Essential documents for receipt auditing in nonprofits include detailed purchase receipts, invoices, and proof of payment to verify the legitimacy of expenses and ensure accurate financial reporting. Collecting donation records, grant award letters, and expenditure reports helps maintain transparency and compliance with regulatory requirements. Maintaining organized documentation supports effective audits and strengthens the organization's accountability to stakeholders.

What Documents Must Be Collected for Receipt Auditing in Nonprofits?

| Number | Name | Description |

|---|---|---|

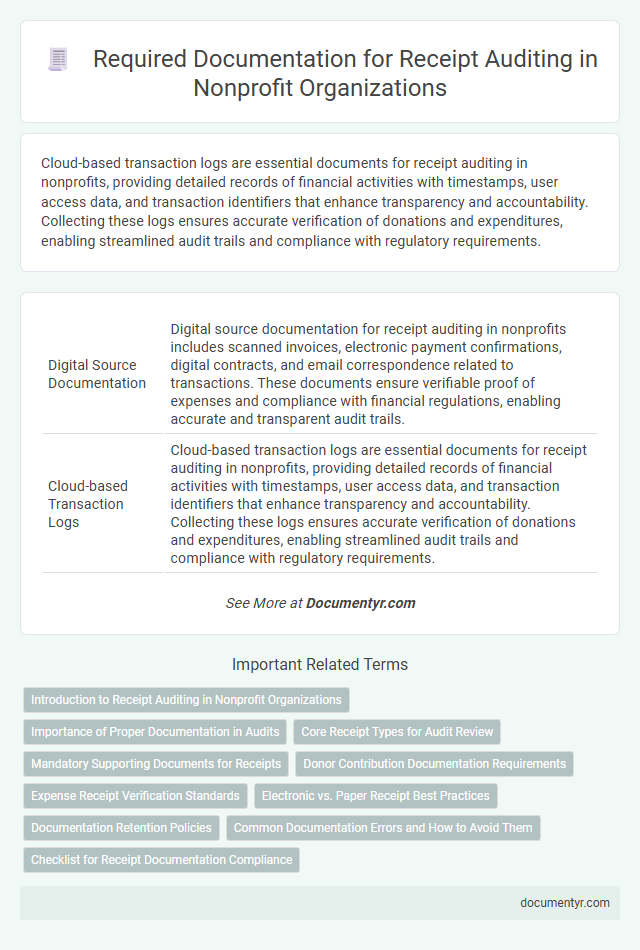

| 1 | Digital Source Documentation | Digital source documentation for receipt auditing in nonprofits includes scanned invoices, electronic payment confirmations, digital contracts, and email correspondence related to transactions. These documents ensure verifiable proof of expenses and compliance with financial regulations, enabling accurate and transparent audit trails. |

| 2 | Cloud-based Transaction Logs | Cloud-based transaction logs are essential documents for receipt auditing in nonprofits, providing detailed records of financial activities with timestamps, user access data, and transaction identifiers that enhance transparency and accountability. Collecting these logs ensures accurate verification of donations and expenditures, enabling streamlined audit trails and compliance with regulatory requirements. |

| 3 | Donor-Restricted Fund Receipts | For receipt auditing in nonprofits, especially concerning donor-restricted fund receipts, it is essential to collect detailed donation records, donor agreements specifying fund restrictions, and acknowledgment letters. Accurate tracking of these documents ensures compliance with donor intent and facilitates transparent financial reporting. |

| 4 | E-signature Authorization Records | E-signature authorization records are critical for receipt auditing in nonprofits, ensuring the validity and compliance of electronically signed documents. These records must include verification of signer identity, consent to use electronic signatures, and a secure audit trail to meet legal and regulatory standards. |

| 5 | Cryptocurrency Donation Acknowledgments | Cryptocurrency donation acknowledgments must include the donor's name, the date of the donation, the type and amount of cryptocurrency donated, and a statement confirming the nonprofit's tax-exempt status. Proper documentation should also capture the fair market value of the cryptocurrency at the time of donation to ensure compliance with IRS regulations during receipt auditing. |

| 6 | AI-Generated Audit Trails | AI-generated audit trails in receipt auditing for nonprofits must collect comprehensive transaction documents, including donor receipts, bank statements, and digital payment confirmations, ensuring accuracy and transparency. These automated logs provide timestamped records and verification details, enhancing compliance with financial regulations and facilitating detailed audits. |

| 7 | Third-Party Payment App Statements | Third-party payment app statements must be collected for receipt auditing in nonprofits to verify transaction authenticity and ensure accurate financial records. These statements provide critical data on payment dates, amounts, and payer details, enabling thorough reconciliation and fraud prevention. |

| 8 | Microgrant Disbursement Receipts | Microgrant disbursement receipts in nonprofits must include detailed documentation such as the grantee's name, grant amount, date of disbursement, purpose of funds, and an itemized list of expenditures. These receipts ensure transparency, validate fund usage, and comply with auditing standards by providing verifiable evidence of microgrant allocation and spending. |

| 9 | Real-time Expense Feed Integrations | Receipt auditing in nonprofits requires collecting detailed transaction documents such as receipts, invoices, and purchase orders to ensure accuracy and compliance. Real-time expense feed integrations streamline this process by automatically capturing and synchronizing financial data from multiple sources, enhancing transparency and reducing manual errors. |

| 10 | Blockchain-Verified Document Originals | Blockchain-verified document originals ensure the integrity and authenticity of receipts by providing an immutable, timestamped record that nonprofits can rely on during auditing processes. Collecting these documents includes certified digital invoices, donation acknowledgments, and transaction records secured on blockchain platforms to enhance transparency and prevent fraud. |

Introduction to Receipt Auditing in Nonprofit Organizations

Receipt auditing in nonprofit organizations involves verifying and validating financial documents to ensure transparency and accountability. Proper documentation supports accurate financial reporting and compliance with regulatory requirements. You must collect essential receipts such as donation records, vendor invoices, and expense reports to maintain thorough audit trails.

