To recover from identity theft involving financial accounts, key documents include a government-issued photo ID, proof of address such as utility bills, and a completed Identity Theft Report from the Federal Trade Commission (FTC). Bank statements, credit reports, and any correspondence with financial institutions help establish unauthorized transactions and support your claim. Submitting these documents promptly aids in restoring account security and resolving fraudulent activity efficiently.

What Documents Are Needed for Identity Theft Recovery for Financial Accounts?

| Number | Name | Description |

|---|---|---|

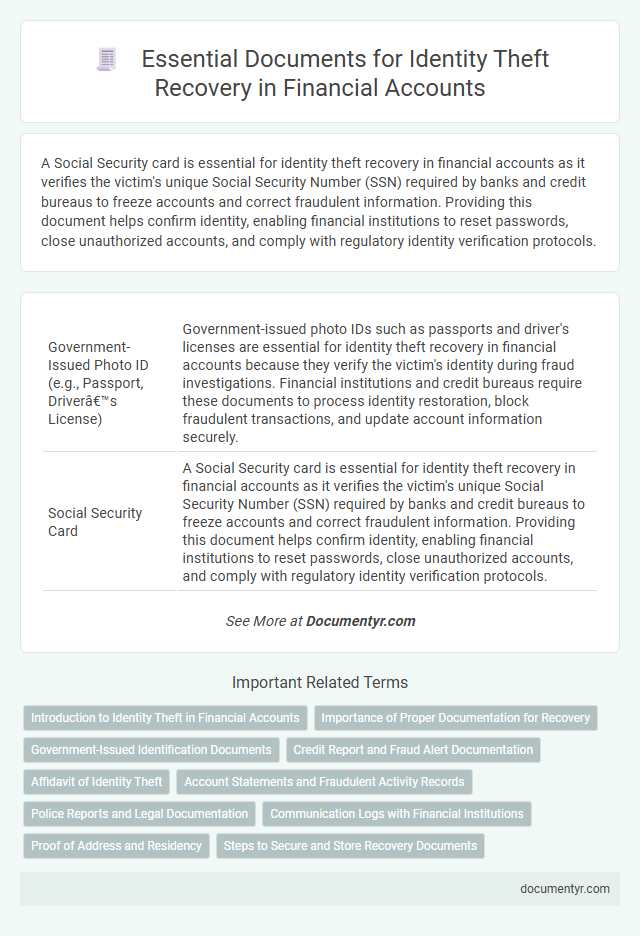

| 1 | Government-Issued Photo ID (e.g., Passport, Driver’s License) | Government-issued photo IDs such as passports and driver's licenses are essential for identity theft recovery in financial accounts because they verify the victim's identity during fraud investigations. Financial institutions and credit bureaus require these documents to process identity restoration, block fraudulent transactions, and update account information securely. |

| 2 | Social Security Card | A Social Security card is essential for identity theft recovery in financial accounts as it verifies the victim's unique Social Security Number (SSN) required by banks and credit bureaus to freeze accounts and correct fraudulent information. Providing this document helps confirm identity, enabling financial institutions to reset passwords, close unauthorized accounts, and comply with regulatory identity verification protocols. |

| 3 | Financial Account Statements (Bank, Credit Card, Investment) | Financial account statements, including bank, credit card, and investment statements, are essential documents for identity theft recovery as they provide detailed transaction histories and evidence of unauthorized activities. These statements help financial institutions verify fraudulent charges and expedite the restoration of compromised accounts. |

| 4 | Fraudulent Account Statements/Transaction Records | Fraudulent account statements and transaction records are essential documents for identity theft recovery in financial accounts, providing clear evidence of unauthorized activities. Submitting these records to financial institutions and credit bureaus supports dispute resolutions and helps restore account integrity. |

| 5 | Police Report or Incident Report | A detailed police report or incident report is essential for identity theft recovery in financial accounts, serving as official documentation of the fraudulent activity. This report must include specific information such as the date of the crime, description of the identity theft, and any compromised account details to assist financial institutions in investigating and reversing unauthorized transactions. |

