Receipts for home improvement projects that qualify for tax credits should include detailed descriptions of materials purchased, labor costs, and any related invoices. Keep official receipts that specify the date, cost, and nature of the work completed, especially for energy-efficient upgrades like solar panels or insulation. These documents are essential to substantiate your claim when filing for home improvement tax credits.

What Receipts Should Be Kept for Home Improvement Tax Credits?

| Number | Name | Description |

|---|---|---|

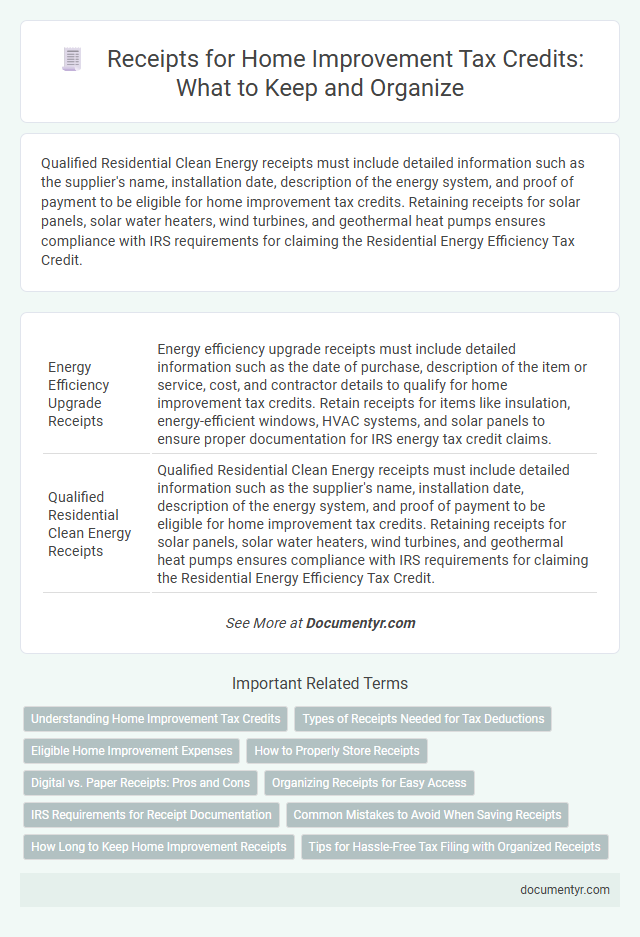

| 1 | Energy Efficiency Upgrade Receipts | Energy efficiency upgrade receipts must include detailed information such as the date of purchase, description of the item or service, cost, and contractor details to qualify for home improvement tax credits. Retain receipts for items like insulation, energy-efficient windows, HVAC systems, and solar panels to ensure proper documentation for IRS energy tax credit claims. |

| 2 | Qualified Residential Clean Energy Receipts | Qualified Residential Clean Energy receipts must include detailed information such as the supplier's name, installation date, description of the energy system, and proof of payment to be eligible for home improvement tax credits. Retaining receipts for solar panels, solar water heaters, wind turbines, and geothermal heat pumps ensures compliance with IRS requirements for claiming the Residential Energy Efficiency Tax Credit. |

| 3 | Solar Panel System Installation Invoices | Receipts for solar panel system installation invoices should be kept as they provide proof of expenses necessary for claiming home improvement tax credits related to renewable energy. These documents must detail the installation date, costs, and the service provider's information to ensure eligibility for potential federal or state tax incentives. |

| 4 | HVAC Heat Pump Equipment Documentation | Receipts for HVAC heat pump equipment purchases, including detailed invoices specifying the unit's model, Energy Star certification, and installation costs, should be kept to qualify for home improvement tax credits. Documentation must clearly show the date of purchase, the cost of materials, and proof of professional installation to meet IRS requirements for energy-efficient upgrades. |

| 5 | Smart Thermostat Purchase Receipts | Receipts for smart thermostat purchases eligible for home improvement tax credits must clearly show the date of purchase, item description, and cost to validate eligibility under energy-efficient upgrades. Keeping documentation from reputable retailers or installers ensures compliance with IRS requirements for claiming the nonbusiness energy property credit. |

| 6 | Geothermal Heat Pump Receipts | Receipts for geothermal heat pump installation, including equipment purchase, labor, and any related materials, should be retained to qualify for home improvement tax credits. Proper documentation ensures eligibility for federal energy efficiency incentives and supports accurate tax reporting. |

| 7 | Insulation Material Receipts (Attic/Walls) | Receipts for insulation materials used in attic or wall improvements are essential for claiming home improvement tax credits, as they provide proof of purchase and eligibility for energy-efficient upgrades. Ensure these receipts detail the type, quantity, and cost of insulation materials to support your tax credit claims accurately. |

| 8 | EV Charging Station Installation Receipts | Receipts for EV charging station installation, including labor, equipment purchase, and electrical work, should be retained to qualify for home improvement tax credits. Detailed invoices specifying costs and dates are essential documentation for IRS verification and credit claims. |

| 9 | Energy Star Appliance Proof of Purchase | Receipts for Energy Star appliances purchased for home improvement tax credits should clearly show the product details, purchase date, and retailer, ensuring eligibility verification. Keeping original invoices or digital copies with model numbers and Energy Star certification symbols is essential for documentation during tax filing. |

| 10 | Home EV Battery Storage System Receipts | Receipts for home EV battery storage system purchases and installations should be kept to qualify for home improvement tax credits, including detailed invoices showing costs, dates, and contractor information. Maintaining proof of payment and manufacturer certifications ensures compliance with tax credit requirements and facilitates accurate claim submissions. |

