Freelancers need a properly formatted receipt or invoice that includes their full name, business name if applicable, contact information, and tax identification number. The document must detail the services provided, dates of service, payment amount, and payment method to ensure transparency and legal compliance. Keeping copies of these receipts helps freelancers track income and prepare accurate tax returns.

What Documents Does a Freelancer Need for Client Receipt Invoicing?

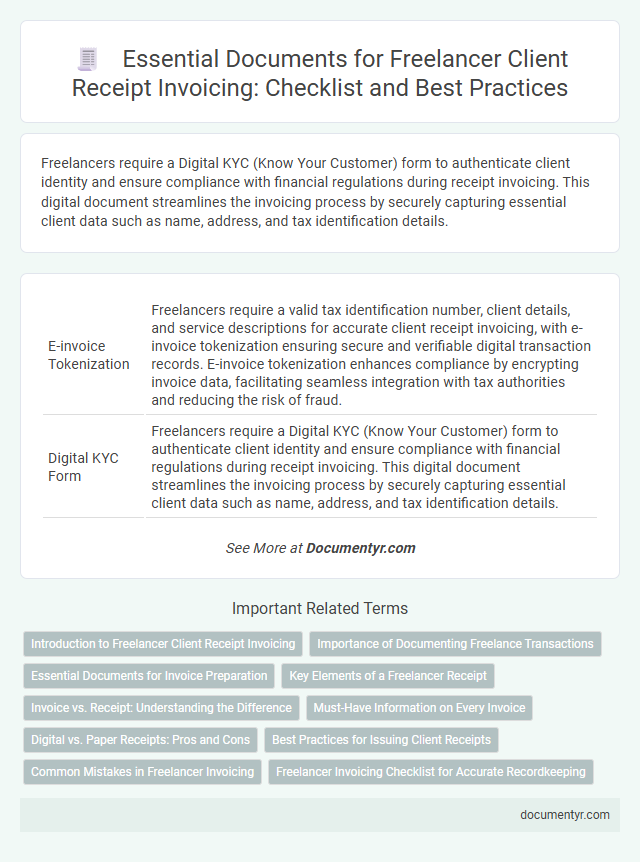

| Number | Name | Description |

|---|---|---|

| 1 | E-invoice Tokenization | Freelancers require a valid tax identification number, client details, and service descriptions for accurate client receipt invoicing, with e-invoice tokenization ensuring secure and verifiable digital transaction records. E-invoice tokenization enhances compliance by encrypting invoice data, facilitating seamless integration with tax authorities and reducing the risk of fraud. |

| 2 | Digital KYC Form | Freelancers require a Digital KYC (Know Your Customer) form to authenticate client identity and ensure compliance with financial regulations during receipt invoicing. This digital document streamlines the invoicing process by securely capturing essential client data such as name, address, and tax identification details. |

| 3 | eSeal Verification File | Freelancers require an eSeal Verification File to ensure the authenticity and integrity of digital receipts issued to clients, providing a secure method for verifying invoice documents. This file contains cryptographic data that validates the electronic signature, safeguarding against fraud and enabling seamless client receipt invoicing compliance. |

| 4 | Smart Contract Receipt | Freelancers require a smart contract receipt to ensure transparent, automated payment terms and secure proof of service delivery in client invoicing. This document integrates blockchain technology to validate transactions, reducing disputes and enhancing trust between parties. |

| 5 | Blockchain Timestamp Certificate | Freelancers need a Blockchain Timestamp Certificate to provide an immutable, verifiable record of the invoice creation date, ensuring secure proof of delivery and contract fulfillment. This document enhances trust between clients and freelancers by certifying the authenticity and exact timing of the invoiced work. |

| 6 | GST-Compliant Digital Invoice | Freelancers require GST-compliant digital invoices containing a unique invoice number, date, client and service details, GSTIN of both parties, HSN/SAC codes, and the applicable GST rates and amounts for accurate client receipt invoicing. These documents ensure legal compliance and facilitate seamless tax filing under GST regulations. |

| 7 | Self-Billed Invoice Declaration | Freelancers require a Self-Billed Invoice Declaration to authorize clients to issue invoices on their behalf, ensuring compliance with tax regulations and maintaining transparent financial records. This document must include essential information such as the freelancer's tax identification number, agreement terms, and signatures from both parties to validate the self-billing arrangement. |

| 8 | E-Signature Audit Trail | Freelancers require a detailed e-signature audit trail as part of client receipt invoicing to ensure the authenticity and legal compliance of their digital documents. This audit trail records timestamps, IP addresses, and signer identities, providing verifiable evidence essential for accurate financial record-keeping and dispute resolution. |

| 9 | Virtual Payment Confirmation Slip | A freelancer needs a Virtual Payment Confirmation Slip as a key document for client receipt invoicing, ensuring proof of transaction completion and payment verification. This slip typically includes transaction ID, payment date, payer and payee details, and payment amount, serving as legally valid evidence for both parties. |

| 10 | Invoice QR Code Validator | Freelancers need an invoice with a QR code validator to ensure client receipt verification, facilitating faster payment processing and compliance with tax regulations. The QR code embeds essential invoice details such as invoice number, date, total amount, and tax identification, enabling clients to easily authenticate and track transactions digitally. |

