Required documents for retirement account rollovers typically include a completed rollover request form, a recent account statement from the existing retirement account, and identification such as a government-issued ID. Beneficiaries may also need to provide a death certificate if rolling over inherited accounts. Ensuring all paperwork is accurately prepared helps facilitate a smooth transfer and avoid tax penalties.

What Documents Are Required for Retirement Account Rollovers?

| Number | Name | Description |

|---|---|---|

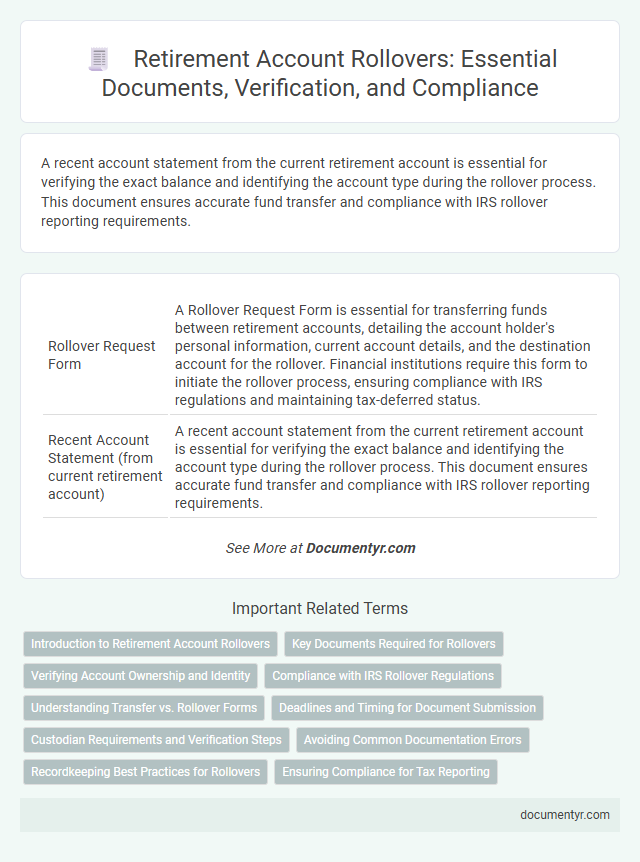

| 1 | Rollover Request Form | A Rollover Request Form is essential for transferring funds between retirement accounts, detailing the account holder's personal information, current account details, and the destination account for the rollover. Financial institutions require this form to initiate the rollover process, ensuring compliance with IRS regulations and maintaining tax-deferred status. |

| 2 | Recent Account Statement (from current retirement account) | A recent account statement from the current retirement account is essential for verifying the exact balance and identifying the account type during the rollover process. This document ensures accurate fund transfer and compliance with IRS rollover reporting requirements. |

| 3 | Rollover/Distribution Form (from previous plan administrator) | The Rollover/Distribution Form from the previous plan administrator is essential for initiating a retirement account rollover, detailing the account holder's information, the distribution amount, and the destination account for the rollover. This document ensures compliance with IRS rules by facilitating a direct transfer, preventing tax penalties and maintaining the tax-deferred status of the retirement funds. |

| 4 | Direct Rollover Letter or Notice | A Direct Rollover Letter or Notice is essential for retirement account rollovers as it authorizes the transfer of funds directly from one financial institution to another, ensuring compliance with IRS regulations. This document must include details such as the account holder's information, the receiving institution's account number, and the specific amount or assets to be rolled over. |

| 5 | 60-Day Rollover Certification (if applicable) | The 60-Day Rollover Certification is a crucial document required for retirement account rollovers, certifying that the funds withdrawn will be deposited into another qualified retirement account within 60 days to avoid taxes and penalties. This certification typically includes details like the account holder's information, withdrawal date, and the planned rollover deadline, ensuring compliance with IRS rules for tax-deferred transfers. |

| 6 | IRS Form 1099-R | IRS Form 1099-R is essential for retirement account rollovers, providing detailed information on distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. This form must be submitted to the IRS and retained by the taxpayer to accurately report rollover amounts and avoid potential tax penalties. |

