Freelancers need to provide invoices or receipts that clearly state the service provided, the date, and the amount charged to qualify for tax deduction receipts. It is essential to include the freelancer's full name, tax identification number, and contact information on these documents to ensure legitimacy. Proper documentation supports accurate expense claims and compliance with tax regulations.

What Documents Does a Freelancer Need for Tax Deduction Receipts?

| Number | Name | Description |

|---|---|---|

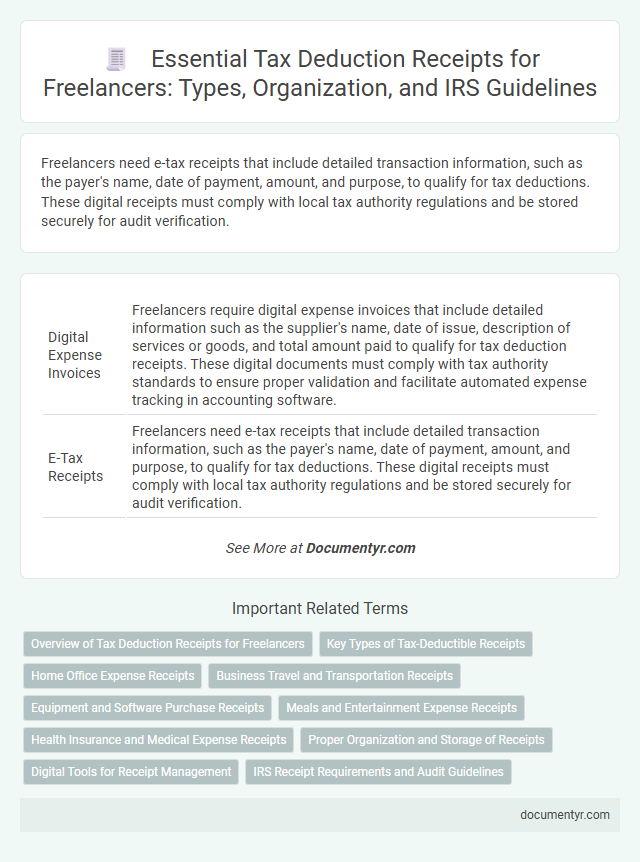

| 1 | Digital Expense Invoices | Freelancers require digital expense invoices that include detailed information such as the supplier's name, date of issue, description of services or goods, and total amount paid to qualify for tax deduction receipts. These digital documents must comply with tax authority standards to ensure proper validation and facilitate automated expense tracking in accounting software. |

| 2 | E-Tax Receipts | Freelancers need e-tax receipts that include detailed transaction information, such as the payer's name, date of payment, amount, and purpose, to qualify for tax deductions. These digital receipts must comply with local tax authority regulations and be stored securely for audit verification. |

| 3 | Cloud-Based Payment Confirmations | Freelancers require cloud-based payment confirmations as essential documents for tax deduction receipts, ensuring accurate proof of income and transaction details stored online. These digital records facilitate seamless tax reporting and audit processes by providing secure, accessible evidence of received payments. |

| 4 | Automated Accounting Statements | Freelancers need automated accounting statements such as digital invoicing records and bank transaction exports for efficient tax deduction receipts management, ensuring accurate documentation of income and expenses. These automated statements help streamline expense categorization, compliance verification, and facilitate seamless integration with tax preparation software. |

| 5 | Blockchain Verified Invoices | Freelancers need tax deduction receipts that include blockchain-verified invoices to ensure authenticity and prevent tampering, providing an immutable record for tax authorities. These documents should contain detailed service descriptions, invoice numbers, timestamps, and digital signatures recorded on a blockchain ledger. |

| 6 | E-Wallet Transaction Records | Freelancers must keep detailed e-wallet transaction records, including digital receipts and payment confirmations, to claim tax deductions effectively. These documents provide verifiable proof of business-related expenses and income, ensuring compliance with tax regulations. |

| 7 | SaaS Subscription Receipts | Freelancers need detailed SaaS subscription receipts that include the vendor's name, date of purchase, service description, amount paid, and payment method to qualify for tax deductions. These documents serve as proof of business expenses, helping to accurately report deductible costs and reduce taxable income. |

| 8 | Crypto Payment Receipts | Freelancers must retain detailed crypto payment receipts that include transaction IDs, wallet addresses, dates, and the fair market value of the cryptocurrency at the time of payment for accurate tax deduction claims. These digital receipts serve as proof of income and are essential for verifying taxable earnings and reporting capital gains or losses during tax filings. |

| 9 | E-Signature Authorized Documents | Freelancers need electronically signed invoices, contracts, and payment receipts authorized with an e-signature to qualify for tax deduction receipts, ensuring legal validity and compliance with tax regulations. These e-signature authorized documents serve as proof of income and expenses, streamlining the verification process during tax filing and audits. |

| 10 | OCR-Scanned Expense Proofs | Freelancers need OCR-scanned expense proofs such as receipts, invoices, and payment confirmations to accurately claim tax deductions and ensure compliance with tax authorities. These digitized documents enable efficient data extraction, verification, and organization critical for filing expenses and maximizing deductible amounts. |

Overview of Tax Deduction Receipts for Freelancers

Tax deduction receipts are essential for freelancers to claim business expenses and reduce taxable income. Understanding what documents to keep helps ensure accurate record-keeping and compliance with tax authorities.

