To ensure successful receipt reimbursement at work, employees must submit original receipts clearly showing the date, vendor, and detailed list of purchased items or services. Expense reports often require accompanying documentation such as purchase orders or approval emails to verify the legitimacy of the transaction. Properly organized and complete documentation streamlines the reimbursement process and prevents delays or denials.

What Documents are Needed for Receipt Reimbursement at Work?

| Number | Name | Description |

|---|---|---|

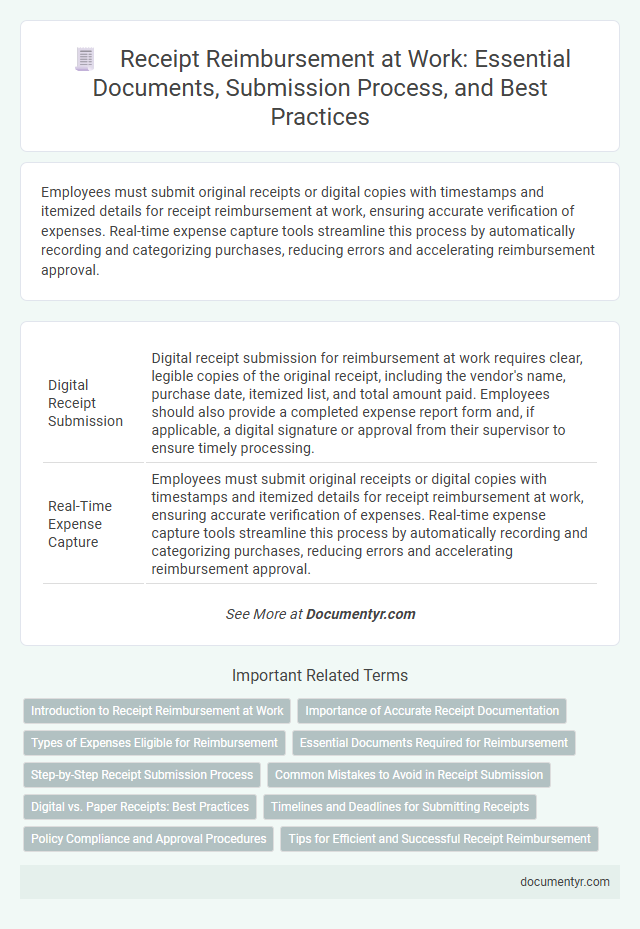

| 1 | Digital Receipt Submission | Digital receipt submission for reimbursement at work requires clear, legible copies of the original receipt, including the vendor's name, purchase date, itemized list, and total amount paid. Employees should also provide a completed expense report form and, if applicable, a digital signature or approval from their supervisor to ensure timely processing. |

| 2 | Real-Time Expense Capture | Employees must submit original receipts or digital copies with timestamps and itemized details for receipt reimbursement at work, ensuring accurate verification of expenses. Real-time expense capture tools streamline this process by automatically recording and categorizing purchases, reducing errors and accelerating reimbursement approval. |

| 3 | E-Invoice Attachment | Employees must provide an e-invoice attachment along with their expense report to ensure seamless receipt reimbursement at work. The e-invoice serves as a verified digital document containing detailed transaction data essential for accurate accounting and compliance. |

| 4 | Blockchain-Verified Receipts | Blockchain-verified receipts provide a secure and tamper-proof record essential for receipt reimbursement at work, requiring a digital copy of the encrypted receipt along with transaction confirmation details. Employers may also request the associated blockchain transaction ID and employee verification information to ensure authenticity and prevent fraud. |

| 5 | Automated OCR Extraction | Automated OCR extraction streamlines receipt reimbursement by accurately capturing essential documents such as itemized receipts, payment proofs, and expense reports. This technology minimizes manual entry errors, accelerates approval workflows, and ensures compliance with company policies through precise data validation. |

| 6 | QR Code Expense Verification | Receipts with QR code expense verification streamline reimbursement by allowing automated capture of transaction details such as vendor name, date, and amount directly from the code, minimizing manual errors. Employers typically require original receipts or digital copies containing a scannable QR code to ensure compliance with expense reporting policies and expedite approval processes. |

| 7 | Geo-Tagged Receipt Upload | Receipt reimbursement at work requires submitting geo-tagged receipt uploads that verify the purchase location and time, ensuring compliance with company expense policies. These digital receipts must include clear images with embedded GPS data to facilitate accurate tracking and approval by finance departments. |

| 8 | Employer-Embedded Expense Codes | Employers often require itemized receipts, proof of payment, and completed reimbursement forms embedded with specific expense codes that align with company accounting systems. These employer-embedded expense codes streamline approval processes and ensure accurate tracking of reimbursable expenses according to internal financial policies. |

| 9 | AI-Powered Document Matching | AI-powered document matching streamlines receipt reimbursement at work by automatically verifying and categorizing essential documents such as itemized receipts, purchase orders, and payment confirmations. This technology enhances accuracy and speeds up the approval process by detecting discrepancies and ensuring compliance with company policies. |

| 10 | Eco-Receipt (Paperless Reimbursement) | For receipt reimbursement at work, employees must submit an eco-receipt or digital proof of purchase, which includes transaction details, date, vendor information, and itemized expenses. Paperless reimbursement systems require electronic receipts stored in expense management software, ensuring compliance with company policies and facilitating faster approval and tracking. |

