Investors must provide identification documents such as a government-issued ID or passport to verify their identity when opening a brokerage account. Proof of address, like a utility bill or bank statement, is typically required to confirm residency. Financial information and tax identification numbers are also essential for compliance with regulatory requirements and tax reporting.

What Documents Does an Investor Need for Opening a Brokerage Account?

| Number | Name | Description |

|---|---|---|

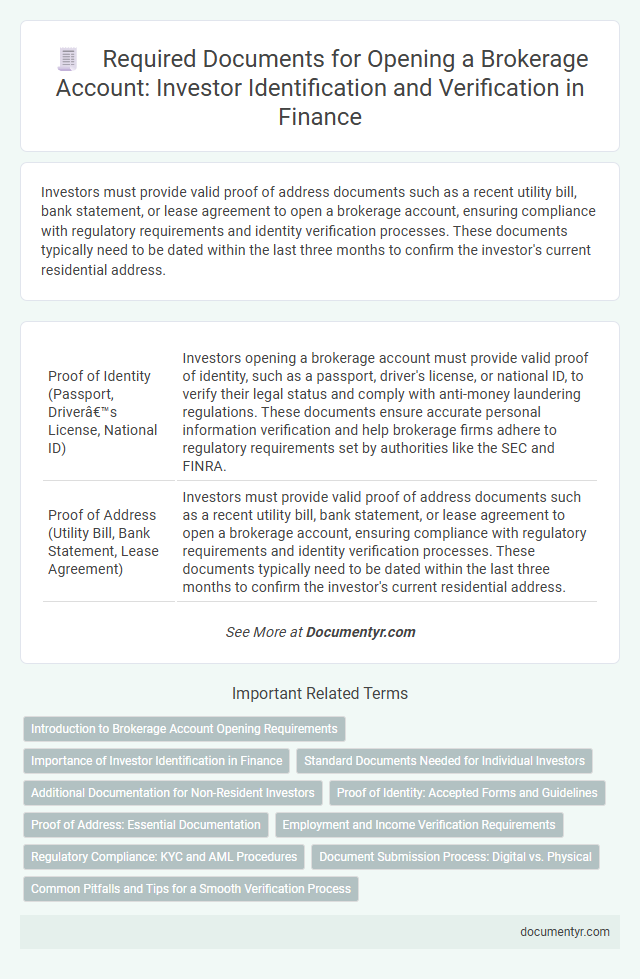

| 1 | Proof of Identity (Passport, Driver’s License, National ID) | Investors opening a brokerage account must provide valid proof of identity, such as a passport, driver's license, or national ID, to verify their legal status and comply with anti-money laundering regulations. These documents ensure accurate personal information verification and help brokerage firms adhere to regulatory requirements set by authorities like the SEC and FINRA. |

| 2 | Proof of Address (Utility Bill, Bank Statement, Lease Agreement) | Investors must provide valid proof of address documents such as a recent utility bill, bank statement, or lease agreement to open a brokerage account, ensuring compliance with regulatory requirements and identity verification processes. These documents typically need to be dated within the last three months to confirm the investor's current residential address. |

| 3 | Social Security Number (SSN) or Tax Identification Number (TIN) | An investor must provide a Social Security Number (SSN) or Tax Identification Number (TIN) when opening a brokerage account to comply with IRS regulations and facilitate tax reporting. These identification numbers verify the investor's identity and ensure proper withholding and reporting of investment income to the Internal Revenue Service. |

| 4 | Employment Information Document | An investor must provide employment information documents such as recent pay stubs, employer contact details, or employment verification letters when opening a brokerage account to verify income stability and assess creditworthiness. These documents help brokerage firms comply with regulatory requirements and tailor investment recommendations based on the investor's financial profile. |

| 5 | Income Verification Document (Pay Slip, Tax Return) | Income verification documents such as recent pay slips and tax returns are essential for opening a brokerage account, providing proof of an investor's financial stability and compliance with regulatory requirements. These documents help brokers assess the client's income level, risk tolerance, and suitability for various investment products. |

| 6 | Financial Information Disclosure Form | Investors must provide a Financial Information Disclosure Form when opening a brokerage account, detailing their income, net worth, investment experience, and risk tolerance to help brokers assess suitable investment options. This form ensures compliance with regulatory requirements and protects both the investor and the brokerage firm by promoting transparency and informed decision-making. |

| 7 | Brokerage Account Application Form | The brokerage account application form collects essential personal information, including name, address, Social Security number, employment details, and financial status, to comply with regulatory requirements. Investors must complete this form accurately to facilitate identity verification, risk assessment, and suitability analysis for investment products. |

| 8 | W-9 Form (for U.S. citizens/residents) | Investors opening a brokerage account must provide a completed W-9 form to verify their Taxpayer Identification Number (TIN) and certify U.S. citizenship or residency status for accurate IRS reporting. This IRS Form W-9 ensures compliance with tax regulations, enabling brokers to report dividends, interest, and capital gains to the Internal Revenue Service. |

| 9 | W-8BEN Form (for Non-U.S. residents) | Non-U.S. residents opening a brokerage account must submit the W-8BEN form to certify foreign status and claim applicable tax treaty benefits, ensuring proper withholding tax rates on U.S.-sourced income. This IRS form reduces withholding taxes on dividends, interest, and other income, streamlining compliance for international investors. |

