Receipt documents required for tax deductions must clearly show the date, amount paid, and the nature of the expense to be eligible. Valid receipts include store invoices, payment confirmations, and official bills that verify purchases or charitable donations. Maintaining organized and detailed receipts ensures proper documentation for audits and tax filing accuracy.

What Receipt Documents Are Required for Tax Deductions?

| Number | Name | Description |

|---|---|---|

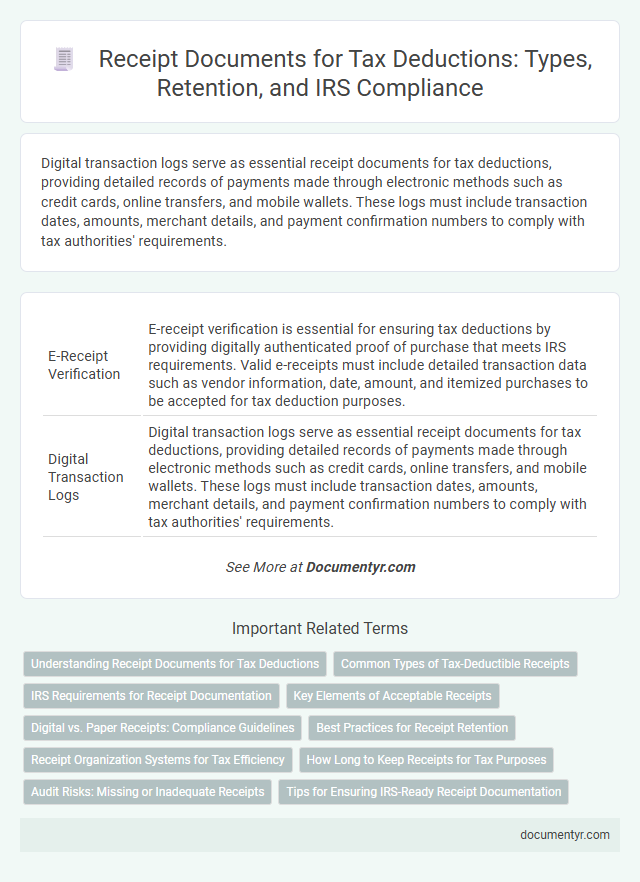

| 1 | E-Receipt Verification | E-receipt verification is essential for ensuring tax deductions by providing digitally authenticated proof of purchase that meets IRS requirements. Valid e-receipts must include detailed transaction data such as vendor information, date, amount, and itemized purchases to be accepted for tax deduction purposes. |

| 2 | Digital Transaction Logs | Digital transaction logs serve as essential receipt documents for tax deductions, providing detailed records of payments made through electronic methods such as credit cards, online transfers, and mobile wallets. These logs must include transaction dates, amounts, merchant details, and payment confirmation numbers to comply with tax authorities' requirements. |

| 3 | Blockchain-Stamped Receipts | Blockchain-stamped receipts provide an immutable and verifiable record essential for tax deductions, ensuring authenticity and compliance with tax authorities. These receipts securely document transaction details, reducing fraud risk and simplifying audit processes. |

| 4 | Cloud-Archived Expense Records | Cloud-archived expense records, including digital receipts and transaction confirmations stored on secure servers, are essential documents for tax deductions as they provide verifiable proof of business expenses. These electronically stored records comply with IRS requirements when properly maintained, ensuring accurate documentation for audit purposes and maximizing deductible claims. |

| 5 | QR Code Receipts | QR code receipts are essential for tax deductions as they provide verifiable transaction details including merchant information, date, and amount, facilitating accurate expense reporting. These digital receipts streamline tax audits by ensuring authenticity and reducing errors compared to traditional paper receipts. |

| 6 | AI-Generated Expense Summaries | AI-generated expense summaries serve as valid receipt documents for tax deductions when they include detailed transaction data, vendor information, dates, and itemized expenses that comply with IRS record-keeping requirements. These digital summaries must be backed by original receipts or electronic proof to ensure audit compliance and facilitate accurate deduction claims. |

| 7 | Mobile Wallet Receipts | Mobile wallet receipts must clearly show transaction details, including the date, amount, merchant name, and payment method, to be valid for tax deductions. Receipts stored digitally in mobile wallets like Apple Pay, Google Pay, or Samsung Pay are acceptable when they provide verifiable proof of purchase and align with IRS documentation requirements. |

| 8 | Third-Party Payment Proofs | Receipts required for tax deductions must include third-party payment proofs such as bank statements, credit card slips, or payment confirmation emails that validate the transaction between the taxpayer and the service provider. These documents serve as concrete evidence to the tax authorities that the payment was made through an intermediary, ensuring eligibility for deduction claims under tax regulations. |

| 9 | Real-Time E-Invoice Attachments | Real-time e-invoice attachments, including purchase receipts and transaction confirmations, are essential for claiming accurate tax deductions and ensuring compliance with tax authorities. Digital receipts with verified timestamps and seller details enhance record-keeping efficiency and reduce errors during tax filing. |

| 10 | NFT Receipt Documentation | NFT receipt documentation required for tax deductions includes proof of purchase showing the date, price, and platform used, alongside a detailed transaction history from the blockchain ledger confirming ownership transfer. Properly maintained records such as digital wallet statements and smart contract details ensure compliance with tax regulations and substantiate deductible expenses. |

Understanding Receipt Documents for Tax Deductions

Receipt documents play a crucial role in substantiating claims for tax deductions. Properly maintained receipts ensure compliance with tax regulations and help maximize eligible deductions.

