To initiate an early 401(k) withdrawal, you need to provide specific documents such as a completed withdrawal request form from your plan administrator and valid identification for verification purposes. Tax forms like the IRS Form W-4P might be necessary to determine the correct withholding amount on your distribution. Supporting documents such as proof of financial hardship or medical expenses may also be required depending on the reason for early withdrawal.

What Documents Are Required for Early 401(k) Withdrawal?

| Number | Name | Description |

|---|---|---|

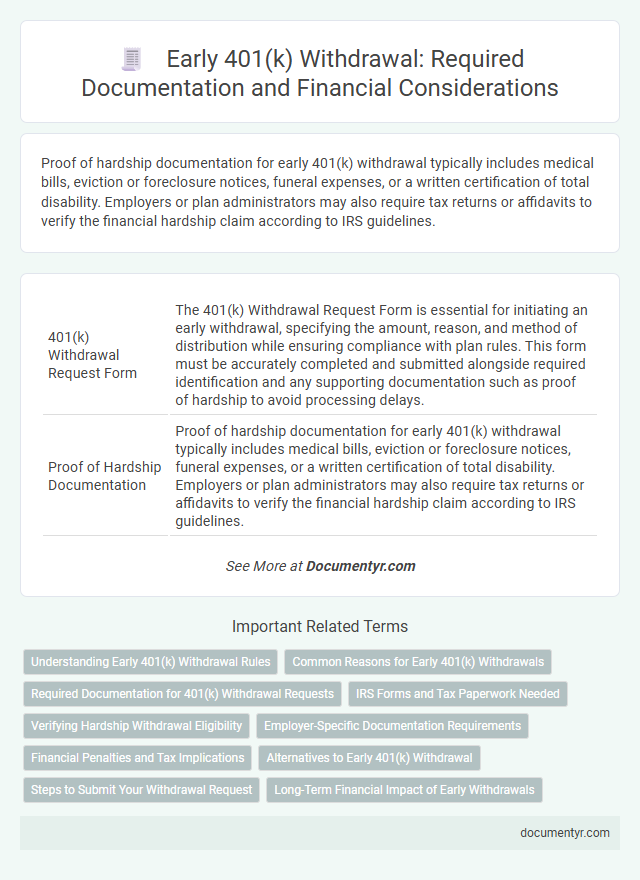

| 1 | 401(k) Withdrawal Request Form | The 401(k) Withdrawal Request Form is essential for initiating an early withdrawal, specifying the amount, reason, and method of distribution while ensuring compliance with plan rules. This form must be accurately completed and submitted alongside required identification and any supporting documentation such as proof of hardship to avoid processing delays. |

| 2 | Proof of Hardship Documentation | Proof of hardship documentation for early 401(k) withdrawal typically includes medical bills, eviction or foreclosure notices, funeral expenses, or a written certification of total disability. Employers or plan administrators may also require tax returns or affidavits to verify the financial hardship claim according to IRS guidelines. |

| 3 | IRS Form 1099-R | IRS Form 1099-R is a critical document required for early 401(k) withdrawal as it reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. This form must be accurately filed with the IRS and provided to the account holder to document the taxable income and any penalties associated with the early withdrawal. |

| 4 | Recent Account Statement | A recent account statement is essential for early 401(k) withdrawal as it verifies the current balance and transaction history, ensuring accurate calculation of the withdrawal amount. This document, typically provided by the plan administrator, supports compliance with IRS regulations and helps avoid potential penalties or delays. |

| 5 | Proof of Identity (Driver’s License or Government ID) | Proof of identity is essential for an early 401(k) withdrawal, typically requiring a government-issued document such as a driver's license or state ID card to verify the account holder's identity. This verification step ensures compliance with financial regulations and helps prevent unauthorized access to retirement funds. |

| 6 | Employer Approval/Authorization Letter | An employer approval or authorization letter is essential for an early 401(k) withdrawal, verifying that the employer consents to the distribution before the plan administrator processes the request. This document serves as proof of compliance with the plan's terms and ensures the withdrawal meets any specific employer-imposed conditions. |

