Freelancers need to gather key documents such as 1099 forms from clients, records of all income and expenses, and receipts for business-related purchases to accurately file taxes. Tracking invoices and maintaining a detailed ledger of earnings ensures compliance with tax regulations. Keeping organized documentation helps freelancers claim deductions and avoid penalties during tax filing.

What Documents Does a Freelancer Need to File Taxes?

| Number | Name | Description |

|---|---|---|

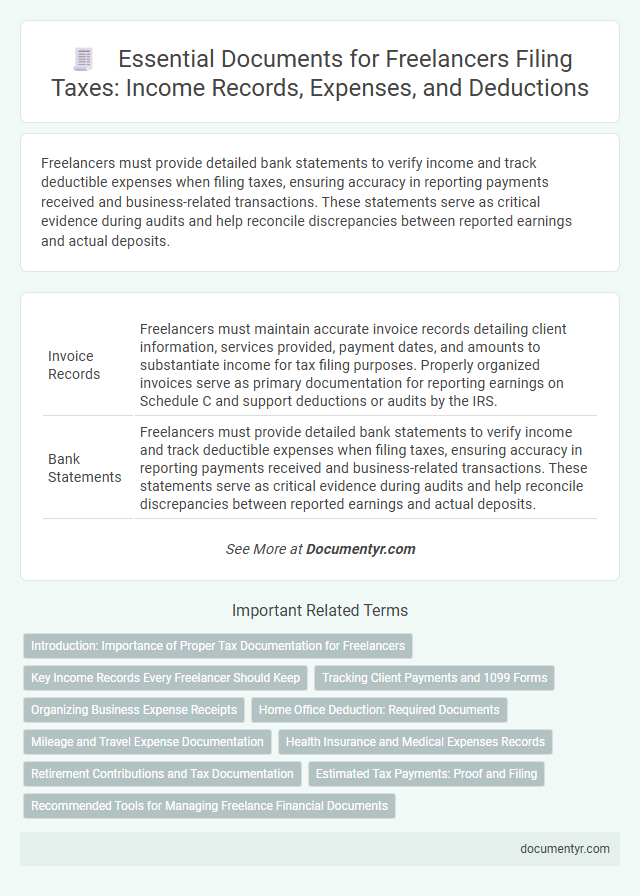

| 1 | Invoice Records | Freelancers must maintain accurate invoice records detailing client information, services provided, payment dates, and amounts to substantiate income for tax filing purposes. Properly organized invoices serve as primary documentation for reporting earnings on Schedule C and support deductions or audits by the IRS. |

| 2 | Bank Statements | Freelancers must provide detailed bank statements to verify income and track deductible expenses when filing taxes, ensuring accuracy in reporting payments received and business-related transactions. These statements serve as critical evidence during audits and help reconcile discrepancies between reported earnings and actual deposits. |

| 3 | 1099-NEC Forms | Freelancers must collect and review all 1099-NEC forms received from clients to accurately report nonemployee compensation on their tax returns. These forms detail payments over $600 made to freelancers, serving as essential documentation for calculating taxable income and ensuring compliance with IRS regulations. |

| 4 | 1099-K Forms | Freelancers need to collect Form 1099-K, which reports payment card and third-party network transactions exceeding $600, to accurately report income earned through platforms like PayPal or credit card processors. This document is essential for reconciling gross payments received and ensuring compliance with IRS tax filing requirements. |

| 5 | W-2 Forms (if applicable) | Freelancers who also have traditional employment must file W-2 forms to report income earned as an employee, alongside their 1099 forms for freelance work. The W-2 form details wages, tips, and other compensation, as well as taxes withheld, which are essential for accurate tax filing and calculating total taxable income. |

| 6 | Expense Receipts | Freelancers must retain expense receipts as critical documentation to accurately claim deductions and reduce taxable income on their tax returns. Detailed records of receipts for business-related purchases, such as software subscriptions, office supplies, and travel expenses, provide essential proof to support expense claims and ensure compliance with IRS regulations. |

