To apply for 501(c)(3) status, a nonprofit must prepare key documents including Articles of Incorporation, which establish the organization legally, and detailed bylaws outlining governance procedures. The IRS Form 1023 or 1023-EZ must be completed with thorough financial statements, a narrative of past, present, and planned activities, and a conflict of interest policy. Maintaining accurate records and submitting a comprehensive application ensures compliance and increases the likelihood of tax-exempt recognition.

What Documents Does a Nonprofit Need for 501(c)(3) Application?

| Number | Name | Description |

|---|---|---|

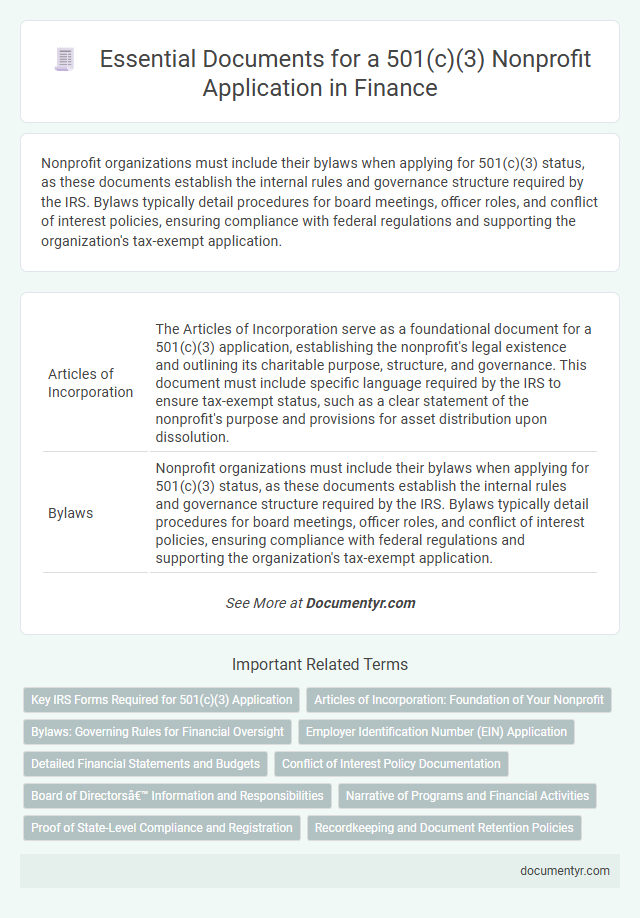

| 1 | Articles of Incorporation | The Articles of Incorporation serve as a foundational document for a 501(c)(3) application, establishing the nonprofit's legal existence and outlining its charitable purpose, structure, and governance. This document must include specific language required by the IRS to ensure tax-exempt status, such as a clear statement of the nonprofit's purpose and provisions for asset distribution upon dissolution. |

| 2 | Bylaws | Nonprofit organizations must include their bylaws when applying for 501(c)(3) status, as these documents establish the internal rules and governance structure required by the IRS. Bylaws typically detail procedures for board meetings, officer roles, and conflict of interest policies, ensuring compliance with federal regulations and supporting the organization's tax-exempt application. |

| 3 | IRS Form 1023 or 1023-EZ | IRS Form 1023 or 1023-EZ, the application for recognition of exemption under section 501(c)(3), requires detailed organizational documents such as the Articles of Incorporation, bylaws, and a comprehensive narrative of activities supporting charitable purposes. Applicants must also submit financial data, including current and projected budgets, to demonstrate fiscal responsibility and nonprofit operational intent. |

| 4 | Employer Identification Number (EIN) Letter | The Employer Identification Number (EIN) letter is a crucial document required for the 501(c)(3) application, serving as the nonprofit's federal tax identification issued by the IRS. This letter validates the organization's legal status and is necessary for opening bank accounts, hiring employees, and completing the tax-exemption process. |

| 5 | Conflict of Interest Policy | A Conflict of Interest Policy is a critical document required for a 501(c)(3) application to ensure nonprofit board members and officers disclose any personal or financial interests that could influence organizational decisions. This policy helps maintain transparency, protect the nonprofit's tax-exempt status, and demonstrate adherence to IRS governance standards. |

