Contractors need to provide detailed receipts that clearly outline the scope of work completed, materials used, and labor costs associated with home renovation projects. These documents must include the contractor's name, contact information, and proof of payment to validate eligibility for home renovation tax credits. Accurate and itemized receipts ensure homeowners can substantiate their claims and maximize their potential tax benefits.

What Receipt Documents Does a Contractor Need for Home Renovation Tax Credits?

| Number | Name | Description |

|---|---|---|

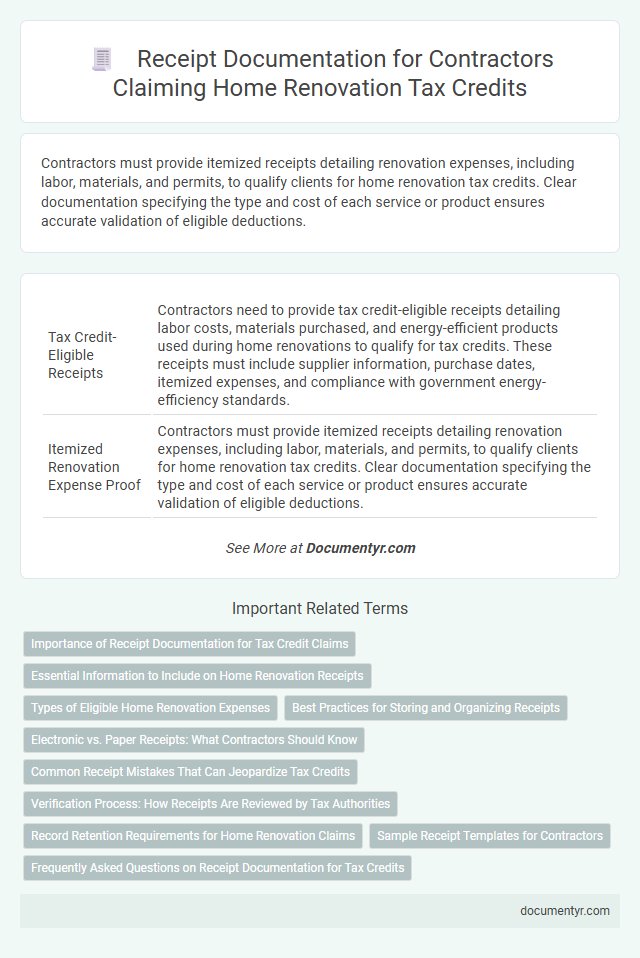

| 1 | Tax Credit-Eligible Receipts | Contractors need to provide tax credit-eligible receipts detailing labor costs, materials purchased, and energy-efficient products used during home renovations to qualify for tax credits. These receipts must include supplier information, purchase dates, itemized expenses, and compliance with government energy-efficiency standards. |

| 2 | Itemized Renovation Expense Proof | Contractors must provide itemized receipts detailing renovation expenses, including labor, materials, and permits, to qualify clients for home renovation tax credits. Clear documentation specifying the type and cost of each service or product ensures accurate validation of eligible deductions. |

| 3 | GST/HST-Compliant Invoices | Contractors must provide GST/HST-compliant invoices that include the supplier's name, GST/HST registration number, a detailed description of the renovation services, the date of the transaction, and the total amount charged including tax breakdowns to qualify for home renovation tax credits. These receipts serve as essential supporting documents for homeowners claiming tax incentives, ensuring compliance with Canada Revenue Agency (CRA) requirements. |

| 4 | Verified Supplier Statements | Verified supplier statements serve as essential receipt documents for contractors claiming home renovation tax credits, confirming the authenticity of purchased materials and services. These statements should include detailed information such as supplier identification, transaction dates, itemized costs, and compliance with tax credit eligibility criteria. |

| 5 | Energy Efficiency Upgrade Receipts | Contractors must provide detailed receipts for energy efficiency upgrades such as insulation, window replacement, and HVAC system installations to qualify for home renovation tax credits. These receipts should include itemized costs, dates of purchase and installation, product specifications, and proof of payment to ensure eligibility and accurate claim processing. |

| 6 | CRA-Approved Documentation | For home renovation tax credits, contractors must provide CRA-approved receipts detailing the service date, nature of work, labor and materials costs, and contractor identification including name and GST/HST registration number. These documents are essential to validate eligibility for the Canada Revenue Agency's eligible home renovation tax credit claims and must be retained for audit purposes. |

| 7 | Licensed Contractor Work Orders | Licensed contractor work orders are essential receipt documents for claiming home renovation tax credits, as they provide detailed evidence of the scope and cost of the work performed. These documents must clearly list the contractor's license number, project description, service dates, and payment amounts to ensure compliance with tax credit requirements. |

| 8 | Accessibility Renovation Receipts | Contractors must provide detailed receipts for accessibility renovations that clearly outline labor, materials, and specific modifications made to improve home accessibility, ensuring eligibility for tax credits. Receipts should include contractor identification, project dates, and itemized expenses to support claims for home renovation tax benefits. |

| 9 | Digital Proof of Payment (e-receipts) | Contractors need to provide digital proof of payment such as e-receipts that include detailed information on services rendered, dates, and payment amounts to validate home renovation tax credits. These e-receipts must be clear, itemized, and stored securely for audit purposes to ensure compliance with tax authority requirements. |

| 10 | Lump-Sum Contract Breakdown Sheets | Contractors must provide lump-sum contract breakdown sheets detailing labor, materials, and subcontractor costs to qualify for home renovation tax credits. These documents serve as essential proof of expenses and ensure transparency for tax authorities during credit claims. |

Importance of Receipt Documentation for Tax Credit Claims

Receipt documentation is crucial for claiming home renovation tax credits, as it provides proof of eligible expenses incurred during the project. Accurate and detailed receipts help verify the scope and cost of work completed by the contractor.

