To apply for student loan forgiveness, you must submit documents including your loan statements, proof of eligible employment, and a completed forgiveness application form. Additional paperwork may involve tax returns, income verification, and certification of employment by your employer. Accurate and timely submission of these documents ensures smooth processing of your forgiveness request.

What Documents Must You Submit for Student Loan Forgiveness Applications?

| Number | Name | Description |

|---|---|---|

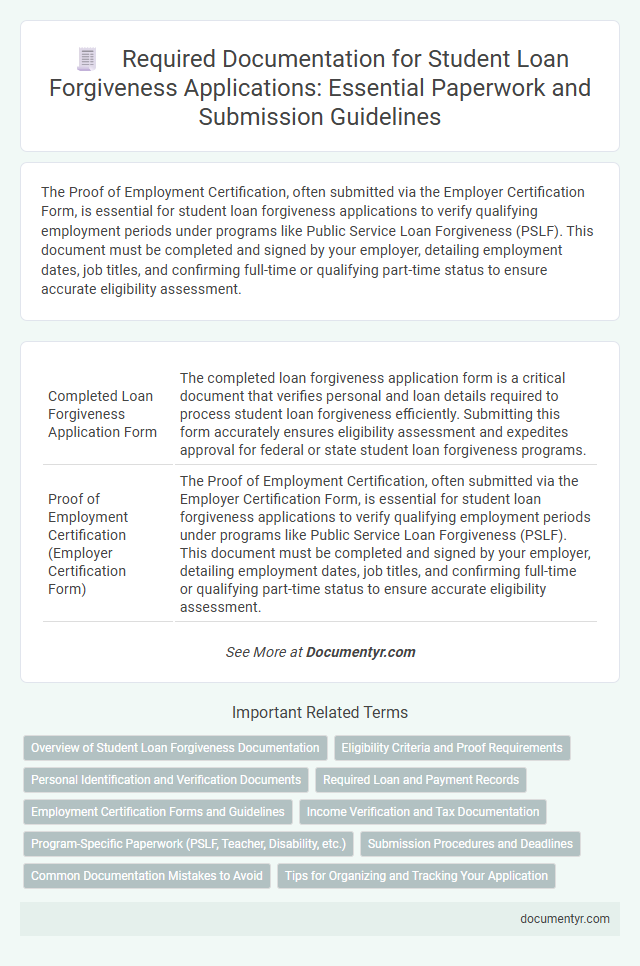

| 1 | Completed Loan Forgiveness Application Form | The completed loan forgiveness application form is a critical document that verifies personal and loan details required to process student loan forgiveness efficiently. Submitting this form accurately ensures eligibility assessment and expedites approval for federal or state student loan forgiveness programs. |

| 2 | Proof of Employment Certification (Employer Certification Form) | The Proof of Employment Certification, often submitted via the Employer Certification Form, is essential for student loan forgiveness applications to verify qualifying employment periods under programs like Public Service Loan Forgiveness (PSLF). This document must be completed and signed by your employer, detailing employment dates, job titles, and confirming full-time or qualifying part-time status to ensure accurate eligibility assessment. |

| 3 | Pay Stubs or W-2 Forms | Submit recent pay stubs or W-2 forms to verify income and employment status when applying for student loan forgiveness, as these documents provide essential proof of your financial situation. Accurate income verification helps determine eligibility for income-driven repayment plans and loan forgiveness programs. |

| 4 | IRS Tax Return Transcripts | IRS tax return transcripts are essential documents for student loan forgiveness applications, providing verified proof of income required to determine eligibility and repayment amounts. These transcripts must be obtained directly from the IRS to ensure accuracy and must typically cover the most recent tax years specified by the loan servicer or forgiveness program. |

| 5 | Loan Payment History Records | Loan payment history records are essential for student loan forgiveness applications, as they verify on-time payments and eligibility for repayment-based forgiveness programs. Providing detailed statements from loan servicers ensures accurate assessment of your compliance with program requirements and supports approval of your forgiveness request. |