| 6 | Statement of Receipts and Expenses | A detailed Statement of Receipts and Expenses is essential for a 501(c)(3) application, documenting all sources of income and expenditures to demonstrate financial transparency and compliance with IRS requirements. This financial statement helps verify the nonprofit's ability to manage funds responsibly and supports the organization's eligibility for tax-exempt status. |

| 7 | Balance Sheet | A nonprofit applying for 501(c)(3) status must include a recent balance sheet that details assets, liabilities, and net assets to demonstrate financial stability and accountability. This document provides the IRS with a clear snapshot of the organization's financial position, essential for evaluating eligibility for tax-exempt status. |

| 8 | Narrative of Activities | The Narrative of Activities for a 501(c)(3) application must clearly describe the nonprofit's past, present, and planned programs to demonstrate its charitable purpose under IRS guidelines. Detailed explanations should include specific activities, beneficiaries, and how these efforts align with exempt purposes such as education, religion, or public charity. |

| 9 | List of Board of Directors | The 501(c)(3) application requires a detailed List of Board of Directors, including names, addresses, and titles, to demonstrate governance structure and accountability. This documentation ensures compliance with IRS regulations and provides transparency regarding the nonprofit's leadership. |

| 10 | Governing Board Meeting Minutes | Governing board meeting minutes are essential for the 501(c)(3) application as they provide documented evidence of the nonprofit's formal approval of its formation, bylaws, and key organizational decisions. These minutes demonstrate the board's oversight and commitment to compliance with IRS requirements, reinforcing the nonprofit's legitimacy and governance structure. |

| 11 | Detailed Proposed Budget | A detailed proposed budget for a 501(c)(3) application must include itemized revenue sources, anticipated expenses, and cash flow projections to demonstrate financial sustainability and alignment with the nonprofit's mission. This budget should clearly distinguish between program services, administrative costs, and fundraising expenses to ensure transparency and compliance with IRS requirements. |

| 12 | Fundraising Plan | A comprehensive fundraising plan is essential for a 501(c)(3) application, detailing strategies for donor engagement, grant acquisition, and revenue diversification to demonstrate financial sustainability. This document supports the IRS's requirement to assess the organization's ability to maintain ongoing operations and fund charitable activities effectively. |

| 13 | Description of Past, Current, and Planned Activities | A comprehensive Description of Past, Current, and Planned Activities is essential for a 501(c)(3) application, detailing all nonprofit operations to demonstrate alignment with tax-exempt purposes under IRS guidelines. This document must clearly outline the organization's mission-driven programs, accomplishments, and future initiatives to establish its commitment to charitable, educational, or religious activities. |

| 14 | Copy of State Charity Registration (if required) | A copy of the state charity registration is often required for the 501(c)(3) application to demonstrate compliance with state-level charitable solicitation laws and verify the nonprofit's legitimacy. This document ensures the organization has met specific state requirements, which can vary widely, and is crucial for federal tax-exempt status approval. |

| 15 | Written Consent to Incorporate (where applicable) | A Written Consent to Incorporate serves as official approval from initial directors or incorporators authorizing the nonprofit's formation and submission of the 501(c)(3) application, ensuring compliance with state requirements. This document is essential when state law permits incorporation without a formal meeting, validating the organization's legal status and governance structure. |

| 16 | State Tax Exemption Application (if applicable) | Nonprofits applying for 501(c)(3) status often need to submit a State Tax Exemption Application, which includes proof of federal tax-exempt status, the organization's articles of incorporation, and a detailed description of activities. This application ensures exemption from state income, sales, and property taxes, aligning state requirements with federal IRS guidelines to maintain compliance. |

Key IRS Forms Required for 501(c)(3) Application

To apply for 501(c)(3) status, your nonprofit must submit key IRS forms including Form 1023, the Application for Recognition of Exemption. Supporting documents such as organizing documents (articles of incorporation) and a detailed narrative of activities are essential to demonstrate your organization's purpose and operations. The IRS also requires Form 8718, the User Fee for Exempt Organization Determination Letter Request, to process the application efficiently.