You need to keep receipts that clearly show the contractor's name, address, and registration number, along with a description of services performed and payment amounts. These documents support your claim by substantiating the eligibility of the renovation expenses with tax authorities. Proper receipt records reduce the risk of claim denial and simplify the auditing process.

Essential Information to Include on Home Renovation Receipts

Receipts for home renovation tax credits must clearly state the contractor's name, license number, and contact information. Including the date of service, detailed description of work performed, and total amount paid is essential.

Proof of payment, such as a credit card slip or canceled check, strengthens the validity of the receipt for tax credit claims. Accurate and detailed receipts ensure smoother processing of your home renovation tax credit applications.

Types of Eligible Home Renovation Expenses

Contractors must collect specific receipt documents to support claims for home renovation tax credits. These documents detail the types of eligible expenses incurred during the renovation.

- Invoices from Licensed Professionals - Official invoices from certified contractors and specialists are required to validate labor costs involved in the renovation.

- Receipts for Building Materials - Detailed receipts showing purchased materials, such as lumber, plumbing, electrical supplies, and fixtures, are necessary for expense verification.

- Proof of Equipment Rentals - Documentation for rented equipment used during the renovation helps substantiate eligible costs related to the project.

Maintaining organized and accurate receipt records ensures eligibility for home renovation tax credits and facilitates a smooth claim process.

Best Practices for Storing and Organizing Receipts

Receipt documents are essential for contractors to claim home renovation tax credits accurately. Proper storage and organization of these receipts ensure easy access during tax filing and audits.

- Keep Original Receipts - Store all original invoices and receipts to validate the expenses claimed for tax credits.

- Separate by Project - Organize receipts by each renovation project to simplify expense tracking and reporting.

- Use Digital Backup - Scan and save digital copies of receipts in secure folders to prevent loss and facilitate quick retrieval.

Electronic vs. Paper Receipts: What Contractors Should Know

Contractors must understand the differences between electronic and paper receipts when handling home renovation tax credits. Proper documentation is crucial for tax credit eligibility and audit compliance.

- Electronic Receipts Are Legally Valid - Digital receipts from reputable sources meet tax authority requirements for home renovation claims.

- Paper Receipts Provide Tangible Proof - Physical receipts offer a straightforward way to document expenses during home renovation projects.

- Organized Record Keeping is Essential - Maintaining clear copies of either receipt type ensures smooth processing of tax credits.

Common Receipt Mistakes That Can Jeopardize Tax Credits

Contractors must keep clear and detailed receipts to qualify for home renovation tax credits. Accurate documentation ensures your expenses are properly recorded and verifiable.

Common receipt mistakes that can jeopardize tax credits include missing dates, vague descriptions, and incomplete payment details. Receipts lacking contractor information or itemized costs often lead to claim denials.

Verification Process: How Receipts Are Reviewed by Tax Authorities

Tax authorities require detailed receipts to verify eligibility for home renovation tax credits. Receipts must clearly itemize labor and materials, including dates, contractor information, and project descriptions. During the verification process, tax officials cross-check receipts against project permits and payment records to ensure authenticity and compliance.

Record Retention Requirements for Home Renovation Claims

Contractors must retain detailed receipts for all home renovation expenses to support tax credit claims. These documents include invoices, payment proofs, and itemized lists of materials and labor costs. Proper record retention ensures compliance with tax regulations and facilitates smooth verification during audits related to home renovation tax credits.

Sample Receipt Templates for Contractors

| Receipt Document Type | Description | Essential Information Included | Purpose for Home Renovation Tax Credits | Sample Template Features |

|---|---|---|---|---|

| Payment Receipt | Proof of payment made by the homeowner to the contractor | Contractor name, payment amount, date, project details, payment method | Confirms the financial transaction for eligible renovation expenses | Clear header, payment summary, space for signatures, invoice number |

| Work Completion Receipt | Document confirming the completion of agreed renovation work | Project description, completion date, contractor contact info, homeowner name | Validates that renovation work aligns with tax credit requirements | Detailed work list, completion confirmation checkbox, date field |

| Material Purchase Receipt | Record of purchased materials used in the home renovation | Supplier name, material description, quantity, price, purchase date | Supports claims related to material costs for credits | Itemized list section, subtotal, tax and total amount fields |

| Contract Agreement Receipt | Initial contract receipt outlining scope and agreed pricing | Project scope, payment schedule, estimated costs, signatures | Documents agreed terms required for auditing and tax verification | Contract summary, terms and conditions section, client and contractor info |

What Receipt Documents Does a Contractor Need for Home Renovation Tax Credits? Infographic