Receipt documents needed for tax deductions typically include detailed proof of payment such as sales receipts, invoices, and official statements that clearly list the item or service purchased. These documents must show the date, amount paid, and the recipient's information to be valid for tax purposes. Keeping organized and legible receipt copies ensures accurate and efficient deduction claims on tax returns.

What Receipt Documents Are Needed for Tax Deductions?

| Number | Name | Description |

|---|---|---|

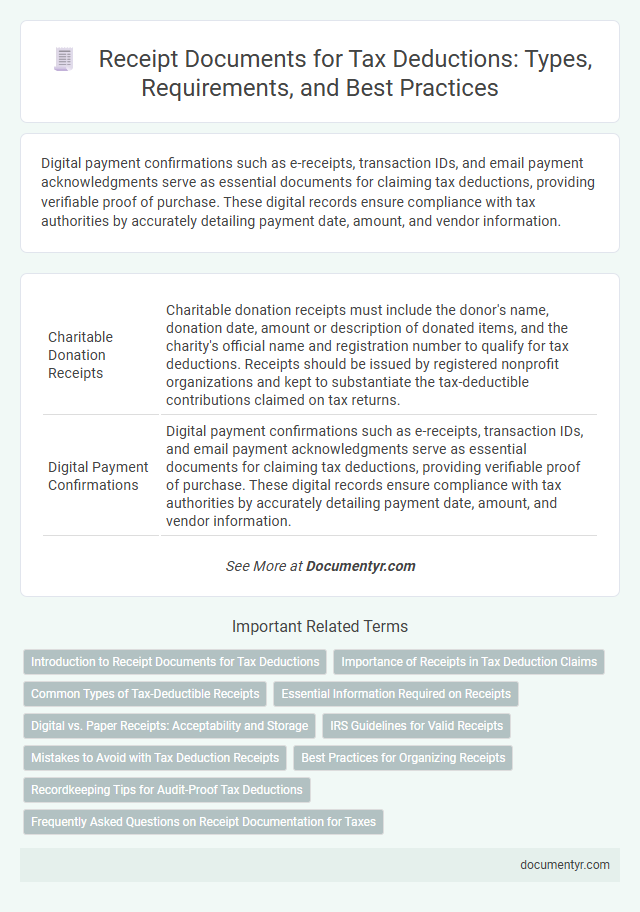

| 1 | Charitable Donation Receipts | Charitable donation receipts must include the donor's name, donation date, amount or description of donated items, and the charity's official name and registration number to qualify for tax deductions. Receipts should be issued by registered nonprofit organizations and kept to substantiate the tax-deductible contributions claimed on tax returns. |

| 2 | Digital Payment Confirmations | Digital payment confirmations such as e-receipts, transaction IDs, and email payment acknowledgments serve as essential documents for claiming tax deductions, providing verifiable proof of purchase. These digital records ensure compliance with tax authorities by accurately detailing payment date, amount, and vendor information. |

| 3 | E-Receipt Aggregators | E-receipt aggregators compile and organize digital receipts from multiple vendors, streamlining the documentation required for tax deductions by ensuring all transactions are accurately captured and readily accessible. These platforms enable taxpayers to maintain compliant records by automatically categorizing expenses and generating summaries aligned with tax authority standards. |

| 4 | Green Energy Credit Receipts | Receipts required for Green Energy Credit tax deductions must include detailed proof of purchase, installation dates, and certification of qualifying renewable energy equipment such as solar panels, wind turbines, or geothermal heat pumps. Proper documentation should also contain the supplier's name, cost breakdown, and compliance with IRS standards to validate eligibility and maximize the tax credit benefit. |

| 5 | Medical Expense E-Invoices | Medical expense e-invoices required for tax deductions must clearly itemize eligible medical services, costs, and the provider's tax identification number, ensuring compliance with tax authority guidelines. Digital receipts should be securely stored and accurately reflect payment dates and patient details to substantiate claims during audits. |

| 6 | Subscription Service Invoices | Subscription service invoices must clearly display the service provider's details, subscription period, payment amount, and transaction date to qualify as valid receipt documents for tax deductions. These invoices serve as essential proof of business expenses related to software, media, or professional memberships that can be deducted on tax returns. |

| 7 | Home Office Supply Receipts | Home office supply receipts required for tax deductions must clearly itemize purchased materials such as paper, ink, pens, and organizational tools used exclusively for business purposes. Receipts should include the date, vendor information, and amount paid to validate the deduction claim with IRS guidelines. |

| 8 | Ride-Sharing Expense Reports | Ride-sharing expense reports require detailed receipts that include the date, time, ride origin and destination, and fare amount to qualify for tax deductions. These receipts must be stored electronically or physically and should clearly differentiate personal rides from business trips for accurate expense tracking. |

| 9 | Cryptocurrency Transaction Receipts | Cryptocurrency transaction receipts needed for tax deductions must include details such as transaction date, amount, wallet addresses, transaction ID, and fair market value at the time of transfer. Maintaining digital or printed copies of exchange statements, wallet records, and receipts for purchases made with crypto ensures accurate reporting for IRS compliance. |

| 10 | Freelancer Platform Fee Statements | Freelancers must retain platform fee statements as essential receipt documents to claim tax deductions, ensuring clear evidence of business expenses related to service fees. These statements detail the transaction amounts and dates, supporting accurate expense reporting for tax authorities. |

Introduction to Receipt Documents for Tax Deductions

Receipt documents play a crucial role in supporting your claims for tax deductions. Understanding which receipts are necessary ensures accurate and compliant tax filing.

