Receipts for medical expense tax deductions must include detailed documentation such as the date of service, description of the medical treatment or product, and the amount paid. Valid receipts often cover payments for doctor's visits, prescriptions, hospital stays, and medical devices, ensuring eligibility for tax deduction claims. Maintaining organized and accurate receipt documents is essential to maximize deductible medical expenses and comply with IRS requirements.

What Receipt Documents Are Needed for Medical Expense Tax Deductions?

| Number | Name | Description |

|---|---|---|

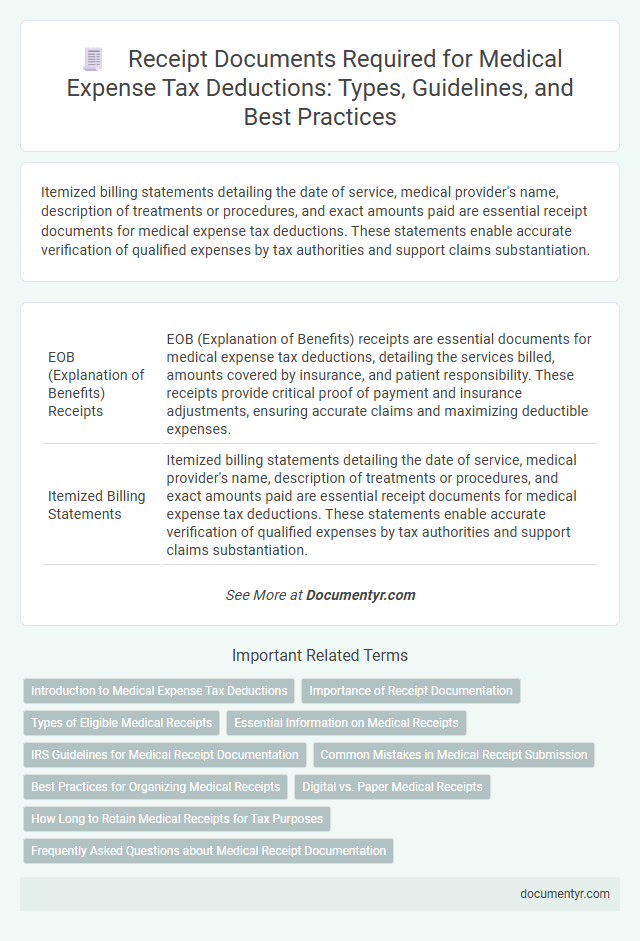

| 1 | EOB (Explanation of Benefits) Receipts | EOB (Explanation of Benefits) receipts are essential documents for medical expense tax deductions, detailing the services billed, amounts covered by insurance, and patient responsibility. These receipts provide critical proof of payment and insurance adjustments, ensuring accurate claims and maximizing deductible expenses. |

| 2 | Itemized Billing Statements | Itemized billing statements detailing the date of service, medical provider's name, description of treatments or procedures, and exact amounts paid are essential receipt documents for medical expense tax deductions. These statements enable accurate verification of qualified expenses by tax authorities and support claims substantiation. |

| 3 | Telehealth Service Receipts | Medical expense tax deductions require detailed telehealth service receipts that include the provider's name, date of service, description of the telehealth consultation, and the amount paid. Receipts should also specify the patient's name and the type of medical service delivered to ensure compliance with IRS documentation requirements. |

| 4 | FSA/HSA Reimbursement Receipts | For FSA/HSA reimbursement, detailed receipts must clearly show the date of service, type of medical expense, provider's name, and amount paid to substantiate tax deductions. Receipts lacking itemized information or provider details may be rejected by the IRS, making accuracy essential for successful medical expense claims. |

| 5 | Prescription Co-pay Receipts | Prescription co-pay receipts are essential documents for medical expense tax deductions, as they provide proof of out-of-pocket payments made for prescribed medications. These receipts must include the date of purchase, the medication name, the amount paid, and the pharmacy details to qualify for tax deductions. |

| 6 | Out-of-Network Provider Receipts | Receipts from out-of-network medical providers must include the provider's name, date of service, detailed description of the medical service rendered, amount paid, and proof of payment to qualify for medical expense tax deductions. These documents are essential for substantiating claims when insurance does not fully cover out-of-network costs. |

| 7 | Medical Device Purchase Receipts | Medical device purchase receipts must clearly itemize the device, display the purchase date, and include the seller's information to qualify for medical expense tax deductions. These documents should provide proof of payment and detail the medical necessity of the device as prescribed by a healthcare professional. |

| 8 | Surprise Medical Billing Receipts | Surprise medical billing receipts must include the patient's name, date of service, provider details, itemized charges, and proof of payment to qualify for medical expense tax deductions. Accurate documentation of these unexpected charges ensures compliance with IRS requirements and maximizes deductible claims. |

| 9 | No Surprises Act Dispute Receipts | Receipts required for medical expense tax deductions under the No Surprises Act include detailed bills or statements from healthcare providers that clearly itemize services, amounts paid, and insurer payments or patient responsibility. These documents serve as evidence in disputes to verify out-of-network charges and ensure accurate tax deduction claims. |

| 10 | Digital Health Platform Receipts | Digital health platform receipts required for medical expense tax deductions must include detailed information such as the patient's name, date of service, type of medical service or product provided, service provider's details, and the total amount paid. Receipts should also be clear, itemized, and issued by accredited digital health service providers to ensure eligibility during tax filings. |

