Receipt documents needed for insurance claim validation include original purchase receipts detailing the item description, purchase date, and price to verify ownership and value. Proof of payment such as credit card statements or bank slips supports the transaction's authenticity. Detailed receipts with warranty information or serial numbers enhance claim approval by providing comprehensive evidence of the insured item.

What Receipt Documents Are Needed for Insurance Claim Validation?

| Number | Name | Description |

|---|---|---|

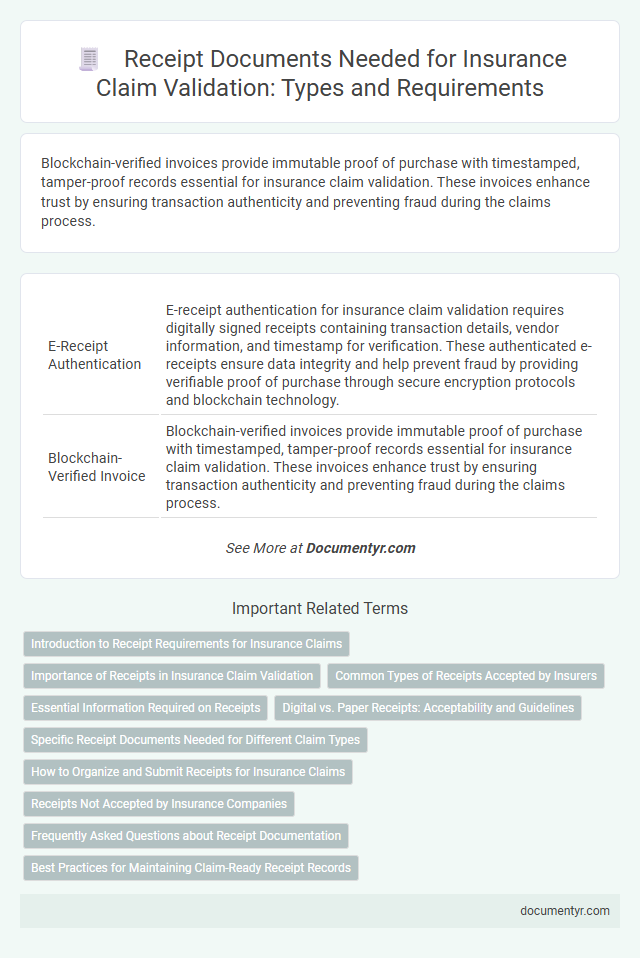

| 1 | E-Receipt Authentication | E-receipt authentication for insurance claim validation requires digitally signed receipts containing transaction details, vendor information, and timestamp for verification. These authenticated e-receipts ensure data integrity and help prevent fraud by providing verifiable proof of purchase through secure encryption protocols and blockchain technology. |

| 2 | Blockchain-Verified Invoice | Blockchain-verified invoices provide immutable proof of purchase with timestamped, tamper-proof records essential for insurance claim validation. These invoices enhance trust by ensuring transaction authenticity and preventing fraud during the claims process. |

| 3 | Dynamic QR Code Receipt | Dynamic QR code receipts provide verifiable transaction details essential for insurance claim validation, ensuring authenticity and preventing fraud. These receipts contain encrypted data such as purchase date, amount, and merchant information, streamlining the verification process for insurance adjusters. |

| 4 | Digital Chain of Custody Proof | Digital chain of custody proof in receipt documents ensures the authenticity and integrity of transactions by securely tracking the transfer and handling of goods or services involved in the insurance claim. This evidence is critical for validating claims, as it provides verifiable timestamps and tamper-proof records essential for preventing fraud and confirming entitlement. |

| 5 | AI-Generated Expense Stub | AI-generated expense stubs provide a detailed, itemized record of purchases, essential for validating insurance claims by verifying transaction authenticity and expense accuracy. These digital receipts often include timestamps, vendor details, and payment methods, ensuring seamless integration with insurance databases for swift claim processing. |

| 6 | Smart Contract Purchase Record | Smart contract purchase records provide immutable, verifiable proof of transaction details essential for insurance claim validation, ensuring accuracy and fraud prevention. These blockchain-based receipts streamline claim processing by automatically verifying purchase authenticity and ownership through secure, timestamped data. |

| 7 | Timestamped E-Payment Notification | Timestamped e-payment notifications serve as crucial receipt documents for insurance claim validation, providing verified evidence of transaction dates and amounts. Insurers rely on these digital records to confirm timely premium payments and support accurate claim processing. |

| 8 | Supply Chain Traceability Document | Supply chain traceability documents, including detailed receipts and certificates of origin, are essential for insurance claim validation as they verify the authenticity and movement of goods throughout the distribution process. These documents establish a clear audit trail, ensuring that all items involved in the claim have been accurately accounted for, mitigating risks of fraud or discrepancies. |

| 9 | Automated Transaction Log File | Automated transaction log files serve as critical receipt documents for insurance claim validation by providing precise records of purchase dates, item descriptions, payment amounts, and vendor details. These digital logs enhance claim accuracy and expedite processing through verifiable, timestamped transaction entries aligned with policy requirements. |

| 10 | API-Linked Purchase Confirmation | API-linked purchase confirmation receipts provide verifiable transaction details crucial for insurance claim validation, ensuring authenticity and accuracy. These digital receipts contain timestamped purchase data, merchant information, and product specifics that streamline the verification process and reduce fraudulent claims. |

Introduction to Receipt Requirements for Insurance Claims

Receipts play a crucial role in the insurance claim validation process by providing proof of purchase and verifying the value of the claimed items. Insurance companies require specific receipt documents to ensure authenticity and accurate reimbursement.

