To open a joint bank account, primary documents typically include valid identification proofs such as passports or government-issued IDs for all account holders. Proof of address, like utility bills or rental agreements, must be submitted to verify each person's residence. Banks may also require completed application forms and signatures from all parties involved to establish account ownership and responsibilities.

What Documents Are Required for Opening a Joint Bank Account?

| Number | Name | Description |

|---|---|---|

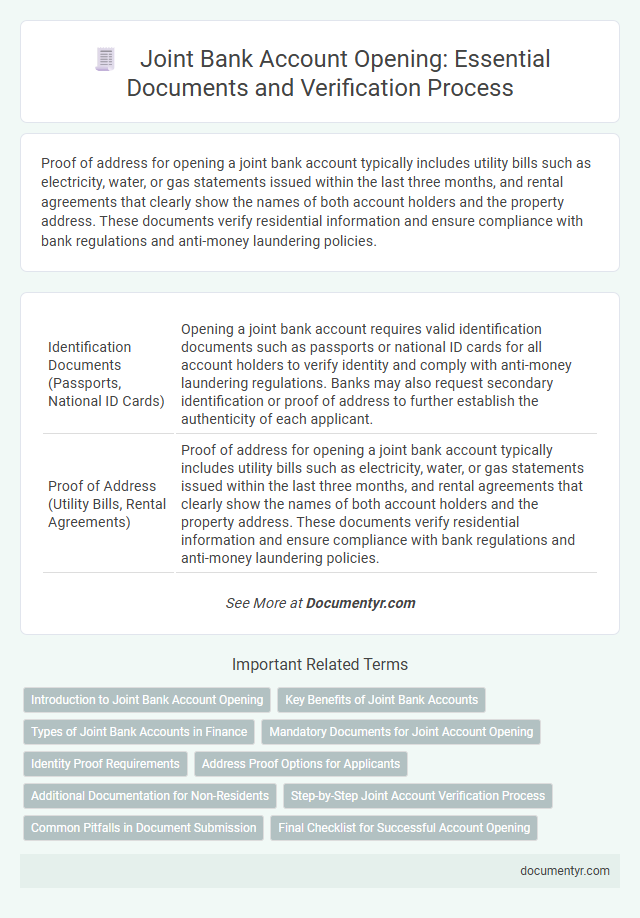

| 1 | Identification Documents (Passports, National ID Cards) | Opening a joint bank account requires valid identification documents such as passports or national ID cards for all account holders to verify identity and comply with anti-money laundering regulations. Banks may also request secondary identification or proof of address to further establish the authenticity of each applicant. |

| 2 | Proof of Address (Utility Bills, Rental Agreements) | Proof of address for opening a joint bank account typically includes utility bills such as electricity, water, or gas statements issued within the last three months, and rental agreements that clearly show the names of both account holders and the property address. These documents verify residential information and ensure compliance with bank regulations and anti-money laundering policies. |

| 3 | PAN Card (for India) / Tax Identification Number | Opening a joint bank account in India requires submitting PAN cards or Tax Identification Numbers (TIN) of all account holders as mandatory identity proof for tax and compliance purposes. These documents ensure accurate linking of the account to the Indian Income Tax Department for transaction tracking and tax reporting. |

| 4 | Recent Photographs (Passport-sized) | Recent passport-sized photographs are essential for opening a joint bank account, as banks require clear identification of all account holders to verify their identity. Typically, each applicant must submit two to three recent photographs meeting specific size and background criteria, ensuring compliance with the bank's KYC (Know Your Customer) regulations. |

| 5 | Joint Account Opening Form | The Joint Account Opening Form is essential for initiating a joint bank account, capturing critical information such as personal details, signatures, and account preferences of all parties involved. This form serves as the legal document authorizing banks to operate the account jointly and verify compliance with Know Your Customer (KYC) regulations. |

| 6 | KYC (Know Your Customer) Form | Opening a joint bank account requires submitting a completed KYC (Know Your Customer) form for each account holder, including valid identity proof such as a PAN card or passport, and address verification like utility bills or Aadhaar card. Banks also typically demand passport-sized photographs and signature verification documents to comply with regulatory norms and prevent fraud. |

| 7 | Income Proof (if applicable) | Income proof such as salary slips, tax returns, or bank statements is required to verify financial stability and source of funds when opening a joint bank account, especially if the account involves credit or overdraft facilities. Providing accurate income documentation helps banks comply with regulatory requirements and assess the joint applicants' creditworthiness. |

| 8 | Employment Verification (if applicable) | Employment verification documents for opening a joint bank account typically include recent pay stubs, an employment letter, or a valid work ID to confirm the applicant's current job status and income stability. Banks may also require contact information of the employer for direct verification to ensure authenticity and reduce fraud risk. |

| 9 | Signature Specimen Card | A Signature Specimen Card is a critical document required for opening a joint bank account, as it captures the official signatures of all account holders to authorize transactions. Banks use this card to verify and authenticate signatures on checks, withdrawal slips, and other financial instruments linked to the joint account. |