| 7 | IRS Form 5498 | IRS Form 5498 is essential for retirement account rollovers as it reports contributions, rollovers, and the fair market value of individual retirement accounts (IRAs) to the IRS, ensuring accurate tax reporting. This document provides critical information for both account holders and financial institutions to verify the proper handling of rollover transactions and compliance with IRS regulations. |

| 8 | Proof of Identity (e.g., Government-issued ID) | Proof of identity for retirement account rollovers typically requires a government-issued ID such as a driver's license, passport, or state ID card to verify the account holder's identity. Financial institutions also may request Social Security numbers and recent utility bills to confirm residency and prevent fraud during the rollover process. |

| 9 | Beneficiary Designation Form | A Beneficiary Designation Form is essential for retirement account rollovers to ensure that account assets transfer according to your wishes upon death. This document must be accurately completed and submitted to the financial institution managing the rollover to avoid probate and facilitate tax-efficient inheritance. |

| 10 | Acceptance Letter from Receiving Institution | The acceptance letter from the receiving institution is a critical document in retirement account rollovers, confirming their approval to receive funds and detailing the account information and transfer procedure. This letter ensures compliance with IRS regulations and facilitates a smooth, tax-advantaged transfer between accounts. |

| 11 | Employer Authorization (if employer-sponsored plan) | Employer-sponsored retirement account rollovers require specific documentation, primarily including the employer's formal authorization or plan administrator's approval to initiate the transfer. This authorization ensures compliance with Internal Revenue Service (IRS) rules and verifies that the rollover adheres to the terms of the employer's qualified retirement plan. |

| 12 | Spousal Consent Form (if required) | A Spousal Consent Form is required for retirement account rollovers involving qualified plans like 401(k)s when the account holder is married, confirming the spouse's approval of the transaction. This document ensures compliance with ERISA regulations and protects spousal rights to benefits or survivor protections during the rollover process. |

| 13 | Account Application for New IRA or Retirement Plan | The account application for a new IRA or retirement plan requires personal identification documents such as a Social Security number, driver's license, or passport, along with financial information including account numbers and statements from the existing retirement account. Additionally, completing specific forms like the IRA application or rollover request form is essential to initiate the transfer of assets from the old plan to the new retirement account efficiently. |

| 14 | Transfer of Assets Form | The Transfer of Assets Form is a crucial document required for retirement account rollovers, authorizing the transfer of funds between financial institutions. This form typically includes personal identification details, account information, and specifies the type of rollover to ensure a seamless asset transfer while maintaining tax-deferred status. |

| 15 | Medallion Signature Guarantee (if required) | Retirement account rollovers often require a Medallion Signature Guarantee, a specialized stamp from financial institutions verifying the authenticity of the signature to prevent fraud. Necessary documents typically include a distribution form, a rollover request form, and a government-issued ID, with the Medallion Signature Guarantee needed when transferring certificates of deposit or stock powers. |

Introduction to Retirement Account Rollovers

Retirement account rollovers involve transferring funds from one retirement plan to another to maintain tax advantages. Understanding the necessary documents for this process ensures a smooth and compliant transaction.

- Account Statements - Provide detailed records of your current retirement account balances and transactions.

- Rollover Request Form - Official paperwork required by your new plan administrator to initiate the transfer.

- Identification Documents - Valid photo ID such as a driver's license or passport to verify your identity during the rollover process.

Key Documents Required for Rollovers

What documents are required for retirement account rollovers? Key documents include your most recent account statement, which provides details about your existing retirement account. You also need a rollover request form from the receiving financial institution to initiate the transfer process.

Are identification documents necessary for retirement rollovers? Yes, valid government-issued photo ID such as a driver's license or passport is essential to verify your identity. Some institutions might also require your Social Security number to process the rollover smoothly.

Is proof of account ownership required during a rollover? Proof typically comes in the form of account statements or account registration details from your current retirement plan. These documents ensure the funds are transferred between the correct accounts without tax implications.

