Digital receipt audits require several key documents to ensure accuracy and compliance, including original receipts, transaction records, and proof of payment. Businesses must also provide purchase orders, invoices, and any relevant supplier contracts to verify the legitimacy of expenses. Proper documentation supports efficient auditing, reduces discrepancies, and helps maintain transparent financial records.

What Documents Are Required for Digital Receipt Audits?

| Number | Name | Description |

|---|---|---|

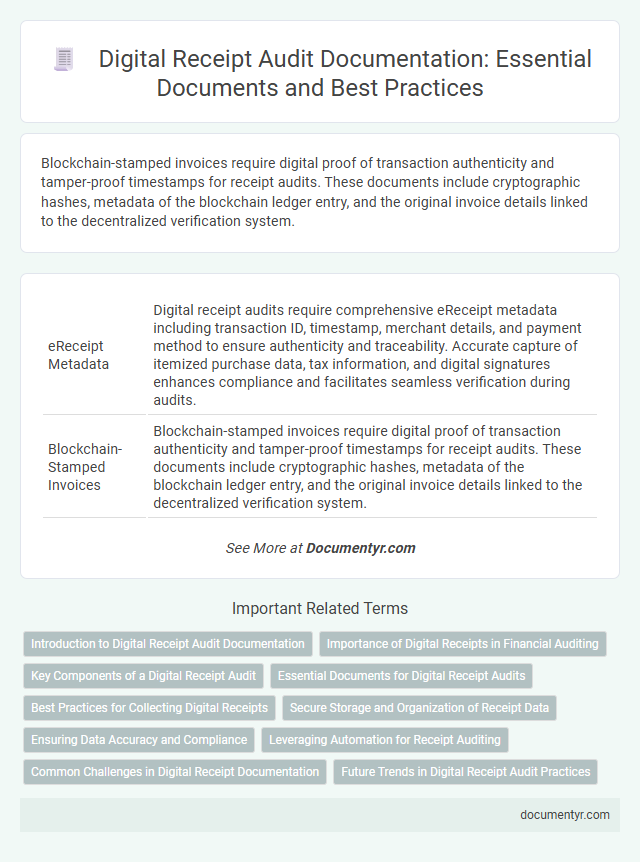

| 1 | eReceipt Metadata | Digital receipt audits require comprehensive eReceipt metadata including transaction ID, timestamp, merchant details, and payment method to ensure authenticity and traceability. Accurate capture of itemized purchase data, tax information, and digital signatures enhances compliance and facilitates seamless verification during audits. |

| 2 | Blockchain-Stamped Invoices | Blockchain-stamped invoices require digital proof of transaction authenticity and tamper-proof timestamps for receipt audits. These documents include cryptographic hashes, metadata of the blockchain ledger entry, and the original invoice details linked to the decentralized verification system. |

| 3 | Digital Chain of Custody Document | Digital receipt audits require the digital Chain of Custody document to verify the authenticity and integrity of the transaction data by tracking every transfer and access point throughout the lifecycle. This document ensures compliance with regulatory standards and provides an auditable trail for secure digital receipt management. |

| 4 | Cryptographic Proof of Authenticity | Digital receipt audits require cryptographic proof of authenticity, such as blockchain-verified digital signatures and time-stamped hash values, to ensure data integrity and prevent tampering. These documents provide irrefutable evidence that the receipt originates from a legitimate source and has remained unchanged since issuance. |

| 5 | Tokenized Purchase Ledger | Tokenized Purchase Ledger must include encrypted transaction IDs, timestamped purchase details, and authenticated vendor credentials to ensure secure and verifiable digital receipt audits. Access to blockchain-verified payment confirmations and digitally signed invoice copies is essential for comprehensive audit validation. |

| 6 | AI-Driven Audit Trails | AI-driven audit trails require digital receipts embedded with metadata such as transaction timestamps, vendor details, and payment methods to ensure accurate verification and traceability. Structured data formats like XML or JSON enhance automated audits by enabling seamless integration and real-time anomaly detection within the receipt records. |

| 7 | Smart Contract Receipts | Smart contract receipts require blockchain transaction records, digital signatures, and timestamp proofs for digital receipt audits. Verifiable audit trails and cryptographic proof of execution ensure authenticity and compliance during the auditing process. |

| 8 | QR Code-Embedded Receipts | Digital receipt audits require QR code-embedded receipts containing encoded transaction details such as purchase date, store information, itemized products, and payment method to ensure authenticity and traceability. Auditors also need access to linked digital transaction logs and verification metadata to validate the integrity and compliance of the receipts. |

| 9 | eSignature Timestamp Records | eSignature timestamp records play a crucial role in digital receipt audits by providing verifiable proof of the exact time a document was signed, ensuring compliance with legal and regulatory standards. These records must be accompanied by audit trails, identity authentication details, and the original signed documents to validate the authenticity and integrity of digital transactions. |

| 10 | OCR-Extracted Data Sheets | Digital receipt audits require OCR-extracted data sheets that capture detailed transaction information, including vendor names, dates, itemized purchases, and total amounts. These documents ensure accuracy and streamline verification processes by converting scanned receipts into searchable, editable digital formats essential for audit compliance. |

Introduction to Digital Receipt Audit Documentation

Digital receipt audits streamline the verification of transactions by using electronic records. Understanding the necessary documentation is essential for efficient and accurate audit processes.