| 7 | Early Withdrawal Explanation Letter | An Early Withdrawal Explanation Letter must clearly outline the specific financial hardship or qualifying reason prompting the early 401(k) withdrawal, supported by relevant documentation such as medical bills, eviction notices, or death certificates. This letter is crucial for avoiding penalties by demonstrating compliance with IRS exceptions and employer plan rules governing early distributions before age 59 1/2. |

| 8 | Supporting Financial Documentation (e.g., bills, eviction notice, medical invoices) | Supporting financial documentation for early 401(k) withdrawal includes detailed bills, eviction notices, and medical invoices that verify financial hardship or qualified expenses. These documents are essential to substantiate the rationale behind the withdrawal request in compliance with IRS guidelines. |

| 9 | IRS Form W-4P (Withholding Certificate for Pension or Annuity Payments) | IRS Form W-4P (Withholding Certificate for Pension or Annuity Payments) is a key document required for early 401(k) withdrawal to determine the amount of federal income tax withholding. Properly completing Form W-4P ensures compliance with IRS regulations and helps avoid under-withholding penalties during pension or annuity distributions. |

| 10 | Divorce Decree or Court Order (if applicable) | A Divorce Decree or Court Order is essential documentation for an early 401(k) withdrawal when funds are being divided as part of a divorce settlement or legal agreement, ensuring compliance with the plan administrator's requirements. These documents must clearly specify the amount or percentage to be distributed to the ex-spouse, often outlined in a Qualified Domestic Relations Order (QDRO), to authorize the withdrawal without penalty. |

| 11 | Qualified Domestic Relations Order (QDRO) (if applicable) | A Qualified Domestic Relations Order (QDRO) is required to authorize early 401(k) withdrawal in divorce or legal separation cases, ensuring the proper division of retirement assets according to court orders. This legal document must be submitted alongside ID verification and plan-specific withdrawal forms to facilitate the release of funds without incurring penalties. |

| 12 | Direct Deposit Authorization Form | The Direct Deposit Authorization Form is essential for early 401(k) withdrawal as it specifies the bank account where the funds will be transferred, ensuring a secure and timely transaction. This form must be completed accurately along with the withdrawal request to facilitate smooth processing and avoid delays in receiving the distribution. |

| 13 | Plan-Specific Withdrawal Guidelines or Summary Plan Description (SPD) | Plan-Specific Withdrawal Guidelines and the Summary Plan Description (SPD) outline the essential documents required for an early 401(k) withdrawal, including a completed withdrawal request form and evidence supporting the qualifying hardship or exception. Reviewing these documents ensures compliance with the individual plan's rules and helps avoid penalties or delays in processing the withdrawal. |

| 14 | Proof of Age (if using age-based exception) | Proof of age is essential for early 401(k) withdrawal under age-based exceptions, typically requiring a government-issued ID such as a driver's license or passport to verify eligibility. Employers or plan administrators often mandate these documents to ensure compliance with IRS rules and avoid penalties. |

| 15 | Proof of Disability (if using disability exception) | To qualify for an early 401(k) withdrawal under the disability exception, individuals must provide official documentation such as a Social Security Administration (SSA) disability award letter or a physician's certification confirming total and permanent disability. These documents serve as critical proof to satisfy IRS requirements and avoid early withdrawal penalties. |

Understanding Early 401(k) Withdrawal Rules

Early 401(k) withdrawals involve specific rules that impact taxes and penalties. Understanding required documentation helps ensure compliance and avoid unexpected costs.

- Withdrawal request form - You must submit a formal request to your plan administrator to initiate the withdrawal.

- Proof of hardship qualification - Documentation such as medical bills or foreclosure notices serves as evidence for hardship exceptions.

- Tax forms (e.g., IRS Form 1099-R) - This form reports the distribution amount and is needed for tax filing purposes.

Common Reasons for Early 401(k) Withdrawals

What documents are required for early 401(k) withdrawal? Typically, you need a completed withdrawal request form and proof supporting your reason for early withdrawal. Common documents include medical bills for health emergencies or purchase agreements for first-time homebuyer expenses.

Which common reasons justify early 401(k) withdrawals? Common reasons include significant medical expenses, permanent disability, or a qualified domestic relations order (QDRO). Having documentation like doctor's statements or court orders helps validate these cases.

Do you need tax-related documents for early 401(k) withdrawal? Yes, tax forms such as IRS Form 1099-R will be issued for reporting the distribution. A completed IRS Form W-4P might also be necessary to handle tax withholding properly.

