To verify a charitable donation receipt, the donor must provide the official receipt issued by the charity organization, which includes the name of the donor, the date of the donation, and the donation amount. The receipt should also contain the charity's registration number or tax-exempt status to ensure authenticity. Supporting documents such as proof of payment, bank statements, or acknowledgment letters may be required to complement the donation record.

What Documents Are Necessary for Charitable Donation Receipt Verification?

| Number | Name | Description |

|---|---|---|

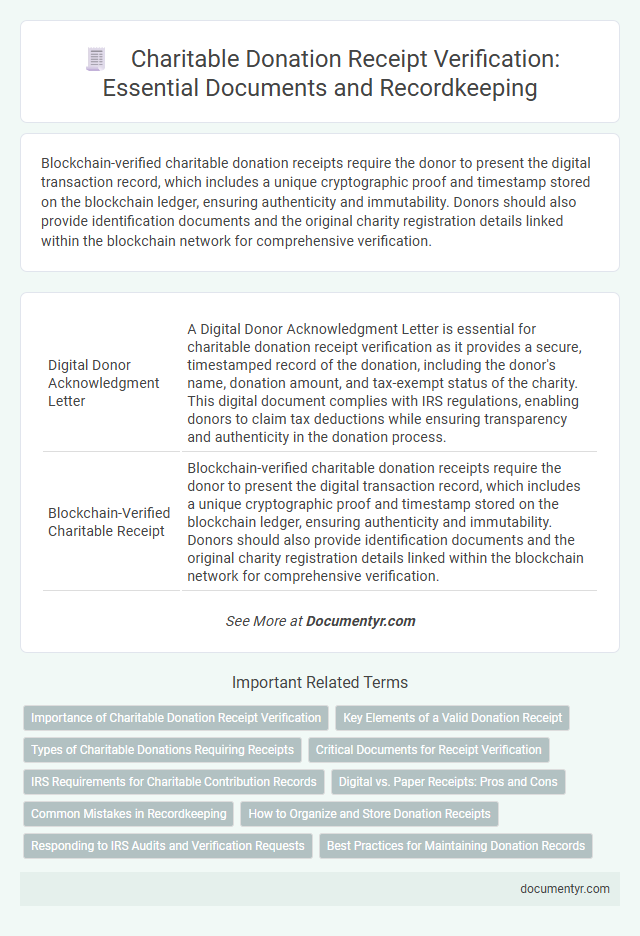

| 1 | Digital Donor Acknowledgment Letter | A Digital Donor Acknowledgment Letter is essential for charitable donation receipt verification as it provides a secure, timestamped record of the donation, including the donor's name, donation amount, and tax-exempt status of the charity. This digital document complies with IRS regulations, enabling donors to claim tax deductions while ensuring transparency and authenticity in the donation process. |

| 2 | Blockchain-Verified Charitable Receipt | Blockchain-verified charitable donation receipts require the donor to present the digital transaction record, which includes a unique cryptographic proof and timestamp stored on the blockchain ledger, ensuring authenticity and immutability. Donors should also provide identification documents and the original charity registration details linked within the blockchain network for comprehensive verification. |

| 3 | e-Donation Tax Compliance Certificate | An e-Donation Tax Compliance Certificate is essential for verifying charitable donation receipts, as it confirms the donor's eligibility for tax deductions and ensures the donation complies with tax regulations. This digital certificate contains detailed information such as donor identification, donation amount, date, and the charity's registration details, facilitating accurate record-keeping and audit processes. |

| 4 | AI-Generated Giving Statement | AI-generated giving statements require key documents such as the donor's identification, proof of donation including bank transfer records or transaction receipts, and the official charitable organization's registration number for verification. Ensuring these elements are included helps authenticate the donation and complies with legal and tax regulations. |

| 5 | Nonprofit EIN Verification Document | Nonprofit EIN verification documents, such as the IRS determination letter, are essential for authenticating charitable donation receipts and confirming the organization's tax-exempt status. These documents ensure donors can claim tax deductions by validating the nonprofit's legitimacy through its Employer Identification Number. |

| 6 | ESG (Environmental, Social, Governance) Impact Report | Charitable donation receipt verification requires donor identification, donation amount confirmation, and the official donation receipt issued by the charity. ESG Impact Reports provide essential data on environmental, social, and governance outcomes, supporting transparency and accountability in verifying the effectiveness of funded initiatives. |

| 7 | NFT Donation Transaction Record | For charitable donation receipt verification involving NFT donation transactions, essential documents include the blockchain transaction record, a digital wallet address confirmation, and a detailed NFT metadata report outlining the asset's provenance and valuation. These documents ensure transparency and validate the authenticity and ownership transfer of the donated NFT. |

| 8 | QR-Coded Gift Confirmation Slip | A QR-coded gift confirmation slip is essential for verifying charitable donation receipts, as it contains encrypted transaction details that facilitate quick and accurate validation by scanning. This digital verification method improves transparency and ensures the authenticity of donation records, streamlining the receipt confirmation process. |

| 9 | Donor-Advised Fund (DAF) Distribution Notice | A Donor-Advised Fund (DAF) Distribution Notice serves as a critical document for charitable donation receipt verification, detailing the amount distributed and the recipient charity. This notice must include the donor's name, fund sponsor, distribution date, and confirmation that no goods or services were received in exchange for the donation to ensure compliance with IRS regulations. |

| 10 | Cross-Border Philanthropy Compliance Form | Cross-Border Philanthropy Compliance Forms are essential documents for verifying charitable donation receipts, ensuring adherence to international donation regulations and tax laws. These forms confirm the donor's identity, donation details, and compliance with both the donor's and recipient's country legal requirements for tax deduction eligibility. |

