Receipt documents necessary for FSA/HSA medical expense submissions must include the date of service, provider or merchant details, description of the medical service or product, and the total amount paid. The receipt should clearly show that the expense qualifies as medical, dental, or vision care, excluding non-eligible items. Maintaining detailed, legible receipts ensures smooth reimbursement and compliance with IRS guidelines for health-related expenses.

What Receipt Documents are Necessary for FSA/HSA Medical Expense Submissions?

| Number | Name | Description |

|---|---|---|

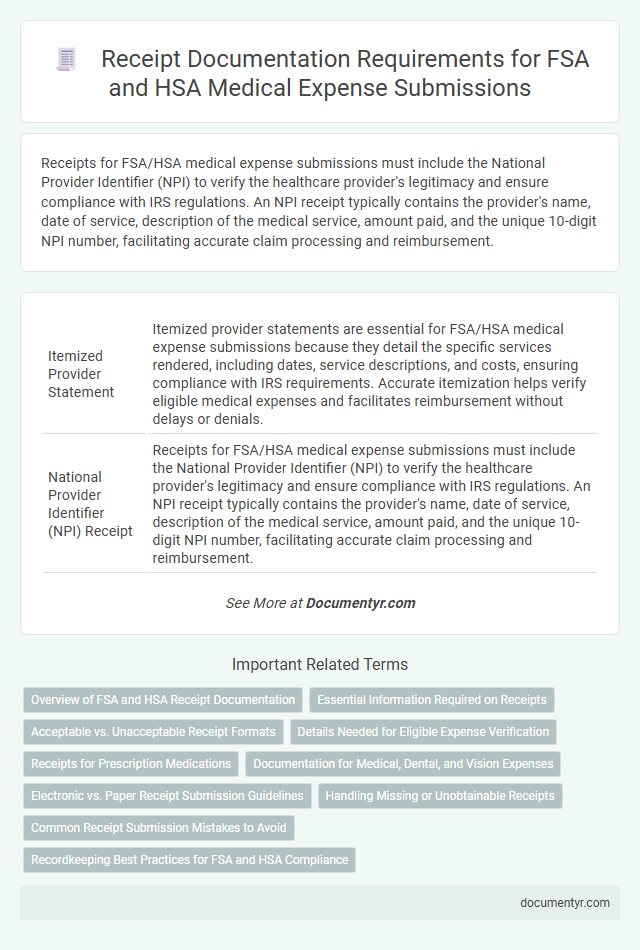

| 1 | Itemized Provider Statement | Itemized provider statements are essential for FSA/HSA medical expense submissions because they detail the specific services rendered, including dates, service descriptions, and costs, ensuring compliance with IRS requirements. Accurate itemization helps verify eligible medical expenses and facilitates reimbursement without delays or denials. |

| 2 | National Provider Identifier (NPI) Receipt | Receipts for FSA/HSA medical expense submissions must include the National Provider Identifier (NPI) to verify the healthcare provider's legitimacy and ensure compliance with IRS regulations. An NPI receipt typically contains the provider's name, date of service, description of the medical service, amount paid, and the unique 10-digit NPI number, facilitating accurate claim processing and reimbursement. |

| 3 | EOB (Explanation of Benefits) Attachments | EOB (Explanation of Benefits) attachments provide detailed information about medical services covered, patient responsibility, and insurance payments, making them essential for FSA/HSA medical expense submissions. Including clear EOB documents alongside receipts ensures accurate claim processing and verification of eligible medical expenses. |

| 4 | Adjudication Summary | For FSA/HSA medical expense submissions, receipts must include detailed provider information, service date, type of service or item, and amount paid to ensure swift adjudication. The adjudication summary verifies these elements against plan requirements, facilitating accurate reimbursement and reducing claim denials. |

| 5 | Zero-Coverage Documentation | Receipts for FSA/HSA medical expense submissions must include zero-coverage documentation, which verifies that insurance did not pay for the service, ensuring eligibility for reimbursement. This documentation should clearly show the provider's name, date of service, description of treatment, amount billed, and a zero-dollar insurance payment or denial statement. |

| 6 | Rx Details Barcode Receipt | Receipts for FSA/HSA medical expense submissions must include the pharmacy name, date of service, patient name, detailed description of the medication, and the Rx barcode to verify the prescription. The barcode ensures accurate processing and compliance with IRS requirements by linking the purchase directly to the prescribed medication. |

| 7 | Telehealth Visit Invoice | Telehealth visit invoices must include the provider's name, date of service, detailed description of the medical service, and the amount charged to qualify for FSA/HSA medical expense reimbursement. Receipts lacking these essential elements may be rejected during the claim submission process, so ensuring comprehensive documentation is critical for compliance with IRS guidelines. |

| 8 | Digital Copay Receipt | Digital copay receipts are essential for FSA/HSA medical expense submissions as they provide detailed proof of payment, including the date of service, provider information, and exact copay amount. These receipts must clearly itemize the service rendered and the patient's responsibility to ensure eligibility for reimbursement under flexible spending or health savings accounts. |

| 9 | Provider-Signed Superbill | Provider-signed superbills are essential receipt documents for FSA/HSA medical expense submissions, as they include detailed information about the patient, date of service, type of treatment, and the provider's signature verifying the service rendered. These superbills help substantiate eligibility of expenses and ensure compliance with IRS requirements for reimbursement. |

| 10 | QR-Coded Medical Payment Stub | QR-coded medical payment stubs are essential for FSA/HSA submissions as they contain detailed transaction data, provider information, date of service, and payment amounts, ensuring IRS compliance and facilitating faster claim processing. These stubs eliminate ambiguity by encoding verified medical expense details, streamlining expense validation and reimbursement. |

Overview of FSA and HSA Receipt Documentation

Receipts for FSA and HSA medical expense submissions must include specific details to ensure eligibility and reimbursement. Proper documentation helps verify that expenses qualify under IRS guidelines for these accounts.