Introduction to Receipt Reimbursement at Work

What documents are needed for receipt reimbursement at work? Receipt reimbursement requires submitting proof of your expenses, usually in the form of original receipts or digital copies. These documents verify the costs incurred and ensure proper reimbursement according to company policies.

Importance of Accurate Receipt Documentation

Accurate receipt documentation is essential for a smooth reimbursement process at work. It ensures that all expenses are properly verified and approved by the finance department.

Receipts must include the date, vendor name, and amount paid to qualify for reimbursement. Original or digital copies are required to prevent discrepancies and fraud. Maintaining detailed records protects both the employee and the company during audits or financial reviews.

Types of Expenses Eligible for Reimbursement

Receipts are essential for verifying expenses and securing reimbursement at work. Knowing which types of expenses qualify helps streamline the submission process.

- Travel Expenses - Covers transportation costs such as airfare, taxis, and mileage when traveling for work purposes.

- Meal Expenses - Includes meals purchased during business trips or client meetings that comply with company policies.

- Office Supplies - Encompasses items like stationery, printing materials, and other necessary supplies for job functions.

Essential Documents Required for Reimbursement

Receipt reimbursement at work requires submitting specific essential documents to ensure proper processing. These documents verify the expenses incurred and align with company policies.

Typically, an original receipt showing detailed transaction information and proof of payment must be provided. A completed reimbursement form signed by the employee is often required to validate the request.

Step-by-Step Receipt Submission Process

To request receipt reimbursement at work, employees must gather key documents such as the original receipt, a completed reimbursement form, and any necessary approval from a supervisor. The submission process begins by verifying that the receipt includes essential details like date, vendor name, and amount. Next, the employee submits the receipt and form to the finance department for review and approval before reimbursement is processed.

Common Mistakes to Avoid in Receipt Submission

Submitting receipts for reimbursement at work requires accurate and complete documentation. Essential documents include the original receipt, a detailed expense report, and any required approval forms.

Common mistakes in receipt submission include submitting unclear or damaged receipts and missing necessary authorization signatures. Ensure your receipts clearly show the date, vendor, and amount to avoid reimbursement delays.

Digital vs. Paper Receipts: Best Practices

For receipt reimbursement at work, employees must provide clear, legible documents that detail the purchase date, vendor, and amount spent. Digital receipts are increasingly preferred due to ease of storage, sharing, and reduced risk of loss compared to paper receipts. Best practices include saving digital receipts in organized folders or using expense management apps to streamline the reimbursement process and ensure compliance with company policies.

Timelines and Deadlines for Submitting Receipts

Submitting receipts on time is crucial for receipt reimbursement at work to ensure timely processing and payment. Knowing the required documents and strict deadlines helps streamline your reimbursement experience.

- Original Receipts Required - You must provide original itemized receipts showing date, vendor, and amount for verification.

- Submission Deadline - Receipts typically need to be submitted within 30 days of the expense date to qualify for reimbursement.

- Supporting Documents - Expense reports or approval forms must accompany receipts to validate the claim and expedite approval.

Policy Compliance and Approval Procedures

| Document Type | Purpose | Policy Compliance | Approval Procedures |

|---|---|---|---|

| Original Receipts | Proof of purchase or expense incurred | Receipts must clearly show date, vendor, amount, and detailed description aligned with company expense policy | Submit original receipts for verification; must be attached with reimbursement form before approval |

| Expense Reimbursement Form | Document detailing expense purpose, amount, and date | Form fields must be completed accurately to reflect company guidelines on allowable expenses | Form requires employee signature and manager's approval for submission to finance department |

| Manager Approval | Authorization of expense validity and policy adherence | Manager verifies compliance with company spending limits and justification | Manager signs and dates the form, ensuring transparency and accountability in the reimbursement process |

| Supporting Documentation | Additional evidence such as meeting agendas, travel itineraries, or client invoices | Required when expenses relate to external engagements or exceed specific thresholds as per policy | Attach supporting documents with reimbursement request for comprehensive validation by finance |

| Company Expense Policy Document | Reference guide for reimbursement limits and allowed expense categories | Employees must review and comply before submitting claims | Policy adherence is verified by supervisors or finance during approval |

What Documents are Needed for Receipt Reimbursement at Work? Infographic