (if applicable) | Signed contract detailing the employment terms, salary, and duration of the contract | Confirms employment legitimacy and income expectations, especially for expatriates |

Bank Account and Financial Statements

Applying for a credit card as a non-US resident requires providing specific financial documents to verify your identity and financial stability. Bank accounts and financial statements play a critical role in demonstrating your ability to manage credit responsibly.

- Bank Account Documentation - Proof of an active bank account in your name supports your creditworthiness and financial activity.

- Recent Bank Statements - These statements offer a snapshot of your regular income, expenses, and account balances over a period.

- Financial Statements - Official documents such as pay stubs or tax returns provide further evidence of your financial condition and income sources.

Alternative Options for Building US Credit

Applying for a credit card as a non-US resident requires specific documents such as a valid passport, proof of address, and a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Financial institutions may also request bank statements, employment verification, and income documentation to assess your creditworthiness.

Alternative options for building US credit include secured credit cards, which require a cash deposit as collateral, and becoming an authorized user on a family member's credit card. Using services like credit builder loans or reporting rent payments through credit bureaus can also help establish a strong credit history in the US.

What Documents Are Needed for Applying for a Credit Card as a Non-US Resident? Infographic