LLCs must file an annual report with the state, providing updated information such as the company's address, registered agent, and member or manager details. Maintaining a current and accurate operating agreement, even if not submitted to the state, is essential for internal governance and compliance. Some states also require payment of an annual franchise tax or fee to remain in good standing.

What Documents Does an LLC Need for Annual State Compliance?

| Number | Name | Description |

|---|---|---|

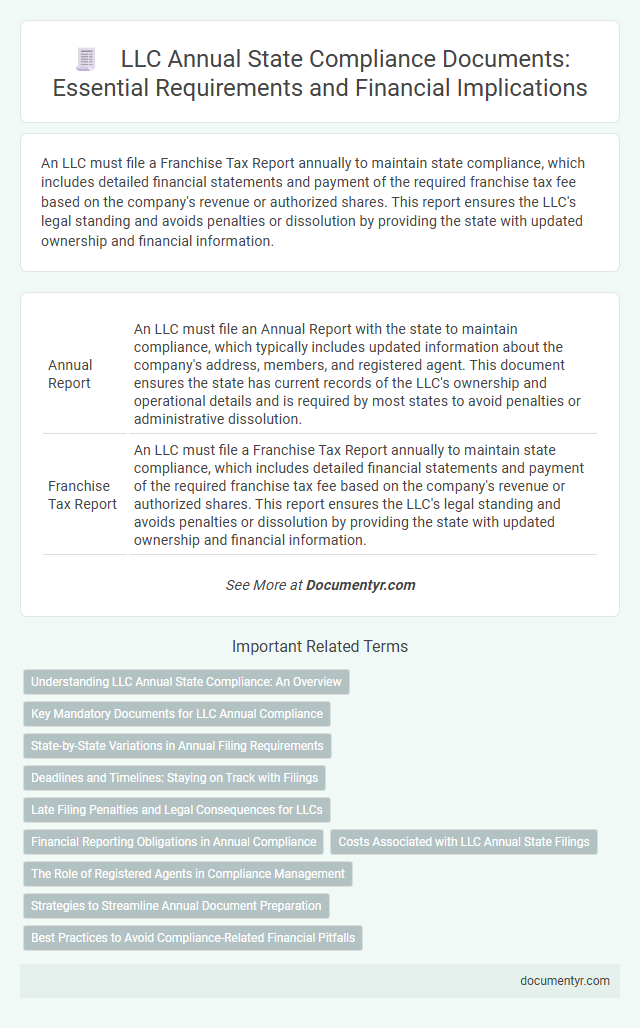

| 1 | Annual Report | An LLC must file an Annual Report with the state to maintain compliance, which typically includes updated information about the company's address, members, and registered agent. This document ensures the state has current records of the LLC's ownership and operational details and is required by most states to avoid penalties or administrative dissolution. |

| 2 | Franchise Tax Report | An LLC must file a Franchise Tax Report annually to maintain state compliance, which includes detailed financial statements and payment of the required franchise tax fee based on the company's revenue or authorized shares. This report ensures the LLC's legal standing and avoids penalties or dissolution by providing the state with updated ownership and financial information. |

| 3 | Statement of Information | An LLC must file a Statement of Information annually with the state to provide updated details such as the company's address, members, and registered agent, ensuring compliance with state regulations. Failure to submit this document on time can result in penalties or administrative dissolution of the LLC. |

| 4 | Certificate of Good Standing | An LLC must obtain a Certificate of Good Standing annually to verify compliance with state regulations and confirm the company's legal status. This document is essential for maintaining business credibility and is often required for renewal of licenses, contracts, and banking purposes. |

| 5 | Minutes of Annual Meeting | Minutes of the annual meeting are essential documents that LLCs must maintain to comply with state regulations and demonstrate adherence to corporate governance standards. These records detail key decisions, member votes, and resolutions passed during the meeting, serving as crucial evidence for audits and legal compliance. |