Importance of Proper Documentation in Audits

Proper documentation is essential for receipt auditing in nonprofits to ensure transparency and accountability. Collecting accurate financial records helps verify the legitimacy of transactions and supports regulatory compliance.

Your audit process must include receipts, invoices, bank statements, and expense reports. These documents provide a clear trail for auditors to evaluate financial activities and prevent errors or fraud.

Core Receipt Types for Audit Review

Receipt auditing in nonprofits requires careful collection of specific documents to ensure transparency and compliance. Understanding the core receipt types essential for audit review helps maintain accurate financial records.

- Donation Receipts - Records of monetary or in-kind contributions from donors verifying the gift amount and date.

- Grant Award Letters - Official documents outlining funding terms and conditions provided by grantors to the nonprofit.

- Sales Receipts - Proof of transactions for goods or services sold by the nonprofit, detailing amounts received and payment methods.

Your organized collection of these core receipt types simplifies the audit process and supports fiscal accountability.

Mandatory Supporting Documents for Receipts

| Document Type | Description | Importance in Receipt Auditing |

|---|---|---|

| Official Donation Receipts | Receipts provided to donors confirming the amount and date of contributions. | Essential for verifying donation claims and ensuring tax compliance. |

| Invoices | Documents detailing the purchase of goods or services related to nonprofit activities. | Supports validation of expenses and prevents unauthorized transactions. |

| Bank Statements | Records of financial transactions showing deposits and withdrawals. | Used to cross-reference receipt amounts and confirm fund flow accuracy. |

| Grant Award Letters | Official correspondence specifying the terms, amount, and conditions of grants received. | Verifies funding sources and ensures proper allocation of grants. |

| Event Attendance Records | Lists or registries documenting participant attendance at fundraising events. | Correlates event income with receipts and donation reports. |

| Check Copies and Electronic Fund Transfer Confirmations | Proof of donation payments made by check or electronic transfer. | Validates the receipt of funds and supports audit trails. |

| Internal Receipt Logs | Records maintained by the nonprofit detailing received donations and payments. | Facilitates tracking of all incoming funds and supports reconciliation processes. |

Donor Contribution Documentation Requirements

What documents must be collected for receipt auditing in nonprofits concerning donor contributions? Accurate donor contribution documentation requires collecting donation receipts, acknowledgment letters, and donor information forms. These documents ensure compliance with tax regulations and maintain transparency in your nonprofit's financial records.

Expense Receipt Verification Standards

Expense receipt verification standards for nonprofits require collecting original receipts that detail the vendor, date, amount, and purpose of the expense. Receipts must be legible, itemized, and compliant with the organization's financial policies to ensure accuracy and accountability. Supporting documents such as purchase orders or credit card statements are often necessary to corroborate the expenses during receipt auditing.

Electronic vs. Paper Receipt Best Practices

Receipt auditing in nonprofits requires meticulous collection of relevant documents to ensure transparency and proper financial tracking. Electronic and paper receipts each present unique advantages and practices that support effective auditing.

- Electronic Receipts Facilitate Efficient Storage - Digital receipts can be systematically organized and easily retrieved during audits, reducing the risk of loss or damage compared to paper documents.

- Paper Receipts Provide Tangible Proof - Physical receipts remain necessary for transactions where digital proofs are unavailable, ensuring comprehensive documentation.

- Standardized Documentation Enhances Accuracy - Consistently collecting both electronic and paper receipts with clear details such as date, amount, and vendor supports accurate nonprofit financial reviews.

Documentation Retention Policies

Receipt auditing in nonprofits requires careful collection and retention of specific documents to ensure transparency and compliance. Your organization's documentation retention policies play a critical role in guiding which records to maintain and for how long.

- Receipt Copies - Maintain original or digital copies of all receipts related to donations, expenses, and program funding to support audit trails.

- Financial Statements - Collect bank statements, ledgers, and transaction reports that verify the accuracy of amounts recorded on receipts.

- Retention Schedules - Follow established documentation retention policies that specify timeframes and methods for securely storing and disposing of financial records.

Common Documentation Errors and How to Avoid Them

Receipt auditing in nonprofits requires the collection of accurate and complete documentation to ensure financial transparency and compliance. Essential documents include original receipts, invoices, donation records, and expense reports that validate all transactions.

Common documentation errors involve missing signatures, illegible details, and incomplete information such as dates or amounts. To avoid these mistakes, nonprofits should implement standardized receipt templates and conduct regular training for staff on proper documentation procedures. Utilizing digital tools for scanning and storing receipts can enhance accuracy and accessibility during audits.

What Documents Must Be Collected for Receipt Auditing in Nonprofits? Infographic