International purchase receipt verification requires essential documents such as the original purchase receipt, proof of payment, and valid identification of the buyer. Customs declarations and export/import licenses may also be necessary depending on the product category and destination country. Accurate documentation ensures smooth verification and compliance with international trade regulations.

What Documents Are Required for International Purchase Receipt Verification?

| Number | Name | Description |

|---|---|---|

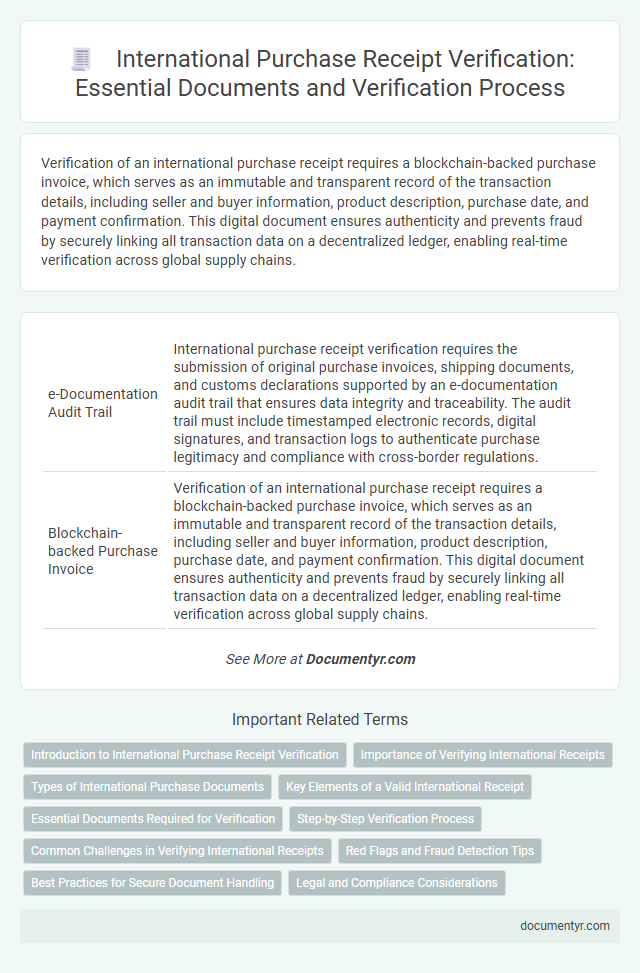

| 1 | e-Documentation Audit Trail | International purchase receipt verification requires the submission of original purchase invoices, shipping documents, and customs declarations supported by an e-documentation audit trail that ensures data integrity and traceability. The audit trail must include timestamped electronic records, digital signatures, and transaction logs to authenticate purchase legitimacy and compliance with cross-border regulations. |

| 2 | Blockchain-backed Purchase Invoice | Verification of an international purchase receipt requires a blockchain-backed purchase invoice, which serves as an immutable and transparent record of the transaction details, including seller and buyer information, product description, purchase date, and payment confirmation. This digital document ensures authenticity and prevents fraud by securely linking all transaction data on a decentralized ledger, enabling real-time verification across global supply chains. |

| 3 | Digital Certificate of Origin (eCO) | Verification of an international purchase receipt typically requires a Digital Certificate of Origin (eCO) to confirm the product's manufacturing country, ensuring compliance with trade regulations and eligibility for tariffs. The eCO, issued electronically by authorized chambers of commerce, serves as a secure and verifiable document that validates the authenticity and origin of goods in cross-border transactions. |

| 4 | Smart Customs Declaration Form | The Smart Customs Declaration Form is essential for international purchase receipt verification as it provides detailed information about the shipment, including item descriptions, values, and origin, allowing customs authorities to assess duties accurately. This electronic document must be submitted alongside the purchase receipt and commercial invoice to ensure seamless clearance and compliance with international trade regulations. |

| 5 | Electronic Bill of Lading (eB/L) | An Electronic Bill of Lading (eB/L) is a crucial document required for international purchase receipt verification, serving as a digital equivalent of the traditional paper bill of lading and providing proof of shipment and ownership of goods. Verification of the eB/L ensures authenticity, preventing fraud and facilitating efficient customs clearance and payment processing in cross-border transactions. |

| 6 | AI-based Transaction Validation Report | AI-based transaction validation reports require key documents such as the original international purchase receipt, proof of payment, and shipping confirmation to ensure authenticity. These reports utilize advanced algorithms to cross-verify invoice details, payment methods, and delivery data for accurate receipt verification. |

| 7 | Cross-border E-Invoicing (CbEI) | Cross-border E-Invoicing (CbEI) verification requires digital invoices compliant with international standards such as PEPPOL or UN/CEFACT, accompanied by customs declaration documents and payment proof to ensure transaction authenticity and regulatory compliance. Accurate receipt verification relies on the integration of standardized electronic documents, including purchase orders and shipping manifests, to streamline cross-border audit trails. |

| 8 | Import Compliance Statement (ICS) | The Import Compliance Statement (ICS) is a crucial document required for international purchase receipt verification, ensuring all imported goods comply with customs regulations and trade laws. This statement must include detailed information such as product descriptions, country of origin, values, and tariff classifications to facilitate accurate import duty assessments and prevent compliance breaches. |