| 6 | Operating Agreement | An LLC must maintain an updated operating agreement to comply with annual state requirements, as it outlines the management structure and member roles essential for legal and financial accountability. This document, often reviewed during state filings, ensures clarity in ownership and operational procedures, supporting regulatory compliance and reducing potential disputes. |

| 7 | Member/Manager List | An LLC must maintain and submit an accurate Member/Manager List as part of its annual state compliance to verify current ownership and management structure. This document ensures regulatory transparency and is often required alongside the Annual Report or Statement of Information filings. |

| 8 | State-Specific Compliance Form | An LLC must file a State-Specific Compliance Form, such as an Annual Report or Franchise Tax Report, which varies by state and outlines essential company information like ownership, address, and registered agent. Failure to submit these mandatory documents on time can result in penalties, suspension of business privileges, or administrative dissolution by the state. |

| 9 | Registered Agent Information Update | LLCs must submit an updated Statement of Information or Annual Report that includes current registered agent details, ensuring compliance with state requirements. Failure to update registered agent information can result in penalties or administrative dissolution of the LLC. |

| 10 | Business License Renewal | An LLC must submit a business license renewal application annually to maintain compliance with state regulations, often accompanied by updated financial statements or tax filings. Failure to renew the business license on time can result in penalties, fines, or suspension of the LLC's operating privileges. |

| 11 | IRS Form 1065 (if applicable) | LLCs classified as partnerships must file IRS Form 1065, the U.S. Return of Partnership Income, annually to report income, deductions, gains, and losses. Submitting this form ensures compliance with federal tax requirements and supports accurate state-level reporting for the LLC's annual state compliance. |

| 12 | Schedule K-1 (if applicable) | An LLC classified as a partnership must issue Schedule K-1 to each member, detailing their share of income, deductions, and credits for accurate tax reporting. Compliance with state regulations often requires filing the LLC's annual report alongside maintaining proper financial records, including Schedule K-1 forms when applicable. |

| 13 | State Tax Return | An LLC must file a State Tax Return annually, which typically includes income statements, expense reports, and payment records to comply with state tax regulations. Proper submission of the State Tax Return ensures the LLC meets all tax obligations, avoids penalties, and maintains good standing with the Secretary of State. |

| 14 | Employer Identification Number (EIN) Confirmation | An LLC must provide an Employer Identification Number (EIN) confirmation as part of its annual state compliance documentation to verify its federal tax identification. This EIN confirmation ensures the LLC is properly registered with the IRS and enables accurate reporting of employment taxes and financial activities to the state authorities. |

| 15 | Beneficial Ownership Information Report | An LLC must file a Beneficial Ownership Information Report detailing individuals who directly or indirectly own or control 25% or more of the company, ensuring transparency and compliance with state regulations. This report is critical for meeting annual state compliance requirements and preventing legal penalties. |

Understanding LLC Annual State Compliance: An Overview

LLCs must submit specific documents to meet annual state compliance requirements, ensuring legal operation. Common documents include the annual report, statement of information, and updated member or manager lists. Your timely submission of these records helps maintain good standing and avoids penalties.

Key Mandatory Documents for LLC Annual Compliance

Limited Liability Companies (LLCs) must file specific documents annually to maintain good standing with their state. These annual state compliance requirements vary but generally focus on essential documentation that verifies the LLC's ongoing legitimacy.

- Annual Report - This document updates the state on the LLC's current contact information, management, and ownership details.

- State Tax Filings - LLCs must submit necessary tax forms and payments as required by their state to comply with tax obligations.

- Registered Agent Confirmation - Confirmation or update of the LLC's registered agent ensures proper legal and official communication.

Filing these key documents on time prevents penalties and maintains the LLC's authorized status within the state.