| 10 | Marriage Certificate (for spouse accounts, if required) | A marriage certificate is often required when opening a joint bank account with a spouse to verify the marital relationship and ensure compliance with bank policies. This document helps establish legal identification and eligibility for spousal account privileges and benefits. |

| 11 | Guardianship/Minor Consent Documents (if a minor is involved) | Guardianship or minor consent documents such as a court order appointing a legal guardian or a notarized consent form from the minor's parents are essential when opening a joint bank account involving a minor. Banks also typically require the minor's birth certificate and valid identification for all account holders to comply with legal and regulatory standards. |

| 12 | Declaration Form (FATCA/CRS, if required) | Opening a joint bank account requires submitting a Declaration Form for FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard) to ensure compliance with international tax reporting regulations. This form verifies the tax residency status of all account holders and enables banks to report relevant financial information to tax authorities. |

Introduction to Joint Bank Account Opening

Opening a joint bank account allows two or more individuals to manage finances together efficiently. It offers shared access to funds and simplifies bill payments, savings, and investments.

Banks require specific documents to verify the identity and consent of all account holders. These documents ensure compliance with legal and regulatory standards for joint accounts.

Key Benefits of Joint Bank Accounts

Opening a joint bank account requires specific documents to ensure proper verification and authorization of all account holders. These documents facilitate smooth account management and access for all parties involved.

- Proof of Identity - Valid government-issued IDs like passports or driver's licenses are necessary for each account holder.

- Proof of Address - Recent utility bills or bank statements verify the residential address of all applicants.

- Authorization Forms - Signed consent forms confirm agreement among joint holders about account usage and responsibilities.

Joint bank accounts offer shared access to funds, simplified expense management, and increased financial transparency for you and your partners.

Types of Joint Bank Accounts in Finance

Opening a joint bank account requires specific documents such as valid identification proofs, address verification, and completed application forms for all account holders. Types of joint bank accounts include Joint Survivorship, where the surviving holder retains account control, and Joint Tenancy, which allows equal ownership among account holders. Understanding these types helps you select the best option for shared financial management and required document submissions.

Mandatory Documents for Joint Account Opening

| Document Type | Description | Purpose |

|---|---|---|

| Identity Proof | Valid government-issued ID such as passport, driver's license, or national ID card | Verify identity of all account holders |

| Address Proof | Utility bill, rental agreement, or bank statement dated within the last 3 months | Confirm residential address of each applicant |

| PAN Card (Permanent Account Number) | Mandatory in countries like India for tax identification | Required for tax purposes and KYC compliance |

| Passport-sized Photographs | Recent color photographs of all applicants | Used for record keeping and identification |

| Bank Account Application Form | Completed and signed by all joint account holders | Collects personal and financial details for account setup |

| KYC Documents | Know Your Customer documents as per bank guidelines | Compliance with anti-money laundering regulations |

| Signature Specimen | Signatures of all joint applicants on designated forms | Authorize account operations and transactions |

Identity Proof Requirements

Opening a joint bank account requires providing valid identity proof for all account holders to verify their authenticity. Banks enforce strict documentation standards to comply with regulatory requirements and prevent fraud.

- Government-issued ID - Each account holder must submit a government-issued identity document such as a passport, driver's license, or national identity card.

- Proof of Address - Valid address proof including utility bills, bank statements, or rental agreements is mandatory for all joint account applicants.

- Photographs - Recent passport-sized photographs of all joint account holders are required for identification and record-keeping purposes.

Address Proof Options for Applicants

When opening a joint bank account, applicants must provide valid address proof to verify their residency. Common address proof documents include utility bills, such as electricity or water bills, bank statements, rental agreements, or government-issued ID cards with address details. Each applicant needs to submit one of these accepted documents to complete the verification process efficiently.

Additional Documentation for Non-Residents

What additional documents are required for non-residents to open a joint bank account? Non-residents must provide valid identification such as a passport along with proof of address from their home country. Banks may also require a valid visa or residency permit and a tax identification number for compliance purposes.

Step-by-Step Joint Account Verification Process

Opening a joint bank account requires submitting specific documents to verify the identity and consent of all account holders. The verification process ensures compliance with banking regulations and secures your shared financial interests.

First, each applicant must provide valid identification, such as a government-issued ID or passport. Proof of address documents like utility bills or bank statements dated within the last three months are necessary. Finally, completed application forms and signature verification are required to finalize the account setup.

Common Pitfalls in Document Submission

Opening a joint bank account requires submitting specific documents to verify the identities and addresses of all account holders. Missing or incorrect documentation can delay the account opening process and cause additional verification steps.

- Incomplete identification proofs - Submitting expired or unsupported ID documents often leads to rejection by the bank.

- Mismatch in address details - Inconsistent address information between documents can trigger verification holds.

- Omission of required signatures - Failure of all account holders to sign necessary forms results in processing delays or application denial.

What Documents Are Required for Opening a Joint Bank Account? Infographic