Importance of Charitable Donation Receipt Verification

| Document Type | Description | Purpose in Verification |

|---|---|---|

| Official Donation Receipt | Issued by the charity organization, this document includes donor name, donation amount, date, and charity registration number. | Confirms authenticity of the donation and eligibility for tax deductions. |

| Charity Registration Proof | Government-issued license or certificate proving the charity's legal status. | Ensures the organization is recognized for receiving tax-deductible donations. |

| Bank Statement or Proof of Payment | Bank transfer details, credit card statements, or receipts that show the transaction to the charity. | Verifies the financial transaction matches the claimed donation amount. |

| Donation Agreement or Pledge Letter | Document outlining the terms, amount, and purpose of the donation, often used for larger gifts. | Confirms donor intent and agreement with the charity. |

| Correspondence with Charity | Emails, letters, or communication confirming donation and receipt issuance. | Supports validation by providing additional proof of the donation process. |

|

Importance of Charitable Donation Receipt Verification Verifying charitable donation receipts is critical to ensure the legitimacy of both the donation and the charity organization. It protects You from fraud, securing your tax benefits and maintaining compliance with legal requirements. Proper documentation helps in audit situations and enhances trust in charitable giving. |

||

Key Elements of a Valid Donation Receipt

A valid charitable donation receipt must contain essential information to confirm the transaction. Proper documentation ensures compliance with tax regulations and validates the donor's claim for deductions.

Key elements in a donation receipt help verify its authenticity and accuracy for record-keeping and audit purposes.

- Donor's Name and Address - Identifies the individual or organization making the donation to prevent ambiguity.

- Date of Donation - Specifies when the contribution was made, critical for tax year verification.

- Charitable Organization Details - Includes the official name, address, and registration number of the charity to confirm legitimacy.

- Donation Amount or Description - Specifies the exact cash amount or a detailed description of non-cash items donated.

- Statement of Goods or Services Received - Indicates whether any benefits were provided in exchange, necessary for tax deduction limits.

- Signature or Authorized Stamp - Validates the receipt by the charity's representative for authenticity.

Types of Charitable Donations Requiring Receipts

Charitable donation receipt verification requires specific documentation to confirm the legitimacy of the contribution. Receipts serve as proof for tax deductions and must include essential details such as donor information and donation value.

Types of charitable donations requiring receipts include cash donations, property gifts, and vehicle contributions. Receipts are also necessary for in-kind donations like clothing, furniture, and other goods to ensure proper valuation and compliance.

Critical Documents for Receipt Verification

What critical documents are necessary for charitable donation receipt verification? Donors must provide a formal donation receipt issued by the charity, including the organization's name, date of donation, and amount contributed. Acknowledgment letters or bank statements showing the transaction also serve as essential verification proof.

IRS Requirements for Charitable Contribution Records

Verifying charitable donation receipts requires specific documentation to comply with IRS regulations. Proper records ensure your contributions are valid for tax deductions.

- Written Acknowledgment - A receipt from the charity stating the donation amount and whether any goods or services were provided in return is mandatory for contributions over $250.

- Bank Records or Credit Card Statements - These provide proof of payment when written acknowledgment is unavailable and support deduction claims.

- Cancelled Checks - A canceled check acts as evidence of the charitable contribution and supports the legitimacy of your donation.

Maintaining accurate and complete documentation is essential for IRS charitable donation receipt verification.

Digital vs. Paper Receipts: Pros and Cons

Verification of charitable donation receipts requires valid documentation such as acknowledgement letters from the charity, proof of donation like bank statements, and official receipts detailing the donation amount and date. Both digital and paper receipts serve as essential evidence, but their acceptance depends on the institution or tax authority involved.

Digital receipts offer advantages like easy storage, quick access, and eco-friendliness, enabling donors to submit electronic copies for verification seamlessly. Paper receipts provide a physical tangible record that some institutions may prefer, although they carry risks such as loss or damage over time.

Common Mistakes in Recordkeeping

Proper documentation is essential for charitable donation receipt verification, including official receipts from the charity, proof of payment, and detailed records of donated items. Common mistakes in recordkeeping involve missing receipts, unclear descriptions of non-cash donations, and lack of date or donor information. Ensuring your records are complete and accurate helps prevent issues during tax audits and supports the validity of your charitable contributions.

How to Organize and Store Donation Receipts

Organize donation receipts by categorizing them according to donation dates and amounts to facilitate easy retrieval during verification. Store physical receipts in labeled folders or binders, while digital copies should be saved in secure, cloud-based storage systems with proper backup. Maintain a consistent log or spreadsheet to track each receipt's details, ensuring compliance with tax regulations and quick access when needed.

Responding to IRS Audits and Verification Requests

Receipts for charitable donations must be carefully maintained to respond effectively to IRS audits and verification requests. Proper documentation verifies the legitimacy and value of your contributions, ensuring compliance with tax regulations.

- Official Donation Receipt - The receipt should include the charity's name, date of donation, and amount or description of donated goods.

- Written Acknowledgment from Charity - For donations over $250, a written acknowledgment from the organization is required to claim a tax deduction.

- Proof of Payment - Bank statements, canceled checks, or credit card statements serve as evidence of monetary donations.

What Documents Are Necessary for Charitable Donation Receipt Verification? Infographic