Receipt documents required for business expense reimbursement typically include detailed invoices, itemized receipts, and proof of payment that clearly identify the date, vendor, and amount spent. These documents must comply with company policies and IRS regulations to ensure accurate record-keeping and tax compliance. Failure to provide proper receipts can lead to reimbursement delays or denials.

What Receipt Documents Are Required for Business Expense Reimbursement?

| Number | Name | Description |

|---|---|---|

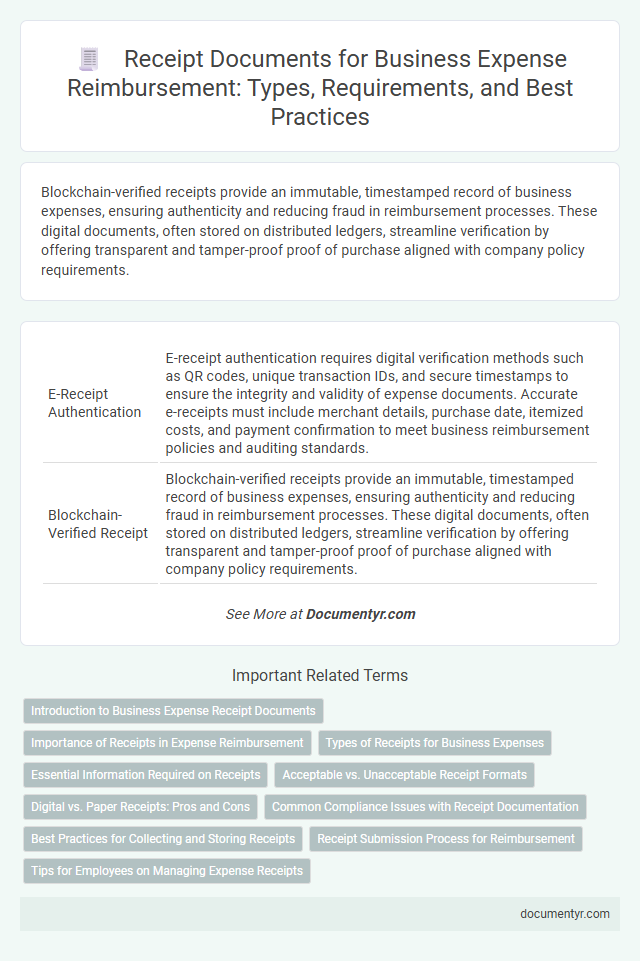

| 1 | E-Receipt Authentication | E-receipt authentication requires digital verification methods such as QR codes, unique transaction IDs, and secure timestamps to ensure the integrity and validity of expense documents. Accurate e-receipts must include merchant details, purchase date, itemized costs, and payment confirmation to meet business reimbursement policies and auditing standards. |

| 2 | Blockchain-Verified Receipt | Blockchain-verified receipts provide an immutable, timestamped record of business expenses, ensuring authenticity and reducing fraud in reimbursement processes. These digital documents, often stored on distributed ledgers, streamline verification by offering transparent and tamper-proof proof of purchase aligned with company policy requirements. |

| 3 | Digital Wallet Transaction Proof | Digital wallet transaction proof, including detailed e-receipts or transaction confirmation emails, is essential for business expense reimbursement to verify payment authenticity and transaction details. These digital receipts must display the date, amount, merchant name, and payment method to comply with accounting and auditing standards. |

| 4 | QR Code Expense Voucher | QR Code Expense Vouchers serve as essential receipt documents for business expense reimbursement, enabling quick verification and streamlined processing through scannable digital formats. These vouchers must include transaction details such as date, amount, vendor information, and QR code for compliance and accurate expense tracking. |

| 5 | Fintech-Integrated Expense Record | Fintech-integrated expense records streamline business expense reimbursement by automatically capturing and categorizing digital receipts, ensuring compliance with tax regulations and company policies. These records typically require itemized receipts showing vendor details, transaction dates, amounts, and payment methods to validate expense claims accurately. |

| 6 | AI-Generated Receipt Audit Trail | AI-generated receipt audit trails are essential for business expense reimbursement as they provide verifiable digital records that include timestamps, transaction details, and authenticity metadata, ensuring compliance with company policies and regulatory standards. These documents streamline the reimbursement process by reducing errors and enhancing transparency in expense verification. |

| 7 | Split-Payment Receipt Statement | Split-payment receipt statements are essential for business expense reimbursement as they clearly document each transaction's portion paid by different methods, ensuring accurate accounting and compliance with company policies. These receipts must itemize the split payments, including dates, amounts, and payment sources, to provide transparent evidence for audit and reimbursement approval processes. |