Verifying Account Ownership and Identity

To complete a retirement account rollover, verifying account ownership is essential. Financial institutions typically require official documentation linking you to both the old and new accounts.

Proof of identity must be submitted, often including government-issued identification such as a driver's license or passport. Account statements or letters from the current account custodian also facilitate a smooth rollover process.

Compliance with IRS Rollover Regulations

Ensuring compliance with IRS rollover regulations requires specific documentation for retirement account rollovers. Proper paperwork helps avoid taxes and penalties during the transfer process.

- IRS Form 1099-R - This form reports distributions from your retirement accounts and is essential for tracking rollover transactions.

- Rollover Contribution Form - Your new plan provider requires this to document the incoming rollover and confirm its timing complies with IRS rules.

- Account Statements - Statements from both the distributing and receiving accounts demonstrate the movement of funds and support IRS reporting requirements.

Understanding Transfer vs. Rollover Forms

Retirement account rollovers require specific documentation to ensure a smooth transfer of funds. Understanding the distinctions between transfer and rollover forms is crucial for avoiding tax penalties.

- Transfer Forms - Used when moving funds directly between financial institutions without taking possession of the money.

- Rollover Forms - Required when you receive a distribution and then deposit it into another retirement account within 60 days.

- Account Statements - Recent statements from both the old and new accounts help verify balances and provide necessary details for processing.

Properly completing the correct forms streamlines your retirement account rollover and protects your tax benefits.

Deadlines and Timing for Document Submission

When completing a retirement account rollover, you must provide identification documents, your current account statements, and the rollover request form. Submission deadlines vary, but the IRS generally requires the rollover to be completed within 60 days to avoid taxes or penalties. Ensuring timely submission of these documents protects your retirement funds from unnecessary tax consequences.

Custodian Requirements and Verification Steps

Retirement account rollovers require specific documentation to comply with custodian requirements and ensure a smooth transfer of funds. These documents verify the account holder's identity and confirm the eligibility of the accounts involved in the rollover process.

Custodians typically require a completed rollover request form, a recent account statement, and a government-issued ID for verification. They may also ask for a direct rollover distribution form from the originating financial institution. Verification steps include confirming the account holder's identity, validating the receiving account details, and ensuring the rollover meets IRS regulations to avoid tax penalties.

Avoiding Common Documentation Errors

| Required Documents for Retirement Account Rollovers | Description | Common Documentation Errors to Avoid |

|---|---|---|

| Account Statements | Recent statements from the existing retirement account showing current balance and account details. | Using outdated statements or incomplete account information that can delay processing. |

| Rollover Request Form | Official form provided by the receiving financial institution to initiate the rollover process. | Submitting forms without signatures or missing required fields such as account numbers. |

| Identification Documents | Government-issued photo ID, such as a driver's license or passport, to verify the identity of the account holder. | Providing expired IDs or unclear scans that may cause verification issues. |

| Direct Rollover Letter | Letter from the current plan administrator authorizing the direct transfer of funds to a new institution. | Missing authorization signatures or incorrect recipient institution details. |

| IRS Form 1099-R | Tax document reporting distributions from the retirement account, necessary for tax compliance during rollover. | Failing to submit 1099-R or submitting the wrong form version causing tax reporting errors. |

| Trustee-to-Trustee Transfer Instructions | Written instructions for custodian-to-custodian transfer avoiding distribution taxes and penalties. | Vague instructions or missing custodian details that hinder smooth transfers. |

Recordkeeping Best Practices for Rollovers

Retirement account rollovers require specific documentation to ensure a smooth transfer and maintain tax advantages. Essential documents include the latest account statements, the completed rollover request form, and identification verifying your identity.

Recordkeeping best practices for rollovers involve keeping copies of all submitted forms and confirmation notices. Maintaining organized digital or physical files helps safeguard your financial history and supports future tax reporting requirements.

What Documents Are Required for Retirement Account Rollovers? Infographic