| 7 | Mileage Log | Freelancers must maintain a detailed mileage log to accurately claim vehicle expenses as deductions on their tax returns, documenting the date, purpose, starting and ending locations, and total miles driven for each trip. This log serves as critical evidence during IRS audits and ensures compliance with tax regulations while maximizing deductible expenses. |

| 8 | Previous Year’s Tax Return | Freelancers should retain their previous year's tax return, including Form 1040 and Schedule C, to accurately report income and deductions for the current filing period. This document helps verify income sources, track expenses, and maintain consistency in tax reporting, essential for minimizing errors and maximizing eligible deductions. |

| 9 | Business License | A freelancer must have a valid business license to legally operate and file taxes, as it verifies their business activity with local authorities and enables proper tax identification. This document ensures compliance with state and local regulations, facilitating accurate reporting of income and deductions on tax returns. |

| 10 | Contracts and Agreements | Freelancers need to maintain detailed contracts and agreements to accurately report income and substantiate expenses when filing taxes. These documents help verify payment terms, project scope, and freelance deductions essential for IRS compliance and audit protection. |

| 11 | Health Insurance Statements (Form 1095-A, 1095-B, 1095-C) | Freelancers must include Health Insurance Statements such as Form 1095-A for marketplace coverage, Form 1095-B from providers on minimum essential coverage, and Form 1095-C from employers offering health insurance when filing taxes. These documents verify health insurance compliance and are crucial for claiming the Premium Tax Credit or avoiding penalties under the Affordable Care Act. |

| 12 | Home Office Expense Records | Freelancers must maintain detailed home office expense records, including rent or mortgage statements, utility bills, and receipts for office supplies, to accurately claim deductions on their tax returns. Proper documentation substantiates the portion of home expenses attributable to the business use of the space, optimizing tax savings under IRS guidelines. |

| 13 | Payment Processor Statements (e.g., PayPal, Stripe reports) | Freelancers must gather payment processor statements such as PayPal and Stripe reports, which detail all transactions including income and fees, essential for accurate tax reporting. These documents provide comprehensive evidence of earnings and help reconcile income with the IRS requirements for self-employment tax filings. |

| 14 | Quarterly Estimated Tax Payment Receipts (Form 1040-ES) | Freelancers need to retain Quarterly Estimated Tax Payment Receipts using Form 1040-ES to accurately report and pay income taxes throughout the year, preventing penalties and underpayment interest. These receipts serve as critical proof of timely tax payments when filing annual tax returns with the IRS. |

| 15 | Retirement Contribution Statements (IRA, SEP, etc.) | Freelancers must include Retirement Contribution Statements (such as IRA, SEP IRA, or SIMPLE IRA forms) when filing taxes to accurately report deductible retirement contributions. These documents help reduce taxable income and ensure compliance with IRS regulations for self-employed retirement plans. |

| 16 | State and Local Tax Documents | Freelancers must gather state-specific tax forms such as state income tax returns and any required local tax filings to ensure compliance with regional regulations. Important documents include state-issued 1099 forms, sales tax permits if selling taxable goods or services, and records of estimated tax payments made throughout the year. |

| 17 | Dependent Care Receipts | Freelancers must retain dependent care receipts to accurately claim tax credits related to child or dependent care expenses, which can reduce taxable income. These documents include detailed invoices or payment confirmations specifying the provider, dates of service, and amounts paid, essential for IRS compliance and audit verification. |

| 18 | Education Expense Records (Form 1098-T, 1098-E) | Freelancers should retain Education Expense Records such as Form 1098-T, which reports tuition payments, and Form 1098-E, detailing student loan interest paid, as these documents are essential for claiming education-related tax credits and deductions. Accurate documentation of these forms helps reduce taxable income and maximize eligible tax benefits during the filing process. |

| 19 | Charitable Donation Receipts | Freelancers must retain charitable donation receipts to claim tax deductions accurately, as these documents verify the amount and legitimacy of contributions. Proper documentation ensures compliance with IRS regulations and can significantly reduce taxable income during tax filing. |

| 20 | Asset Purchase Documentation | Freelancers must retain asset purchase documentation, such as receipts, invoices, and bills of sale, to accurately report business expenses and claim depreciation on tax returns. These records are essential for verifying asset costs and supporting deductions related to equipment, software, or other business assets on IRS Schedule C. |

Introduction: Importance of Proper Tax Documentation for Freelancers

Proper tax documentation is essential for freelancers to accurately report income and maximize deductions. Maintaining organized records simplifies tax filing and minimizes the risk of errors or audits.