- Proof of Expense - Receipts must clearly show the date, amount, and vendor to validate the expense for tax purposes.

- Itemized Documentation - Detailed receipts listing goods or services purchased provide evidence for specific deductible items.

- Official Format - Receipts should come from recognized businesses and include tax identification numbers to be accepted by tax authorities.

Importance of Receipts in Tax Deduction Claims

What receipt documents are needed for tax deductions? Receipts serve as crucial proof of expenses when filing tax returns. Proper documentation ensures accurate deduction claims and helps avoid disputes with tax authorities.

Common Types of Tax-Deductible Receipts

Tax deductions require specific receipt documents to validate expenses. Common types of tax-deductible receipts include medical bills, charitable donation receipts, and business expense invoices. Keeping organized records of these receipts helps maximize eligible deductions during tax filing.

Essential Information Required on Receipts

Receipts needed for tax deductions must include specific details to be valid for tax purposes. Essential information on these receipts ensures proper documentation and compliance with tax regulations.

Key details should contain the date of the transaction, the seller's name or business, and a clear description of the goods or services purchased. You also need the total amount paid and the method of payment to verify eligibility for deductions.

Digital vs. Paper Receipts: Acceptability and Storage

Receipt documents are essential for substantiating tax deductions and ensuring compliance with tax regulations. Both digital and paper receipts can serve as valid proof, but their acceptability depends on the tax authority's guidelines.

Digital receipts are increasingly accepted due to advancements in technology and ease of storage, provided they clearly display all required transaction details. Paper receipts remain widely used and accepted, especially for in-person purchases or when digital options are unavailable. Proper organization and safe storage of either format are crucial for efficient tax reporting and audit preparedness.

IRS Guidelines for Valid Receipts

Receipts are crucial for substantiating tax deductions according to IRS guidelines. Valid receipts must clearly show the date, amount, and nature of the expense to qualify for deduction purposes.

IRS regulations require receipts to include the vendor's name and detailed description of the items or services purchased. Proper documentation helps taxpayers avoid audits and ensures compliance with tax laws.

Mistakes to Avoid with Tax Deduction Receipts

| Receipt Documents Needed for Tax Deductions | Common Mistakes to Avoid with Tax Deduction Receipts |

|---|---|

| Official receipts from charitable donations, including organization name, date, and amount donated | Submitting incomplete or unclear receipts lacking essential details such as date, amount, or payee information |

| Medical expense receipts with detailed descriptions of services or medications purchased | Using handwritten receipts that are not professionally issued or do not clearly specify the expense |

| Home office expense receipts showing utility bills, rent statements, and repair invoices | Mixing personal expenses with business-related receipts without clear separation or notation |

| Travel and transportation receipts including tickets, fuel purchases, and lodging details | Failing to keep original receipts or relying only on credit card statements without supporting documentation |

| Receipts for educational expenses such as tuition fees and course materials | Not retaining receipts for the entire tax year, resulting in missing proof for claimed deductions |

Best Practices for Organizing Receipts

Organizing receipts is essential for maximizing tax deductions and ensuring accuracy during tax filing. Proper documentation helps avoid audits and simplifies financial management for individuals and businesses.

- Keep Original Receipts - Retain original paper or digital receipts to verify expenses and support deduction claims.

- Sort by Category - Categorize receipts by expense type such as business, medical, or charitable donations to streamline tax reporting.

- Use Digital Tools - Scan and store receipts using tax software or apps to enhance accessibility and reduce physical clutter.

Recordkeeping Tips for Audit-Proof Tax Deductions

Proper receipt documentation is essential to maximize tax deductions and avoid issues during an audit. Organizing receipts and related documents ensures compliance with tax regulations and simplifies recordkeeping.

- Keep Original Receipts - Store original, itemized receipts that clearly detail the purchase date, amount, and vendor information.

- Use Digital Copies - Digitize paper receipts storing them in secure cloud storage for easy access and backup.

- Maintain Consistent Records - Create a systematic filing system grouping receipts by category and tax year for efficient retrieval.

Following these recordkeeping tips supports audit-proof tax deductions and helps sustain accurate financial records.

What Receipt Documents Are Needed for Tax Deductions? Infographic