Immigrants applying for a credit card typically need to provide identification documents such as a valid passport, proof of residency like a utility bill or lease agreement, and a Social Security number or Individual Taxpayer Identification Number (ITIN). Proof of income, such as pay stubs or employment verification, may be required to assess creditworthiness. Bank statements and credit history, if available, can further support the application process.

What Documents Does an Immigrant Need for Credit Card Application?

| Number | Name | Description |

|---|---|---|

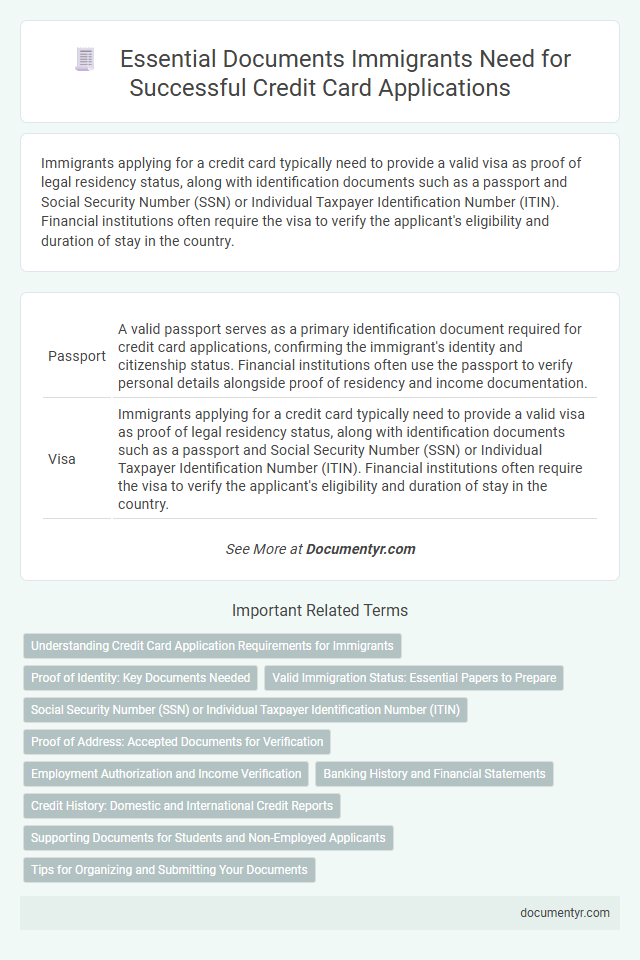

| 1 | Passport | A valid passport serves as a primary identification document required for credit card applications, confirming the immigrant's identity and citizenship status. Financial institutions often use the passport to verify personal details alongside proof of residency and income documentation. |

| 2 | Visa | Immigrants applying for a credit card typically need to provide a valid visa as proof of legal residency status, along with identification documents such as a passport and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Financial institutions often require the visa to verify the applicant's eligibility and duration of stay in the country. |

| 3 | Permanent Resident Card (Green Card) | A Permanent Resident Card (Green Card) is essential for immigrants applying for a credit card as it verifies lawful permanent residency status and provides a valid form of identification. Lenders use this document to assess eligibility and establish a credible credit history in the United States. |

| 4 | Employment Authorization Document (EAD) | An Employment Authorization Document (EAD) is a critical document for immigrants applying for a credit card, as it serves as official proof of work eligibility and identity. Lenders rely on the EAD to verify employment status, which directly impacts creditworthiness and approval chances for secured and unsecured credit cards. |

| 5 | Social Security Number (SSN) | Immigrants applying for a credit card typically need to provide a valid Social Security Number (SSN) as a primary identifier used by credit card issuers to verify credit history and employment eligibility. Without an SSN, immigrants may face challenges in accessing traditional credit cards but can consider alternatives like Individual Taxpayer Identification Numbers (ITIN) or secured credit cards designed for newcomers. |

| 6 | Individual Taxpayer Identification Number (ITIN) | Immigrants applying for a credit card often need an Individual Taxpayer Identification Number (ITIN) as proof of tax identification when they do not qualify for a Social Security Number (SSN). The ITIN verifies identity and tax status, enabling card issuers to assess creditworthiness in compliance with federal regulations. |

| 7 | Proof of Address (Utility Bill, Lease Agreement) | Immigrants applying for a credit card must provide proof of address, which can include utility bills such as electricity or water statements and lease agreements that verify their residential location. These documents are essential for confirming residency and are often required by financial institutions to complete the credit card application process. |

| 8 | Bank Statements | Immigrants applying for a credit card typically need to provide recent bank statements as proof of financial stability and transaction history, demonstrating their ability to manage credit responsibly. These bank statements must usually cover the last three to six months and include details such as account holder name, account number, and transaction records to satisfy issuer verification requirements. |

| 9 | Proof of Income (Pay Stubs, Job Offer Letter) | Proof of income is essential for immigrant credit card applications, typically requiring recent pay stubs or a formal job offer letter detailing salary and employment terms. These documents verify consistent earnings and employment stability, strengthening the applicant's creditworthiness in the financial assessment. |

