For charitable donation deductions, receipt documents must include the donor's name, the date of the donation, and a clear description of the donated items or cash amount. Organizations should provide official acknowledgment letters or receipts to validate the contribution for tax purposes. Receipts for donations over $250 must specifically state whether any goods or services were received in return to comply with IRS requirements.

What Receipt Documents are Necessary for Charitable Donation Deductions?

| Number | Name | Description |

|---|---|---|

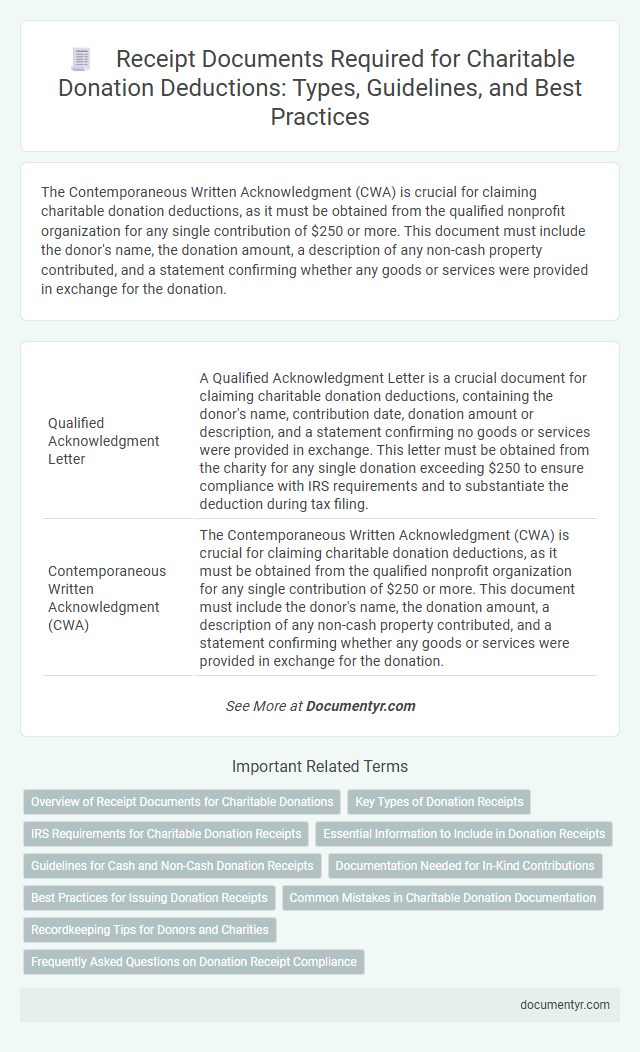

| 1 | Qualified Acknowledgment Letter | A Qualified Acknowledgment Letter is a crucial document for claiming charitable donation deductions, containing the donor's name, contribution date, donation amount or description, and a statement confirming no goods or services were provided in exchange. This letter must be obtained from the charity for any single donation exceeding $250 to ensure compliance with IRS requirements and to substantiate the deduction during tax filing. |

| 2 | Contemporaneous Written Acknowledgment (CWA) | The Contemporaneous Written Acknowledgment (CWA) is crucial for claiming charitable donation deductions, as it must be obtained from the qualified nonprofit organization for any single contribution of $250 or more. This document must include the donor's name, the donation amount, a description of any non-cash property contributed, and a statement confirming whether any goods or services were provided in exchange for the donation. |

| 3 | Substantiation Threshold | Receipts required for charitable donation deductions must include the donor's name, donation date, amount, and a description of any non-cash items when contributions exceed the IRS substantiation threshold of $250. Donations under this threshold typically require only a bank record or written communication from the charity for tax deduction purposes. |

| 4 | Quid Pro Quo Disclosure Statement | A Quid Pro Quo Disclosure Statement is required for charitable donations over $75 when the donor receives goods or services in return, specifying the estimated value of those benefits. This statement ensures proper documentation for IRS deductions, verifying the deductible amount of the contribution. |

| 5 | Donor Advised Fund Receipt | A donor advised fund receipt must include the name of the charity, the date of the donation, and a detailed description of the donated item or cash amount to qualify for charitable donation deductions. This receipt serves as official proof required by the IRS to validate the donor's eligibility for tax benefits related to contributions made through the fund. |

| 6 | Electronic Gift Receipt Validation | Electronic gift receipt validation requires donors to obtain a digital acknowledgment from the charity that includes the donor's name, donation date, description of the gifted item, and the estimated value for tax deduction purposes. This validated electronic document must comply with IRS regulations to ensure the receipt is accepted during charitable donation deduction claims. |

| 7 | Non-Cash Contribution Documentation | Receipts for non-cash charitable donations must include a detailed description of the items donated, the date of the contribution, and the organization's name to qualify for tax deductions. Donors should also secure a written acknowledgment from the charity for contributions exceeding $500, along with a qualified appraisal for items valued above $5,000. |