| 10 | Risk Disclosure Acknowledgment | Investors must provide a Risk Disclosure Acknowledgment when opening a brokerage account to confirm their understanding of the potential financial risks involved in trading securities. This document ensures compliance with regulatory requirements by outlining key risk factors such as market volatility, investment loss potential, and the limitations of past performance as an indicator of future results. |

| 11 | Signed Customer Agreement | A signed customer agreement is a mandatory document that outlines the terms, conditions, and responsibilities between the investor and the brokerage firm, ensuring legal compliance and protection for both parties. This agreement typically includes consent for account activities, fee disclosures, and privacy policies necessary for account activation and ongoing management. |

| 12 | Investment Objectives Questionnaire | An Investment Objectives Questionnaire is crucial for opening a brokerage account as it helps assess an investor's risk tolerance, financial goals, and time horizon. This document enables brokers to recommend suitable investment products aligned with the investor's individual profile and regulatory compliance requirements. |

| 13 | Beneficiary Designation Form | Investors are required to submit a Beneficiary Designation Form when opening a brokerage account to specify individuals entitled to the account assets in the event of the account holder's death. This document complements identity verification papers and financial information, ensuring seamless asset transfer and estate planning within brokerage firms. |

Introduction to Brokerage Account Opening Requirements

What documents are required to open a brokerage account? Opening a brokerage account involves submitting specific documents to verify your identity and financial information. These documents ensure compliance with regulatory standards and help protect your investments.

Importance of Investor Identification in Finance

Opening a brokerage account requires specific documents to verify your identity and ensure compliance with financial regulations. Proper investor identification is crucial to protect against fraud and maintain the integrity of financial markets.

- Government-Issued ID - A valid passport or driver's license confirms your identity and citizenship status.

- Proof of Address - Utility bills or bank statements verify your residential address for account consistency.

- Social Security Number or Tax ID - Required for tax reporting and to comply with anti-money laundering laws.

Standard Documents Needed for Individual Investors

Individual investors need a government-issued photo ID such as a passport or driver's license to verify their identity when opening a brokerage account. Proof of address documents like utility bills or bank statements are required to confirm residency. Investors must also provide their Social Security Number or Tax Identification Number for tax reporting and compliance purposes.

Additional Documentation for Non-Resident Investors

Non-resident investors must provide specific additional documentation when opening a brokerage account. These documents help verify identity and comply with international financial regulations.

Common requirements include a valid passport, proof of address, and a completed IRS W-8BEN form for tax purposes. Some brokers also request a reference letter from a financial institution or a certified translation of documents not in English.

Proof of Identity: Accepted Forms and Guidelines

Opening a brokerage account requires submitting proper documentation to verify your identity. Proof of identity is crucial to comply with legal and regulatory standards.

- Government-Issued Photo ID - Accepted forms include a valid passport, driver's license, or state-issued ID card.

- Recent Issuance - Identification documents typically must be current or issued within the last five years to be accepted.

- Clear and Legible Copies - Submitted IDs must be clear, legible, and unaltered to ensure verification accuracy.

Proof of Address: Essential Documentation

| Document Type | Description | Examples |

|---|---|---|

| Proof of Address | Essential documentation for verifying your residential location. Financial institutions require this to comply with regulatory standards and prevent fraud. | Utility bills (electricity, water, gas), bank statements, government-issued letters or notices, lease agreements, or mortgage statements dated within the last 3 months. |

| Proof of Identity | Official government-issued identification to confirm the investor's identity. | Passport, driver's license, national ID card. |

| Social Security Number or Tax Identification Number | Required for tax reporting and compliance with IRS regulations. | Social Security card, tax ID document. |

| Employment Information | Details about your current employment status for risk assessment and regulatory obligations. | Employer name, job title, contact information. |

| Financial Information | Data about your income and assets to guide investment recommendations and assess suitability. | Income proof, bank statements, investment portfolios. |

Employment and Income Verification Requirements

Investors must provide employment details such as their current employer's name, job title, and contact information when opening a brokerage account. This information helps verify the investor's occupational status and assess financial stability.

Income verification typically requires recent pay stubs, tax returns, or bank statements to confirm the investor's earnings. Brokerage firms use this data to comply with regulatory requirements and to determine suitable investment options based on the investor's financial capacity.

Regulatory Compliance: KYC and AML Procedures

Investors must provide valid identification documents such as a government-issued ID or passport to comply with KYC (Know Your Customer) regulations when opening a brokerage account. Proof of address, like utility bills or bank statements, is also required to verify residency and prevent fraud. AML (Anti-Money Laundering) procedures demand disclosure of source of funds and financial background to detect and prevent illicit activities.

Document Submission Process: Digital vs. Physical

Investors must submit several key documents when opening a brokerage account, including proof of identity, proof of address, and financial information. The document submission process can be completed either digitally or physically, depending on the brokerage firm's policies.

Digital submission involves uploading scanned copies or photos of required documents through an online portal, which expedites account verification and approval. Physical submission requires mailing or delivering original or notarized copies to the brokerage office, often resulting in longer processing times. Many modern brokerages prefer digital methods to enhance security and speed, while some traditional firms still accept physical documents for compliance and regulatory reasons.

What Documents Does an Investor Need for Opening a Brokerage Account? Infographic