Articles of Incorporation: Foundation of Your Nonprofit

The Articles of Incorporation serve as the foundational document required for a 501(c)(3) application. This legal paper establishes the nonprofit's existence and outlines its purpose, which must align with IRS requirements for tax-exempt status. Ensuring that your Articles of Incorporation include specific language about the organization's mission and dissolution clauses is critical for approval.

Bylaws: Governing Rules for Financial Oversight

Bylaws serve as the essential governing rules that outline financial oversight for a nonprofit applying for 501(c)(3) status. These documents establish clear procedures to ensure responsible management and compliance.

- Financial Management Procedures - Bylaws define policies for budgeting, accounting, and expenditure approvals to maintain transparency.

- Board Responsibilities - The rules specify the fiduciary duties of board members in overseeing the nonprofit's financial activities.

- Conflict of Interest Policies - Your bylaws include guidelines to prevent conflicts that could jeopardize the organization's tax-exempt status.

Employer Identification Number (EIN) Application

Obtaining an Employer Identification Number (EIN) is a crucial step when applying for 501(c)(3) tax-exempt status for a nonprofit organization. The EIN serves as the organization's federal tax ID and is required for all IRS filings and legal activities.

- EIN Application Form - Form SS-4 must be completed and submitted to the IRS to request an EIN for the nonprofit entity.

- Online EIN Application - The IRS offers an online application process that provides immediate EIN issuance for eligible organizations.

- Proof of EIN Assignment - Confirmation of EIN issuance from the IRS is necessary to include with the 501(c)(3) application package as official identification.

Detailed Financial Statements and Budgets

What detailed financial statements and budgets are required for a 501(c)(3) nonprofit application? Detailed financial statements must include current assets, liabilities, income, and expenses to demonstrate fiscal responsibility. A comprehensive budget outlines projected revenue and expenditures, ensuring transparency and effective financial planning for the IRS review process.

Conflict of Interest Policy Documentation

Nonprofit organizations applying for 501(c)(3) status must submit specific documentation to demonstrate compliance with IRS requirements. One critical document is the Conflict of Interest Policy, which ensures ethical governance and transparency.

- Conflict of Interest Policy - A formal document outlining procedures to identify and manage conflicts among board members and staff.

- Board Approval - Evidence of the board's review and adoption of the Conflict of Interest Policy, typically through meeting minutes or resolutions.

- Disclosure Statements - Signed forms from board members affirming any potential conflicts and commitment to abide by the policy.

Including comprehensive Conflict of Interest Policy documentation strengthens the nonprofit's 501(c)(3) application by demonstrating governance integrity.

Board of Directors’ Information and Responsibilities

When applying for 501(c)(3) status, your nonprofit must provide detailed information about the Board of Directors. This includes names, addresses, and brief biographies of each board member.

Board members hold fiduciary responsibilities such as overseeing financial management and ensuring compliance with nonprofit laws. Their roles and duties should be clearly documented to demonstrate governance structure to the IRS.

Narrative of Programs and Financial Activities

The Narrative of Programs is a crucial document for the 501(c)(3) application, detailing the nonprofit's mission, services, and target beneficiaries. This narrative explains how the organization's activities align with its charitable purpose and demonstrates its impact on the community.

The Financial Activities section requires detailed financial statements, including a budget, past financial reports, and projections. These documents provide transparency about the nonprofit's funding sources, expenditures, and financial sustainability. Accurate financial records help the IRS evaluate the organization's ability to responsibly manage tax-exempt funds.

Proof of State-Level Compliance and Registration

Proof of state-level compliance and registration is a critical component of your 501(c)(3) application. This includes documentation showing that your nonprofit is properly registered with the appropriate state agency, such as the Secretary of State or Charity Bureau.

Examples of acceptable proof include a state registration certificate, a copy of your state tax exemption letter, or a confirmation letter from the state regulatory authority. Ensuring you have these documents ready supports a smoother federal application process and confirms your organization operates legally within your state.

What Documents Does a Nonprofit Need for 501(c)(3) Application? Infographic