| 8 | Form 8283 Attachment | Form 8283 Attachment is essential for claiming charitable donation deductions when non-cash contributions exceed $500, providing detailed information about the donated property. Receipts must include donor information, description of items, and signatures to substantiate the deduction for IRS compliance. |

| 9 | Digital Donation Receipts Compliance | Digital donation receipts must comply with IRS guidelines by including the donor's name, donation date, amount, and a clear statement of any goods or services received in exchange. Ensuring these electronic receipts are securely stored and easily accessible supports compliance and substantiates charitable donation deductions for tax purposes. |

| 10 | Charity EIN Verification Slip | A valid Charity EIN Verification Slip is essential for claiming charitable donation deductions, as it confirms the organization's tax-exempt status recognized by the IRS. Receipt documents must include the charity's EIN, donation amount, date, and a statement verifying whether any goods or services were provided in return to qualify for tax deductions. |

Overview of Receipt Documents for Charitable Donations

Receipt documents play a crucial role in substantiating charitable donation deductions. Understanding the necessary paperwork helps ensure Your contributions are properly documented for tax purposes.

- Donation Receipt - An official receipt from the charity showing the donor's name, donation date, and amount.

- Written Acknowledgment - A document required for donations over $250, confirming the gift and stating any goods or services received in return.

- Bank Statements or Canceled Checks - Proof of payment that supports smaller donations when formal receipts are unavailable.

Key Types of Donation Receipts

What receipt documents are necessary for charitable donation deductions? You need official donation receipts that include the charity's name, donation amount, and date. These documents serve as proof for tax deduction claims.

What are the key types of donation receipts? The main types include cash donation receipts, non-cash contribution receipts, and acknowledgment letters from the charity. Each type provides specific information required by tax authorities to validate your deductions.

IRS Requirements for Charitable Donation Receipts

The IRS requires specific receipt documents to validate charitable donation deductions. Proper receipts ensure taxpayers can claim deductions accurately and avoid issues during audits.

A valid receipt must include the donor's name, the charity's name, date of donation, and the amount or description of the donated property. For donations over $250, the IRS mandates a written acknowledgment from the charity outlining these details.

Essential Information to Include in Donation Receipts

Receipts for charitable donations are vital for tax deduction claims. These documents must include specific details to be accepted by tax authorities.

- Donor Information - The receipt must include the donor's full name and contact details.

- Charity Details - The name and tax identification number of the charitable organization should be clearly stated.

- Donation Description - A detailed description of the donated item or amount, including the date of the donation, is required.

Properly detailed donation receipts ensure compliance with IRS regulations for tax-deductible contributions.

Guidelines for Cash and Non-Cash Donation Receipts

Receipt documents are essential for claiming charitable donation deductions, serving as proof of the donation made. For cash donations, a written acknowledgment from the charity including the amount, date, and charity's name is required. Non-cash donations must have a receipt detailing the description of donated items, their fair market value, and the date of donation to meet IRS guidelines.

Documentation Needed for In-Kind Contributions

Receipts for charitable donation deductions must include detailed documentation, especially for in-kind contributions such as clothing, furniture, or electronics. A qualified appraisal is required if the item's value exceeds $5,000, along with a contemporaneous written acknowledgment from the charity. Accurate records help ensure compliance with IRS regulations and maximize tax benefits for donors.

Best Practices for Issuing Donation Receipts

Receipt documents necessary for charitable donation deductions include official donation receipts issued by registered charities. These receipts must contain specific details such as the donor's name, donation amount, date of donation, and the charity's registration number.

Best practices for issuing donation receipts involve ensuring accuracy and completeness of all required information. Charities should issue receipts promptly after the donation is received to facilitate timely tax reporting. Keeping digital copies of receipts helps both donors and organizations maintain proper records for audit purposes.

Common Mistakes in Charitable Donation Documentation

Proper receipt documentation is essential for claiming charitable donation deductions accurately. You must obtain a written acknowledgment from the charity for donations over $250 to comply with IRS requirements.

Common mistakes include missing or incomplete receipts, which can lead to denied deductions. Failing to specify the donation amount, date, and charity name on the receipt often results in audit issues and lost tax benefits.

Recordkeeping Tips for Donors and Charities

Charitable donation deductions require specific receipt documents to ensure compliance with tax regulations. Proper recordkeeping benefits both donors and charities by providing clear proof of contributions.

- Official Donation Receipt - This document includes the charity's name, donation date, amount, and acknowledgment of no goods or services received.

- Written Acknowledgment for Donations Over $250 - Donors must obtain a written statement from the charity confirming the donation amount and detailing any benefits received.

- Maintaining Organized Records - Both donors and charities should keep digital or physical copies of receipts, bank statements, and correspondence for at least three to seven years for audit purposes.

What Receipt Documents are Necessary for Charitable Donation Deductions? Infographic