Landlords require specific receipt documents to justify deductions from a security deposit, including itemized repair invoices, cleaning service receipts, and documented estimates for damage repairs. These receipts must clearly detail the costs and services provided, directly linked to the property's condition at lease end. Providing thorough and accurate receipts ensures transparency and supports the validity of security deposit deductions.

What Receipt Documents Does a Landlord Require for Security Deposit Deductions?

| Number | Name | Description |

|---|---|---|

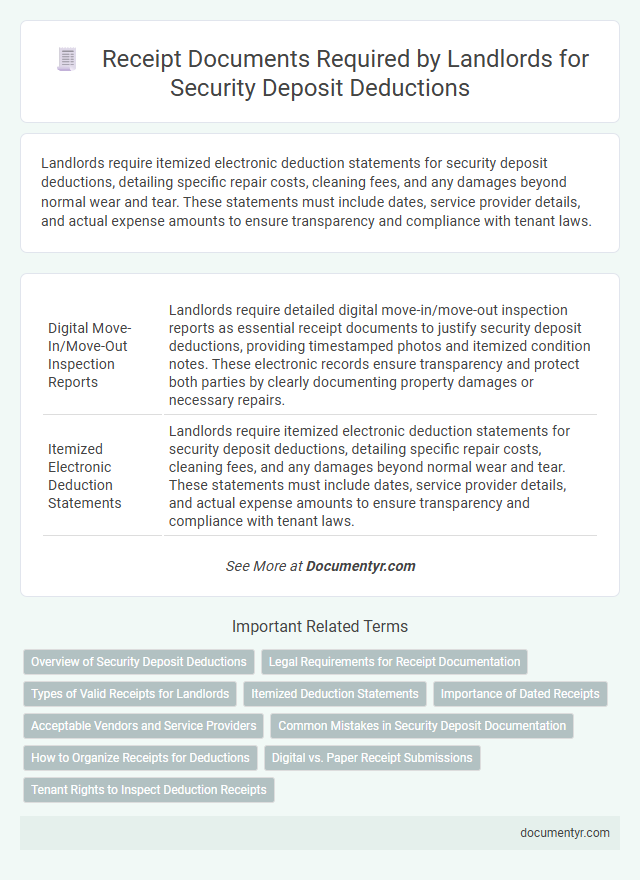

| 1 | Digital Move-In/Move-Out Inspection Reports | Landlords require detailed digital move-in/move-out inspection reports as essential receipt documents to justify security deposit deductions, providing timestamped photos and itemized condition notes. These electronic records ensure transparency and protect both parties by clearly documenting property damages or necessary repairs. |

| 2 | Itemized Electronic Deduction Statements | Landlords require itemized electronic deduction statements for security deposit deductions, detailing specific repair costs, cleaning fees, and any damages beyond normal wear and tear. These statements must include dates, service provider details, and actual expense amounts to ensure transparency and compliance with tenant laws. |

| 3 | E-Receipts for Professional Cleaning Services | Landlords typically require itemized e-receipts from professional cleaning services to justify security deposit deductions, detailing the service provider's name, date, and cost of the cleaning. These digital receipts serve as verifiable proof of expenses incurred, ensuring transparency and compliance with local rental laws. |

| 4 | Smart Home Damage Assessment Logs | Landlords require Smart Home Damage Assessment Logs as key receipt documents to justify security deposit deductions, providing detailed digital records of any damages identified through smart home sensors and monitoring systems. These logs offer precise timestamps and evidence that help substantiate repair costs, ensuring transparent and fair deductions. |

| 5 | Cloud-Based Repair Invoices | Landlords require detailed cloud-based repair invoices as receipt documents for security deposit deductions, ensuring transparency and accuracy in expense tracking. These digital invoices typically include itemized costs, date of service, vendor details, and proof of payment, which help validate all charges deducted from the tenant's deposit. |

| 6 | Forensic Carpet Cleaning Receipts | Landlords require forensic carpet cleaning receipts as proof when deducting security deposits to verify that the cleaning was necessary and professionally performed due to tenant-caused damage. These receipts must detail the service provider, date, and specific cleaning techniques used to ensure transparency and compliance with local rental laws. |

| 7 | Mobile Payment Proofs for Handyman Services | Landlords require mobile payment proofs such as screenshots, transaction IDs, and payment confirmation emails for security deposit deductions related to handyman services. These digital receipts ensure transparent verification of repairs and maintenance expenses deducted from the tenant's security deposit. |

| 8 | Blockchain-Verified Transaction Records | Landlords require blockchain-verified transaction records as secure proof for security deposit deductions, ensuring transparency and tamper-proof documentation of payment history. These records provide immutable evidence of maintenance costs, repair invoices, or agreed-upon deductions, reducing disputes and enhancing trust between tenants and landlords. |

| 9 | QR-Coded Disposal Fees Receipts | Landlords require QR-coded disposal fees receipts as proof for security deposit deductions related to waste management charges, ensuring transparency through traceable and verifiable transaction records. These digitally encoded receipts help validate that disposal costs were legitimately incurred and deducted in compliance with local rental regulations. |

| 10 | AI-Powered Damage Detection Summaries | Landlords require detailed receipt documents such as repair invoices, cleaning service bills, and replacement costs to justify security deposit deductions. AI-powered damage detection summaries enhance accuracy by analyzing property condition photos and generating precise reports that streamline verification and dispute resolution. |

Overview of Security Deposit Deductions

Security deposit deductions must be clearly documented by landlords to ensure transparency and legal compliance. Proper receipt documentation protects both parties and provides a reference for itemized charges.