| 6 | FTC Identity Theft Report (IdentityTheft.gov) | The FTC Identity Theft Report, available at IdentityTheft.gov, serves as a critical document for recovering financial accounts after identity theft by providing an official record of the fraud and personalized recovery steps. This report helps victims communicate with banks, credit bureaus, and creditors to restore account security and correct fraudulent activity efficiently. |

| 7 | Credit Report (from all Credit Bureaus) | Obtaining credit reports from all three major credit bureaus--Equifax, Experian, and TransUnion--is essential for identity theft recovery, as these documents reveal unauthorized accounts and fraudulent activities impacting financial accounts. Reviewing discrepancies on Equifax, Experian, and TransUnion reports helps victims to dispute inaccuracies and initiate alerts or freezes to protect credit profiles from further damage. |

| 8 | Notarized Identity Theft Affidavit | A notarized identity theft affidavit is a crucial document required for recovering financial accounts compromised by identity theft, serving as a formal declaration of the fraudulent activity. This affidavit must be completed accurately and notarized to authenticate the victim's claim, facilitating the restoration of accounts and protection against further unauthorized transactions. |

| 9 | Proof of Address (Utility Bill, Lease, Mortgage Statement) | Proof of address documents such as utility bills, lease agreements, or mortgage statements are essential for identity theft recovery in financial accounts, as they verify the victim's current residence and help financial institutions confirm identity. These documents must be recent, typically within the last three months, to ensure accuracy and support the restoration of account control during the fraud resolution process. |

| 10 | Sworn Statement/Affidavit of Unauthorized Activity | A Sworn Statement or Affidavit of Unauthorized Activity is essential for identity theft recovery in financial accounts, as it formally documents the fraudulent transactions and asserts that the claimant did not authorize them. This legal declaration supports disputes with financial institutions, enabling the reversal of unauthorized charges and the restoration of account security. |

| 11 | Correspondence with Financial Institutions | Correspondence with financial institutions during identity theft recovery typically includes fraud affidavits, dispute letters, police reports, and identity verification documents such as passports or driver's licenses. Maintaining copies of all communication, including emails and certified mail receipts, ensures accurate record-keeping and supports expedited resolution of unauthorized transactions. |

| 12 | Affidavit of Forgery | An Affidavit of Forgery is crucial for identity theft recovery in financial accounts as it formally declares unauthorized transactions or forged signatures, helping institutions validate the fraud claim. This document, combined with government-issued ID, police reports, and account statements, strengthens the recovery process and expedites dispute resolution. |

| 13 | Power of Attorney (if applicable) | A Power of Attorney document is essential for identity theft recovery in financial accounts when a trusted individual must act on behalf of the victim to resolve fraudulent activities. This legal authorization enables access to banks, credit card companies, and credit bureaus to expedite account restoration and dispute processes. |

| 14 | Legal Name Change Documentation (if applicable) | Legal name change documentation, such as a certified court order or updated government-issued identification, is essential for identity theft recovery when a victim has changed their name. Financial institutions require these documents to verify the identity and update accounts accurately, ensuring secure restoration of access. |

| 15 | Dispute Forms (from Financial Institutions or Credit Bureaus) | Dispute forms from financial institutions or credit bureaus are essential documents for identity theft recovery as they initiate the formal process to correct fraudulent activities on financial accounts. Submitting accurately completed dispute forms with supporting proof, such as government-issued ID or police reports, helps expedite account restoration and credit history correction. |

Introduction to Identity Theft in Financial Accounts

Identity theft in financial accounts occurs when unauthorized individuals access or misuse personal financial information. Recovering from such fraud involves presenting key documents to verify identity and restore account security.

- Government-Issued Identification - Valid photo IDs such as a passport or driver's license are essential to prove your identity during the recovery process.

- Fraudulent Activity Reports - Copies of police reports or identity theft affidavits document the unauthorized access or transactions in your accounts.