| 6 | Documentation of Qualifying Loan Types | To apply for student loan forgiveness, you must submit official documents such as loan promissory notes, account statements, and letters from your loan servicer confirming the loan type as Direct Loans or other qualifying federal loans. Ensuring these documents clearly indicate the loan's eligibility under programs like Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness is essential for verifying qualification. |

| 7 | Proof of Full-Time Employment Status | Proof of full-time employment status for student loan forgiveness applications typically requires official employment verification letters from your employer, detailing your job title, employment dates, and confirmation of full-time hours, often defined as a minimum of 30 hours per week. Pay stubs, tax documents like W-2 forms, and signed affidavits may also be accepted to substantiate continuous full-time employment in qualifying positions. |

| 8 | Public Service Organization Verification | Public service loan forgiveness applications require submitting employer certification forms that verify employment at qualifying public service organizations, including detailed job titles and hours worked. Applicants must provide official payroll records or employer letters confirming their status and duration of employment to ensure eligibility. |

| 9 | Teacher Certification/Assignment Forms (for Teacher Loan Forgiveness) | Teacher Loan Forgiveness applications require submitting official Teacher Certification forms confirming full-time employment in a low-income school, alongside proof of qualifying teaching assignments verified by school administrators. Documentation must include detailed records of subjects taught, dates of service, and school eligibility to ensure compliance with Department of Education guidelines. |

| 10 | Disability Discharge Documentation (if applying for disability-based forgiveness) | Applicants seeking student loan forgiveness through disability discharge must submit documentation from the U.S. Department of Veterans Affairs (VA) confirming a service-connected disability rating of 100%, a Social Security Administration (SSA) notice of disability award, or a physician's certification verifying total and permanent disability. These documents are critical to substantiate the disability claim and ensure eligibility for loan discharge under programs such as Total and Permanent Disability (TPD) Discharge. |

| 11 | Military Service Records (if applying for military-related forgiveness) | Military service members applying for student loan forgiveness under military-related programs must submit official Military Service Records, such as DD Form 214 or current active duty orders, to verify eligibility. Accurate documentation of service dates, discharge status, and military branch is essential for the Department of Education to process the forgiveness application efficiently. |

| 12 | Income-Driven Repayment Plan Documentation | Income-Driven Repayment Plan documentation for student loan forgiveness applications typically requires recent tax returns, IRS tax transcripts, or alternative income documentation such as pay stubs or signed statements of income. Submitting these documents verifies eligibility by demonstrating income levels and payment plans aligned with forgiveness program criteria. |

| 13 | Proof of Payments Made Under Qualifying Repayment Plan | Proof of payments made under a qualifying repayment plan requires submitting bank statements, loan servicer payment history, or canceled checks that demonstrate consistent on-time payments. Accurate documentation of payment dates, amounts, and loan account details is essential to verify eligibility for student loan forgiveness programs. |

| 14 | Proof of Federal Student Loan Consolidation (if applicable) | Proof of Federal Student Loan Consolidation requires submitting a Consolidation Loan Disclosure Statement or a loan payoff confirmation letter from your loan servicer to verify the consolidation date and status. This documentation ensures your application for student loan forgiveness correctly reflects any consolidated federal student loans, which is critical for eligibility under forgiveness programs. |

| 15 | Personal Identification (Driver’s License, Social Security Card) | Submit valid personal identification documents such as a government-issued driver's license and your Social Security card to verify your identity when applying for student loan forgiveness. These documents are essential for confirming your eligibility and ensuring accurate processing of your application. |

Overview of Student Loan Forgiveness Documentation

Student loan forgiveness applications require a specific set of documents to verify eligibility and ensure accurate processing. Proper documentation provides the necessary proof of your loan status, employment, and repayment history.

- Proof of Income - Submit recent pay stubs or tax returns to confirm your income level for income-driven forgiveness programs.

- Loan Account Statements - Provide detailed statements from your loan servicer showing your repayment history and current balance.

- Employment Certification - Include official documentation from your employer verifying your employment duration and status for programs like Public Service Loan Forgiveness.

