Charitable donation receipts require key documents including proof of donation such as bank statements, canceled checks, or credit card statements showing the transaction details. Donors must also provide a receipt from the charitable organization that includes the donor's name, donation amount, date of contribution, and the organization's tax-exempt status. Maintaining accurate documentation ensures compliance with tax regulations and facilitates smooth verification during audits.

What Documents Are Required for Charitable Donation Receipts?

| Number | Name | Description |

|---|---|---|

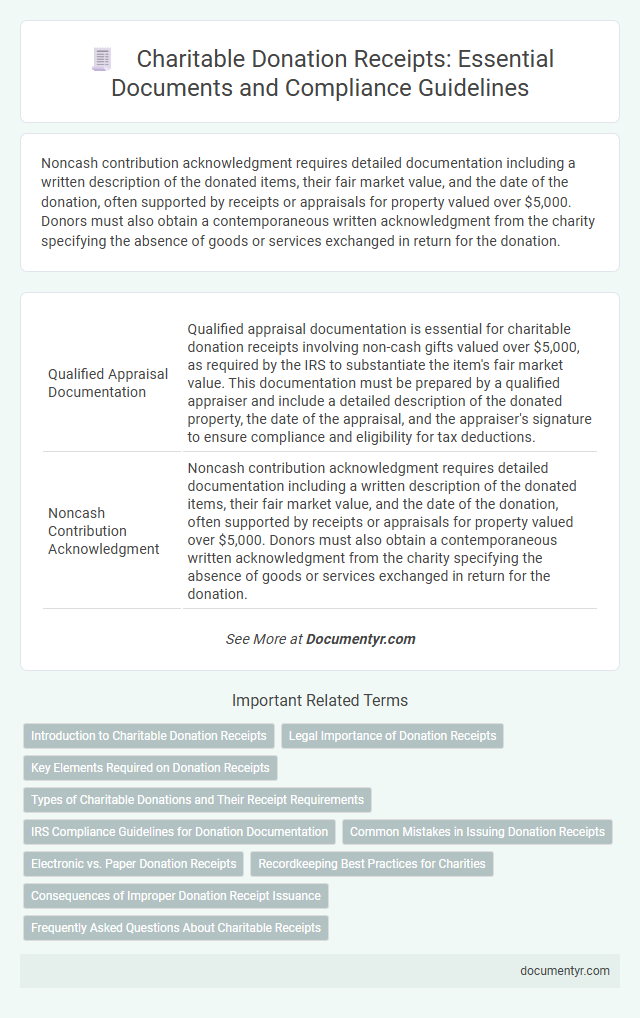

| 1 | Qualified Appraisal Documentation | Qualified appraisal documentation is essential for charitable donation receipts involving non-cash gifts valued over $5,000, as required by the IRS to substantiate the item's fair market value. This documentation must be prepared by a qualified appraiser and include a detailed description of the donated property, the date of the appraisal, and the appraiser's signature to ensure compliance and eligibility for tax deductions. |

| 2 | Noncash Contribution Acknowledgment | Noncash contribution acknowledgment requires detailed documentation including a written description of the donated items, their fair market value, and the date of the donation, often supported by receipts or appraisals for property valued over $5,000. Donors must also obtain a contemporaneous written acknowledgment from the charity specifying the absence of goods or services exchanged in return for the donation. |

| 3 | Digital Donor Authentication | Digital donor authentication for charitable donation receipts typically requires a valid government-issued ID and an email address linked to the donor's verified digital identity. Secure electronic signatures or two-factor authentication methods enhance verification accuracy and ensure compliance with legal standards for receipt issuance. |

| 4 | Itemized Gift Valuation Statement | An Itemized Gift Valuation Statement is required for charitable donation receipts when non-cash donations exceed $500, detailing each item's description, fair market value, and condition. This document supports the donor's tax deduction claims by providing clear evidence of the donated assets' worth. |

| 5 | IRS Form 8283 Attachment | To claim a deduction for non-cash charitable contributions exceeding $500, donors must complete IRS Form 8283 and attach it to their tax return, providing detailed descriptions, appraisals, and donor signatures. This attachment is essential for substantiating the donation's value and ensuring compliance with IRS documentation requirements. |

| 6 | QR Code Receipt Verification | Charitable donation receipts typically require the donor's name, donation amount, date of donation, and the charity's registration number to validate the receipt's authenticity. QR code receipt verification enhances security by allowing donors and authorities to quickly scan and confirm the receipt details against the issuing charity's official database. |

| 7 | Donor-Advised Fund Confirmation | A donor-advised fund confirmation requires a detailed acknowledgment from the fund manager, including the date of donation, the fund's name, and a statement confirming no goods or services were exchanged. This documentation ensures compliance with IRS regulations for charitable donation receipts and supports accurate tax deduction claims. |

| 8 | Real-Time Blockchain Donation Proof | Real-time blockchain donation proofs require donor identification documents such as a government-issued ID and the official donation receipt generated on the blockchain ledger, ensuring immutable and transparent transaction records. These digital receipts must include transaction hashes, timestamps, and donor wallet addresses to verify authenticity and facilitate tax deduction claims. |

| 9 | Environmental Impact Certification | Charitable donation receipts require Environmental Impact Certification to verify that the contributed funds directly support eco-friendly projects and comply with sustainability standards. This certification ensures transparency and accountability by confirming the environmental benefits of the donation. |

| 10 | In-Kind Contribution Breakdown | A detailed in-kind contribution breakdown for charitable donation receipts must include the description, quantity, fair market value, and condition of each donated item to ensure accurate tax reporting and compliance with IRS regulations. Proper documentation also requires the donor's information and an acknowledgment letter from the charity specifying the date of donation and a statement confirming no goods or services were received in exchange. |

Introduction to Charitable Donation Receipts

Charitable donation receipts serve as official proof of your contributions to nonprofit organizations. These documents are essential for tax deduction purposes and verifying your generosity.