- Income Records - Freelancers must keep detailed records of all earnings, including invoices and payment receipts, to ensure accurate income reporting.

- Expense Documentation - Keeping receipts and statements of business-related expenses helps reduce taxable income through valid deductions.

- Tax Forms - Collecting necessary tax forms such as 1099-MISC or 1099-NEC from clients is crucial for proper tax compliance and reporting.

Key Income Records Every Freelancer Should Keep

Freelancers must keep detailed records of all income sources, including 1099 forms received from clients and invoices issued for completed work. Maintaining accurate bank statements and payment platform summaries helps verify income and simplifies tax filing. You should also track any advance payments and deposits to ensure all taxable earnings are properly reported to the IRS.

Tracking Client Payments and 1099 Forms

What documents are essential for freelancers to file taxes accurately? Tracking client payments is crucial for maintaining accurate income records throughout the year. The 1099 forms report non-employee compensation and must be collected to verify earnings from each client.

Organizing Business Expense Receipts

| Document Type | Purpose | Details |

|---|---|---|

| Business Expense Receipts | Proof of Deductible Expenses | Receipts must clearly show date, vendor, amount, and business purpose to validate tax deductions. Organize receipts by category such as office supplies, travel, and software subscriptions. |

| Income Records | Track Earnings | Invoices, payment statements, and 1099 forms document total income received during the tax year. |

| Expense Logs | Detailed Expense Tracking | Maintain spreadsheets or accounting software records summarizing all business expenses supported by receipts. |

| Tax Forms | Official Tax Filing | Forms like Schedule C (Form 1040) report income and expenses for sole proprietors and freelancers. |

Home Office Deduction: Required Documents

Freelancers claiming the home office deduction must gather specific documents to ensure accurate tax filing. Proper documentation supports the deduction and helps avoid IRS audits.

- Proof of Home Ownership or Rental Agreement - Mortgage statements or lease agreements confirm the taxpayer's legal right to use the space.

- Utility Bills - Electric, water, and internet bills demonstrate ongoing costs related to maintaining the home office.

- Detailed Expense Records - Receipts and invoices for home improvements or repairs allocated to the home office area validate deductible expenses.

Mileage and Travel Expense Documentation

Freelancers must keep detailed records of their mileage and travel expenses to accurately report deductions on their tax returns. Proper documentation includes mileage logs and receipts for transportation-related costs.

Maintaining a mileage log with dates, distances, and purposes of trips is essential for tax compliance. Receipts for parking fees, tolls, and public transportation also support travel expense claims. You should organize these documents consistently throughout the tax year to maximize deductions and avoid issues with the IRS.

Health Insurance and Medical Expenses Records

Freelancers must maintain thorough health insurance documentation when preparing to file taxes. These records verify coverage and may impact eligibility for health-related tax credits or deductions.

Medical expenses receipts and invoices are essential to substantiate claims for deductible costs. Keeping organized health expense records can maximize potential tax benefits and ensure compliance with IRS requirements.

Retirement Contributions and Tax Documentation

Freelancers must maintain detailed records of their income and expenses to accurately file taxes. Key documents include 1099 forms from clients and receipts for deductible expenses.

Retirement contributions, such as those to an IRA or Solo 401(k), require proper documentation to claim tax benefits. Keeping track of contribution statements and acknowledgment letters helps ensure correct reporting during tax filing.

Estimated Tax Payments: Proof and Filing

Freelancers must keep accurate records of all estimated tax payments made throughout the year as proof of compliance. These payments are reported using Form 1040-ES, which helps calculate quarterly tax obligations. Maintaining detailed receipts and bank statements supports accurate filing and avoids potential IRS penalties.

What Documents Does a Freelancer Need to File Taxes? Infographic