Valid receipts must include detailed information such as the date of purchase, item description, seller details, and total amount paid. Without these essential receipt documents, claims may face delays or rejection during the validation process.

Importance of Receipts in Insurance Claim Validation

Receipts play a critical role in insurance claim validation by providing proof of ownership and transaction details. Accurate and detailed receipts help ensure a smooth and efficient claims process.

- Proof of Purchase - Receipts confirm the date, price, and item description, verifying that the claimed items were legitimately acquired.

- Verification of Value - Receipts establish the exact cost paid, aiding insurers in calculating appropriate claim compensation.

- Supporting Documentation - Receipts act as essential evidence that supports the authenticity of the insurance claim and prevents fraud.

Common Types of Receipts Accepted by Insurers

Insurance companies typically require specific types of receipts to validate claims accurately. Commonly accepted receipts include itemized purchase receipts, repair invoices, and service bills that clearly detail the date, description, and cost of the items or services. You should ensure that your receipts are legible and contain all necessary information to support a smooth insurance claim process.

Essential Information Required on Receipts

Receipts play a critical role in insurance claim validation by providing proof of purchase and ownership. Essential information on these documents includes the date of transaction, item description, and purchase amount.

Receipts must also display the retailer's name and contact details to verify authenticity. Clear, legible receipts with detailed information expedite the insurance claim process and reduce the chances of rejection.

Digital vs. Paper Receipts: Acceptability and Guidelines

| Receipt Document Type | Acceptability for Insurance Claim | Guidelines |

|---|---|---|

| Paper Receipts | Widely accepted | Ensure the receipt is original, clearly shows purchase details such as date, amount, vendor name, and item description. Avoid copies to prevent claim delays. |

| Digital Receipts (Email or PDF) | Increasingly accepted | Submit receipts directly from the vendor's official email or website. Screenshots may be rejected. Confirm the receipt includes all necessary purchase information matching claim details. |

| Mobile App Receipts | Accepted if verifiable | Use vendor-approved apps that issue receipts with identifiable transaction IDs. Provide a valid printout or digital copy from the app. Ensure synchronization with purchase records. |

| Photographs of Receipts | Conditionally accepted | Photos must be clear, legible, and unaltered. Some insurers may require original receipt submission alongside photographs for verification. |

| Receipt Information Needed | - | The receipt must include transaction date, item description, purchase amount, vendor details, and payment method. Accurate and complete documentation improves claim validation speed. |

| Your Role | - | Keep all receipts intact and organized. Verify digital receipts are official and properly saved. Providing clear documentation helps ensure smooth processing of your insurance claim. |

Specific Receipt Documents Needed for Different Claim Types

Receipt documents play a crucial role in validating insurance claims by providing proof of purchase and transaction details. Different claim types require specific receipt documents to ensure accurate processing and verification.

- Medical Claim Receipts - Detailed invoices from healthcare providers showing treatment dates, services rendered, and payment amounts.

- Auto Insurance Receipts - Repair bills, towing receipts, and parts purchase receipts that verify expenses related to vehicle damage.

- Property Insurance Receipts - Receipts for replacement items or repair services that confirm the value and ownership of insured property.

Providing the correct receipt documents tailored to the claim type results in faster claim approval and reduces the risk of rejection.

How to Organize and Submit Receipts for Insurance Claims

What receipt documents are needed for insurance claim validation? Receipts must clearly show the date of purchase, item description, and payment method to be valid. Organize receipts by date and category to streamline the submission process.

How should receipts be organized for insurance claims? Group receipts according to the type of expense, such as medical, property, or travel costs. Use folders or digital scans labeled with relevant claim information to ensure easy access.

What is the best way to submit receipts for insurance claims? Submit original receipts whenever possible along with clear photocopies or digital scans. Ensure each receipt matches the claim form details, such as amounts and dates, to avoid processing delays.

Receipts Not Accepted by Insurance Companies

Receipts play a crucial role in validating insurance claims by providing proof of purchase and details of the transaction. However, not all receipts are accepted by insurance companies for claim verification purposes.

Receipts lacking detailed information such as date, seller identity, or itemized purchases are often rejected. Handwritten receipts without official stamps or signatures may also be invalid. Receipts from informal or unauthorized vendors typically fail to meet insurance requirements.

Frequently Asked Questions about Receipt Documentation

Receipt documents are essential for insurance claim validation as they provide proof of purchase and details of the insured item or service. Commonly required receipts include original sales invoices, payment confirmations, and detailed itemized bills. Ensure receipts clearly show the date, vendor information, and transaction amount to meet insurer requirements.

What Receipt Documents Are Needed for Insurance Claim Validation? Infographic