Eligibility Criteria and Proof Requirements

To apply for student loan forgiveness, applicants must submit documents proving eligibility, such as employment verification, income statements, and loan history reports. Proof requirements often include tax returns, pay stubs, and detailed loan statements from servicers to confirm payment compliance and program participation. Meeting specific criteria like public service employment or income-driven repayment plans is essential for approval of forgiveness applications.

Personal Identification and Verification Documents

What personal identification and verification documents are required for student loan forgiveness applications?

Applicants must submit government-issued photo identification, such as a valid passport or driver's license. Proof of Social Security number and recent utility bills or bank statements may also be required to verify residency and identity.

Required Loan and Payment Records

Submitting accurate loan and payment records is crucial for student loan forgiveness applications. These documents verify your eligibility and ensure proper credit toward forgiveness programs.

Required records typically include the original loan agreement, payment history, and statements reflecting all payments made. Lenders or servicers provide these documents, which confirm the loan balance and compliance with repayment terms.

Employment Certification Forms and Guidelines

Employment Certification Forms are critical documents when applying for student loan forgiveness, as they verify qualifying employment. These forms must be accurately completed to meet program guidelines and ensure loan forgiveness eligibility.

- Employment Verification - Confirm your job title, employer name, and dates of employment on the certification form.

- Authorized Signatures - Obtain signatures from your employer or an authorized official to validate the form's authenticity.

- Submission Frequency - Submit updated forms annually or as required to document ongoing qualifying employment.

Following the guidelines for Employment Certification Forms helps secure approval for student loan forgiveness programs effectively.

Income Verification and Tax Documentation

Income verification is crucial for student loan forgiveness applications to determine eligibility and repayment plans. Applicants must provide accurate documentation reflecting their current financial status.

Tax documentation typically includes recent federal tax returns, W-2 forms, and sometimes pay stubs to verify income. The IRS Tax Transcript is often required for additional validation. This information helps loan servicers assess the borrower's income-driven repayment plan or qualify for forgiveness programs.

Program-Specific Paperwork (PSLF, Teacher, Disability, etc.)

Student loan forgiveness applications require program-specific paperwork tailored to each forgiveness program. For Public Service Loan Forgiveness (PSLF), applicants must submit an Employment Certification Form verifying qualifying employment. Teacher loan forgiveness demands submission of documentation proving teaching service in eligible schools, while disability discharge applications need comprehensive medical documentation confirming total and permanent disability.

Submission Procedures and Deadlines

| Document Type | Description | Submission Method | Deadline |

|---|---|---|---|

| Loan Account Information | Official statements or documentation confirming your student loan account details, including lender name and loan balance. | Upload via the loan servicer's secure online portal or submit by mail as instructed. | Submit within 30 days of application initiation or by the stated program deadline. |

| Proof of Employment | Verification of employment from qualifying employers, usually including employer certification forms or pay stubs. | Submit electronically through the forgiveness program's approved submission channels or by certified mail. | Must be submitted concurrently with the application or by the specific deadline outlined in the forgiveness program guidelines. |

| Income Documentation | Tax returns or pay statements verifying income to confirm eligibility under income-driven repayment plans tied to forgiveness. | Upload digital copies via the designated online system or provide physical documents where allowed. | Deadline aligns with annual application period, typically ending on December 31 of each program year. |

| Identification Documents | Government-issued ID such as driver's license or passport for identity verification during application processing. | Upload scanned copies through secure portal or include certified copies with mailed application packets. | Submission required before or at the time of application review to avoid processing delays. |

| Official Forgiveness Application Form | Completed application form specific to the forgiveness program, detailing personal, loan, and employment information. | Complete and submit online via the official program website or mail a hard copy to the designated address. | Applications must be received before the program's cut-off date, often posted annually by the loan servicer or federal agency. |

Common Documentation Mistakes to Avoid

Submitting accurate documents is crucial for student loan forgiveness applications. Common required documents include proof of income, employment certification, and detailed loan statements.

Errors like missing signatures, outdated income tax returns, or incomplete employment verification delay processing. Ensuring all paperwork is current and thoroughly reviewed prevents application rejection.

What Documents Must You Submit for Student Loan Forgiveness Applications? Infographic