| 8 | Smart Invoice Attachment | Smart invoice attachment technology streamlines business expense reimbursement by automatically capturing and organizing receipt documents such as itemized invoices, payment proofs, and VAT details. This digital solution ensures accurate data extraction and compliance with company policies, reducing manual errors and accelerating approval processes. |

| 9 | Subscription Service Fiscal Proof | Subscription service fiscal proof for business expense reimbursement requires detailed receipts that include the vendor's name, subscription period, payment amount, and transaction date. These documents must comply with fiscal regulations, often featuring tax identification numbers and digital verification codes to validate authenticity. |

| 10 | Contactless Payment Receipt | Contactless payment receipts are essential documents for business expense reimbursement as they provide transaction details such as date, amount, merchant name, and payment method, verifying the legitimacy of the expense. These receipts support accurate accounting and compliance with corporate reimbursement policies by capturing electronic proof of payment without the need for physical signatures. |

Introduction to Business Expense Receipt Documents

Receipts play a crucial role in documenting business expenses for reimbursement purposes. Proper receipt documentation ensures compliance with company policies and tax regulations.

- Proof of Purchase - Receipts serve as official evidence of a transaction between a business and a vendor.

- Expense Verification - Detailed receipts validate the amount spent and the nature of the business expense.

- Tax Compliance - Accurate receipts help businesses maintain records required for tax deductions and audits.

Importance of Receipts in Expense Reimbursement

Receipts play a crucial role in business expense reimbursement by providing concrete proof of purchases. They validate the legitimacy of expenses, ensuring accurate financial records and compliance with company policies.

Submitting proper receipt documents is essential for timely reimbursement. Receipts typically must include the date, vendor name, amount paid, and description of the items or services purchased. You should keep original or digital copies of all receipts to avoid delays or denials in your expense claims.

Types of Receipts for Business Expenses

Receipt documents are essential for verifying business expenses and ensuring accurate reimbursement. Different types of receipts serve as proof of various expenditures incurred during business activities.

Common types of receipts for business expenses include itemized receipts, credit card slips, and digital payment confirmations. You should retain detailed receipts for meals, travel, lodging, office supplies, and client entertainment to support your reimbursement claims.

Essential Information Required on Receipts

Receipts are crucial for verifying business expenses and ensuring accurate reimbursement. Essential information on receipts helps maintain transparent financial records and compliance with company policies.

- Date of Purchase - The receipt must clearly show the transaction date to confirm the expense timing.

- Vendor Information - The business name and contact details of the vendor should be present to validate the source of the purchase.

- Itemized List of Goods or Services - Detailed descriptions and prices of purchased items ensure clarity of the reimbursed expense.

Acceptable vs. Unacceptable Receipt Formats

Business expense reimbursement requires clear and verifiable receipt documents to ensure accurate accounting and compliance. Understanding acceptable versus unacceptable receipt formats helps streamline the approval process.

- Acceptable Receipts - Legible printed or digital receipts that include the vendor's name, date of purchase, itemized list, and total amount are required for reimbursement.

- Unacceptable Formats - Handwritten notes, faded or incomplete receipts, and screenshots lacking key transaction details are commonly rejected.

- Electronic Copies - Scanned PDFs and mobile app-generated receipts with all transaction details intact are acceptable substitutes for paper receipts.

Submitting proper receipt documentation reduces delays and ensures successful expense reimbursement.

Digital vs. Paper Receipts: Pros and Cons

Receipt documents are essential for business expense reimbursement to validate your spending and comply with company policies. Both digital and paper receipts serve this purpose, but each format has distinct advantages and disadvantages.

Digital receipts offer easy storage, quick retrieval, and reduced risk of physical damage or loss. Paper receipts provide a tangible proof of purchase but are prone to fading, tearing, or misplacement over time.

Common Compliance Issues with Receipt Documentation

| Receipt Documentation Requirements for Business Expense Reimbursement |

|---|

|

| Common Compliance Issues with Receipt Documentation |

|

Best Practices for Collecting and Storing Receipts

Receipts required for business expense reimbursement typically include detailed transaction records showing the date, amount, vendor, and description of purchased goods or services. Best practices for collecting receipts involve obtaining original, itemized documents immediately after transactions and using digital tools to capture and organize them efficiently. Storing receipts securely in cloud-based systems ensures easy access, reduces loss risk, and supports compliance with financial auditing standards.

Receipt Submission Process for Reimbursement

Receipts required for business expense reimbursement must clearly detail the date, amount, and nature of the expense to ensure proper validation. The receipt submission process typically involves scanning or photographing the original document and uploading it to the company's designated expense management system. Accurate and timely submission of receipts facilitates quicker approval and reimbursement of business-related expenses.

What Receipt Documents Are Required for Business Expense Reimbursement? Infographic