- Financial Account Statements - Recent statements highlight unauthorized transactions and help in disputing fraudulent charges with the financial institution.

Importance of Proper Documentation for Recovery

Proper documentation plays a critical role in the identity theft recovery process for financial accounts. Collecting and submitting the right documents ensures faster resolution and protection against further fraud.

- Police Report - Provides an official record of the identity theft incident required by financial institutions.

- Identity Proof - Valid government-issued ID such as a passport or driver's license to verify the victim's identity.

- Fraudulent Transaction Records - Statements or notices highlighting unauthorized transactions support dispute claims.

Maintaining accurate and complete documentation drastically improves the chances of successful recovery and account restoration.

Government-Issued Identification Documents

Government-issued identification documents play a crucial role in identity theft recovery for financial accounts. These documents confirm your identity and help financial institutions verify unauthorized activity.

- Driver's License - This card provides a photo ID along with your full name and birth date to confirm your identity.

- Passport - A passport serves as an internationally recognized form of identification with comprehensive personal details.

- State Identification Card - Issued by state authorities, this card is an alternative photo ID that verifies your identity without driving privileges.

Credit Report and Fraud Alert Documentation

To recover from identity theft involving financial accounts, obtaining a current credit report is essential for identifying unauthorized activities. Filing fraud alerts with credit bureaus requires documentation such as a government-issued ID and a police report or identity theft affidavit. These documents help to promptly block fraudulent attempts and restore the accuracy of credit information.

Affidavit of Identity Theft

What documents are needed for identity theft recovery for financial accounts? The Affidavit of Identity Theft is a critical document that helps verify the victim's claim to financial institutions. This affidavit outlines the fraudulent activity and provides essential details to begin the recovery process.

Account Statements and Fraudulent Activity Records

Account statements serve as crucial evidence when recovering from identity theft in financial accounts. These documents clearly display unauthorized transactions and discrepancies over specific periods.

Fraudulent activity records, including police reports and fraud alerts from credit bureaus, strengthen your case by officially documenting the misuse. Collecting monthly or quarterly statements from affected accounts highlights irregular spending patterns and unauthorized withdrawals. Providing detailed and organized records accelerates the verification and resolution process with financial institutions.

Police Reports and Legal Documentation

Recovering from identity theft on financial accounts requires specific documentation to prove your identity and report the fraudulent activity. Police reports serve as official evidence of the crime and are often necessary when working with financial institutions and credit bureaus.

Legal documentation such as sworn affidavits or identity theft reports further support your case by detailing the unauthorized actions taken in your name. Ensuring you have these documents ready streamlines the recovery process and helps restore your financial security.

Communication Logs with Financial Institutions

| Document Type | Description | Purpose |

|---|---|---|

| Communication Logs with Financial Institutions | Detailed records of phone calls, emails, and written correspondence between You and your bank or credit card company regarding identity theft incidents. | Serve as proof of timely reporting and efforts made to resolve fraudulent activity; help verify the timeline of events and responses from the institution. |

| Identity Theft Report | Official police report or identity theft affidavit filed with law enforcement or the Federal Trade Commission (FTC). | Essential for formally documenting the identity theft and supporting disputes with financial institutions. |

| Financial Account Statements | Copies of account statements showing unauthorized transactions or unusual activity. | Provide evidence of fraudulent charges requiring reversal or investigation. |

| Government-Issued Identification | Valid photo ID such as a driver's license or passport. | Proves Your identity when communicating with financial institutions for account recovery and dispute resolution. |

| Fraud Dispute Letters | Letters sent to financial institutions disputing fraudulent transactions. | Document the official complaint and request for charge reversals or account freezes. |

Proof of Address and Residency

Proof of address and residency documents are essential for identity theft recovery related to financial accounts. Commonly accepted documents include utility bills, bank statements, or government-issued letters showing the victim's name and current address. These proofs help verify the identity of the account holder and restore control over compromised financial accounts.

What Documents Are Needed for Identity Theft Recovery for Financial Accounts? Infographic