Digital receipt management systems require key documents such as purchase receipts, invoices, and payment confirmations to ensure accurate record-keeping. Users must upload digital copies or scans of these documents in commonly accepted formats like PDF, JPEG, or PNG. Proper categorization and metadata entries enhance searchability and streamline expense tracking within the system.

What Documents are Required for Digital Receipt Management Systems?

| Number | Name | Description |

|---|---|---|

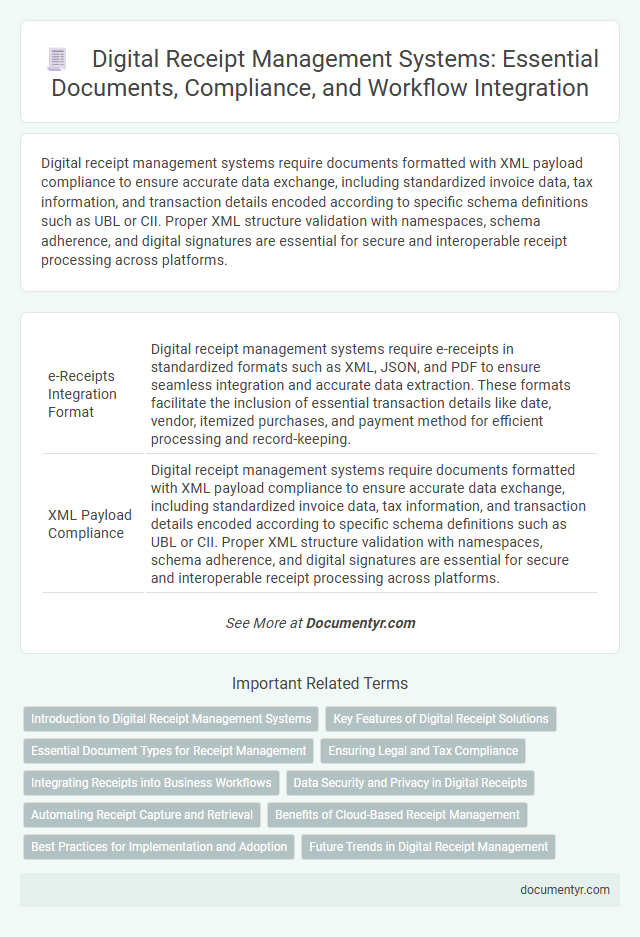

| 1 | e-Receipts Integration Format | Digital receipt management systems require e-receipts in standardized formats such as XML, JSON, and PDF to ensure seamless integration and accurate data extraction. These formats facilitate the inclusion of essential transaction details like date, vendor, itemized purchases, and payment method for efficient processing and record-keeping. |

| 2 | XML Payload Compliance | Digital receipt management systems require documents formatted with XML payload compliance to ensure accurate data exchange, including standardized invoice data, tax information, and transaction details encoded according to specific schema definitions such as UBL or CII. Proper XML structure validation with namespaces, schema adherence, and digital signatures are essential for secure and interoperable receipt processing across platforms. |

| 3 | Blockchain-Stamped Invoices | Blockchain-stamped invoices require original billing documents, digital signatures, and cryptographic hashes to ensure authenticity and immutability within digital receipt management systems. These systems also demand metadata including timestamping, transaction IDs, and decentralized ledger proofs to facilitate secure verification and audit trails. |

| 4 | OCR-Compatible Scanned Documents | OCR-compatible scanned documents for digital receipt management systems must be clear, high-resolution images such as PDFs or JPEGs with legible text to ensure accurate data extraction. Essential documents include invoices, purchase receipts, and payment confirmations that are properly formatted and free of distortions or handwritten elements to maximize OCR efficiency. |

| 5 | Automated Metadata Tagging | Digital receipt management systems require documents such as purchase invoices, transaction records, and vendor details to enable automated metadata tagging, which extracts key data like date, amount, and supplier information. This automation streamlines organization, enhances searchability, and improves accuracy by minimizing manual input in financial documentation. |

| 6 | Digital Signature Authentication Files | Digital receipt management systems require digital signature authentication files such as X.509 certificates and cryptographic keys to validate the authenticity of transactions. These files ensure secure verification by enabling encryption and electronic verification protocols compliant with regulatory standards. |

| 7 | API Transaction Logs | API transaction logs are essential documents for digital receipt management systems as they provide detailed records of all API calls, including timestamps, transaction IDs, and status codes, ensuring transparent audit trails. These logs enable seamless tracking, verification, and reconciliation of digital receipt transactions, optimizing accuracy and compliance in financial record-keeping. |

| 8 | AI-Powered Receipt Categorization | AI-powered digital receipt management systems require scanned copies or digital images of receipts, invoices, and transaction records in formats such as PDF, JPEG, or PNG for accurate data extraction and categorization. These systems also utilize metadata files containing date, vendor information, and transaction amounts to enhance automated classification and streamline expense tracking. |

| 9 | GDPR-Compliant Consent Forms | GDPR-compliant consent forms are essential in digital receipt management systems to ensure lawful processing and storage of personal data. These documents must clearly outline data usage, obtain explicit user permission, and provide options for data access and withdrawal to meet regulatory requirements. |

| 10 | Multi-Factor Authentication Credentials | Multi-factor authentication credentials for digital receipt management systems typically include a combination of passwords, biometric verification such as fingerprint or facial recognition, and one-time passcodes sent via SMS or generated through authenticator apps. These secure access methods ensure only authorized users can upload, view, and manage digital receipts, enhancing data integrity and preventing unauthorized access. |

Introduction to Digital Receipt Management Systems

Digital Receipt Management Systems streamline the process of organizing and storing receipts electronically. These systems reduce paper clutter and improve expense tracking efficiency.