| 9 | Harmonized System (HS) Code Authentication | Accurate international purchase receipt verification requires submission of customs documentation including the Harmonized System (HS) Code, which classifies traded products for global tariff and regulatory purposes. Proper HS Code authentication ensures compliance with trade regulations, facilitates customs clearance, and prevents discrepancies during cross-border transactions. |

| 10 | Supplier Due Diligence Attestation | Supplier Due Diligence Attestation requires documentation including the supplier's business registration, tax identification number, compliance certificates, and proof of ethical sourcing practices to verify legitimacy and adherence to regulations. These records ensure that the international purchase receipt is authentic, accurate, and aligned with anti-fraud and anti-corruption policies. |

Introduction to International Purchase Receipt Verification

International purchase receipt verification ensures the authenticity and accuracy of cross-border transactions. It involves validating documents essential for confirming the legitimacy of your international purchases.

- Purchase Invoice - A detailed document listing items purchased, prices, and transaction dates, critical for verification.

- Customs Declaration - Official paperwork submitted to customs authorities showing import details and compliance.

- Shipping Documents - Bills of lading or airway bills that track the movement of goods from the seller to the buyer.

Importance of Verifying International Receipts

Verifying international purchase receipts requires essential documents such as the original invoice, payment proof, and shipping confirmation. These documents ensure the authenticity of the transaction and facilitate smooth customs clearance.

Receipt verification plays a crucial role in preventing fraud and discrepancies in cross-border transactions. It helps businesses confirm that the goods received match the purchase agreement and comply with international trade regulations. Accurate verification also supports effective record-keeping and financial auditing processes.

Types of International Purchase Documents

International purchase receipt verification requires several key documents to ensure authenticity and compliance. These documents provide proof of transaction, shipment, and payment details.

Common types of international purchase documents include the commercial invoice, bill of lading, and packing list. Each document plays a crucial role in verifying the accuracy and legality of the purchase.

Key Elements of a Valid International Receipt

Key elements of a valid international receipt include the seller's contact information, detailed description of purchased goods or services, and the transaction date. Accurate representation of payment method and currency used is essential for verification. You must ensure the receipt contains a unique transaction or invoice number for traceability in the verification process.

Essential Documents Required for Verification

| Document | Description |

|---|---|

| Original Purchase Receipt | Proof of transaction including item details, purchase date, and total amount paid. Essential for validating the purchase. |

| Invoice | Detailed billing document from the seller showing costs of items or services, taxes, and payment terms. |

| Payment Proof | Bank statements, credit card slips, or electronic payment confirmations that verify the transaction. |

| Shipping Documents | Bill of lading, air waybill, or courier receipt establishing shipment and delivery of goods internationally. |

| Customs Declaration Forms | Official papers used for customs clearance showing that goods were legally imported or exported. |

| Identification Documents | Personal identification may be required to confirm the purchaser's identity during verification. |

Your accuracy in submitting these essential documents ensures smooth international purchase receipt verification.

Step-by-Step Verification Process

International purchase receipt verification requires multiple documents to confirm transaction authenticity and compliance. A systematic approach ensures accuracy and prevents fraud in cross-border sales.

- Purchase Receipt - The original receipt or invoice showing item details, price, seller, and purchase date.

- Proof of Payment - Bank statements, credit card slips, or payment confirmations verifying the transaction.

- Shipping Documentation - Bills of lading, customs declarations, or tracking records verifying product shipment and delivery.

- Identification Documents - Buyer's government-issued ID or business license to validate the purchaser's identity.

- Product Authentication Certificates - Manufacturer or third-party certificates confirming product originality and specifications.

Following this documentation checklist streamlines the step-by-step verification process for international purchase receipts.

Common Challenges in Verifying International Receipts

Verifying international purchase receipts requires documents such as the original invoice, proof of payment, and shipping or customs documentation. These documents help authenticate the transaction and validate the purchase details across borders.

Common challenges in verifying international receipts include language barriers and differing invoice formats. Currency conversion discrepancies and inconsistent regulatory standards further complicate the verification process.

Red Flags and Fraud Detection Tips

International purchase receipt verification requires documents such as the original purchase receipt, proof of payment, and shipping details to confirm transaction authenticity. Red flags include mismatched purchase dates, inconsistent pricing, and missing or altered information on receipts. Fraud detection tips emphasize cross-checking seller credibility, verifying payment methods, and using secure platforms to reduce risks.

Best Practices for Secure Document Handling

Verifying international purchase receipts requires precise documentation to ensure authenticity and compliance with customs regulations. Secure handling of these documents prevents fraud and protects sensitive information during the verification process.

- Purchase Invoice - The invoice must clearly detail the buyer, seller, product description, quantity, price, and payment terms for validation.

- Bill of Lading - This shipping document confirms the transfer of goods and serves as proof of shipment and delivery logistics.

- Customs Declaration - Accurate customs forms are essential to verify compliance with import/export regulations and duties.

What Documents Are Required for International Purchase Receipt Verification? Infographic