Receipts necessary for college tuition tax credits include official tuition statements such as Form 1098-T provided by educational institutions, which detail the amount paid for qualified tuition and related expenses. Students should also keep receipts for required fees, books, supplies, and equipment that are directly related to enrollment or attendance. Maintaining clear documentation ensures eligibility for tax credits like the American Opportunity Credit and the Lifetime Learning Credit.

What Receipts Are Necessary for College Tuition Tax Credits?

| Number | Name | Description |

|---|---|---|

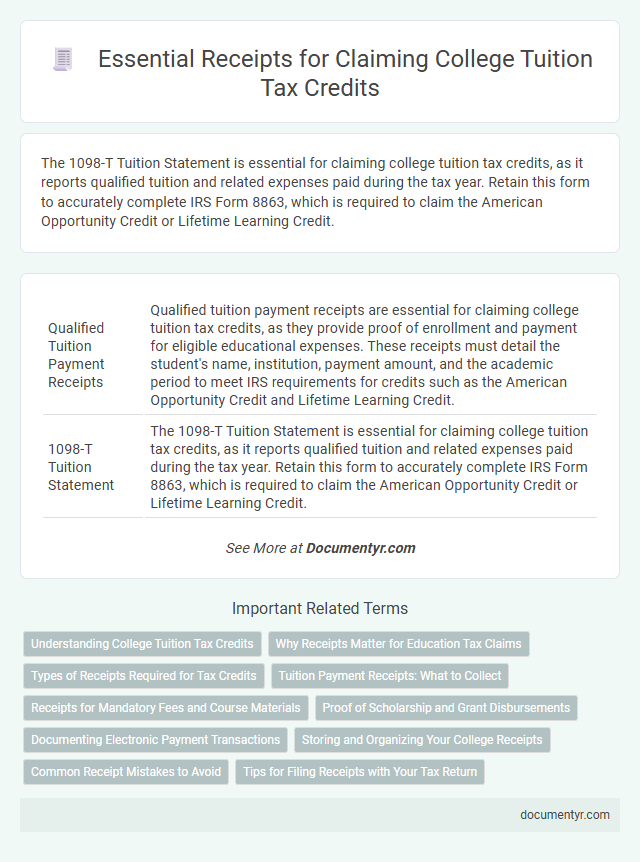

| 1 | Qualified Tuition Payment Receipts | Qualified tuition payment receipts are essential for claiming college tuition tax credits, as they provide proof of enrollment and payment for eligible educational expenses. These receipts must detail the student's name, institution, payment amount, and the academic period to meet IRS requirements for credits such as the American Opportunity Credit and Lifetime Learning Credit. |

| 2 | 1098-T Tuition Statement | The 1098-T Tuition Statement is essential for claiming college tuition tax credits, as it reports qualified tuition and related expenses paid during the tax year. Retain this form to accurately complete IRS Form 8863, which is required to claim the American Opportunity Credit or Lifetime Learning Credit. |

| 3 | Form W-9S Submission Confirmation | Form W-9S submission confirmation is essential for claiming college tuition tax credits, as it verifies the student's taxpayer identification information required by the IRS. Retaining this confirmation receipt ensures accurate reporting and compliance when filing education-related tax benefits such as the American Opportunity Credit or Lifetime Learning Credit. |

| 4 | Eligible Academic Fee Receipts | Eligible academic fee receipts for college tuition tax credits must include the official tuition invoice or payment confirmation issued by the educational institution, specifying the student's name, institution name, academic term, and the amount paid. Receipts for mandatory fees such as course materials, lab fees, and activity fees can also qualify if they are clearly itemized and related directly to the student's enrollment. |

| 5 | Enrollment Deposit Proof | Enrollment deposit proof is essential for claiming college tuition tax credits as it verifies the student's commitment to attend the institution. Receipts showing the amount paid for the enrollment deposit provide IRS-required documentation to substantiate eligible education expenses. |

| 6 | Course Material Purchase Receipts | Receipts for course material purchases, including textbooks, software, and supplies required for enrollment or attendance, are necessary to claim college tuition tax credits accurately. These receipts must clearly show the date, amount, and description of the items to ensure eligibility for education-related tax benefits. |

| 7 | Required Textbook Invoice | For college tuition tax credits, a detailed textbook invoice is necessary to verify the purchase of required course materials, including itemized costs and dates of purchase. This invoice must clearly associate the textbooks with the enrolled courses to qualify for educational tax benefits. |

| 8 | Technology Fee Documentation | Receipts for technology fees paid as part of college tuition are necessary to claim education tax credits such as the American Opportunity Credit or Lifetime Learning Credit. Documentation must clearly itemize the technology fee separately from other charges to ensure eligibility for the tax credit. |

| 9 | Scholarship Allocation Statement | A Scholarship Allocation Statement is essential for claiming college tuition tax credits because it details how scholarships were applied toward qualified educational expenses. This document helps verify the portion of funds allocated to tuition, fees, and course materials, ensuring accurate credit calculation on tax returns. |

| 10 | Virtual Learning Access Charge Receipts | Receipts for Virtual Learning Access Charges are necessary to claim college tuition tax credits, as they provide proof of payments made for internet access required for online education. These receipts must itemize charges specifically related to virtual learning services to qualify for tax deductions or credits. |

Understanding College Tuition Tax Credits

Understanding which receipts are necessary for college tuition tax credits is crucial for maximizing your eligible savings. Proper documentation ensures you can claim credits like the American Opportunity Credit and Lifetime Learning Credit without issues.