- Donation Amount - Specifies the exact value of your contribution made to the charity.

- Donor Information - Includes your full name and contact details for identification.

- Organization Details - Contains the charity's name and tax identification number for legitimacy.

Proper documentation ensures that charitable gifts are accurately recorded and recognized by tax authorities.

Legal Importance of Donation Receipts

Charitable donation receipts serve as essential legal documents that validate the transfer of funds or goods to a registered nonprofit organization. These receipts typically require specific details, including the donor's name, date of donation, amount or description of the donated item, and the charity's official identification number.

Providing accurate and complete donation receipts is crucial for compliance with tax laws and enables donors to claim eligible tax deductions. Legal authorities rely on these documents to verify charitable contributions, ensuring transparency and preventing fraudulent claims.

Key Elements Required on Donation Receipts

Charitable donation receipts must include the donor's name, the date of the donation, and the amount or description of the donated item. The receipt should clearly state the name and address of the charitable organization issuing the receipt. A statement confirming whether any goods or services were provided in exchange for the donation is also essential for compliance and tax purposes.

Types of Charitable Donations and Their Receipt Requirements

What documents are required for charitable donation receipts? Different types of charitable donations require specific documentation to validate your contributions. Cash donations typically need bank records or receipts from the charity, while non-cash donations require a detailed description and, for items over certain values, an appraisal or written acknowledgment.

IRS Compliance Guidelines for Donation Documentation

Charitable donation receipts must meet specific IRS compliance guidelines to ensure proper documentation for tax deductions. Accurate records protect donors and organizations by verifying the details of each contribution.

- Written Acknowledgment - The IRS requires a written receipt for any single donation of $250 or more to qualify for a tax deduction.

- Detail of Donation - Receipts must include the donor's name, donation date, amount or description of non-cash items, and a statement about any goods or services received.

- Organization Information - The receipt must clearly display the charitable organization's name, address, and confirmation of its tax-exempt status.

Common Mistakes in Issuing Donation Receipts

Charitable donation receipts require specific documents such as a completed donation form, proof of payment, and the organization's registration details. These documents ensure the receipt is valid for tax deduction purposes.

Common mistakes in issuing donation receipts include missing signatures, incorrect donation amounts, and lack of proper donor information. You must carefully verify these details to avoid rejection by tax authorities.

Electronic vs. Paper Donation Receipts

Charitable donation receipts serve as official proof for tax deductions and must include specific information regardless of format. Both electronic and paper receipts are acceptable, but they differ in storage and delivery methods.

- Essential Information - Donation receipts require the donor's name, donation date, amount, and the charity's details to be valid.

- Electronic Receipts - These digital receipts are typically delivered via email or downloadable links and must be securely stored for tax purposes.

- Paper Receipts - Printed receipts provide a physical record, often preferred for in-person donations and traditional record-keeping systems.

Recordkeeping Best Practices for Charities

| Document Type | Description | Recordkeeping Best Practices |

|---|---|---|

| Donation Receipt | Official proof issued by the charity confirming the donation amount and date | Issue receipts promptly, include donor details, donation amount, date, and charity information; store copies securely for at least 7 years |

| Donor Identification | Information verifying the donor's identity, often required for large donations | Collect and maintain records such as driver's license or government-issued ID for donations exceeding specific thresholds |

| Donation Records | Internal logs tracking all donations received including type and value | Maintain an organized ledger or digital database updated regularly to ensure accuracy and ease of audit |

| Appraisal Documents | Third-party valuations for non-cash donations like property or artwork | Store appraisal reports securely to support the recorded value claimed for tax purposes |

| Bank Statements | Proof of monetary contributions received through bank transfers or deposits | Reconcile bank statements with donation records monthly to ensure consistency |

| Gift Acknowledgment Letters | Written confirmations sent to donors summarizing the donation and tax-deductible amount | Prepare and send acknowledgment letters promptly; maintain copies with donor files |

| IRS or Tax Authority Forms | Documents required for compliance with tax regulations, e.g., Form 8283 for non-cash gifts in the US | Keep copies of submitted tax forms to support compliance and donor claims |

Consequences of Improper Donation Receipt Issuance

Proper documentation for charitable donation receipts includes donor information, donation amount, and the date of the contribution. Failure to issue accurate receipts can lead to legal penalties and loss of donor trust. Inaccurate or missing receipts may result in disallowed tax deductions for donors and potential audits for the charity.

What Documents Are Required for Charitable Donation Receipts? Infographic