- Invoices from Clients - These confirm the income you received and support your earnings claims.

- Receipts for Business Expenses - They verify costs related to equipment, software, and office supplies eligible for deductions.

- Proof of Payments - Bank statements or transaction records validate payments made or received during your freelancing activities.

Key Types of Tax-Deductible Receipts

Freelancers must keep accurate documentation to support their tax deduction claims. Your receipts serve as proof of expenses and are essential for accurate tax reporting.

- Business Expense Receipts - Receipts for office supplies, software subscriptions, and equipment purchases that directly relate to your freelance work.

- Travel and Mileage Receipts - Proof of transportation costs such as airfare, taxis, or vehicle mileage used for business purposes.

- Client Payment Receipts - Records of payments received from clients that verify your income and help reconcile tax filings.

Home Office Expense Receipts

Freelancers must keep accurate records of home office expense receipts to qualify for tax deductions. These receipts include utility bills, rent statements, and maintenance invoices related to the workspace.

You should organize these documents carefully to substantiate your home office expenses during tax filing. Proper documentation ensures compliance and maximizes your deductible claims.

Business Travel and Transportation Receipts

Freelancers must keep detailed business travel and transportation receipts to qualify for tax deductions. These documents include tickets, mileage logs, and invoices that verify work-related travel expenses.

Receipts should clearly show dates, destinations, and expense amounts to meet tax authority requirements. Proper organization of these records supports accurate deduction claims and simplifies tax filing.

Equipment and Software Purchase Receipts

Freelancers must keep purchase receipts for equipment and software to claim tax deductions accurately. These receipts serve as proof of business expenses, detailing the item, price, and purchase date. Proper documentation ensures compliance with tax regulations and maximizes deductible amounts.

Meals and Entertainment Expense Receipts

Freelancers must maintain proper documentation to claim tax deductions on meals and entertainment expenses. Accurate receipts help validate these costs for the IRS or relevant tax authorities.

- Itemized Receipts - Detailed receipts showing the date, location, and items purchased are required for tax deduction claims.

- Proof of Business Purpose - Notes or documentation explaining the business purpose of the meal or entertainment ensure the expense qualifies for deductions.

- Payment Method Records - Credit card statements or bank records matching the receipt amounts provide additional verification for tax audits.

Organizing these documents systematically reduces errors and supports legitimate tax deductions for freelancers' meals and entertainment expenses.

Health Insurance and Medical Expense Receipts

Freelancers must keep accurate health insurance receipts to claim tax deductions effectively. These documents serve as proof of premium payments required by tax authorities.

Medical expense receipts are essential for deducting qualified health costs from taxable income. You should retain detailed invoices and payment confirmations for doctor visits, prescriptions, and treatments. Organizing these records ensures compliance and maximizes potential tax benefits.

Proper Organization and Storage of Receipts

What documents does a freelancer need for tax deduction receipts? Freelancers should gather all receipts related to business expenses, including invoices, payment proofs, and expense reports. Proper organization and storage of receipts ensure easy access during tax filing and accurate deduction claims.

Digital Tools for Receipt Management

| Document Type | Description | Role in Tax Deduction |

|---|---|---|

| Invoice Copies | Copies of invoices issued for freelance services provided. | Proof of income and payment received for tax reporting. |

| Expense Receipts | Receipts for business-related expenses such as software subscriptions, office supplies, and travel. | Supporting documentation for deductible expenses during tax filing. |

| Bank Statements | Statements showing deposits and withdrawals related to freelance income. | Verification of income flow and expense payments. |

| Tax Deduction Receipts | Official receipts issued by vendors or service providers recognized for tax deduction claims. | Essential proof to claim tax deductions on eligible expenses. |

| Digital Tools for Receipt Management | Software applications like Expensify, QuickBooks, and Receipt Bank designed to scan, store, and organize receipts digitally. | Enhance accuracy, enable easy retrieval, and simplify tax deduction documentation. |

| Cloud Storage Services | Platforms such as Google Drive, Dropbox, and OneDrive used to securely back up digital receipts and related documents. | Ensures accessibility and protection of documents for tax audits and filing. |

| Mobile Apps | Apps specifically built for freelancers to capture receipt images and track expenses on the go. | Streamlines recording of deductible expenses, minimizing manual errors and lost receipts. |

What Documents Does a Freelancer Need for Tax Deduction Receipts? Infographic