Understanding Home Improvement Tax Credits

Home improvement tax credits require keeping detailed receipts of eligible expenses to qualify for deductions or credits. Understanding which receipts to keep ensures you maximize your tax benefits for renovations that improve energy efficiency or accessibility.

Receipts that document purchases of energy-efficient appliances, solar panels, or insulation materials should be retained. Labor costs for qualified services, including installation and repairs, must also be recorded with clear invoices. Keeping thorough records supports claims for credits like the Residential Energy Efficient Property Credit and the Nonbusiness Energy Property Credit.

Types of Receipts Needed for Tax Deductions

Keeping accurate receipts is essential for claiming home improvement tax credits. Understanding which types of receipts qualify helps ensure proper documentation for tax deductions.

- Invoice Receipts - Detailed invoices from contractors or service providers showing the nature of the work and cost.

- Material Purchase Receipts - Receipts for building materials and supplies that were bought specifically for qualifying home improvements.

- Energy-Efficient Product Receipts - Proof of purchase for certified energy-efficient appliances or systems eligible for tax credits.

Organizing and maintaining these receipts supports accurate and successful home improvement tax credit claims.

Eligible Home Improvement Expenses

| Eligible Home Improvement Expenses | Receipt Details to Keep |

|---|---|

| Energy-efficient windows and doors | Purchase invoice showing brand, model, energy rating, and installation date |

| Solar panels and solar water heaters | Receipt including system specifications, installation cost, and certified installer details |

| Insulation materials and installation | Proof of purchase for insulation products, contractor invoice with installation description |

| Heating, ventilation, and air conditioning (HVAC) upgrades | Detailed bill outlining equipment model, energy efficiency rating, and service charges |

| Home accessibility modifications | Receipts for materials and labor, including invoices specifying the nature of modifications |

| Water-saving plumbing fixtures | Purchase receipt indicating product type, certification for water efficiency, and installation fees |

| Smart thermostats and energy management systems | Sales receipt including product details, installation date, and installer certification |

How to Properly Store Receipts

Receipts for home improvement tax credits should include detailed invoices, proof of payment, and any contractor agreements. These documents verify the expenses eligible for tax deductions or credits.

Properly storing receipts involves organizing them by date and project type in labeled folders or digital files. Use cloud storage or a dedicated app to ensure easy access and backup for tax filing.

Digital vs. Paper Receipts: Pros and Cons

Home improvement tax credits require careful documentation of expenses. Choosing between digital and paper receipts impacts record-keeping efficiency and accuracy.

- Digital Receipts Offer Easy Storage - They can be organized in cloud services, minimizing physical clutter and enabling quick access.

- Paper Receipts Provide Tangible Proof - Physical copies reduce risks of data loss from technical failures or accidental deletion.

- Digital Receipts Facilitate Searchability - Electronic records support keyword searches, improving retrieval speed during tax filing.

Organizing Receipts for Easy Access

Keep receipts related to materials, labor, and any permits obtained for your home improvement projects to qualify for tax credits. Organize receipts by category and date to streamline the process during tax season. Store them in a dedicated folder or digital archive for easy access when needed.

IRS Requirements for Receipt Documentation

Receipts for home improvement tax credits must clearly show the date, amount paid, and description of the materials or services. The IRS requires documentation demonstrating that the expenses qualify under specific energy-efficient or home improvement credit categories.

Proof of payment such as canceled checks or credit card statements should accompany receipts to meet IRS standards. You should keep all records for at least three years to support your tax credit claims during an audit.

Common Mistakes to Avoid When Saving Receipts

Proper documentation is essential for claiming home improvement tax credits. Keeping accurate receipts ensures smooth processing and maximizes your credit eligibility.

- Keeping incomplete receipts - Receipts must include detailed information such as supplier name, date, and itemized costs to be valid for tax credits.

- Misplacing receipts - Store receipts in a dedicated folder or digital archive to avoid losing them before filing taxes.

- Ignoring non-qualifying expenses - Separate eligible home improvement costs from ineligible purchases to avoid confusion during claims.

How Long to Keep Home Improvement Receipts

How long should you keep home improvement receipts for tax credits? Keep these receipts for at least three years from the date you file your tax return to ensure you can substantiate your claims if audited. Some experts recommend retaining them up to seven years in case of extended reviews or additional tax matters.

What Receipts Should Be Kept for Home Improvement Tax Credits? Infographic