State-by-State Variations in Annual Filing Requirements

| State | Required Annual Document | Filing Deadline | Filing Fee | Additional Notes |

|---|---|---|---|---|

| California | Statement of Information | Within 90 days of formation, then every year | $20 for LLCs | Must be filed even if no changes occur; mandatory for continued compliance |

| Delaware | Annual Franchise Tax Report | March 1 | $300 flat fee | Franchise tax assessed based on authorized shares or assumed par value capital |

| Texas | Public Information Report | May 15 | $0 (included with Franchise Tax Report) | Filed together with Franchise Tax Report; late penalty applies if filed late |

| Florida | Annual Report | May 1 | $138.75 | Failure to file results in administrative dissolution |

| New York | Biennial Statement | Last day of the month in which the LLC was formed, every 2 years | $9 | Filed every two years; late fee applies |

| Illinois | Annual Report | Before the first day of the LLC's anniversary month | $75 | Information includes registered agent, address, and members/managers |

| Washington | Annual Report | Last day of the LLC's anniversary month | $60 | Filed online through the Corporations Division |

| Georgia | Annual Registration | April 1 | $50 | Begins the year after formation; registration keeps LLC in good standing |

| Ohio | No annual state report required | N/A | N/A | Biennial reports not required; however, federal filings must still be maintained |

| Massachusetts | Annual Report | Third anniversary of formation and annually thereafter | $500 | Report includes principal office info and manager/member details |

Deadlines and Timelines: Staying on Track with Filings

LLCs must submit specific documents annually to maintain state compliance, including the Annual Report and, in some states, a Franchise Tax Report. These filings ensure the LLC remains in good standing and avoids penalties or dissolution.

Deadlines for submitting annual compliance documents vary by state but typically fall within a set window each year. Missing these deadlines can result in late fees, administrative dissolution, or loss of business privileges.

Late Filing Penalties and Legal Consequences for LLCs

Annual state compliance requires LLCs to submit specific documents promptly to avoid penalties and legal issues. Timely filing protects your business from costly fines and potential administrative dissolution.

- Annual Report Submission - Most states mandate LLCs to file an annual report detailing updated business information and ownership.

- Late Filing Penalties - Missing the filing deadline can result in fines ranging from $50 to several hundred dollars, depending on the state's regulations.

- Legal Consequences - Repeated late filings may lead to suspension of business privileges or involuntary dissolution of the LLC by the state authorities.

Financial Reporting Obligations in Annual Compliance

LLCs must fulfill specific financial reporting obligations to maintain annual state compliance. These requirements ensure transparency and accurate representation of the company's financial status to state authorities.

- Annual Report - A document that typically includes financial summaries, member information, and business activities to update the state on the LLC's status.

- Statement of Information - Filed in some states, it often requires the disclosure of financial data and management details to uphold regulatory compliance.

- Financial Statements - Comprehensive reports such as balance sheets or income statements may be required to demonstrate the LLC's financial health during the reporting period.

Costs Associated with LLC Annual State Filings

LLCs are required to submit specific documents for annual state compliance, typically including an Annual Report or Statement of Information. These documents update the state on your LLC's current business address, management structure, and registered agent details.

Filing fees for annual state compliance vary widely, ranging from $50 to over $500 depending on the state. Additional costs may include penalties for late submissions and fees for expedited processing services.

The Role of Registered Agents in Compliance Management

Maintaining annual state compliance for an LLC requires filing key documents such as the Annual Report and updated Operating Agreement. A Registered Agent plays a critical role by receiving official government correspondences and legal notices on behalf of the LLC. You must ensure your Registered Agent is reliable to avoid missed deadlines and potential penalties in compliance management.

Strategies to Streamline Annual Document Preparation

What documents does an LLC need for annual state compliance? LLCs typically require an annual report and updated member or manager information to meet state regulations. Maintaining a checklist of required filings helps ensure timely and accurate submissions.

How can an LLC streamline annual document preparation? Using automated reminder systems and cloud-based document management reduces errors and saves time. Centralizing record-keeping supports quick access and efficient updates to compliance documents.

What Documents Does an LLC Need for Annual State Compliance? Infographic