Introduction to Freelancer Client Receipt Invoicing

Understanding the essential documents for client receipt invoicing is crucial for freelancers to maintain clear financial records and ensure timely payments. Proper invoicing helps streamline your business transactions and build trust with clients.

- Invoice - A detailed invoice outlines the services provided, payment terms, and totals due, serving as the primary document for client billing.

- Service Agreement - This contract defines the scope of work, deadlines, and payment conditions to avoid disputes and clarify expectations.

- Payment Receipt - A receipt confirms the client's payment, providing proof of transaction and maintaining accurate financial records.

Importance of Documenting Freelance Transactions

Accurate documentation is crucial for freelance transaction receipts to ensure clarity and legal compliance. Essential documents include detailed invoices, signed contracts, and proof of payment records. You must maintain these records to support tax filings and client disputes effectively.

Essential Documents for Invoice Preparation

Freelancers require specific documents to ensure accurate and professional client receipt invoicing. These essential documents help streamline payment processes and maintain clear financial records.

Key documents for invoice preparation include contracts or agreements detailing project scope and payment terms. Time tracking sheets or work logs verify hours worked or tasks completed. Additionally, tax identification numbers and banking details are necessary for compliance and payment processing.

Key Elements of a Freelancer Receipt

| Document | Description | Key Elements for Receipt Invoicing |

|---|---|---|

| Freelancer Receipt | A formal document issued to clients confirming payment for services rendered. |

|

| Invoice | Request for payment document outlining services and fees. | Invoice Number, Due Date, Service Breakdown, Total Amount Due |

| Payment Confirmation | Proof of payment such as transaction slip or bank statement. | Transaction ID, Date of Payment, Amount Transferred |

| Tax Registration Certificate (if applicable) | Document proving tax compliance status. | Tax Identification Number, Validity Date |

Invoice vs. Receipt: Understanding the Difference

Understanding the difference between an invoice and a receipt is crucial for freelancers managing client transactions. An invoice is a request for payment issued before services are rendered, detailing the amount owed and payment terms. A receipt, on the other hand, is proof of payment received, confirming that the transaction has been completed.

Must-Have Information on Every Invoice

Freelancers must ensure their client receipt invoices contain specific essential information to maintain professionalism and compliance. Your invoices should clearly communicate all necessary details for accurate payment processing and record-keeping.

- Invoice Number - A unique identifier for each invoice to help track payments and simplify accounting.

- Client and Freelancer Details - Full names, addresses, and contact information of both parties to validate the transaction.

- Itemized List of Services - Detailed descriptions, quantities, and rates of services provided to clarify billing.

Digital vs. Paper Receipts: Pros and Cons

What documents does a freelancer need for client receipt invoicing? Freelancers require accurate invoices, payment proofs, and contract agreements to ensure transparent financial transactions. These documents help validate services rendered and support tax reporting obligations.

What are the pros and cons of digital receipts for freelancers? Digital receipts offer easy storage, quick sharing, and enhanced organization through software tools. However, they depend on electronic devices and internet access, which may pose risks of data loss or security breaches.

How do paper receipts compare to digital receipts for freelancer invoicing? Paper receipts provide tangible proof and are easily accessible without technology. The downsides include higher physical storage needs, risk of damage or loss, and slower retrieval times.

What factors should freelancers consider when choosing between digital and paper receipts? Freelancers should evaluate convenience, security, accessibility, and compliance requirements. Balancing these factors helps ensure efficient financial management and reliable client communication.

Best Practices for Issuing Client Receipts

Freelancers must maintain proper documentation when issuing client receipts to ensure clear financial records. Essential documents include a detailed invoice, proof of service delivery, and agreement contracts.

Best practices for issuing client receipts emphasize accuracy, clarity, and timely delivery. Including payment terms, itemized services, and tax information enhances transparency and professionalism.

Common Mistakes in Freelancer Invoicing

Freelancers must have accurate client receipts and properly issued invoices to ensure smooth payment processes. Essential documents include service agreements, detailed invoices, and proof of delivery or completion.

Common mistakes in freelancer invoicing include missing invoice numbers, unclear descriptions, and failure to include tax information. You should verify all details to avoid delays and disputes with clients.

What Documents Does a Freelancer Need for Client Receipt Invoicing? Infographic