Receipts required for charitable donation tax deductions must include the donor's name, the charity's name, the date of the donation, and a detailed description of the contributed property or cash amount. For donations over $250, a written acknowledgment from the charity is mandatory, specifying whether any goods or services were exchanged. Properly retaining these receipts ensures compliance with IRS regulations and maximizes the potential tax benefits.

What Receipts Are Required for Charitable Donation Tax Deductions?

| Number | Name | Description |

|---|---|---|

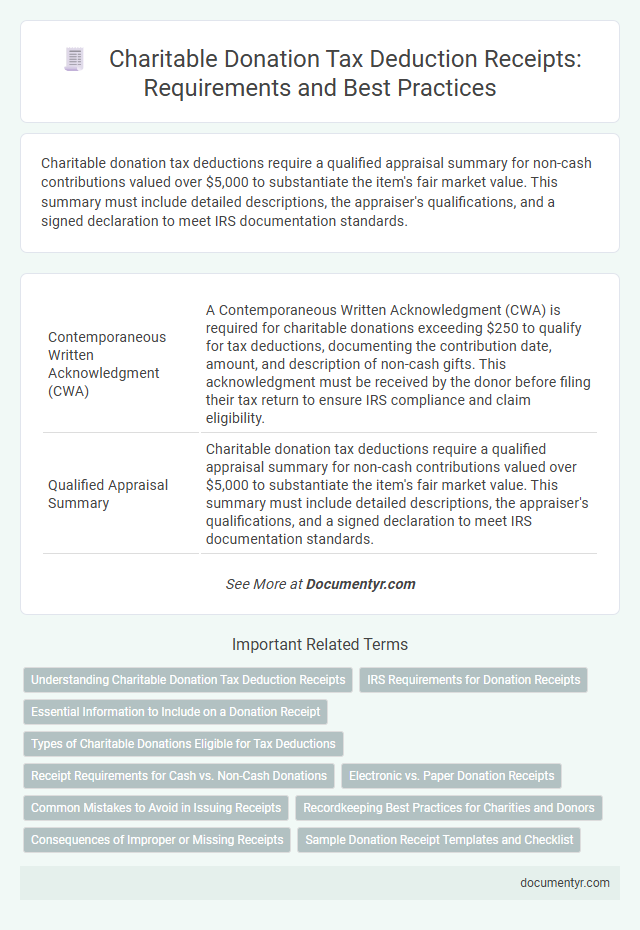

| 1 | Contemporaneous Written Acknowledgment (CWA) | A Contemporaneous Written Acknowledgment (CWA) is required for charitable donations exceeding $250 to qualify for tax deductions, documenting the contribution date, amount, and description of non-cash gifts. This acknowledgment must be received by the donor before filing their tax return to ensure IRS compliance and claim eligibility. |

| 2 | Qualified Appraisal Summary | Charitable donation tax deductions require a qualified appraisal summary for non-cash contributions valued over $5,000 to substantiate the item's fair market value. This summary must include detailed descriptions, the appraiser's qualifications, and a signed declaration to meet IRS documentation standards. |

| 3 | Donor-Advised Fund Receipt | Donor-advised fund receipts for charitable donation tax deductions must include the fund's name, the date of the contribution, a description of the donated property, and a statement confirming whether any goods or services were provided in exchange. The receipt should also specify the exact amount contributed or an estimate of the donated property's fair market value to meet IRS substantiation requirements. |

| 4 | Non-Cash Contribution Acknowledgment | Receipts required for charitable donation tax deductions of non-cash contributions must include a written acknowledgment from the charity detailing the donor's name, description of the donated items, and the date of the contribution. For donations exceeding $500, taxpayers must complete Form 8283 and attach it to their tax return, with the charity providing a statement verifying receipt and condition of the items. |

| 5 | Electronic Gift Receipt Compliance | Charitable donation tax deductions require electronic gift receipts to include the donor's name, donation date, and a detailed description of the donated items or amount, ensuring IRS compliance. Electronic receipts must also clearly state the charity's tax-exempt status and provide a statement confirming no goods or services were received in exchange for the donation. |

| 6 | QR Code Donation Verification | Receipts required for charitable donation tax deductions must include a QR code that enables secure and immediate verification of the donation's authenticity and amount. This QR code links directly to the charity's official database, ensuring compliance with IRS regulations and simplifying tax deduction claims. |

| 7 | Digital Signature Validation | Receipts required for charitable donation tax deductions must include the donor's name, donation amount, date, and the charity's acknowledgment, with digital signature validation ensuring authenticity and compliance with IRS regulations. Digital signatures enhance security by verifying the receipt's origin and preventing tampering, which is essential for substantiating charitable contributions in tax filings. |

| 8 | Automated Giving Statement | Automated giving statements serve as essential receipts for charitable donation tax deductions, providing donors with clear, itemized records of their contributions. These statements typically include the charity's name, donation amount, date of gift, and confirmation that no goods or services were received in return, ensuring IRS compliance for tax reporting. |

| 9 | Micro-donation Aggregate Receipt | Receipts required for charitable donation tax deductions include official acknowledgment from the charity for contributions exceeding $250, while micro-donations under this threshold can be substantiated using an aggregate receipt summarizing multiple small donations. This aggregate receipt must detail the total amount donated, the dates of the contributions, and confirmation that no goods or services were received in exchange, ensuring compliance with IRS requirements. |

| 10 | Cryptocurrency Donation Receipt | A valid cryptocurrency donation receipt must include the donor's name, the date of the donation, a detailed description of the donated digital assets, and the fair market value at the time of transfer, complying with IRS guidelines. This receipt is essential for substantiating charitable donation tax deductions and must be issued by the qualified charitable organization. |