| 10 | Credit Report (if available) | Immigrants applying for a credit card should provide a valid credit report if available, as it verifies credit history and enhances approval chances. Lenders often require additional identification and proof of residence but prioritize the credit report to assess risk accurately in the credit evaluation process. |

| 11 | Letter of Reference (from Employer or Landlord) | A Letter of Reference from an employer or landlord serves as a crucial document for immigrants applying for a credit card, verifying employment stability or rental history to establish creditworthiness. This letter typically includes details such as duration of employment or tenancy, payment reliability, and character assessment, helping financial institutions assess risk and approve credit applications. |

| 12 | State-issued Identification Card or Driver’s License | A valid State-issued Identification Card or Driver's License is essential for an immigrant applying for a credit card as it verifies legal identity and residency status. Financial institutions require these documents to comply with Know Your Customer (KYC) regulations and prevent fraud. |

Understanding Credit Card Application Requirements for Immigrants

Applying for a credit card as an immigrant involves specific documentation to verify identity and financial status. Understanding these requirements helps streamline the approval process and ensures compliance with financial institutions' policies.

- Proof of Identity - Valid government-issued identification such as a passport or permanent resident card is essential to confirm your identity.

- Proof of Residency - Documents like a lease agreement or utility bill verify your current address within the country.

- Income Verification - Pay stubs, employment letters, or tax returns demonstrate your ability to repay credit obligations.

Proof of Identity: Key Documents Needed

| Document Type | Description | Examples |

|---|---|---|

| Government-Issued Identification | Primary proof of identity and legal status in the country. Required to verify applicant's identity and citizenship or immigration status. | Passport, National ID Card, Driver's License |

| Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) | Essential for credit history tracking and tax purposes. Required for credit profile creation. | Social Security Card, IRS ITIN documentation |

| Proof of Immigration Status | Confirms legal residency or visa status validity. Important for eligibility to apply for financial products. | Permanent Resident Card (Green Card), Visa, Employment Authorization Document (EAD) |

| Proof of Address | Verifies current residence to match application details. Helps in credit risk assessment. | Utility Bills, Lease Agreement, Bank Statements |

| Additional Identification | Supplementary proof of identity when primary documents are insufficient. | Birth Certificate, Consular ID |

Valid Immigration Status: Essential Papers to Prepare

When applying for a credit card, immigrants must prove their valid immigration status. This verification ensures compliance with financial regulations and helps establish trust with the credit issuer.

Essential documents include a valid passport, a visa or permanent resident card, and an Employment Authorization Document (EAD) if applicable. Providing these papers confirms legal residency or work authorization in the country. Lenders use these documents to assess the applicant's eligibility and verify identity.

Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

What documents are required for an immigrant to apply for a credit card? Immigrants must provide either a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) to complete their credit card application. These identifiers are essential for credit verification and approval.

Proof of Address: Accepted Documents for Verification

Proof of address is a crucial requirement for credit card applications, especially for immigrants. Accepted documents for verification include utility bills, bank statements, lease agreements, and government-issued correspondence. Ensure Your proof of address is recent, typically within the last three months, to meet most financial institutions' criteria.

Employment Authorization and Income Verification

Immigrants applying for a credit card must provide valid employment authorization to demonstrate their legal right to work in the country. Common documents include an Employment Authorization Document (EAD) or a valid work visa.

Income verification is essential to prove the applicant's ability to repay credit card debt. Pay stubs, tax returns, or bank statements are frequently accepted as proof of income for credit card applications.

Banking History and Financial Statements

Immigrants applying for a credit card must provide specific documents that demonstrate their banking history and financial stability. These documents help credit card issuers assess the applicant's creditworthiness and repayment capability.

- Bank Statements - Recent bank statements verify the applicant's transaction history and account activity over a specific period.

- Proof of Income - Pay stubs, tax returns, or employment letters confirm the applicant's earnings and financial reliability.

- Credit History Reports - A credit report, if available, offers insight into the applicant's previous credit behavior and outstanding debts.

Credit History: Domestic and International Credit Reports

Immigrants applying for a credit card must provide comprehensive credit history documentation to increase approval chances. Both domestic and international credit reports are crucial for assessing financial reliability.

- Domestic Credit Report - A detailed record from local credit bureaus showing borrowing and repayment behaviors within the host country.

- International Credit Report - Documentation from credit agencies in the applicant's home country demonstrating past creditworthiness abroad.

- Translation and Verification - Certified translations and official verification of foreign credit documents ensure clarity and authenticity for the issuing bank.

Submitting accurate and complete credit history documents strengthens the immigrant's credit card application process.

Supporting Documents for Students and Non-Employed Applicants

Immigrant students and non-employed applicants must provide proof of identity, such as a passport or government-issued ID, along with a valid visa or residency permit. Supporting financial documents, including bank statements or proof of scholarships and financial aid, help demonstrate creditworthiness. Letters of enrollment from educational institutions and statements of no employment or alternative income sources are essential to support the credit card application process.

What Documents Does an Immigrant Need for Credit Card Application? Infographic