Common receipt documents required for tax deductions include invoices, payment confirmations, and official sales receipts issued by vendors or service providers. These documents must clearly display the date, amount paid, and the nature of the transaction to qualify for deductions. Accurate record-keeping of receipts supports audit processes and minimizes the risk of disallowed expenses.

Common Types of Tax-Deductible Receipts

Receipts play a crucial role in claiming tax deductions, serving as proof of expenses incurred throughout the fiscal year. Common types of tax-deductible receipts include those for charitable donations, medical expenses, and business-related purchases.

Charitable donation receipts must clearly show the organization's name and amount donated to qualify for deductions. Medical expense receipts should detail the service provider, date, and total cost to be accepted by tax authorities.

IRS Requirements for Receipt Documentation

Understanding which receipt documents are required for tax deductions is crucial to comply with IRS regulations. Proper documentation supports your claims and helps avoid audit issues.

- Original Receipts - The IRS requires original receipts to verify expenses for tax deductions.

- Detailed Information - Receipts must include the date, amount, and nature of the expense for IRS validation.

- Proof of Payment - Documentation showing proof of payment, such as cancelled checks or credit card statements, must accompany receipts.

Maintaining accurate and complete receipt documentation ensures that your tax deduction claims meet IRS requirements.

Key Elements of Acceptable Receipts

| Key Elements of Acceptable Receipts for Tax Deductions |

|---|

| Business and Personal Information: The receipt must include the name and address of the vendor or service provider. Your name or the name of the individual or business making the purchase should also be clearly stated. |

| Date of Transaction: The receipt should clearly indicate the date when the purchase or payment was made. This helps verify the timing related to the tax year in question. |

| Description of Goods or Services: A detailed description of the items or services purchased is essential for tax purposes. Vague or generic terms may not be accepted by tax authorities. |

| Amount Paid: The total amount paid including taxes and fees must be visible. This total is crucial for calculating the exact deduction available. |

| Proof of Payment: Documentation demonstrating that payment was made, such as a credit card slip, canceled check, or cash receipt, supports the validity of the expense. |

| Signature or Authorization: Some receipts may require a signature or an official stamp from the vendor to be recognized as valid for tax deduction purposes. |

Digital vs. Paper Receipts: Compliance Guidelines

What receipt documents are required for tax deductions and how do digital and paper receipts compare in compliance guidelines?

Tax authorities generally require receipts that clearly show the date, amount, vendor, and purpose of the transaction. Both digital and paper receipts must meet these criteria to be valid for tax deductions, with digital receipts often needing to comply with electronic record-keeping standards.

Best Practices for Receipt Retention

Receipts required for tax deductions include those for business expenses, charitable donations, medical costs, and education fees. Best practices for receipt retention involve keeping digital or physical copies organized by date and category for easy access during tax filing. Maintaining clear and accurate records helps ensure compliance with tax regulations and supports deduction claims in case of an audit.

Receipt Organization Systems for Tax Efficiency

Proper organization of receipt documents is crucial for maximizing tax deductions and ensuring compliance with tax regulations. Efficient systems help you easily locate and verify receipts during tax filing or audits.

- Digital Scanning and Storage - Converting physical receipts into digital files with clear labeling simplifies retrieval and reduces the risk of loss.

- Expense Categorization - Grouping receipts by categories such as travel, office supplies, and meals enhances accuracy in tax reporting and deduction claims.

- Date and Vendor Indexing - Organizing receipts by transaction date and vendor name supports a chronological and vendor-specific audit trail for tax authorities.

How Long to Keep Receipts for Tax Purposes

Receipts are essential documents for claiming tax deductions as they provide proof of expenses incurred. Common receipt documents required include those for medical expenses, charitable donations, business purchases, and home office supplies. Keeping accurate and organized receipts helps ensure the validity of deductions during tax audits.

Tax authorities generally recommend keeping receipts for at least three to seven years, depending on the nature of the deduction and local tax laws. For instance, the IRS typically requires records to be retained for three years from the date of filing, but this period can extend if there are discrepancies or special circumstances. Maintaining receipts beyond the minimum period provides a safeguard against potential tax disputes.

Digital copies of receipts are widely accepted and can simplify record-keeping while preserving all necessary information. Storing receipts in an easily retrievable format supports efficient tax filing and audit processes. Consistent maintenance of receipt records ensures compliance and maximizes eligible tax deductions over time.

Audit Risks: Missing or Inadequate Receipts

Receipts play a crucial role in validating tax deductions during an audit. Missing or inadequate receipts can significantly increase audit risks and result in disallowed deductions.

- Proof of Purchase - Receipts must clearly show the date, amount, and vendor to substantiate tax deduction claims.

- Detailed Expense Records - Receipts lacking itemized details may be insufficient to justify the specific nature of deductible expenses.

- Retention Period - You should retain original receipts for at least seven years to comply with audit requirements and avoid penalties.

What Receipt Documents Are Required for Tax Deductions? Infographic