- Itemized Repair Receipts - Detailed invoices for repairs or cleaning expenses justify deducted amounts from the security deposit.

- Written Estimates - Pre-approved cost estimates for damages support the landlord's claim for deposit deductions.

- Move-Out Inspection Reports - Inspection documents confirm the condition of the property and identify damage beyond normal wear and tear.

Providing these receipt documents helps landlords substantiate security deposit deductions and minimizes disputes with tenants.

Legal Requirements for Receipt Documentation

| Document Type | Description | Legal Requirement |

|---|---|---|

| Itemized Receipt | Detailed list of repairs or cleaning services deducted from the security deposit, including costs. | Many jurisdictions require landlords to provide an itemized receipt showing exact amounts deducted to ensure transparency and compliance with tenant protection laws. |

| Original Invoices | Official invoices from contractors or service providers for repairs or maintenance charged against the deposit. | Providing original invoices supports the legitimacy of deductions and is often mandated by law to prevent unfair charges. |

| Photographic Evidence | Photos documenting the condition of the property before and after tenancy demonstrating the need for deductions. | Some regions accept photographic evidence as legal documentation to justify deductions, supplementing written receipts. |

| Receipt for Returned Deposit Portion | Proof of payment showing the remittance of any remaining security deposit balance back to the tenant. | Landlords are legally required to document the return of the unused portion of the security deposit to protect both parties. |

You must ensure all receipt documents comply with your local landlord-tenant laws to avoid disputes related to security deposit deductions.

Types of Valid Receipts for Landlords

Landlords must provide valid receipts when making security deposit deductions to ensure transparency and accountability. Proper documentation helps tenants understand the charges and protects landlords from disputes.

- Repair and Maintenance Receipts - Detailed invoices from licensed contractors or service providers verifying work performed and costs incurred.

- Cleaning Service Receipts - Official proof of payment for professional cleaning services necessary to restore the property's condition.

- Replacement Item Receipts - Purchase receipts for items like appliances or fixtures that were damaged and replaced by the landlord.

Itemized Deduction Statements

Landlords require itemized deduction statements to justify security deposit deductions effectively. These documents detail specific damages or unpaid rent, providing clear evidence of costs incurred.

Itemized statements typically include descriptions of repairs, associated expenses, and dates of service. This transparency helps tenants understand the exact reasons for each deduction on their security deposit.

Importance of Dated Receipts

Receipts are essential documents a landlord requires when making security deposit deductions to ensure transparency and accuracy. Dated receipts specifically validate the timing and legitimacy of expenses related to the rental property.

- Proof of Expense - Dated receipts provide concrete evidence of costs incurred for repair or cleaning after a tenant's departure.

- Legal Protection - These receipts help landlords comply with state laws by documenting legitimate deductions, reducing disputes.

- Accountability and Transparency - Providing dated receipts to tenants promotes trust by clearly showing when and why deductions were made.

Acceptable Vendors and Service Providers

What receipt documents does a landlord require for security deposit deductions? Landlords typically require receipts from licensed and reputable vendors to validate security deposit deductions. Acceptable vendors include certified pest control services, licensed repair contractors, and professional cleaning companies.

Common Mistakes in Security Deposit Documentation

Landlords require detailed receipts to justify security deposit deductions, including repair invoices, cleaning service bills, and itemized damage assessments. Common mistakes in security deposit documentation involve vague descriptions, missing dates, and lack of itemization, which can lead to disputes. You should ensure all receipts are clear, specific, and kept in chronological order to avoid conflicts and support your claim effectively.

How to Organize Receipts for Deductions

Landlords require detailed receipt documents to justify security deposit deductions, including invoices for repairs, cleaning services, and replacement costs. Proper documentation ensures transparency and prevents disputes with tenants.

Organize receipts by categorizing them into repair, cleaning, and material expenses. Keep digital copies with dates and descriptions for quick reference. Maintaining an itemized ledger alongside receipts helps streamline the deduction process and supports clear communication.

Digital vs. Paper Receipt Submissions

Landlords require clear receipt documents to validate security deposit deductions, ensuring transparency and legal compliance. Digital receipts often provide faster submission and easy record-keeping compared to traditional paper receipts. Both formats must include detailed transaction information such as date, amount, and payment method to be accepted.

What Receipt Documents Does a Landlord Require for Security Deposit Deductions? Infographic