- Transaction Receipts - Digital copies of sales or service receipts that detail the purchase information.

- Invoice Records - Electronic invoices that support the transaction details and payment status.

- Payment Confirmations - Proof of payment such as digital payment gateway records or bank statements.

This documentation ensures your digital receipt audits comply with regulatory standards and improve accountability.

Importance of Digital Receipts in Financial Auditing

Digital receipts are essential documents in financial auditing as they provide accurate, time-stamped proof of transactions. Auditors rely on these electronic records to verify expenses and ensure compliance with financial regulations.

Required documents for digital receipt audits include transaction records, payment confirmations, and timestamps. These digital proofs help streamline the audit process and reduce the risk of discrepancies or fraud.

Key Components of a Digital Receipt Audit

| Key Component | Description | Required Documents |

|---|---|---|

| Transaction Verification | Confirming the authenticity and accuracy of each transaction recorded in the digital receipt system. | Original digital receipts, transaction logs, payment confirmations, and timestamps. |

| Vendor Information | Verifying details of the vendor to ensure the transaction was made with authorized providers. | Vendor registration documents, supplier contracts, and tax identification numbers. |

| Customer Identification | Ensuring the receipt corresponds to the correct customer for accountability and record-keeping purposes. | Customer profiles, account data, and digital signatures or authentication records. |

| Payment Method Validation | Confirming the payment method recorded in the digital receipt matches the actual payment processed. | Bank statements, credit card transaction records, and payment gateway logs. |

| Compliance Check | Assessing if the digital receipts comply with regulatory standards and company policies. | Regulatory guidelines, audit trail reports, and compliance certificates. |

| Data Integrity | Ensuring the digital receipt data has not been altered or corrupted during storage or transmission. | System logs, encryption records, and checksum/hash validation reports. |

Essential Documents for Digital Receipt Audits

Digital receipt audits require specific documentation to ensure accuracy and compliance. Proper records enable streamlined verification and financial accountability.

- Digital Receipts - Verified digital copies of transaction receipts serve as primary evidence in audits.

- Transaction Logs - Detailed logs record the date, time, and amount of each transaction for validation.

- Payment Confirmations - Electronic confirmations or bank statements support receipt authenticity and payment completion.

Best Practices for Collecting Digital Receipts

Digital receipt audits require accurate and organized documentation to ensure smooth verification. Key documents include electronic receipts, transaction logs, and proof of purchase files.

Collect digital receipts promptly and store them in a centralized, secure location for easy access during audits. Verify the authenticity of each receipt by cross-referencing transaction details such as date, amount, and vendor information. You should maintain consistent file naming conventions to enhance retrieval efficiency and support audit accuracy.

Secure Storage and Organization of Receipt Data

Digital receipt audits require accurate and comprehensive documentation, including original receipts, transaction records, and proof of payment. Secure storage of these documents in encrypted digital systems ensures data integrity and prevents unauthorized access. Proper organization of receipt data using standardized formats facilitates quick retrieval and efficient audit processes for your business.

Ensuring Data Accuracy and Compliance

Digital receipt audits require accurate and complete documentation to verify transaction validity and compliance with financial regulations. Key documents include original digital receipts, transaction logs, and payment confirmation records which ensure traceability.

Supporting documents such as purchase orders, delivery notes, and electronic invoices help cross-verify transaction details, reinforcing data accuracy. Maintaining these records in standardized digital formats aligns with audit requirements and regulatory policies.

Leveraging Automation for Receipt Auditing

Digital receipt audits require key documents such as original digital receipts, transaction logs, and supplier invoices to ensure accuracy and compliance. Leveraging automation streamlines the collection and verification process by automatically extracting relevant data from these documents. Automated systems enhance audit efficiency, reduce human error, and enable real-time tracking of discrepancies.

Common Challenges in Digital Receipt Documentation

What documents are required for digital receipt audits? Digital receipt audits typically require invoices, transaction records, and payment confirmations. Proper documentation ensures accuracy and compliance during the audit process.

What are common challenges in digital receipt documentation? Inconsistent formatting and missing data are frequent obstacles faced during digital receipt management. These issues can lead to delays and errors in the audit verification process.

What Documents Are Required for Digital Receipt Audits? Infographic