Required Documentation for 401(k) Withdrawal Requests

To initiate an early 401(k) withdrawal, you need to submit specific documentation to verify account ownership and withdrawal eligibility. Required documents typically include a valid government-issued ID, a completed withdrawal request form, and proof of the qualifying event justifying the early withdrawal. Plan administrators may also request additional paperwork such as tax withholding forms and evidence of financial hardship depending on plan rules.

IRS Forms and Tax Paperwork Needed

When requesting an early 401(k) withdrawal, the primary IRS form required is Form 1099-R, which reports distributions from pensions, annuities, retirement, or profit-sharing plans. This form provides the necessary documentation of the withdrawal amount and any applicable taxes withheld.

Alongside Form 1099-R, taxpayers must complete Form 5329 to report and calculate any additional early withdrawal penalties unless an exemption applies. Accurate submission of these forms ensures compliance with IRS regulations and helps avoid unexpected tax liabilities.

Verifying Hardship Withdrawal Eligibility

Early 401(k) withdrawal requires specific documentation to verify your eligibility for a hardship withdrawal. Proper verification ensures compliance with IRS regulations and plan requirements.

- Proof of Hardship - Documentation such as medical bills, funeral expenses, or eviction notices that clearly demonstrate the financial hardship.

- Plan Withdrawal Request Form - A completed form submitted to the plan administrator stating the reason for the early withdrawal.

- Account Statements - Recent 401(k) statements showing current balances to confirm the withdrawal amount does not exceed allowable limits.

Submitting detailed and accurate documents can expedite the approval process for a hardship withdrawal.

Employer-Specific Documentation Requirements

| Document Type | Description | Purpose | Employer-Specific Requirements |

|---|---|---|---|

| Withdrawal Request Form | Official form provided by plan administrator to request early 401(k) withdrawal | Initiates withdrawal process | Employers may require a customized version of the form or additional signatures |

| Proof of Hardship | Documentation supporting hardship withdrawal claim (e.g., medical bills, eviction notice) | Verifies eligibility for hardship withdrawal under IRS rules | Employers often specify acceptable documents and may require notarization or internal approval |

| Employment Verification | Letter or certification confirming employment status | Confirms active or terminated employment relevant to withdrawal eligibility | Employer provides official statement or employment verification form |

| Plan-Specific Notices | Information regarding plan terms and withdrawal penalties | Ensures participant awareness of consequences and rules | Employers supply customized notices or disclosures aligned with the specific 401(k) plan |

| Tax Withholding Forms | Forms to elect federal and state income tax withholding on withdrawal amount | Complies with IRS tax withholding requirements | Employers may require completion of employer-specific forms or use plan administrator's templates |

Financial Penalties and Tax Implications

Early 401(k) withdrawal requires submitting a withdrawal request form along with proof of identity and account ownership. Financial penalties typically include a 10% early withdrawal fee if funds are accessed before age 59 1/2, unless specific exceptions apply. Tax implications involve including the withdrawn amount as taxable income on the federal tax return, potentially increasing the overall tax liability for the year.

Alternatives to Early 401(k) Withdrawal

Early 401(k) withdrawal requires specific documents such as a withdrawal request form, proof of hardship, and identification. These documents verify eligibility and ensure compliance with IRS regulations.

Alternatives to early 401(k) withdrawal include taking a 401(k) loan, exploring hardship withdrawals with fewer penalties, or considering other emergency savings. Using a 401(k) loan allows you to borrow from your account without immediate tax consequences, provided repayment terms are met. Exploring these options helps avoid penalties and preserves retirement savings.

Steps to Submit Your Withdrawal Request

Early 401(k) withdrawal requires specific documentation to avoid penalties and ensure compliance with IRS rules. Understanding the necessary steps helps streamline the submission process effectively.

- Gather Identification Documents - Provide a government-issued ID to verify your identity and prevent fraud.

- Complete the Withdrawal Request Form - Fill out your plan provider's official form specifying the withdrawal amount and reason.

- Submit Supporting Financial Evidence - Include documents such as medical bills or hardship letters if applying under hardship withdrawal rules.

What Documents Are Required for Early 401(k) Withdrawal? Infographic