You need specific documents to set up and operate a Digital Receipt Management System effectively. Key documents include scanned receipts, purchase invoices, and warranty certificates to ensure accurate record-keeping.

Key Features of Digital Receipt Solutions

Digital receipt management systems require essential documents such as purchase invoices, payment confirmations, and delivery receipts to ensure accurate record-keeping. These systems feature automated data extraction, secure cloud storage, and real-time access to digital receipts for enhanced organization and retrieval. Integration with accounting software and customizable reporting tools are key features that streamline financial management and improve efficiency.

Essential Document Types for Receipt Management

What documents are required for effective digital receipt management systems? Essential document types include purchase receipts, invoices, and payment confirmations. These documents ensure accurate tracking and verification of financial transactions.

Ensuring Legal and Tax Compliance

Digital receipt management systems require documents such as invoices, purchase orders, and payment confirmations to ensure accurate record-keeping. These documents must comply with legal standards and tax regulations, including VAT details and authorized signatures. Proper digitization and secure storage of these records support audit readiness and financial transparency.

Integrating Receipts into Business Workflows

Digital receipt management systems require essential documents such as purchase receipts, invoices, and payment confirmations to ensure accurate record-keeping. Integrating these documents into business workflows streamlines expense tracking and financial reporting.

Receipts must be captured in standardized formats like PDF, JPEG, or XML to facilitate seamless data extraction and processing. Automated OCR technology enhances the digitization process by converting physical receipts into searchable digital files. Proper integration enables real-time synchronization with accounting software, improving budget management and audit readiness.

Data Security and Privacy in Digital Receipts

Digital receipt management systems require specific documents to ensure seamless processing and compliance. Protecting data security and privacy is crucial when handling digital receipts.

- Proof of Purchase - Validates the transaction and must be securely stored to prevent tampering.

- User Consent Forms - Required to comply with data privacy regulations and protect personal information.

- Encryption Certificates - Ensure that digital receipts are transmitted and stored with strong data encryption standards.

Your privacy and data security are integral to trustworthy digital receipt management.

Automating Receipt Capture and Retrieval

Digital Receipt Management Systems require specific documents for effective automation of receipt capture and retrieval. These documents ensure accuracy and streamline expense tracking.

- Original Receipts - Clear and legible copies of purchase receipts are essential for automated data extraction and verification.

- Invoice Details - Structured invoice data supports the system in organizing and categorizing expenses properly.

- Merchant Information - Details such as vendor name, date, and transaction amount help in accurate indexing and quick retrieval.

Benefits of Cloud-Based Receipt Management

Digital receipt management systems require documents such as invoices, purchase orders, payment confirmations, and vendor receipts to ensure accurate and efficient tracking. These systems often integrate with email and accounting software to automatically capture and organize essential receipts.

Cloud-based receipt management offers secure storage, easy access from any device, and seamless scalability for growing businesses. It reduces the risk of data loss and enables real-time collaboration, improving overall financial management efficiency.

Best Practices for Implementation and Adoption

| Document Type | Description | Best Practices for Implementation and Adoption |

|---|---|---|

| Purchase Invoices | Invoices from suppliers detailing products or services purchased. | Ensure digital formats like PDF or XML are standardized for easy integration with the system. Implement OCR technology to accurately capture data from diverse invoice layouts. |

| Payment Receipts | Proof of payment made to vendors or service providers. | Maintain clear digital signatures and timestamps for authentication. Use secure storage with easy retrieval features to enhance accountability. |

| Delivery Notes | Documents confirming receipt of goods by the company. | Digitize delivery notes at the point of receipt to reduce errors. Link these documents to purchase invoices to streamline reconciliation processes. |

| Expense Receipts | Records of business-related expenditures. | Implement mobile capture tools for on-the-go documentation. Enforce metadata tagging to organize and categorize expenses efficiently. |

| Tax Documents | Records related to tax reporting such as VAT receipts. | Ensure compliance with local tax regulations through automated validation rules. Use encryption to protect sensitive financial data. |

| Contracts and Agreements | Supporting documents that authorize transactions or purchases. | Integrate contract management functionalities to link with receipt data. Provide audit trails for all amendments and approvals. |

| Internal Approval Forms | Documentation confirming internal authorization for expenses or purchases. | Standardize form templates for consistency. Automate workflow approvals within the digital system to enhance efficiency. |

| User Training Materials | Guides and resources to support system users. | Develop comprehensive onboarding sessions to facilitate user adoption. Regularly update materials to reflect changes in system features or regulations affecting document requirements. |

What Documents are Required for Digital Receipt Management Systems? Infographic