- Tuition Payment Receipts - Receipts from the educational institution confirming the amount paid for qualified tuition and related fees are essential.

- Form 1098-T - This form provided by colleges reports the amount billed for tuition, crucial for verifying educational expenses.

- Receipts for Required Course Materials - Some course materials required by the institution may qualify if purchased directly from the school or included in tuition.

Keeping accurate receipts and documentation allows taxpayers to confidently claim the maximum college tuition tax credits available.

Why Receipts Matter for Education Tax Claims

Receipts are essential documents when claiming college tuition tax credits to verify qualified education expenses. They serve as proof for tax authorities to ensure accurate credit claims and prevent fraud.

Maintaining detailed receipts supports compliance with IRS requirements for education-related tax benefits. Proper documentation enables taxpayers to maximize eligible credits and reduce the risk of audits.

- Tuition Payment Receipts - Demonstrate the amount paid directly to the educational institution for qualifying tuition and fees.

- Course Material Receipts - Validate expenses for required books and supplies that are necessary for enrollment or attendance.

- Institutional Statements - Official documents such as Form 1098-T that summarize billed tuition and scholarships for accurate tax reporting.

Types of Receipts Required for Tax Credits

Receipts necessary for college tuition tax credits include official tuition statements, such as the IRS Form 1098-T provided by educational institutions. Payment receipts that show the amount paid for qualified educational expenses, including tuition, fees, and course materials, are also required. Additional documentation like cancelled checks or credit card statements may support the claim but must clearly identify the payer and the educational institution.

Tuition Payment Receipts: What to Collect

Tuition payment receipts are essential documents for claiming college tuition tax credits. These receipts must clearly show the student's name, the amount paid, and the date of payment. Keep official receipts from the educational institution to ensure accurate and successful tax credit claims.

Receipts for Mandatory Fees and Course Materials

| Receipt Type | Description | Examples | Importance for College Tuition Tax Credits |

|---|---|---|---|

| Receipts for Mandatory Fees | Proof of payment for required student fees imposed by the educational institution | Lab fees, student activity fees, technology fees, enrollment fees | Essential to validate expenditures that qualify for tuition tax credits under IRS regulations |

| Receipts for Course Materials | Documentation of purchases necessary for course completion and instruction | Textbooks, workbooks, software required by the course syllabus | Needed to claim expenses that supplement tuition and contribute to eligible educational costs |

Proof of Scholarship and Grant Disbursements

Receipts for college tuition tax credits must include documentation of any scholarships or grants received. Proof of scholarship and grant disbursements helps verify the amount of financial aid that reduces your qualified education expenses.

Official award letters or disbursement statements from the educational institution serve as essential receipts. These documents confirm the exact funds applied toward tuition, ensuring accurate tax credit claims.

Documenting Electronic Payment Transactions

Receipts are essential for claiming college tuition tax credits, serving as proof of qualified education expenses. Documenting electronic payment transactions is crucial to ensure eligibility and accurate tax reporting.

Electronic payment receipts typically include details such as date, amount, and payee, which verify tuition payments made online or via electronic funds transfer. Maintaining digital copies or printed versions of these receipts helps substantiate your tax credit claims during audits or reviews. Payment confirmations from the educational institution's online portal also qualify as valid documentation for tax purposes.

Storing and Organizing Your College Receipts

What receipts are necessary for claiming college tuition tax credits? Receipts that detail tuition payments, mandatory fees, and course materials are essential for accurate tax reporting. Properly storing and organizing your college receipts ensures you can easily access them during tax season and maximize your eligible credits.

Common Receipt Mistakes to Avoid

Receipts required for college tuition tax credits must clearly indicate the amount paid, the institution's name, and the tax year. Ensuring accuracy on these receipts prevents delays or rejections in tax credit claims.

- Missing Payment Details - Receipts lacking the exact tuition amount paid can lead to disqualification of tax credits.

- Incorrect Institution Information - Receipts that do not include the official college or university name may not be accepted by tax authorities.

- Non-qualifying Expenses Included - Receipts showing fees for housing, books, or supplies alongside tuition can cause confusion and errors in tax credit calculations.

What Receipts Are Necessary for College Tuition Tax Credits? Infographic