- Date of Service - The receipt must clearly show the date when the medical service or purchase occurred.

- Provider or Merchant Information - Receipts should include the name and address of the healthcare provider or merchant.

- Itemized Description of Services or Products - A detailed listing of the medical services or items purchased that are eligible for FSA or HSA reimbursement.

Essential Information Required on Receipts

| Essential Information Required on Receipts for FSA/HSA Medical Expense Submissions |

|---|

| Date of Service or Purchase: The receipt must clearly show the date when the medical service or product was provided or purchased. This ensures the expense falls within the eligible time frame for FSA/HSA submission. |

| Description of Service or Item: A detailed description of the medical service, procedure, or eligible product is necessary. Generic terms like "medical services" are insufficient; specifics such as "office visit," "prescription medication," or "glucose test strips" are required. |

| Provider or Merchant Name: The name of the healthcare provider, pharmacy, or merchant supplying the medical service or product must be clearly indicated. This validates the legitimacy of the expense. |

| Amount Paid: The total amount paid out-of-pocket should be displayed. Only expenses actually paid by the account holder can qualify for reimbursement through FSA/HSA. |

| Proof of Payment: Receipts need to include evidence of payment such as a credit card slip, canceled check, or receipt showing payment completion. |

| Patient Name (if applicable): Some FSA/HSA administrators require the patient's name on the receipt to confirm the expense corresponds to an eligible individual. |

Acceptable vs. Unacceptable Receipt Formats

Submitting medical expenses for FSA/HSA accounts requires proper receipt documentation to ensure transactions qualify for reimbursement. Understanding which receipt formats are acceptable helps avoid claim denials and delays.

- Acceptable receipts must include provider details - Receipts should clearly display the healthcare provider's name, service date, and itemized description of the medical expense.

- Digital and printed receipts are both valid - Scanned or electronic receipts with legible information are generally accepted alongside original paper receipts.

- Handwritten or incomplete receipts are unacceptable - Receipts lacking essential information or handwritten notes often fail to meet FSA/HSA documentation standards.

Details Needed for Eligible Expense Verification

What receipt documents are necessary for FSA/HSA medical expense submissions? Receipts must clearly show the merchant's name, date of purchase, and a detailed description of the medical service or product. Proof of payment and the amount paid are essential to verify eligibility and ensure proper reimbursement.

Receipts for Prescription Medications

Receipts for prescription medications are essential for FSA and HSA medical expense submissions. These receipts serve as proof of purchase and eligibility when submitting claims.

Your prescription medication receipt must include the date of purchase, the name of the pharmacy, and detailed information about the medication. It should clearly show the patient's name, the prescribed drug, and the amount paid. Without these details, the receipt may be rejected by the FSA or HSA administrator.

Documentation for Medical, Dental, and Vision Expenses

Receipts for FSA/HSA medical expense submissions must include the date of service, provider's name, and detailed description of the medical, dental, or vision services rendered. Documentation should clearly show the type of expense, total amount paid, and proof of payment to validate reimbursement claims. You must retain itemized receipts that specify eligible medical, dental, or vision treatments to ensure compliance with FSA/HSA requirements.

Electronic vs. Paper Receipt Submission Guidelines

Receipts play a crucial role in submitting medical expenses for FSA and HSA reimbursements. Understanding the difference between electronic and paper receipt submission guidelines ensures you comply with plan requirements.

- Electronic Receipts Are Accepted - Most FSA/HSA administrators allow electronic copies of receipts, such as PDFs or images, for faster processing.

- Paper Receipts Must Be Legible - Physical receipts submitted must clearly show the date, service description, amount paid, and provider details.

- Submission Deadlines Vary - Timely submission of both electronic and paper receipts is essential to avoid claim denials or delays.

Review your FSA/HSA plan's documentation guidelines carefully to determine acceptable receipt formats for reimbursement.

Handling Missing or Unobtainable Receipts

FSA and HSA medical expense submissions require detailed receipts that include the date of service, provider information, and the amount paid. These documents must clearly show that the expense qualifies under IRS guidelines.

If a receipt is missing or unobtainable, submitting other proof of purchase such as a bank statement or credit card statement may be acceptable. Contacting the provider for a duplicate receipt is recommended to ensure compliance with FSA/HSA rules.

Common Receipt Submission Mistakes to Avoid

Receipts for FSA/HSA medical expense submissions must include the provider's name, date of service, and detailed description of the medical service or product. Common receipt submission mistakes include missing essential information, illegible text, and lack of proof of payment. Ensuring clear, complete, and accurate receipts helps avoid claim denials and delays in reimbursement.

What Receipt Documents are Necessary for FSA/HSA Medical Expense Submissions? Infographic