Understanding Charitable Donation Tax Deduction Receipts

Receipts for charitable donation tax deductions serve as proof of your contributions to qualified organizations. These receipts are essential for claiming deductions on your tax return and must include specific details to comply with IRS requirements.

A valid charitable donation receipt typically contains the donor's name, the date of the contribution, and the name of the charitable organization. It should also specify the amount donated or provide a description of donated property. Retaining these receipts ensures accurate documentation and maximizes your tax benefits.

IRS Requirements for Donation Receipts

Receipts are essential for claiming tax deductions on charitable donations according to IRS regulations. Proper documentation ensures compliance and verification of contributions during tax filing.

- Written Acknowledgment - The IRS requires a written acknowledgment from the charity for any single donation of $250 or more.

- Receipt Details - The receipt must include the donor's name, date of donation, amount contributed, and a description of any non-cash items donated.

- Quid Pro Quo Disclosure - If the donor receives goods or services in exchange for the donation, the charity must disclose the fair market value of those items on the receipt.

Maintaining accurate receipts is critical for substantiating charitable contributions when claiming IRS tax deductions.

Essential Information to Include on a Donation Receipt

Receipts required for charitable donation tax deductions must include key details to validate the donation. Proper documentation ensures the donor can claim the deduction accurately on their tax return.

Essential information on a donation receipt includes the donor's name, donation amount, and date of the contribution. The receipt must also provide the charity's name, tax identification number, and a statement confirming any goods or services received in exchange.

Types of Charitable Donations Eligible for Tax Deductions

Receipts for charitable donations are essential to claim tax deductions accurately and comply with IRS requirements. Specific types of charitable contributions require different types of documentation to validate the donation's nature and value.

- Cash Donations - A written receipt from the charity is required for any cash donation of $250 or more to qualify for a tax deduction.

- Non-Cash Donations - A detailed receipt is necessary, including a description of the items donated, their estimated fair market value, and the date of donation.

- Property Donations over $500 - Form 8283 must be completed along with a receipt, especially when the donation's value exceeds $500, to substantiate the deduction claim.

Receipt Requirements for Cash vs. Non-Cash Donations

Receipts play a crucial role in claiming charitable donation tax deductions by providing proof of your contributions. Different receipt requirements apply to cash and non-cash donations to ensure compliance with tax regulations.

- Cash Donations Require a Written Acknowledgment - Donations of $250 or more must have a receipt from the charity detailing the amount and date of the contribution.

- Non-Cash Donations Need a Receipt with Detailed Description - Donated items over $500 require a receipt that describes the items and their fair market value.

- Additional Documentation for High-Value Non-Cash Gifts - Gifts exceeding $5,000 often require a qualified appraisal attached to the receipt for tax deduction purposes.

Electronic vs. Paper Donation Receipts

Receipts for charitable donation tax deductions must include essential details such as the donor's name, the date of the donation, and the charity's information. Both electronic and paper donation receipts meet IRS requirements as long as they contain this information.

Electronic donation receipts offer convenience and quick access, often delivered via email or digital platforms. Paper receipts still hold validity and can be kept as physical proof for tax records, ensuring you can substantiate your deductions during audits.

Common Mistakes to Avoid in Issuing Receipts

Receipts required for charitable donation tax deductions must include the donor's name, donation amount, date of contribution, and the charity's tax identification number. Common mistakes to avoid in issuing receipts include omitting the charity's official details, failing to specify non-cash contributions, and not providing a written acknowledgment for donations over $250. Ensuring accurate and complete receipts helps you claim the maximum tax benefit without complications.

Recordkeeping Best Practices for Charities and Donors

Receipts required for charitable donation tax deductions include an acknowledgment letter from the charity for contributions over $250, detailing the donation amount and whether any goods or services were received. Donors should obtain and retain written records such as bank statements or credit card slips for smaller donations. Charities must provide clear, compliant receipts promptly to support donor claims and ensure transparency.

Consequences of Improper or Missing Receipts

```htmlWhat receipts are required for charitable donation tax deductions? Receipts must include the charity's name, donation date, and amount or description of non-cash items. Proper documentation ensures compliance with IRS regulations and supports your tax deduction claims.

What are the consequences of improper or missing receipts for charitable donations? The IRS may disallow deductions without valid receipts, leading to increased tax liability and potential penalties. Missing documentation can trigger audits and complicate your tax filing process.

```What Receipts Are Required for Charitable Donation Tax Deductions? Infographic