Introduction to Medical Expense Tax Deductions

Medical expense tax deductions help reduce taxable income by allowing you to claim eligible healthcare costs. Proper documentation is essential to prove these expenses to tax authorities. Receipts for payments made to medical professionals, pharmacies, and hospitals are necessary for claiming these deductions.

Importance of Receipt Documentation

| Receipt Documents Needed for Medical Expense Tax Deductions |

|---|

| Medical expense tax deductions require proper receipt documentation to validate claims. Official receipts must detail the date of service, provider's name, patient's name, description of the medical service or product, and amount paid. Prescription receipts, hospital bills, dental service invoices, and pharmacy receipts are essential. Only receipts showing proof of payment are accepted by tax authorities. |

| Importance of Receipt Documentation |

| Accurate receipt documentation ensures compliance with tax regulations and facilitates smooth processing of medical expense claims. Receipts help substantiate expenses, prevent claim rejections, and reduce the likelihood of audits. Maintaining organized and legible receipts strengthens the taxpayer's position when submitting deductions. Proper documentation supports transparency and accountability in medical expense reporting. |

Types of Eligible Medical Receipts

Receipt documents are essential for claiming medical expense tax deductions. These documents verify the expenses and support your deduction claims.

Eligible medical receipts include hospital bills, prescription medication receipts, and payments for medical consultations. Receipts must clearly show the provider's name, date of service, and detailed charges. Receipts for medical equipment or therapy sessions may also qualify if they meet tax authority guidelines.

Essential Information on Medical Receipts

Medical expense tax deductions require receipts that clearly detail the patient's name, date of service, and the type of medical treatment or service provided. Essential information on medical receipts must include the healthcare provider's name, address, and registration number to verify authenticity. Receipts should also specify the amount paid, specifying whether it covers medications, consultations, or procedures to ensure accurate tax reporting.

IRS Guidelines for Medical Receipt Documentation

Proper documentation is essential for claiming medical expense tax deductions according to IRS guidelines. The IRS requires specific types of receipts to substantiate medical expense claims for tax purposes.

- Itemized Receipts - Detailed receipts showing the date, provider, and amount paid for each medical service.

- Proof of Payment - Receipts or canceled checks that confirm payment of medical expenses, ensuring eligibility for deduction.

- Explanation of Benefits (EOB) - Statements from insurance companies indicating the portion paid and the patient's responsibility.

Common Mistakes in Medical Receipt Submission

What receipt documents are needed for medical expense tax deductions? Medical expense receipts must clearly show the provider's name, date of service, and detailed charges for eligible treatments. Receipts missing these key details often lead to rejected tax deduction claims.

What are common mistakes in medical receipt submission? Submitting handwritten or illegible receipts and lacking itemized treatment information frequently causes delays in tax processing. Accurate and complete documentation ensures smooth approval of medical expense deductions.

Best Practices for Organizing Medical Receipts

Medical expense tax deductions require careful documentation of all related receipts. Essential receipt documents include invoices from healthcare providers, pharmacy bills, and payment statements for medical treatments.

Organizing medical receipts systematically improves accuracy during tax filing and ensures compliance with tax regulations. Best practices involve sorting receipts by date, type of service, and provider to streamline record-keeping and retrieval.

Digital vs. Paper Medical Receipts

Medical expense tax deductions require valid receipt documents to prove eligible costs. Both digital and paper medical receipts serve as proof of payment and must contain detailed information such as the provider's name, date of service, and amount paid.

Digital medical receipts offer convenience and easy storage, often accessible through healthcare provider portals or email. Paper receipts remain widely accepted and may be necessary if digital versions are unavailable or incomplete.

How Long to Retain Medical Receipts for Tax Purposes

Medical expense tax deductions require proper documentation to substantiate the claims on your tax returns. Retaining medical receipts for an appropriate duration is crucial to comply with tax regulations and avoid potential audits.

- Keep receipts for at least seven years - The IRS generally recommends retaining medical expense receipts for a minimum of seven years to cover the statute of limitations for audits.

- Retain detailed receipts and statements - Only receipts that clearly show the date, amount, and nature of the medical expense qualify for deductions and must be kept.

- Organize receipts by tax year - Storing receipts by tax year simplifies the process of proof submission if the IRS requests documentation for a particular filing.

What Receipt Documents Are Needed for Medical Expense Tax Deductions? Infographic